Apart from tracking the balance sheet what else a small business owner can do to track the financial well-being of their company? The answer is accounts receivable turnover. If you have recently stepped in into the business arena then probably you might not be aware of this particular term. Accounts receivable turnover reflects the company’s financial status and determines whether it is handling the cash flow efficiently or not.

Truth be told, accounts receivable turnover exhibits the company’s ability to convert its account receivables into cash. To ensure long-term business success, accounts receivable turnover is something that you can’t neglect at any cost.

What is Accounts Receivable Turnover?

Accounts receivable turnover measures the ability of a company to maintain a healthy cash flow by recovering the outstanding amount from the client against the services provided. You can determine how efficiently your business is handling the credit arrangement and cash collection via Accounts receivable turnover.

In the above mathematic expression, Net credit sales is equivalent to the gross credit sales for a specific timeline, be it monthly, quarterly, or yearly, minus any customer refunds. The Average Accounts Receivable can be calculated by simply adding the beginning accounts and ending accounts receivable for the specific timeline and dividing the whole expression by two. Make sure to consider the same timeline for calculating the average Accounts Receivable and net credit sales.

Read our article:How to Resolve Typical Issues of Medical Accounts Receivable?

Why Account Receivable Turnover is Crucial in the Contemporary Period from the Company’s Perspective?

In general, the accounts receivable turnover ratio is directly proportional to business profitability. The higher ratio indicates that the company is in a profitable state and handling the expenses with authenticity. The lower ratio, on the contrary, indicates the company’s inability to deploy optimal credit control policies. Besides, it also shows that the company is lacking a reliable client base. Probing in the account receivable process and credit terms is essential for safeguarding the well-being of the company.

