The methodical meaning of the term waqf is ‘detention.’ In the statutory definition, Waqf involves the detention of wealth so that its produce or income may always be prepared for religious or humane purposes.

Overview: What is the Meaning of Waqf?

- The ‘Waqf Act, 1954’ describes Waqf as, “the constant dedication by a soul confessing the Islam, of any ‘movable’ or ‘immovable’ property for any purpose approved by ‘Muslim Law’ as religious, pious or humane in the name of Allah.” Application and different types of Waqf have been discussed in this Blog. There is an intention behind creating a waqf. For that purpose, the Office of Mutawalli, which is known as the manager, is required.

- Case Law: It is observed in ‘M Kazimvs A Asghar Ali’ that, it means ‘commitment of some definite property for a pious object or withdrawal of pious intentions.’ As explained by ‘Muslim jurists’ such as ‘Abu Hanifa,’ Waqf is the ‘detention’ of a particular piece that owns the waqif or appropriator, and the dedication of its earnings to charity, the needy, or other useful objects, to provide a loan.

What is the Pre- Requisite for a Valid Waqf?

- Permanent commitment: The dedication of waqf property must be lifelong/permanent, and It should himself dedicate such assets for a purpose sanctioned by ‘Muslim law.’ The reason behind Waqfs is eternally religious.

- Case law: In ‘Karnataka Board of Waqfs v. Mohd. Nazeer Ahmad’, the commitment of business by a Muslim for the use of all travelers irrespective of ‘religion and status’ was held not to be a Waqfs on the ground that under Muslim law a Waqfs should have a religious motive. It should be only for the benefit of the Muslim community, and if it is secular, the charity should be to the poor alone.

What is the Cotmpetency of the Waqif?

- Founder of Waqf: The person who establishes the Waqf of his properties is called the ‘founder of Waqf/Waqif. The waqif must be a competent person at the moment of dedicating the asset in Waqfs. As admires the capacity of a Muslim for producing it, there are only two conditions:

- the unsound mind has no capacity

- the minor person is void.

- Waqf and Non-Muslims: The dedicator must confess Islam, i.e., holds in the schoolings of Islam’, he must not be a Muslim by religion. The ‘Madras and Nagpur High Courts’ have ensured that a non-Muslim can also provide a valid waqf presented the object of it is not opposite the teachings of Islam.

- Patna High Court has also held that a non-Muslim may constitute a valid waqf. Nevertheless, a non-Muslim waqf may represent only a public waqfs; a non-Muslim cannot perform any private waqfs.

- Widow and Waqf: She cannot establish a waqf of any property held by a widow in place of her unpaid dower because the woman is not an official owner of that wealth.

- Pardanashin lady: In this case, it is the duty of the successors and the ‘mutawalli’ to confirm that the women had employed her mind freely for creating the Waqfs after fully realizing the nature of the event.

- Amount of property: a person can devote his entire ownership, but in the event of the ‘testamentary Waqfs,’ higher than one-third of property must not be dedicated.

What is the Legal Doctrine of Cypress Applicable to Waqf?

- The term ‘cypress‘ means ‘’as nearly as possible.’’ The ‘doctrine of cypress’ is a source of the ‘English law of trusts.’ Following this doctrine, a trust is administered out as nearly as attainable, according to the objectives laid down in it.

- Wherever a settlor has enumerated any ‘lawful object’ Finished, or the object cannot be executed more, the trust is not permitted to fail. In these specific cases, the ‘doctrine of cypress’ is applied. The assets of the property are utilized for those objects which are as nearly as possible to the object already given.

- The doctrine of cypress is applicable to waqfs when :

- lapse of time or

- altered circumstances or,

- unusual legal trouble or,

- where the particularised object has previously been completed,

- the waqf may be permitted to continue furthermore by applying the doctrine of cypress.

What are the Legal Episodes of Waqf?

What are the Forms of Waqf Creation?

- By an act inter vivos:– This sort of waqf is performed between living voices, created during the existence of the waqf and practices effect from the very instant.

- By will:– A waqf produced by will is inconsistent with a waqf founded by an act ‘inter Vivos.’ It takes influence after the death of the waqif and also acknowledged as ”testamentary waqf”. Such a waqf cannot determine upon higher than one-third of the net property, outwardly the approval of the heirs.

- Meanwhile, death: –The gifts made while the donor is on the death bed gets operate until the extent of one-third of the property without the consent of the heirs of the estate.

- By traditional user– Deficiency of time also connects to the conception of waqf property, but waqf property can be established by way of conventional use.

