The Professional Tax is a tax imposed on an individual in any trade, profession, employment, and calling in West Bengal. The State legislature introduced the “West Bengal State Tax on Professions, Trades, Callings & Employments Act, 1979” on account of power granted by Article 276 of the Constitution of India. The Act came to life on 1-4-1979.

Eligibility Criteria Related to West Bengal Professional Tax

Those who fall under said Act might be bifurcated into two categories:-

i) Persons* engaged in trades, employment, callings, and professions.

ii) Employer** (Government, Private & Public Sectors who pay out salary/wages to the employees)

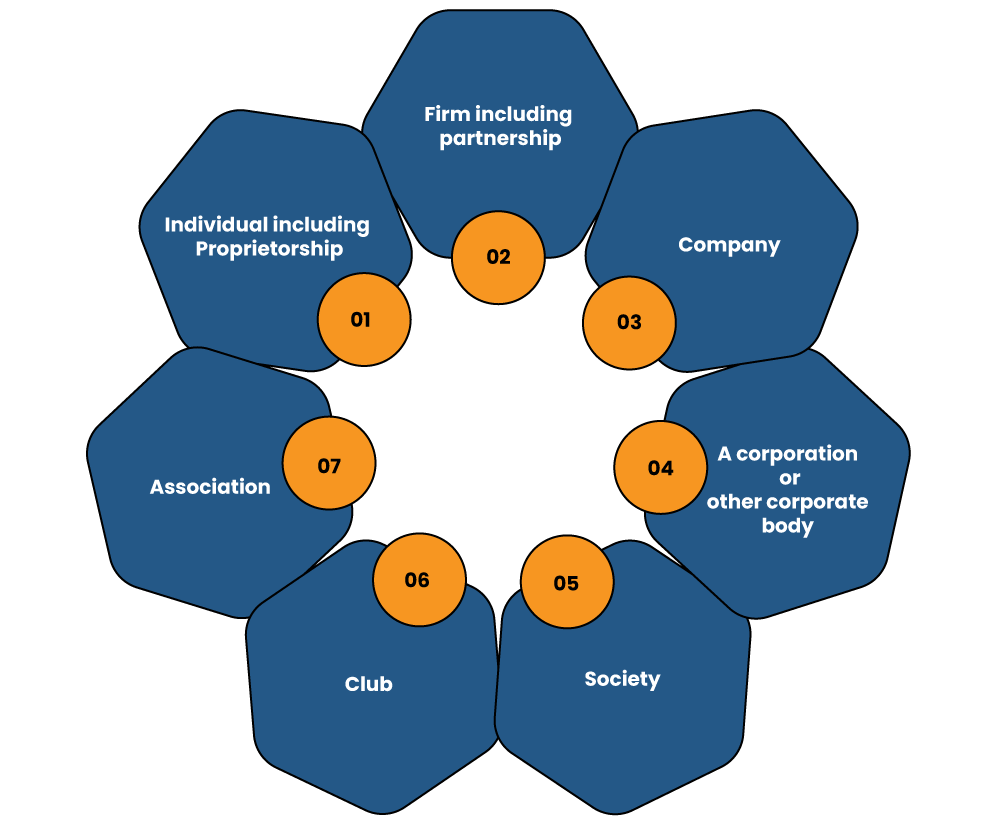

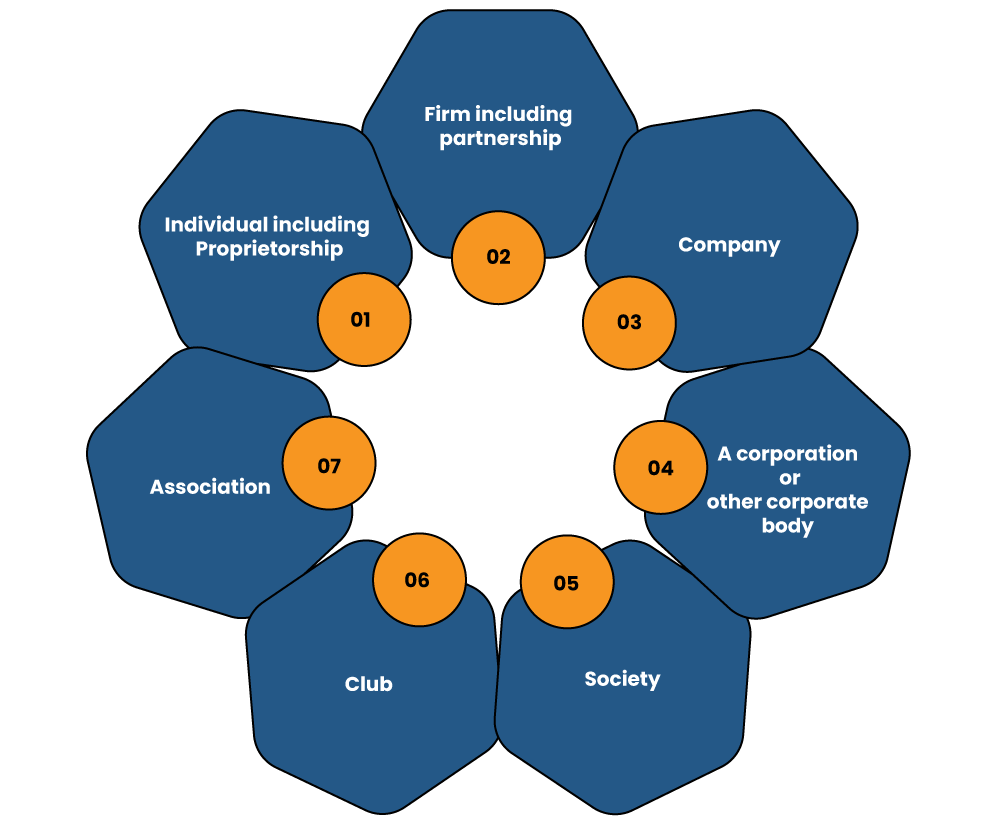

Person means any individual who is involved with any profession, employment, trade & calling in West Bengal & include

- A HUF, Company, Firm, Corporate body, and Club, Society or Association; &

- Any office or branch of such entities, so engaged, but does not include any individual who reaps wages casually on being employed for a timeframe not surpassing 180 days in a year.

Read our article:Professional Tax Registration Certificate- How it differs from TDS?

Exemption Available to Taxpayer under said Act

The State Government held the rights to reduce or exempt the tax rate by issuing notifications. At present, the following individuals are exempted from payment of professional tax

- A Person from a defence background as defined in the Air Force act, 1950, the Army Act, 1950, and the Navy Act, 1957 serving within the territory of the state of West Bengal[1] and drawing income and allowances

- The members of the auxiliary force contribute their service to the defence regime within West Bengal and make income from the same.

Online procedure for West Bengal Professional Tax Registration

- Use the following URL to reach out for the official website of West Bengal Professional Tax. http://wbprofessiontax.gov.in/

- On the mid-screen of the home page, select an option called Enrollment.

- Next, on the subsequent page, select option- First Time Application under Apply for Registration heading.

- The office selection page shall appear on your screen. Here you need to select your District, Sub Division, and Police Station from the drop-down menu, and then click Continue.

- Under Applying As window, select an apt option from available alternatives from the given list. The alternatives covered in the list include;

- Once done, head to the next page by clicking the continue tab.This will lead you to the Principal Info page. Here you need to provide details like

- Name of the applicant

- Father/Husband name

- Trade name

- Address of Principal places of work

- Mobile number, Email Id, Pan No.

- Date of commencement of trade/profession

- Bank Details such as Bank Name, IFSC, Account Number, and Branch Code.

- Once done, click Continue followed by Confirm. Please select the option wisely because it is a one-time process, and an error shall appear if you try to revert.

