After the advent of the GST (Goods and Service Tax), the tax authority came across countless cases of non-filing of returns from various suppliers. They avoid incorporating transactions in the form of GSTR-1 and do not address tax liability thereon. Such activities consequently lead to heavy mismatch which further translated into an act of tax evasion for the GST as well as income tax. Taking this scenario into account, the authority has appended the new provision in Finance Act 2020 for the imposition of TCS and thus; Section 206C was changed by adding Clause (1H). In this article, we will provide some briefing on TCS on sale consideration of goods.

Inculcation of Clause (1H) under Section 206C

As per the Clause (1H) every individual i.e. seller who reaps income after selling the goods of the value exceeding Rs 50 lakhs in any preceding year, excluding the exported goods or other items subject to sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of said amount, a sum equivalent to 0.1% of the sale consideration exceeding Rs 50 Lakhs as income tax-

- Provided that if the buyer fails to furnish the PAN or Aadhaar number to the seller, then the provisions of Section 206CC, sub-section (1), clause (ii) will be interpreted as if for the word “ five percent”, the words “one percent” has been superseded

- Provided further that the provision of the aforesaid section shall not be applicable if the buyer deducts TDS under the ambit of other provisions of the same Act on the good purchased from the seller.

Definition of Buyers and Sellers under the Said Act

(a) The term “Buyer” means an individual who buys out any goods; buyer can be anything other than-

- The Central Government, an embassy, a State Government, legation, commission, consulate, a High Commission, and the trade representation of a foreign State; or

- A local authority as explained in the clause (20) of section 10; or

- An individual importing goods into the country or any other individuals as the Central Government may, by declaration of official gazette, defined for this purpose, subjected to such stipulates as may be mentioned therein;

(b) “Seller” means an individual whose aggregate sales or turnover exceed ten crore rupees for the specific financial year promptly preceding the financial year in which the sale considerations were made, not being an individual as the central government may, by declaration in the official gazette, defined for this objective, subject to such stipulates as may be mentioned therein.

Who is Supposed to Collect TCS under Section 206C (1H)?

The Seller of goods is entitled to collect TCS under Section 206C (1H). However, only those sellers are eligible to collect the TCS whose gross turnover or receipts for the preceding financial year surpasses Rs 10 crore. Such a threshold limit shall have to probe every year. The central ministry[1] may offer some exemption on certain entities through the applicability of this section in pursuant to stipulates as may be specified.

Applicability of TCS on Sale Consideration of Goods

TCS (Tax Collection from Source) is imposed on those buyers from whom sale consideration obtained during the financial year surpasses fifty lakh rupees. This stipulates required to be analyzed independently for each buyer and the amount required to be examined autonomously every year.

It is essential to keep in mind that here the point of consideration for TCS collection is receipts and not sales. Henceforth, in the event consideration is received for sales, TCS shall be applied even if the yearly sale does not surpass fifty lakh rupees. Furthermore, CBDT (Central Board of Direct Taxation) yet to clarify whether receipts in contrast to sales made before 1st Oct 2020, will come under TCS.

As a cautious measure, TCS will be applicable on the same, unless the authority comes up with a contrary clarification. Keep in mind that the said section is not applicable to services for the time being.