Varieties of Waqf

- Public Waqf

- Private Waqf

What are the Classes of waqf from the perspective of its purpose?

- WaqfAhli: the interests of waqfs are assigned for the founder’s offspring and their children. Nevertheless, these successors cannot sell or distribute the property subject-matter of waqf.

- Waqfkhayri: the interests of waqf are assigned to charity and generosity. Representatives of beneficiaries hold the poor and the indigent. Waqfkhayri typically entertained to finance mosques, shelters, schools, and universities.

- Waqf al-sabil: a waqf whose recipients are the general populace. It is mainly related to waqfkhayri, though waqf al-sabil is usually used to install and construct the public utility.

- Waqf al-awaridh: the essence of waqf is contained in resources so that it can be used at times of difficulty or unanticipated events that negatively affect the livelihood and well-being of a society of people. For instance, It may be assigned to the well-being of specific needs such as medicine for ill people, etc.

- Waqf-Istithmar: Its wealth is intended for purchase. Such assets are managed to generate income that command be used in constructing and remodeling it holdings.

- Waqf-mubashar: Its assets are used to produce services to the advantage of some charity beneficiaries or other receivers. Instances of such assets incorporate schools, utilities, etc.

What are the Conclusive Goals of WAQF?

Based on determining cases and the line of famous Mohammedan Jurists, appropriate objects which had been disclosed to be valid targets of waqf are:-

- Mosque and outlines for Imamas to lead worship.

- Commemorating the childbirth of Ali Murtaza

- Rehabilitation of Imambaras.

- Preservation of Khankahs.

- Understanding the Koran in public areas and also at private residences.

- Protection of poor relations and dependant.

- Repayment of money to Fakirs.

- Award to an Idgah.

- Donation to the college and preparations for professors to teach in universities.

- Bridges and Caravan Sarai.

- Combination of alms to needy persons, and aid to the poor to enable them to make the pilgrimage to Mecca.

- Retaining Tazias in the period of Moharram, and preparations for camels and Duldul for divine advances during Moharram.

- Marking the death anniversary of the pioneer and the members of the group.

- Completion of celebrations associated with Kadam Sharif.

- The development of a Cobat or free boarding residence for pilgrims at Mecca.

- Delivering the annual Fateha of the fragments of his family.

- A Durgahor or shrine of a Pir, which has long been held in esteem by the public.

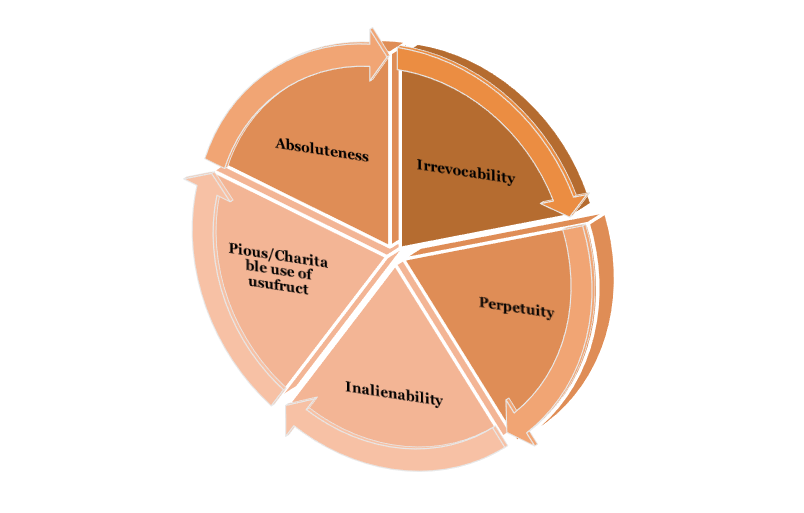

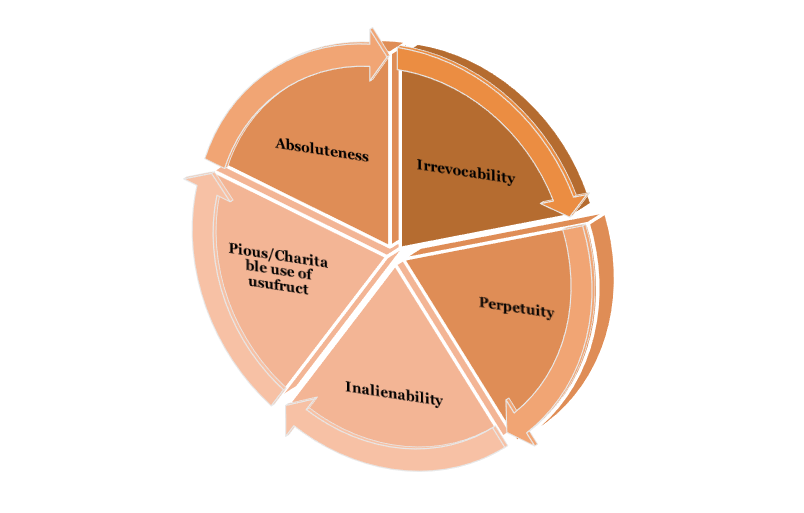

What are the Lawful Outgrowths of Waqf?

