At a growing stage of the Companies, Employee Stock Option Plan (ESOP) plays a vital role to attract and preserve valued employees for long term altitudes. If a company proposes to increase its subscribed capital by issuance of shares, such shares issued will be offered to Employee’s under the ESOP scheme, through a resolution passed by Company. For Public Limited Company, Private Company, Listed and Unlisted Companies Process for Issue of Shares through ESOP are prescribed, for the benefit of Employees as well as Company. In this article the process followed for the Issue of Shares through ESOP will be discussed.

What is the Eligibility Criterion for the Issue of Shares through ESOP?

The main aim to grant ESOP to the Employees is to keep them motivated and facilitate them to be part of the development of the Company. There will be Selection Process through which the desired Employees will be selected for the availing the Issue of Shares through ESOP.

The Explanation to Rule 12 (1) of Companies (Share Capital and Debentures) Rules, 2014 states for the eligible employees who can Issue of Shares through ESOP:

- A permanent employee of the Company who is working in India or outside India

- A Director of the Company may be whole-time or part-time but not an Independent Director

Employees who are not eligible for the Issue of Shares through the ESOP scheme are as follows:

- An employee who is a promoter

- A Director who holds 10% of the outstanding equity shares of the Company

- A Director who is a Promoter of the Company

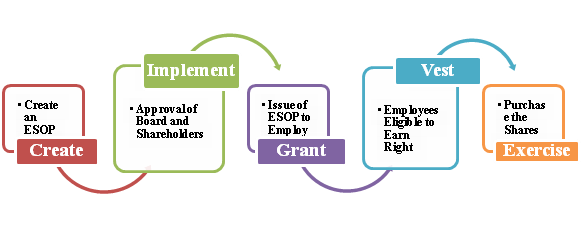

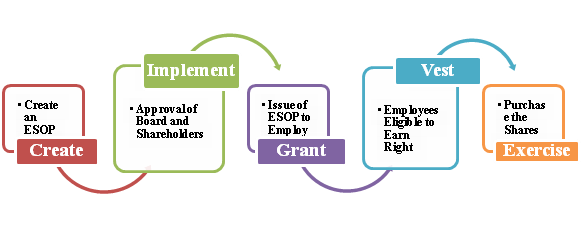

What is the Life Cycle of ESOP for the Issue of Shares through ESOP?

There are 3 terms which are the main focus while Issue of Shares through ESOP to the employees. These terms are said to be the Life cycle of the ESOP:

Create

An ESOP Policy should be framed for the Employees keeping in concern the requirements of the Employees and their progress.

Implement

For the implementation of ESOP approval of the Board of Directors and the shareholders of the Company are required.

Grant

Grant means issue of stocks to the Employee. The grant also includes the commitment of the employer made by informing the Employee to be eligible for ESOP.

Vest

The right of employees to apply for share is granted to them in Vesting.

Exercise

The Exercise Period is post vesting, where the Employee can exercise the option of buying the shares. The Exercise Price is the per-established price at which the Employee will buy the share.

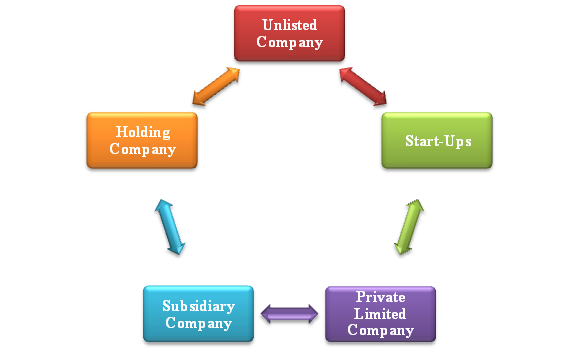

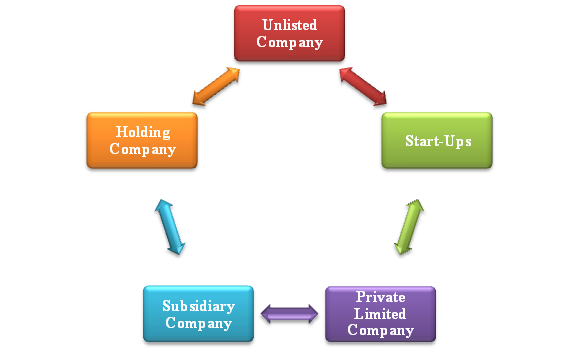

The above Life Cycle is the essence of every ESOP. The different Companies where procedures for ESOP have been implemented are:

What is the Process of Issue of Shares through ESOP?

