NBFC is a growth-oriented sector that contributes heavily to the country’s growth. But in the past few years, this sector has encountered plenty of challenges owing to tight government compliance and evolving technology. In this blog, we will unfold some fact, given the current scenario regarding trends and investments in NBFCs.

A Generalized Overview on NBFCs (Non-Banking Financial Companies)

NBFCs plays a pivotal role in advocating equitable opportunities for growth in the nation by rendering a wide range of financial aid to the unprivileged as well as privileged section of society. Furthermore, NBFCs is a prominent provider of unique financial services to MSME fitting to their requirements and catering to Microfinance needs for the individuals.

As mentioned above, they do consider as the relevant alternative to the banking sector in meeting the financial needs of the industrial sector. However, the scope of operation of the Non-Banking Financial Sector is limited by the rules and regulations lay by the government of India.

Before we start to unfold the multifarious roles of NBFCs in the current scenario, it is very much needed to comprehend the key objective behind the functionalities of these esteemed institutions. To be precise, NBFCs are not merely focusing on profitability as their main goal is to make financial services accessible to all verticals of society and the working sector.

Government Support to Triggers Credit and Investment in NBFCs

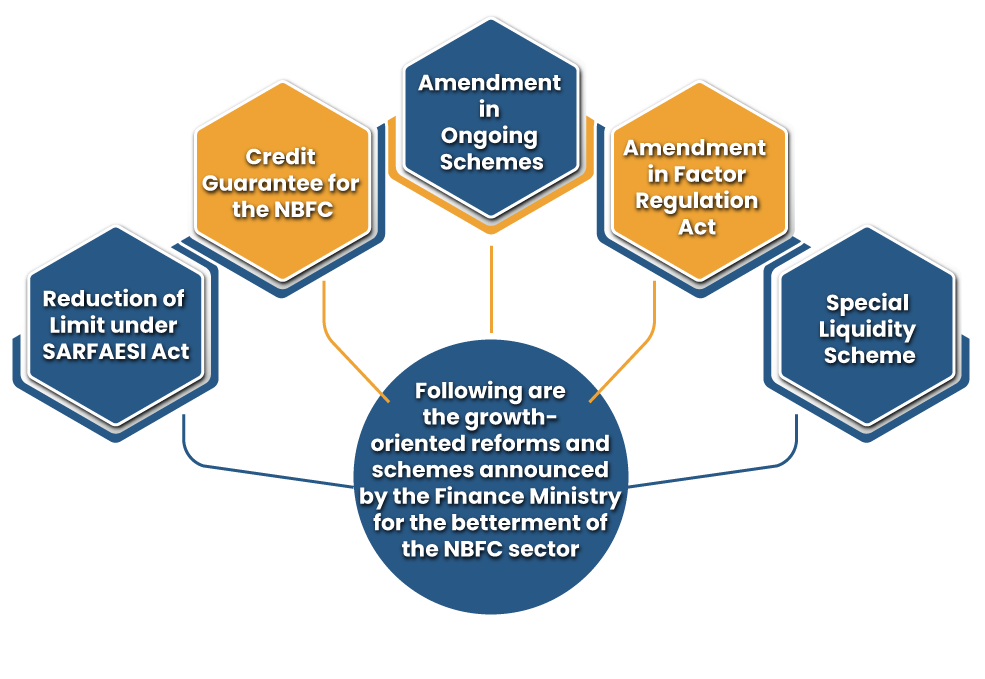

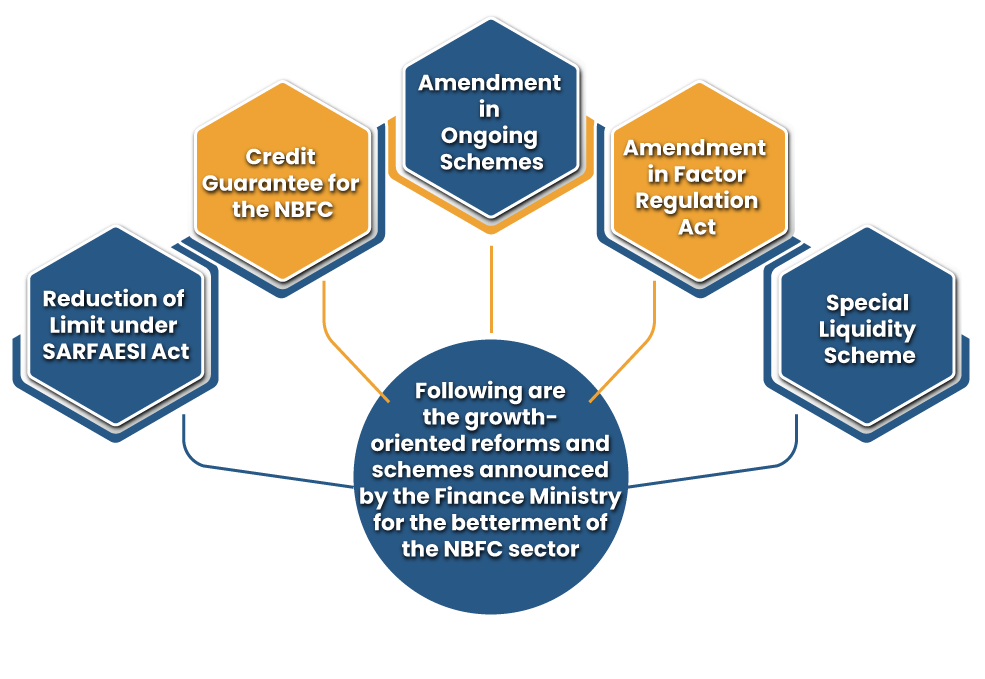

Following are the growth-oriented reforms and schemes announced by the Finance Ministry for the betterment of the NBFC sector.

Special Liquidity Scheme

In mid-2020, the finance ministry came up with a scheme viz Special Liquidity Scheme to render fiscal credit to distressed NBFCs through special purpose vehicle (SPV) established by SBICAP. The scheme was announced in the view of the COVID 19 pandemic as a relief package for the struggling NBFCs and Microfinance minister.

Reduction of Limit under SARFAESI Act

The budget facilitated reducing the asset size if NBFCs from Rs 500cr to Rs 100cr to make them eligible for the debt recovery under the said Act. This will enable them to keep track of the rise of the NPA ratio of NBFCs.

Credit Guarantee for the NBFC

The budget announced by the finance ministry in 2019 primarily focused on a partial credit guarantee scheme to overcome liquidity crisis while for 2020-21 budget further underpin guaranteeing securities on affected assets of NBFCs.

By backing up stressed assets through bonds, the government aims to improve the financial standing of the NBFCs by making them eligible for credit. The much-needed credit can save hundreds of NBFCs from being bankrupt and even increase the chances of investments in NBFCs.

Amendment in Ongoing Schemes

To advance Agri-finance, the focus was on broadening the scope of the NABAED refinance scheme to encompass NBFCs & other cooperatives that are actively operating in the agriculture sector. Accordingly, the agriculture credit worth Rs 15 lakh crore has been led out by the government for the financial year 2021.

Amendment in Factor Regulation Act

Another move that is expected to motivate the MSME sector to make amendments in the existing Factor regulation Act 2011 would allow NBFCs to extend invoice financing to MSMEs via the TReDS portal.