- Commitment to God – The estate vests in God in the understanding that nobody can declare mastery of it. In ‘Md. Ismail vs. Thakur Sabir Ali’, SC continued that the property is devoted to God, and the descendants use only the usufructs.

- Permanent – Within India, a waqf, once submitted and complete, cannot be reversed. The wakif cannot get his property back in his name or any other’s name.

- Changeless or Constant – Perpetuality is an indispensable element of Waqf. Once the property is given to It, it remains for the Waqf forever. It cannot be of a specified time duration.

- Natural – Since Waqf property refers to God, and no human being can alienate it for himself or any other character. It cannot be exchanged or given tirelessly to anybody.

- Religious or charitable use – The usufructs of the waqf assets can only be used for a spiritual and philanthropic purpose. It can likewise be used for descendants in the event of a private waqfs.

- Abolition of the right of wakif – The wakif misses all fairness, even to the usufructs of the estate. He cannot demand any advantages from that property.

- Authority of court’s inspection – The governments can inspect the functioning or administration of the waqf property. Misuse of the wealth of usufructs is a criminal attack as per the Waqf Act.1995[1].

Waqf Act, 1955

- Following this Act, a Muslim can tie his estate for ‘continuity for the support’ of his family, kids and descendants, granted that he makes a procurement in such a manner that the final benefits go to a charitable object of a lasting nature, made either ‘expressly or impliedly.’

- Following this Act, a Hanafi Muslim cannot enjoy the aggregate income or life care in the income of trust property.

- Hanafi Muslim trading the property can make adjustments of his ‘debts out of the rents’ and the profits of the property donated.

- Case Law: In the case of RadhaKanta Deb v. Commissioner AIR 1981 SC 798, Hon’ble Supreme Court mentioned that the Muslim Law acknowledges the continuation and making of a private trust as a charitable trust known as ”waqf-allal-aulad”.

Read our article: What are Section 8 Companies? Know its provisions and Incorporation Procedures

What are the Statutory Control of Waqfs In India?

The following statutes provide for the conception and protection of government/public endowments:

- Official Trustees Act II of 1913

- Charitable Endowments Act VI of 1890

- Religious Endowments Act XX of 1863, Section 14

- The Code of Civil Procedure, 1908, Sections 92-93.

- Charitable and Religious Trusts Act XIV of 1920

Mutawalli

- The manager or the administrator of the waqf is recognized as the ‘Mutawalli.’ Such a person selected has no controls, sell or exchange or mortgage the waqf estate without the prior authorization of the Court, except he has been recognized by the waqf deed expressly to do so.

- Case Law: In ‘Ahmad Arifvs Wealth Tax Commissioner,’ SC held that a mutawalli has no controls, sell or exchange or mortgage the waqf estate, without the prior authorization of the Court, except he has been recognized by the waqf deed expressly to do so.

- Eligibility of Mutawalli – A person that is a major, of ‘sound mind,’ and who is able of ‘performing the functions’ of the waqf as sought by the wakif can be appointed being a mutawalli. A ‘male or female’ of any faith can be selected. If spiritual duties are a fraction of the waqf, then a woman or a non-muslim cannot be selected.

- Case Law: In ShaharBanovs Aga Mohammad, Privy Council held that there is no legal restriction, and A ‘male or female’ of any faith can be selected. If spiritual duties are a fraction of the waqf, then a woman or a non-muslim cannot be selected.

- Appointment of Mutawalli– Usually, the wakif designates a mutawalli. If it is created outwardly selecting a mutawalli, in India, it is deemed valid, and the wakif matches the first mutawalli in Sunni law. Still, according to Shia law, even though the waqfs continues correct, it has to be determined by the beneficiaries. The wakif, too, can lay down the rules to select a mutawalli. The following is the form in which the ability to choose the mutawalli transfers if the first one fails –

- Originator,

- Administrator of the founder, &

- mutawalli on his dying bed.