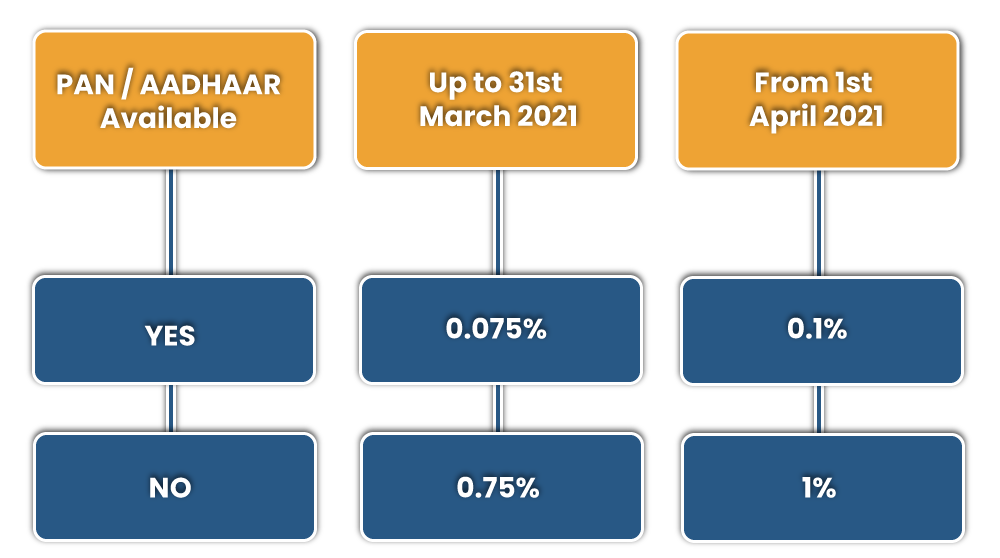

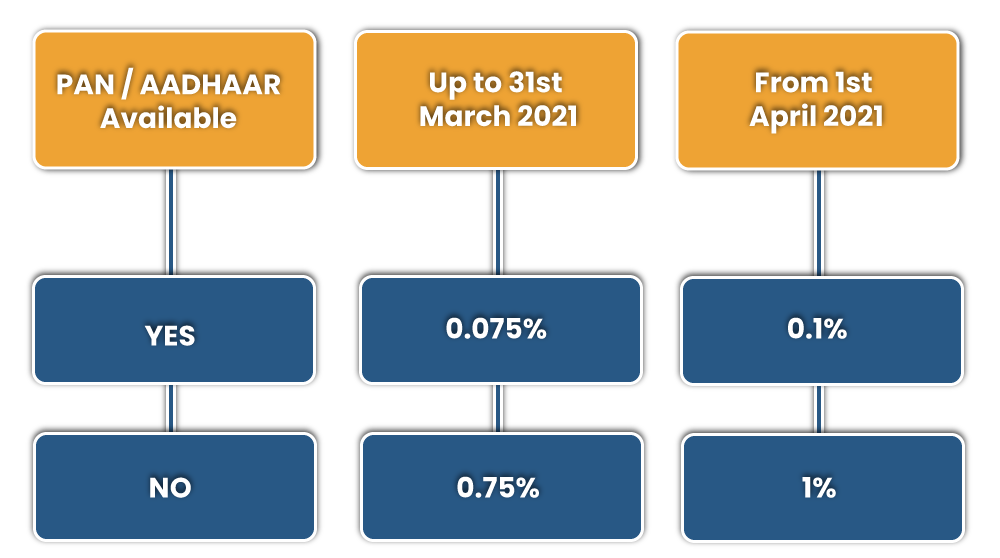

Rate for the TCS on Sale Consideration of Goods

Certificate of TCS on Sale Consideration of Goods

When the taxpayer files the TCS return via Form 27EQ, he has to furnished TCS certification to the buyers within fifteen days of filing. Form 27D is referred to as certification issued after filing of TCS returns. It consolidates the given information:-

- Seller and Buyer’s name.

- Tax Account Number (TAN) of the seller.

- Permanent account number (PAN) of both seller and buyer

- Gross value tax accumulated by the seller.

- Date of collection

- Rate of tax

Scenarios under which Section 206 C (1H) not applicable

The section shall not be applied to the given scenarios:-

- If aggregate turnover/receipts/sales of the assessee, during the financial year is less than ten crore rupees.

- If the sale consideration obtained from the buyer of goods or services is less than fifty lakh rupees.

- In case of export and import.

- In case the sale is made to the government authorities, legation, embassies, consulate or trade entity of the overseas state or a local authority or other individuals as per the given stipulates.

- In case the transaction is subjected to TDS under other sections.

- In case goods are covered by :-

- Sec 206C (1) which encompasses – alcoholic beverages, timber, tendu leaves, and scrap minerals such as iron ore or coal.

- Sec 206C(1F) which encompasses – automobiles surpassing ten lakh rupees in value OR

- Sec 206(1G) wherein remittance is being made in the place other than Indian Territory and TCS is being collected by AD i.e. Authorised Dealer for the same.

- In case of the transaction in commodities and securities traded via recognized stock exchanges or settled by the corporation including renowned stock exchanges or clearing institutions of International Financial Service Centre.

- Transaction in Energy Saving Certificate, electricity, Renewal Energy certificate traded via power exchanges working under the ambit of CERC’s Regulation 21.

- TDS deducted by online shopping portal u/s 194O.

- Receipt obtained by Insurance Agent exposes to TDS deduction u/s 194O.

- Fuel supplied to overseas airlines at Airports situated in the Indian province.

Conclusion

The new provision related to TCS on Sale has come into the existence on 1 October 2020. As per the said provision, if the your turnover exceeds Rs 10 crore in the preceding FY then you have to collect and deposit TCS on the receipts from sale of goods from the buyer from whom you have generated more the Rs 50 lakhs as sale consideration in the ongoing financial year. The TCS is payable on the amount of receipts accounted for more than Rs 50 lakhs & received after 1st. Oct. 2020. As of now, the rate of TCS is stand at 0.1%. However, due to the COVID 19 pandemic this slab rate has been reduced by 25% of it base value; thus; leaving it to the final value of 0.075%.

In layman term, Section 206 C (1H) would be applicable on those individuals, sellers in particular; whose turnover is more than 50 lakhs for the preceding financial year. But it should keep in mind that the applicability of this section is confined to the sales that occur within the Indian Territory. No sellers would come under the ambit of this section who is engaged in cross-border sales.

Read our article: Unregistered Person Can Claim ITC of VAT by Registering Under the Regime of GST