Merchant exports under GST come under the system of trading export. Merchant export is a commonly used term in foreign trade. Besides this, it is helpful in generating the inflow of foreign exchange earnings for the nation. The person who is responsible for carrying merchant export is known as merchant exporter.

Merchant exporter is an individual whose involvement is in trading activities along with exporting and planning to export. There is no involvement of merchant exporters in activities concerning manufacturing. Merchant exports under GST are mainly limited to exports of goods. Although they don’t have a manufacturing unit, they purchase goods from a manufacturer-exporter and take steps for shipping the goods to international customers.

Few manufacturer exporters purchase goods from another manufacturer because of the less capacity of production, in order to match pace with the export order requirement of the foreign customers. They are known as manufacturer merchant exporter.

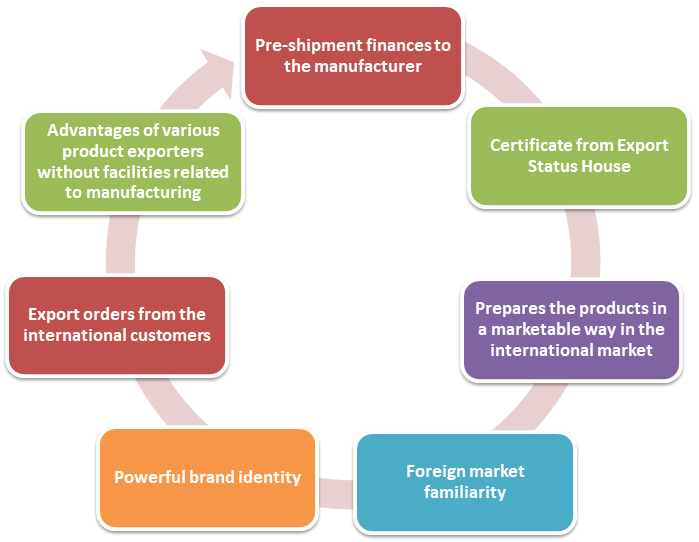

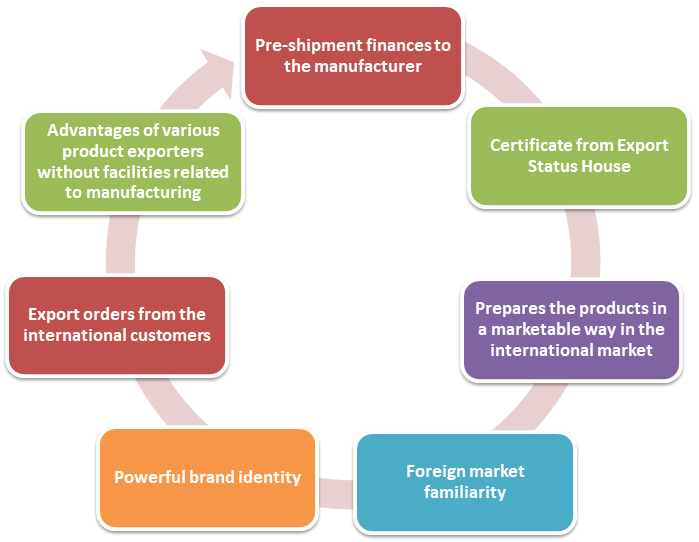

Benefits of Merchant Exports

- The merchant exporter takes the responsibility of managing pre-shipment finances to the manufacturer unescorted by any security.

- If the export performance of a merchant exporter is at par, he becomes eligible to acquire a certificate from Export Status House.

- A manufacturer operating on a small and medium scale with a lack of financial and human resources prepares the products in a marketable way in the international market.

- The manufacturer rides high on the benefits of foreign market familiarity regarding his products, developing powerful brand identity in the international market without any research as well as development.

- The merchant exporter cherishes the advantages of various product exporters without facilities related to manufacturing.

- The merchant exporter used to make arrangements for the export orders from the international customers and let the manufacturer relax.

Merchant Exports under GST

The procedures concerning merchant exports under GST have become simplified due to favorable government measures. Under goods and service tax, as per provisions of section2- (108) of the CGST Act[1], a taxable supply signifies the supply of goods or services or even both levied to tax. Furthermore, as per the provisions of Section 7- subsection 5 of the IGST Act, when a supplier has its roots in India, and the place of supply is outside the geographical regions of India, supply would get prescribed as inter-state supply.