This measure will significantly minimize one of MSMEs’ top loopholes- timely accesses to much-need credit & working capital requirements meet. Additionally, it would trigger the chances of investment in NBFCs.

Government of India, in association with apex banks, allowing NBFCs to avail easy credit against the bonds. With such support, NBFCs can extinguish their existing liabilities and continue to conduct their operation for an extended period of time. Such credit is available at easy repayment options and interest so that cash flow within the economy remains unaffected.

Reasons why NBFCs Seeking Investment from Banks and Other Sources

In the view current scenario, NBFCs across the nation are facing relentless pressure to survive in a competitive environment. They are in desperate need of funds owing to the following reasons:

The COVID 19 pandemic has dented the growth of many industries in the financial sector, and NBFCs are not an exception here. Lack of credit has eroded their ability to sustain longer in the market, and they are facing a severe liquidity crunch at this point. This is one of the primary reasons why these firms seeking investment from viable sources.

Stiffer competition is making life difficult for NBFCs operating across the country. Adoption of the latest technology by their counterpart is weakening their grip on the existing market. To gain a competitive edge, these firms must leverage the latest technology and reform their IT department. Apparently, such tasks require the procurement of heavy investment, which appears to be a daunting task for NBFCs at this point. Government must frame out policies that can increase the chances of investments in NBFCs.

Key Challenges for NBFCs in Upcoming Times

It won’t be easy for NBFCs to stay competitive in the future without technological advancement and required infrastructure amendments. To stay ahead of the curve, these entities are required to shift their focus on the following measures:-

- Harnessing synergies across the value chain of lead generation

- Ensuring widespread reach to cater to all facets of society and industries seeking fiscal aid.

- Developing tactics to mitigates the financial gap created by the Covid – 19.

- Amending risk management assessment in accordance with the existing scenario to avail accurate results.

- Creating opportunities to adopt the latest technology and to implement seamlessly across all services.

- Finding viable investors, apart from banks and PE investors that are attracted towards the investments in NBFCs.

Government to Impart Funding Sources for NBFCs

While establishing new sources for investment to support private lenders and considering the expert views, the Indian government is finding it hard to strike a balance between overcoming fiscal deficit & compromised economic growth in the long run by aiming to counter the existing liquidity crunch for the NBFC sector. It allows to provide additional assistance to other ancillary sectors that can accelerate growth altogether.

Conclusion

Considering the existing trend & future ahead, the NBFCs are all set to get much need resilience not only from the government’s viewpoint but also from the investors, i.e., private equity investors. These said investors might step up investments in NBFCs in spite of the credit crisis that is likely to continue for months from now.

Read our article:A Complete Guide on Operational Manual of the NBFCs