The process of Issue of Shares through ESOP for different types of Companies is as follows:

Process of Issue of Shares through ESOP to Private Limited Company

Section 61 of the Companies Act, 2013[1], enables a Private Limited Company to Issue of Shares through ESOP to the employees. The ESOP scheme should be there written in the Articles of Association (AoA). If in case the AOA is silent about the ESOP scheme then the AOA should be amended accordingly. On the other hand, if the Memorandum of Articles (MoA) does not have the desired share capital for the Scheme, then the MoA should be amended accordingly.

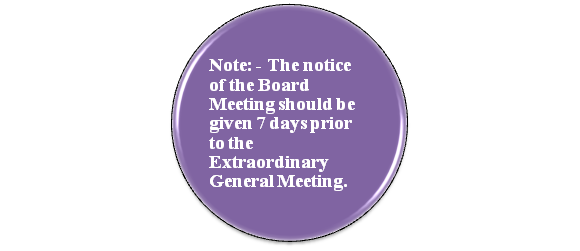

The Board of Directors shall hold a meeting and decide on the following matters:

- Drafting on new MoA and AoA

- Drafting of ESOP Scheme

- Drafting of the Resolution to be passed by the Board of Directors

- An Extraordinary General Meeting (EGM) should be held

- Drafting of the Resolution passed in the EGM

- Drafting of notice passed in EGM

- Preparing the minutes of the EGM and Board Meeting

- Discussion on following points in the Meeting

- Pass the Resolution for amendment of MoA and AoA

- Obtaining shareholders approval for ESOP scheme

- The Registrar of Companies filing should be done in 30 days.

- Identify the Employees eligible for the ESOP Scheme.

- Look for the vesting period of the Scheme

- Stamp Duty should be paid on the Issue of Shares

Process of Issue of Shares through ESOP to Subsidiary Company and Holding Company

The Issue of Shares through ESOP in the case of foreign Holding companies is expressly guided with the FEMA and the Companies Act, 2013:

- The person must be the Employee of the Company

- General permission to the person residing in India

- The shares through ESOP are offered globally by the Company

- Register of director should be maintained

- The shares should be issued according to the prescribed rules and regulations.

The rest of the procedure is similar to that of the Private Limited Company.

Read our article: Appointment of Nominee Director: A Complete Overview

Process of Issue of Shares through ESOP to Star-Ups and Unlisted Company

The following process is followed while Issue of Shares through ESOP to Start-Ups and Unlisted Company:

- Checking of the valuation of the Company

- Drafting of the ESOP Scheme

- Hold a Board Meeting

- Passing of Resolution in the Board Meeting

- Set up a General Meeting for the approval of Scheme by shareholders

- Approval of the plan should be done through a Special Resolution

Some disclosures are to be made before passing the Resolution:

- Total number of stock options

- Identification of eligible employees

- Appraisal Process for determining the eligibility

- Looking into requirements of the vesting period

- Determination of the exercise period and process

- Mentioning of any lock-in period

- Maximum number of Options should be granted per Employee

- Valuation of the Options

- When Termination of Options can be done

- Filing of form MGT-14 after the Resolution is passed in the Meeting

Conclusion

The Companies Act, 2013 permit the allocation of share to the shareholders. The Issue of Shares through ESOP can only be permitted when there is 75% majority of the shareholders are in favour of it. The Issue of Shares through ESOP is for the benefit of employees and development of Company as well. We at Corpbiz provide you help in interpreting the legal provisions of the Companies Act, 2013. Our team of professionals will assist you with the documentation process of the ESOP Schemes. Our professionals will plan ideally and will make sure the successful completion of the process.

Read our article: Grow your Business by Converting Existing LLP into Private Limited Company