Cash flow management is a process by which a firm ensures control over the inflow & outflow of funds. The ultimate goal of cash flow management is to ensure that the company consistently sits on the surplus of capital by reducing unnecessary expenses. The lack of consistency in the account receivable and Payable Process can endanger the company’s fiscal health.

It enables the business to track, analyze, & improve the financials. Account payable & receivable is a key indicator of the company’s financial health. Proper management of these factors is vital for optimizing the cash flow management of the firm. A sound cash flow system ensures that the company has ample fund to carry out daily operations with ease.

What is the Accounts Payable?

Account payable refers to an amount due to suppliers or vendors for goods or services received. The aggregate of all outstanding payments owed to vendors listed under the accounts payable balance in the firm’s balance sheet.

Sometimes Accounts Payable Process gets disrupted due to unforeseen circumstances. One can leverage the below-mentioned strategies to improve account payable process.

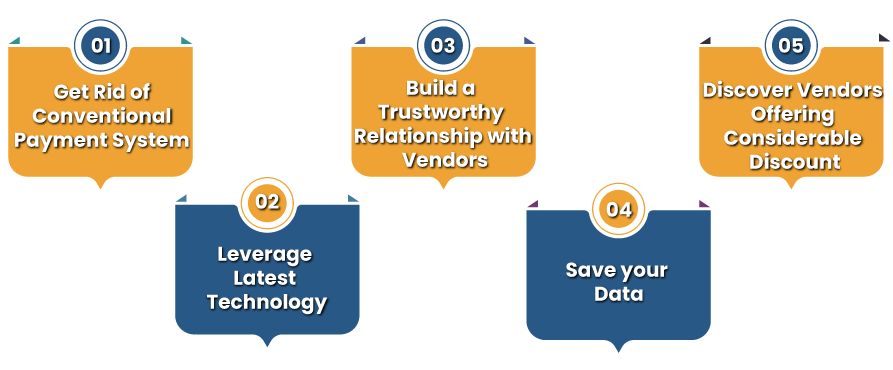

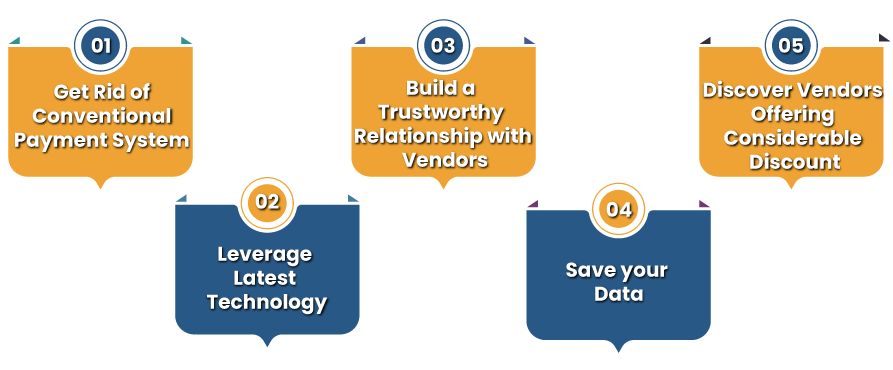

Solutions to Improve the Compromised Account Payable Process

Maintaining account payable is a daunting task, particularly for the smaller businesses that have connection with various members. Following are some useful tips that assist in meeting the said goals.

Get Rid of Conventional Payment System

Delaying the payment of the vendor often complicates the accounts payable process. If possible, avoid making payments through conventional means such as cheques. The methods like online payment or RTGS are a way better option to mitigate the payment delay.

Read our article:Accounts Receivable: Definition and Tips to Manage

Leverage Latest Technology

Poor cash flow management can hinder the account payable process. There should be a proper system that automatically schedules the payment date and intimate firm regarding the delay. Try using the best accounting software for this purpose.

Such a program is designed to automate the accounts payable process, thereby undermining the manual intervention for issuing and maintaining the invoices. The inculcation of automation will improve transparency and reduce errors for effective cash flow management.

Build a Trustworthy Relationship with Vendors

Not all firms are capable of ensuring timely payment to their vendor. It may happen due to various reasons such as unavailability of adequate funds, issues with the accounting department, or sluggish system response. The only way to counter such problems is to hone a relationship with the vendor.

Get into formal talk with your vendor describing the current situation and the reason for the payment delay. This may sound impractical to most of you, but confronting vendors in hard times is the best way to stay functional.

Save your Data

One of the best ways to improve the account receivable process is to continue monitoring the invoice data. Make a habit of sparing the billing documentation such as invoices, purchase orders, email from vendors[1], and receipt in an online file.

Such practices can help you pay invoices on time. Business can leverage these documents to resolve invoice related queries and filing the tax return.

Discover Vendors Offering Considerable Discount

Owing less money is the best way to stay in control of the payable process. Identify which vendors were offering a discount on supplies, inventory, and services you need. Some vendors often provide early payment discounts. Find out if your vendor offers some discount on your bill to pay the entire sum before the due date. Besides, look out for vendors who levied interest or late fees.

If you order a considerably larger amount of items regularly, you might avail healthy discount by buying in bulk. Bulk purchasing can help save tons of money in the longer run.

What is the Accounts Receivable?

Account receivable refers to the balance of money that the company needs to recover from its customers against its services. Simply put, Account receivable is an amount of money owed by the clients against the purchases made on credit. Rising AR means that the company lacks the proficiency to recover the payment from the customers on time.

Strategies to Alleviate Issues with Accounts Receivable Process

There are several ways through which one can alleviate issues with the AR process. These are as follows.

Take Advantage of E-invoicing

Sending invoices via email can prevent you from encountering payment delays. When contrasted with the physical method, e-invoicing is more authentic because it contains every correspondence with clients in its backup that can further be utilized to resolve the payment issues. In short- it keeps the accounting department on edge by eliminating the chance of overdue payment or non-payment.

Opt for Flexible Payment Options

The modern organization is less likely to rely on conventional payment systems because they are lethargic and hampers the cash flow management in the long run. Embracing modern payment systems such as credit cards and net banking can significantly improve the account receivable function, allowing the firm to maintain the optimum cash flow.

Third-Party Player to Improve Account Receivable

Outsourcing acts as a savior for a bigger organization that has trouble in maintaining the particular department.

By handing over the accounts receivable function to a specialized third-party firm, you can shift your focus on what is essential and improve key performance metrics. The outsourcing firm can help you strengthen the cash flow management of the company.

Reframe Credit Policies for the Betterment of the Firm

Offering too much liberty to customers could result in the accumulation of accounts receivable, which can hamper the cash flow. Review and alter the credit policy now and then to avert such complications.

Make sure to draft the credit policy that strikes the right balance and doesn’t bother the end-users. An effective credit policy can get rid of fundamental loopholes in the cash flow management of the company.

Improve the Services and Client-Relationship

Improved services always encourage the client to pay on time. Failing to meet the client’s expectations is the primary reason why such issues come into existence.

Besides, intimating your client with irregular follow-up can disrupt the relationship, leading to prolonged payment delays. Nurturing the relationship with your prospect is the most challenging aspect of running the business. If you find it hard to do so, then hire an expert to accomplish your goals.

Conclusion

There are various unknown variables that hamper the firm’s ability to maintain the finances in one way or another. That implies that the optimization of the cash flow management needs expert guidance and technological adoption. The point mentioned above would enable you to resolve basic issues with the account receivable and payable process.

Read our article:Understanding the Concept of Account Payable