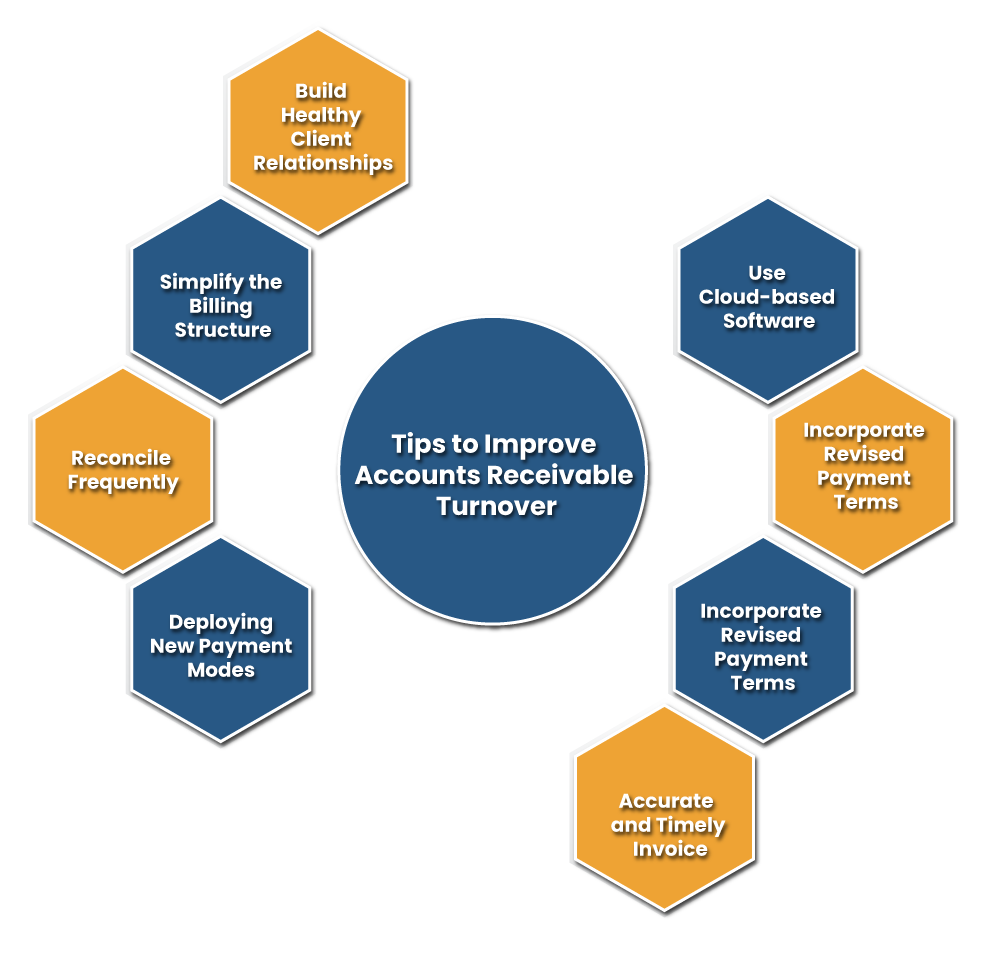

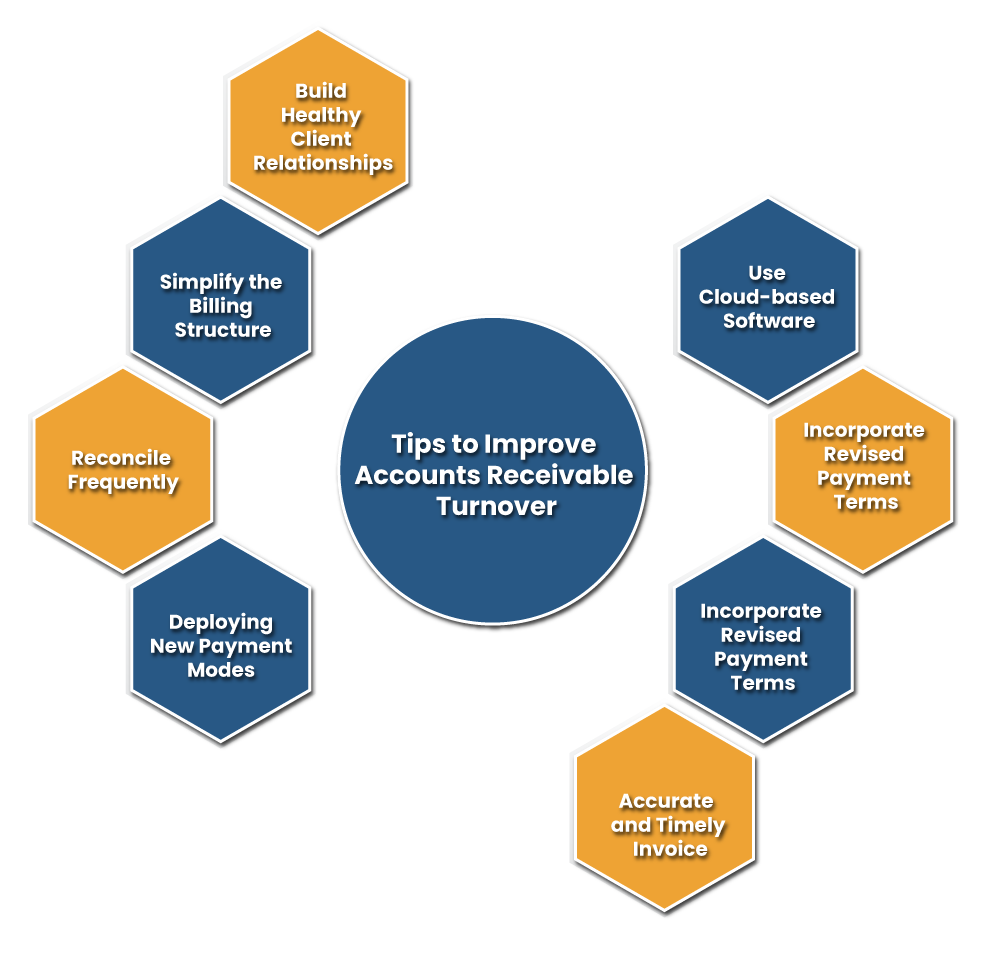

Tips to Improve Accounts Receivable Turnover

In view of this, here are some cutting-edge approaches that you can adopt to improve the accounts receivable turnover of your company

Build Healthy Client Relationships

The very first thing that can do to improve the account receivable is to build healthy relationships with the existing client. If you manage to keep them happy, then you may not encounter an unexpected delay in the payments and your cash flow remains unaffected for a longer duration of time. Small gestures like email check-in and a friendly phone call would be enough to make a difference when it comes to recovering debts.

Accurate and Timely Invoice

Accurate and timely invoice is another way to improve the cash flow in the company. Companies who exempt clients to pay early on-time payment will suffer in the longer run. Therefore, it becomes important for your company to roll out invoices as soon as the client availed of the services. The late issuance of invoices can allow your clients to skip the payable amount. So be wise and cautious while invoicing your customer. Don’t forget that customers are more reluctant to pay the quarterly or annual invoice in comparison to the regular bill.

Incorporate Revised Payment Terms

Make sure layout clear cut policies for debt recovery against the services provided. The policy must encompass the provision for late payment and charges against the same. Don’t hesitate to set up a credit limit in case if you are dealing with high-value services.

Use Cloud-Based Software

Cloud-based accounting software primarily targets the time-consuming aspect of the billing and accounts receivable process. They can help you speed up the billing process with assured accuracy. Accessing the cloud software lets you coordinate with the bookkeeping team in real-time and access financial data on a 24×7 basis.

Deploying New Payment Modes

Obsolete payment methods act as an obstacle to the account receivable process. Implementing new payment modes will motivate the client to address the payment liability on time. If possible, try replacing old payment modes like wire transfer or cheque with the new mode such as credit card and electronic funds transfers.

Deploy Pre-Payment Policies, If Possible

This may be the best technique for managing accounts receivable, but it can’t apply to a larger landscape. Pre-payment policies were used by a well-established organization or other entities that are dealing with high-valued products or have a strong brand presence in the market. For the new companies, it may not be a viable option.

Simplify the Billing Structure

Many service-based organizations have overcome issues with their account receivables by implementing the policy of fixed-fee billing. When you enter into a service contract with your client, you basically render the monthly services at a fixed price. And that can translate into the reduction of panic that often rises when a client confronts a higher invoice than expected.

A fixed fee billing policy can motivate clients to opt for automatic payment instead of the conventional payment method like cheque or wire transfer. Consequently, fixed-fee billing strikes balance between rendering your client with billing clarity and ensuring you reap uninterrupted payment on time.

Follow Up Regularly

No company likes to adopt a stringent approach when it comes to intimating clients for payment. There are some subtle ways to do the same. You can calibrate your collection process by incorporating transparent policies in regards to invoice generation and payment terms.

Reconcile Frequently

Consistent reconciliation with accounting records will let you keep your account receivables up to date. By constantly managing, monitoring, and improving accounts receivable turnover you can ensureseamless flow of cash within the company.

Conclusion

From incorporating cloud based software to improving the billing[1] and credit-based policies, there are number strategies that one can applied to improve the Accountable receivables of the company. But, first, you need pinpoint the areas that are accountable for the poor cash flow for the company.

Once you identified the affected area, the rest would be fixed with ease if you already have solution for that. The solution mentioned above are applicable to every vertical of the business that have a long list of customers. Drop your queries in the comment section if you seek additional detail on the same.

Read our article:Accounts Receivable: Definition and Tips to Manage