The Central Board of Indirect Tax and Customs (CBIC) announced that the Aadhaar Authentication Mandatory for GST Registration from April 1, 2020. The tax pundits across the country have already speculated this change a few months ago, and finally, the Ministry of Finance has put an authentication stamp on it.

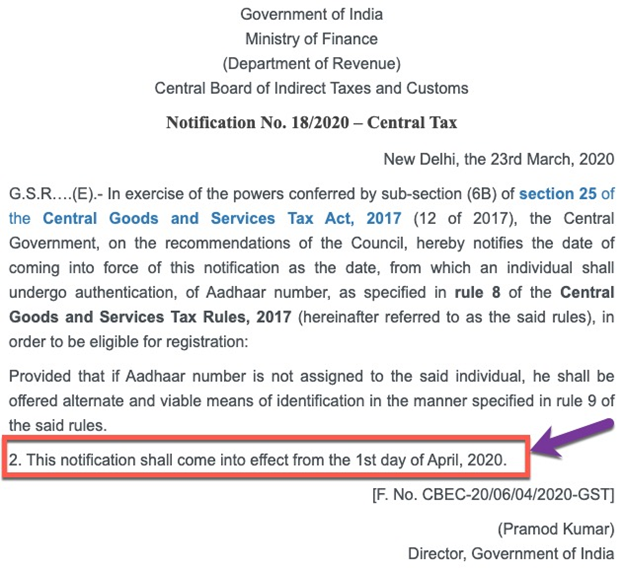

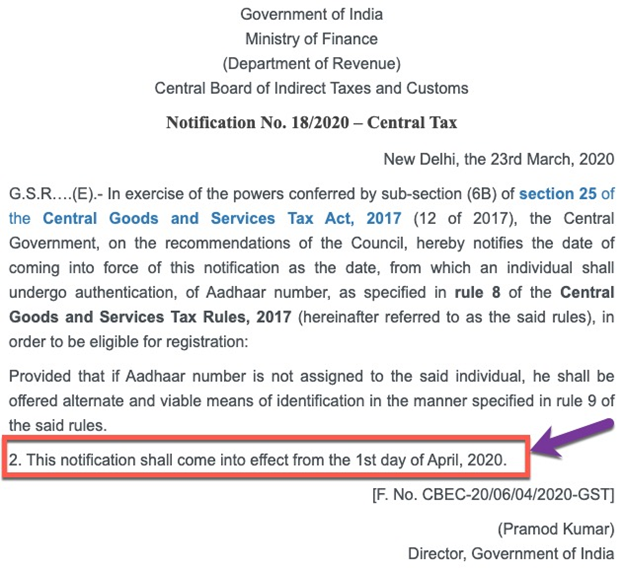

This change was announced via a notification issued from the Department of Revenue under the Ministry of Finance on March 23, 2020, in the name of Director – Pramod Kumar. This notification indicates clearly that GST registration could not be availed in the absence of the Aadhaar Authentication[1]. Notably, this change will take effect on April 1, 2020.

This measure has been implemented in the presence of subsection (6B) under section 25 Central Goods and Services Tax Act, 2017.

The notification demands to render that the provisions of Section 25(6B) & (C) of the Central Goods and Services Tax Act, 2017 will address those individuals that comes under authorised signatory of all types; Managing and Authorised partner; and Karta of an undivided Hindu family.

However, the foreigners or the persons who are not the citizens of India shall not be a part of this amendment. These class of persons needs to follow a different approach to satisfy this prerequisite.

As per the notification, these class of persons shall undergo rule 8 of the Central Goods and Services Tax Rules, 2017 to complete the GST registration formalities.

Authorised signatory such as Karta of a Hindu undivided family and Managing and Authorised partners of a partnership firm, shall undergo authentication as per rule 8 of the Central Goods and Services Tax Rules, 2017, to avail successful possession GST registration.

However, if these individuals don’t have possession of an Aadhaar number, then he/she will be offered alternate means of identification to serve this purpose, specified in Rule 9 of the Central Goods and Services Tax (CGST) Rules, 2017.

Read our article:What is the Impact of GST on Loans?

Why Registration Under GST Is Essential?

- Credibility:

A company or an individual who believes in conducting fair business practices and has legal documents are more likely to get a positive impression from suppliers and consumers. GST is something that can increase the credibility of your business to a great deal.

- Avoid Unnecessary Hurdles:

The GST compliant has now become a crucial part of every business fraternity. Since the GST regime works is through a chain system, the product can be traced by the monitoring authorities with ease, regardless of their stage. If businesses are found non-compliant with the GST regime, the technical hurdles become more apparent. With GST registration, companies can overcome these hassles with ease.

- Legal Strength:

In a nutshell, businesses who conduct their work outside the framework of GST registration aren’t considered as legitimate ones. GST offers a high degree of transparency in the legal term and provides a reliable backup for the companies who want to survive seamlessly in the legal framework.

- Avoid Penalties:

Truth be told, penalties are not for someone who chooses to register under GST. The defaulter, in this case, can encounter negative consequence in term of a penalty of Rs. 10,000. This further could generate a sense of mistrust among the authorities and the target consumers. GST help you overcome all these obstacles and make your business practices as transparent as possible.

Read our article:GST Taxpayers can file their GSTR-3B Returns in an easy way