- The Court, which should match the guidelines –

- It should not ignore the directions of the settler, but shared interest must be given higher importance.

- The decision should be given to the family segment of the wakif instead of an utter outsider.

- Powers of a mutawalli – Being the administrator of the waqf, he is in command of the usufructs of the property. He has the subsequent rights –

- He can exercise all reasonable efforts in good faith to guarantee that benefits the intended beneficiaries. Unlike a trustee, he is not a proprietor of the property until taking permission from the Court upon appropriate grounds; however, the wakif may give such powers to the mutawalli by explicitly specifying them in waqfnama.

- He is qualified to file a suit to preserve the interests of the waqf.

- He can rent the property for farming purposes for less than three years and the non-agricultural plan for less than one year.

- He is allowed to remuneration as presented by the wakif. If the payment is too small, he can appeal to the Court to get an extension.

- Removal of a mutawalli – Usually, once a mutawalli is duly delegated, he cannot be separated by the wakif. Nevertheless, a mutawalli can be removed in the subsequent segments –

- By waqf board

- By Court

- By the wakif

Management of Property

De Facto Mutawalli– If a person who has not been approved to act as a mutawalli by the waqif or the Court, considered the status to maintain the property, he enhances a ‘trustee de son tort’ as is so effective as such.

Liability of Mutwalli to account

Under the waqfs deed, if there endures a clause exempting the mutawalli from responsibility, that has to be considered. Each recipient has the right to claim a report from a mutawalli at any time. Such a recipient also has the power to request his share of income and sue for such an amount.

What are the Waqf Distinctiveness?

Sadqah Vs. Waqf

| Sadqah | Waqf | |

| 1. | The‘legal estate’ and not just the beneficial curiosity pass to the aid to be held by the trustees selected by the donor. | The ‘legal estate or the ownership’ is not conferred in the trustee or the ‘mutawalli’ but is conveyed to God. |

| 2. | ’corpus and the usufruct ‘is age given away. | The trustees of a waqf cannot estrange the corpus of the property, excluding in the case of need with the prior consent of the Court or settlor. |

| 3. | It is in the procedure of a ‘donation or a gift.’ | It is an ‘endowment.’ |

Hiba Vs. Waqf

| Hiba | Waqf | |

| 1. | The object permits from one human being to alternative. | The right gets stub out |

| 2. | Possession is vital. | Inter vivos, no delivery of possession is vital. |

| 3. | There is no restraint to the object. | It is slender only for religious, charitable, or pious, Family purposes. |

| 4. | Absolute right is transferred. | Absolutely quenched and passes in favor of the God. |

Trust Vs. Waqf

| Trust | Waqf | |

| 1. | Religious intention is not obligatory for trust. | Must be religious motive behind generating a waqf. |

| 2. | A trustee may be recipient. | A settlor, except a Hanafi one, is not eligible to keep away any benefit for himself. |

| 3. | Has lawful object. | The purpose must be charitable, pious, or religious according to the Muslim belief. |

| 4. | Includes double ownership- equitable and legal. | The possession of the waqf is quenched, and the ownership is vested in God. |

| 5. | The trustee has greater powers being the legal owner. | Mutawalli is a mere receiver and administrator. |

| 6. | No power to demand remuneration. | Has the power to demand remuneration. |

| 7. | It is not required that a trust may be perpetual, irrevocable, or absolute. | Property is inalienable, irrevocable, and perpetual. |

| 8. | Indian Trusts Act, 1882, relates to trust. | Indian Trust Act, 1882 is not valid to |

Summing Up

Seemingly, there certain different ideas yet at the same time it has it’s very own one of a kind highlights like of religious or devout intention, perpetual nature and use of usufruct and so forth. Sadquah is made deliberately, whereas Zakah is mandatory. It’s thought process is religious, devout altruistic with legitimate article whereas no such intention or item is there in making trust. It can be separated from altruistic enrichments likewise simply based on its article i.e., point or article is simply religious as indicated by Islam whereas the point or object of beneficent enrichments is straightforwardly or in a roundabout way devout or religious and it has no nexus with the religious assessments of a specific group, i.e. It has wide common point.

Waqfs property and evacuee property can be separated based on laws made to distinguish or pronounce these properties, so i.e., a few Central and State Acts were passed for waqf when freedom whereas Evacuee Property Act, 1950 only manages such properties. Finally, it tends to be inferred that commitment and the embodiment of dedication towards ALLAH is more in WAQF and in no other method for donation. To serve society until the end of time.

Read our article:NGO Registration – Step by Step Procedure