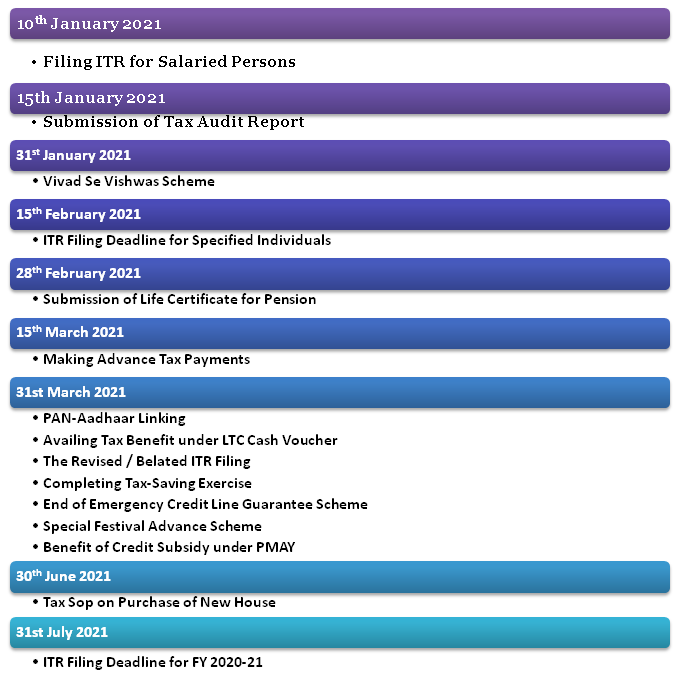

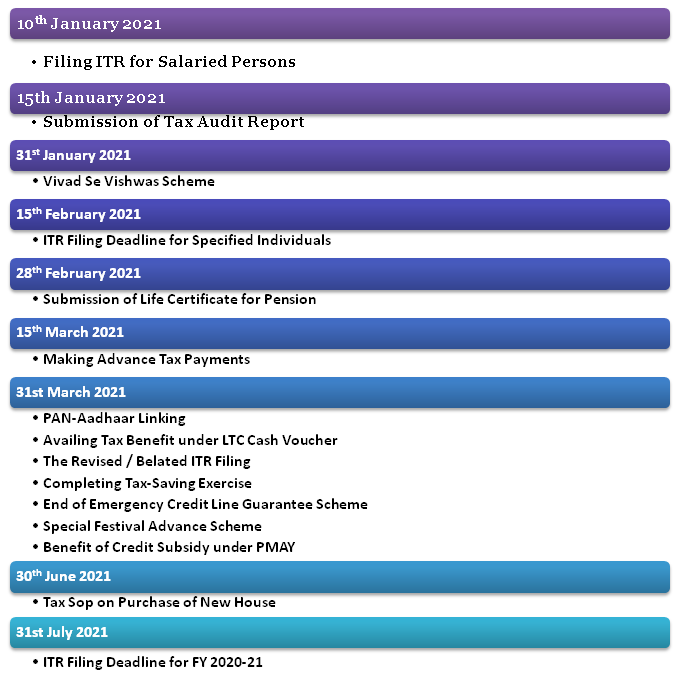

It is good always to be alert, especially when it comes to money. To ensure that you have a smooth year 2021, there are about 16 financial deadlines in 2021 that the taxpayer should know. The government has extended most of the essential financial deadlines in 2021 in the wake of Covid 19 pandemic. Below is a list of all the financial deadlines in 2021 that the taxpayer should make a note in their calendar for the year 2021.

List of All the Financial Deadlines in 2021

Last Date for Filing ITR was Extended Till 10th January 2021 for Salaried Persons.

If you haven’t filed ITR for FY 2019-20, you have time till 10th January 2021 to file without paying any late filing fee. In a press release on dated 30th December, 2020, the government has extended the due date for filing ITRs for individuals whose accounts are not required to be audited.

Generally, these individuals file their tax returns by using the form no ITR-1, ITR-2 or ITR-4. You will have to pay a fine of Rs 10,000 if you fail to file ITRs within the said timeframe.

Last Date for Submission of Tax Audit Report was Extended to 15th January 2021

The government has extended the deadline for submission of various audit reports under the Income Tax Act[1], including tax audit reports; reports related to international and specified domestic transactions for the fiscal year 2019-20 to 15th January 2021.

Last Date to Submit Declaration under Vivad Se Vishwas Scheme has been extended till 31st January 2021

31st January, 2021 is the last date for submission of declaration forms under the Vivad se Vishwas Scheme. The plan was announced in Budget 2020 to settle income tax disputes and reduce pending income tax litigation.

ITR Filing Deadline for Specified Individuals Has Been Extended Till Date 15th February 2021

15th February 2021 is the last date for filing ITR for those individuals whose accounts are need to be audited or who are need to submit the report under Section 92E specified domestic/ international financial transactions were carried out during FY 2019-20.

The Last Date for Submission of Life Certificate for Pension Has Been Extended Till 28th February 2021

To give relief to senior citizens, the government extended the deadline for submission of pension life certificate from 30th November, 2020 to 28th February, 2021.