Since the merchant exporter exists in India and goes on for supplying to a place outside Indian borders, merchant exports are chargeable to GST. Provisions related to both the sections confirm this changeability. Therefore, it is mandatory for merchant exporters to get GST registration.

Circumstances for Availing Concessional Rate Relief- Merchant Exports under GST

The government of India has diminished the GST rate to 0.1% in order to grant special relief to the merchant exporters for buying goods from suppliers operating in a domestic region.

The conditions mentioned below must get fulfilled to avail concessional rate relief-

- The GST rate at 0.1% must get specified under the tax invoice for the procured goods.

- From the issuance date of a tax invoice in the time limit of 90 days, such procured goods must get exported.

- The tax invoice number, along with the GSTIN of the supplier, must get notified on the shipping bill.

- It is crucial for such merchant exporters to get registered with an Export Commodity Board or Export Promotion Council.

- An order copy placed at the concessional rate will be granted in the hands of jurisdictional tax officers of the supplier who get registered.

- Such procured goods would get transported to the place from where it will get transferred to the Airport/LCS/ICD/Port. Even if, in some cases, goods get bought from multiple registered suppliers, this condition exists.

- A copy of the bill of the export or a shipping bill copy, as well as the EGM and export report proof on the export of goods, would get filed with the registered supplier along with its jurisdictional tax officer.

- The merchant export needs to export goods under Letter of Undertaking (LUT) or Bond but not with the tax payment (IGST).

Besides this, if due to any reason the merchant exporter fails in exporting the goods in the time limit of 90 days from the issue date of tax invoice, then the registered supplier can’t avail of the benefits associated with the concessional tax rate.

Read our article:Changes in Budget 2020 in GST

Procedure for Merchant Exports under GST

The procedure that would get followed for merchant exports under the GST regime has got clarified. Concerning this, there is an availability of two alternatives-

- Under bond or Letter of Undertaking (LUT), make export, and eventually, the unutilized ITC would get claimed as a refund.

- By paying off IGST, make export, and then go for claiming a refund. If the exporter has not settled on for the Special Relief Scheme of purchasing goods at 0.1% goods and service tax, then only this option will be available.

Thereafter, the only document that must get filed with the customs is the shipping bill. The shipping bill would get interpreted as an application for a refund after the filing of the shipping bill.

Scenarios Concerning the Refund Process in Which Merchant Exporter gets involved

Mentioned under are few synopses rotating under the process of refund wherein there is an involvement of merchant exporter-

- Supplier of merchant exporter obtains goods from other suppliers and claim for refund under Inverted Duty Structure

Two suppliers exist in this case. The first supplier is behind making a supply to the second supplier at standard rates of GST. However, the second supplier is behind making the supply to the merchant exporter on a 0.1% rate of concession. In this case, the second supplier is not involved in the direct export of goods but engaged in serving goods to merchant exporter. Hence, as per section 54(3), the second supplier can go on for claiming ITC refund under the inverted tax structure.

- A merchant exporter exports goods without tax payment. Acquires goods at 0.1% and go on for claiming refunds

A supplier is a person that supplies goods to the merchant exporter; GST is chargeable at 0.1% in this matter. Also, here the merchant exporter takes steps for exporting the goods without tax payment. As prescribed in the section54(3) of the CGST Act, the merchant exporter can move ahead for claiming a refund with respect to the unutilized input tax credit at the tax period end in a matter of zero-rated goods or those goods that encompasses inverted tax structure.

- A supplier is making the supplies to a merchant exporter at the routine rate and exports takes place with the tax payment(IGST Paid)

The merchant exporter can’t avail of the concessional tax rate on inputs in this matter as he opts to make payment of tax (IGST) for exporting goods. Thus, the supplier would follow the standard tax regime, where input tax credit would get used for output tax payment, and the balance liability would get paid in the form of cash. Merchant exporters can proceed ahead for claiming a refund of unutilized input tax credit and IGST paid against zero-rated supplies.

Take Away

Exercises of merchant exporter got covered under the standards of supply. The merchant exports under GST play a vital role in the economic progression of the nation. The merchant exporter must acquire GST registration and need to go through all the rules and regulations. Hence, our Corpbiz experts would simplify the GST registration process for you and assist you in a wide range of GST-related issues.

Read our article: A Guide on GST Benefits for Small Businesses & Start-ups