After being incorporated, every LLP is mandated is stay in line with time-bound compliances of ROC. These compliances & procedural matters ensure the seamless functioning of the LLP. In general, LLP confronts less compliance when contrasted with other business structures. LLPs are liable to comply with post incorporation compliances; thus, any negligence in this regard would trigger the penalty for the business owners. This write-up aims to pens down the mandatory Post incorporation compliances for LLP in detail.

List of Mandatory post incorporation compliances for LLP

LLP is a corporate business structure that renders the benefits of limited liability of a company & the versatility of a partnership firm. The LLP is an independent legal entity that doesn’t endanger the partner’s personal assets owing to the limited liability in the state of insolvency. ROCs of the respective jurisdictions are vested with the rights of incorporating such a business form in India. Soon after incorporation, these entities are liable to comply with the following post incorporation compliances for LLP.

Opening of Current Bank account

Registered entities in India are mandated to open a current bank account in the designated bank. The same is true with LLP-based entities as well.

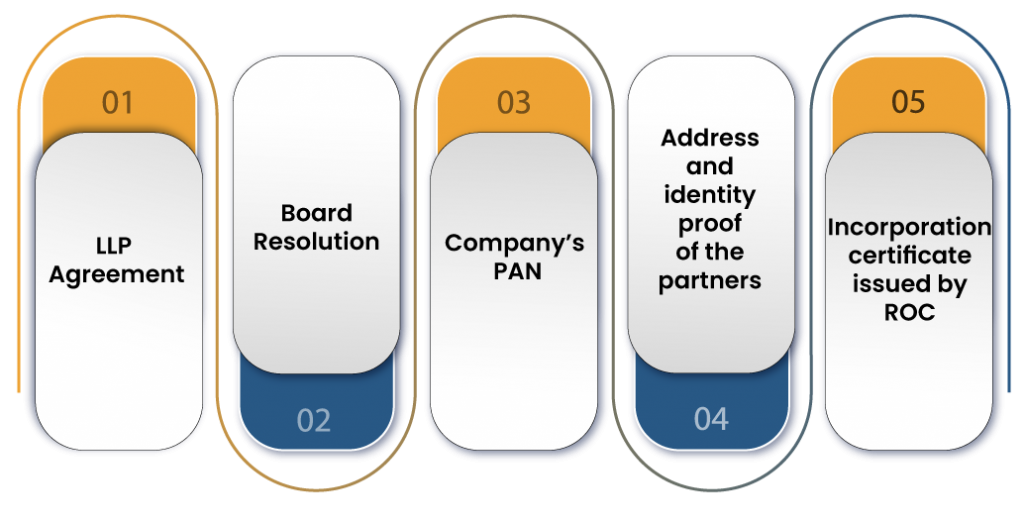

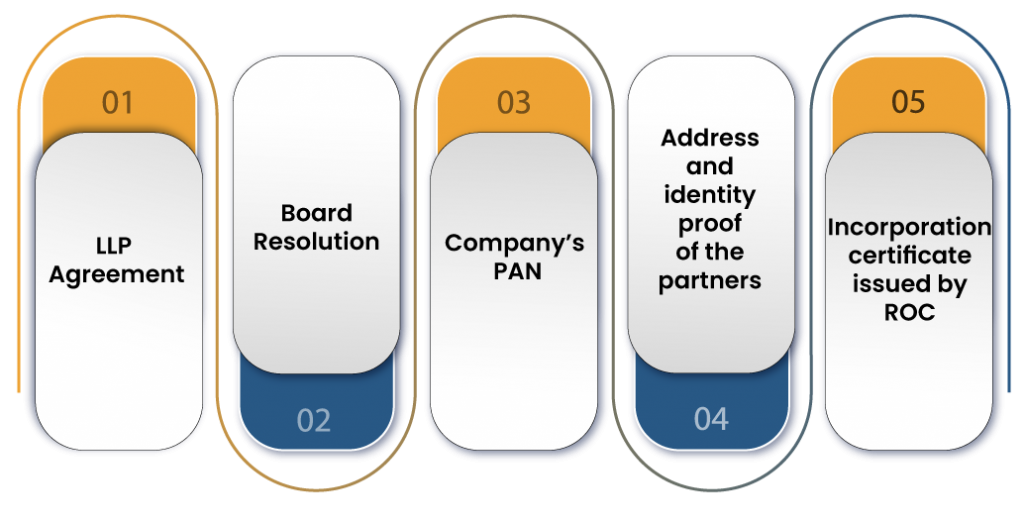

Presently, almost all banks have their web portal that allows companies to open current bank account electronically. While filling up the online application, these portals will prompt the partner to submit the following documents.

After this, the bank will conduct the remaining formalities in an offline manner.

Read our article:LLP Compliances – Statutory Compliance Checklist for LLP

Filing of LLP agreement

A contract between the active partners that manifest the rights and obligations of the serving partners is known as an LLP agreement. An LLP is mandated to file an agreement within thirty days of incorporation. The penalty of Rs 100/day will be levied on the company if it fails to comply with this condition.

Depositing share contribution fund to the designated bank

This is perhaps the most vital post-incorporation compliance for LLP. Based on the partners’ shareholding capacity, every partner is mandated to deposit their contribution into the concerned bank account in the prescribed time frame. A partner with a shareholding capacity of Rs 20,000 or more can transfer funds to the company from their personal account via internet transfer or a cheque.

Likewise, partners having a shareholding capacity of less than Rs 20,000 can make the payment in cash in addition to the aforesaid options.

GST Registration