Pensioners should ensure that their life certificate is presented by this date to continue receive a pension without any break. If the life certificate is not presented, the pension amount will not be distributed to the pensioner.

Last Date for Making Advance Tax Payments Has Been Extended Till Date 15th March 2021

Effective from 1st April, 2020, dividend income has become taxable in the hands of an individual recipient. Dividend income is taxable at income tax slab rates applicable to a person’s income. Additional, TDS will be applicable if the dividend income in the financial year is more than Rs 5,000.

Like this,

- If you have received substantial dividend income in FY 2020-21, then it is likely that you are liable to pay advance tax.

- If the total tax liability exceeds more than Rs 10,000 in the relevant financial year in that condition, then advance tax liability arises.

- If the taxpayer forgets to pay the tax on or before March 15, 2021, he will be fined.

PAN-Aadhaar Linking Deadline Has Been Extended Till Date 31st March 2021

The Government of India has extended the financial deadline for linking PAN card to Aadhaar card from 30 June 2020 to 31 March 2021. As per current law, if your PAN card is not linked to your Aadhaar card till that date, then your PAN card will be deactivated. Once your PAN card is deactivated you will not be able to quote your PAN for any financial transaction.

However, once the inactive PAN card is added with the Aadhaar card number, your PAN card will become operative from the date of linking.

Availing Tax Benefit Has Been Extended Till 31st March 2021 Under The Date Of LTC Cash Voucher Scheme.

According to the financial deadline in 2021 set by Government, 31st March, 2021, is the last date for receiving tax benefits under the LTC Cash Voucher Scheme. The government announced this plan in October 2020 to incentivize employees to use their unclaimed holiday travel allowance (LTA) amount to boost consumer demand. The scheme was first introduced for employees come under central government. This was later extended to non-central government employees, such as private sector and public sector employees.

According to the plan, an employee needs to spend three times the amount considered as LTA rent on goods and services, attracting a GST of 12% or more.

The Revised / Belated ITR Filing Deadline Has Been Extended to 31st March 2021 for the Financial Year 2019-20

If a person (whose accounts do not require auditing) has missed the deadline for filing income tax returns for the financial year 2019-20, that is, January 10, 2020, he should file an ITR by 31st March, 2021.

If you are filing a belated return, then you have to pay penal interest of Rs 10,000. However, for small taxpayers, with an income up to Rs 5 lakh, the late filing fee cannot exceed Rs 1,000.

The Deadline for Completing Tax-Saving Exercise Has Been Extended to 31st March 2021

As per the financial deadlines set by the Government you should complete your tax-saving practice by a last day, that is, March 31, 2021 for FY 2020-21, if you missed this deadline will mean that you missed the opportunity to reduce your tax liability for the financial year 2020-21

End of Emergency Credit Line Guarantee Scheme till Date 31st March 2021

Under the regime of Atmanirbhar Bharat Package, the Government of India has introduced the Emergency Credit Line Guarantee Scheme on 13th May, 2020. The scheme offers fully guaranteed and collateral-free loans to many companies, including individuals who wish to obtain loans for performing business activities. As per the financial deadlines in 2021 set by the government, to avail the benefits of described above the last day of the scheme is 31st March, 2021.

Deadline to Avail Special Festival Advance Scheme is 31st March 2021

Apart from LTC Cash Voucher Scheme, the government also introduced an interest-free advance of Rs 10,000 to government employees. Advances granted will be recoverable in a maximum of 10 installments.

Availing Benefit of Credit Subsidy under PMAY till Date 31st March 2021

31st March, 2021, is the government last date for availing benefit of loan subsidy under the Pradhan Mantri Awas Yojana. The scheme gives home loan between Rs 6 lakh and Rs 18 lakh on annual income for the middle-income group, subject to the credit-linked subsidy, terms and conditions.

Deadline to Avail Benefits of Tax Sop on Purchase of New House Is 30th June 2021

The government introduced an income tax SOP for new home buyers making prior purchases of residential homes up to Rs 2 crore. According to the announcement, the government has increased the allowable difference (for income tax purposes) between the sales/purchase contract price and the circle rate from 10% to 20%. The last date is to take advantage of this scheme is 30 June 2021.

ITR Filing Deadline for FY 2020-21 till Date 31st July 2021

According to the financial deadlines in 2021 set by the government, 31st July, 2021 is the last day for taxpayers to file ITRs. During filing ITR for FY 2020-21, individuals can select between the new concessional tax regime and the existing tax regime. If a taxpayer chooses a new tax regime, he will have to fill an additional form when filing his ITR.

Concluding Remarks

Like every year, the Government of India has extended some financial deadlines in favor of the taxpayer. Download, keep a copy, take a screenshot and paste it on your desk. These dates are like soundboards for you to maintain your finance shape. Consider this for smooth financial activities throughout the year. You may kindly associate with Corpbiz expert to know more about the all financial deadlines in 2021

Read our article:An Overview on Filing of Form 10BA of Income Tax