- On the next page, select the nature of profession or trade and average monthly income. Once done, hit the Continue tab at the bottom of the page.

- On the next page, you can see the application number in the top-right corner. Tap the Continue tab on the same page.

- Now it’s time to make the payment. Select “Proceed to GRIPS for payment” on the next page and click on the Continue tab.

- The portal will generate the Government Reference Number, which you must note down. On the same page, click the link- Go to United Bank (For online payment)

- After making the payment, the declaration page shall appear, which you have to tick to proceed further.

- Lastly, the acknowledgement certificate shall appear on your screen.

Prerequisites regarding Enrolment under the aforesaid Act

Every taxpayer that fall under entry no. 2 to 4 of the “Schedule” added to the Act must obtain an Enrolment Certificate within 90 days from the liability’s date to pay tax. An individual liable for paying tax shall apply for online Enrolment.

Where the taxpayer has more than one office or branch in the state, he/she may file a single application. If a person attracts multiple entries of the Schedule, the higher interest rate of interest cited under those entries shall be applicable. If a person makes an intentional enrolment default within 90 days from the liability’s date, a penalty @ Rs 90 days of the calendar month or part thereof might be levied. Also, the defaulter may face simple imprisonment with or without a fine in such circumstances.

Digitization- Simplifying the Professional taxes services for West Bengal’s taxpayers

Digitization has given a new dimension to the government authorities. The undertaking related to registration, Enrolment, & reconciliation has now become easier and intuitive than the conventional method. The Profession Tax of West Bengal is no different to this digitization wave.

Lately, the commercial tax department has made an attempt to simplify the Profession Tax by shedding down manual intervention. Technically, the portal goes with the essence of the Digital India Initiative as it digitizes the following services.

- Enrolment (new applications & generation, amendments and revocation of dematerialized certificate).

- Registration (new applications & generation, amendments and revocation of dematerialized certificate).

- Online and offline Tax payment facility via GRIPS, a portal of Finance Department, Government of West Bengal.

- Return filing for the registered employers.

- Issuance of certificate related to Profession Tax Payment

- Government Department ID Number Generation for government officers.

Conclusion

Professional tax refers to a tax that the government of state imposes on all person who makes money through any medium. Such tax must not be confused with the definition of other professionals such as lawyers and doctors. In laymen terms, Professional tax covers every individual that reaps income for their living via different profession. The estimation of such taxes and the amount collected varies state-wise.

Read our article:Is Professional Tax Salary Deduction a Special Tax? Let’s Understand in Depth!