GST is a form of an integrated tax structure that aims to subsume various indirect taxes such as CGT, VAT, Import-export duty, octroi, luxury tax, & entertainment tax. GST registration is a legal compulsion for registered entities in India that meet the following underlying criteria of the GST Act.

- If the prevailing supply of goods & services of the business is over Rs 20 lakh. The limit is Rs 10 lakh for North Eastern states.

- If the business is indulged with the inter-state supply of goods and services

- Businesses operating in an e-commerce regime.

- Taxpayers serving as input service distributors (ISD)

Income tax returns

IT return refers to a statement highlighting existing income source, tax liability, detail of the paid taxes, and any refund meant to be delivered to the government.

It is a legal compulsion for the serving partner to file an IT return even if the LLP does not generate any income in the given calendar year. IT returns is filed on an annual basis. Failing to comply with such a requirement would compel the tax authority to impose penalties on the defaulters.

Annual Return Filing

The details of the financial performance, management, & governance of LLP should be compulsorily shared with ROC located in the respective jurisdiction. LLPs are mandated to file annual returns within sixty days of closure of FY and account statement & solvency within thirty days from the end of six months of the FY.

The FY for the LLPs commences from Apr 1 to March 1. The LLP’s annual return is due on 30th May. The statement of account & solvency is due on the 30th of Oct of each FY. Delay filing will lure the penalty of Rs 100/day for the company. The serving partners in default will have to confront the fine of Rs 10000-Rs 100000

Account Auditing

In the purview of the prevailing bylaws, every LLP is liable to audit their account by practising CA if they met the following criteria

- The annual Turnover of the company is over Rs 40 lakhs

- Or, the contribution surpasses Rs 25 lakhs of the threshold limit

To access the exemption under audit, the LLPs accounts filed must enclose a declaration by the partners manifesting their commitment towards fulfilling obligations regarding accounting & preparation of financial statements[1].

Conclusion

As evident from the above, LLPs generally encounter less compliance than other business forms such as private limited companies & public limited companies. Most of the post compliances mentioned above are time-bound and revolve around hefty penalties. Thus, it is essential to keep the proper tap on due dates of such compliances.

Read our article:Is it easy to maintain Annual Compliance for LLP? Let us know in detail!