Black money in our nation is circulated continuously. It can affect the fiscal resilience and eventually jeopardize the whole economy. In India, the circulation of black money is massive, which negatively impact the Government’s revenue, thereby creating a resource crunch for its multiple welfare programmes.

Black money is usually circulated and used in the form of cash. To curb the circulation of such funds, the Government introduced the section 269ST of the Income Tax Act 1961

What is Section 269ST of IT Act 1961?

As per the Section 269ST, the individual can only receive a sum of Rs 2, 00,000 or more via account payee bank draft or account payee cheque or electronic clearing system or through other prescribed electronic mode (w.e.f. 1.9.2019):-

- In total from an individual in a day; or

- In relation to a single transaction; or

- In respect of transactions regarding one event or occasion from a person.

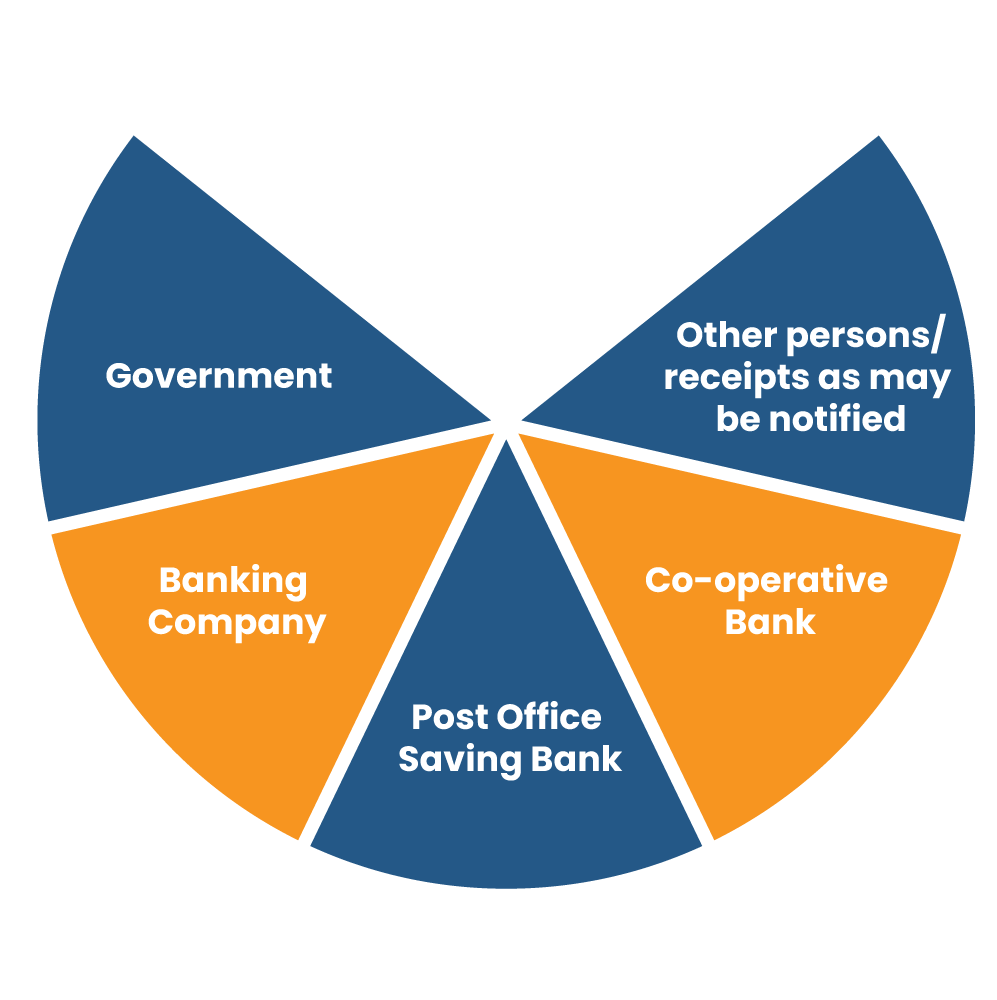

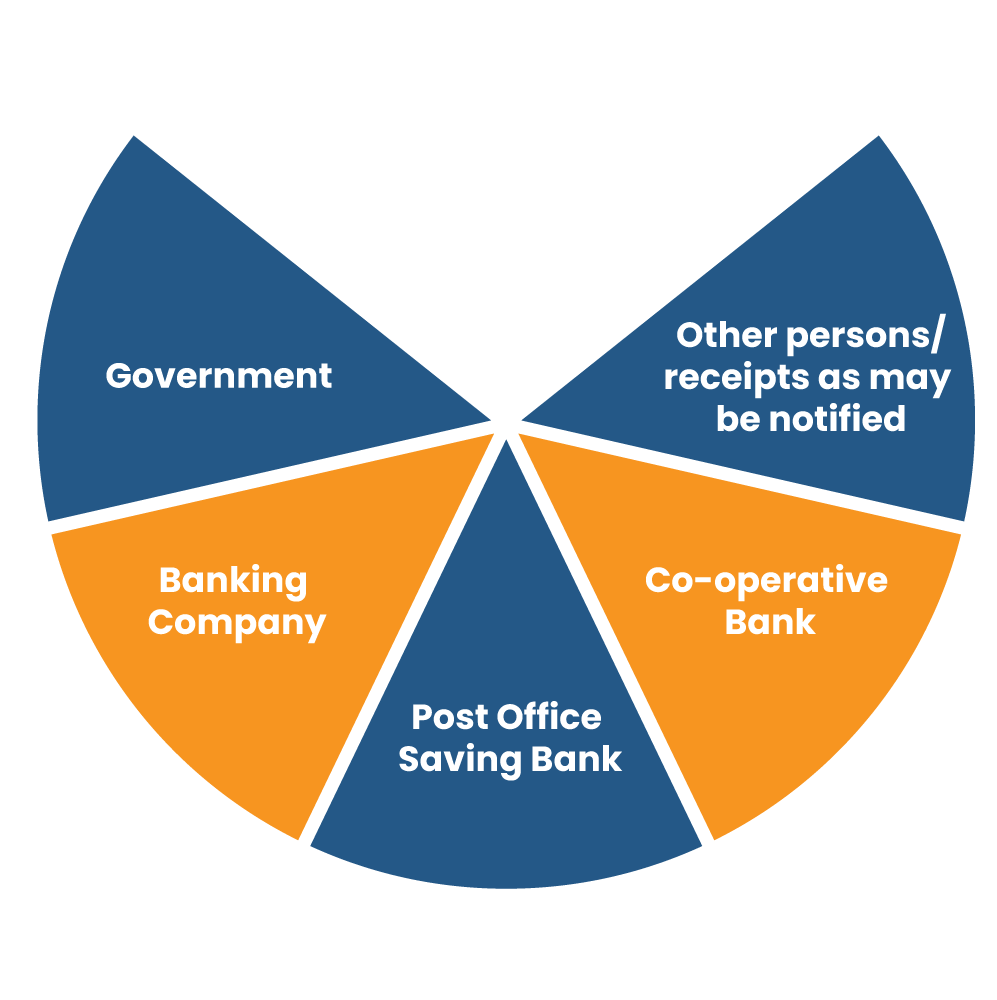

Non-applicability of Section 269ST

- Any receipt by any banking company, Government, co-operative bank or post office savings bank.

- Transactions of nature cited in section 269SS.

- Such other individuals or class of persons, notified by the Central Government.

Accordingly, vide Notification No. 57/2017, dated 3-7- 2017 & Notification No. 28/2017 dated 5-4-2017, the Central Government clarified that the provision under section 269ST shall not cover the following, viz:-

- receipt (cash withdrawals) by any individual from a bank or a post office savings bank;

- receipt by a business communication on behalf of a co-operative bank or a banking company, with reference to guidelines provided by the RBI[1];

- receipt by a white label electronic teller machine from retail outlet on behalf of a bank, with reference to guidelines provided by the RBI under the Payment & Settlement Systems Act, 2007;

- receipt from an agent by a pre-paid payment instruments’ issuers, with reference to guidelines provided by the RBI under the Payment & Settlement Systems Act, 2007;

- receipt by an institution or company issuing credit cards for bills raised relating to one or more credit cards;

- the receipt, which falls outside the ambit of section 10(17A).

Penalty Regarding Non-Conformity With Provisions of Section 269ST

Suppose an individual receives any amount in violation of the provision under section 269ST of Income Tax Act 1961. In that case, he/she shall be accountable to pay a penalty of a sum equivalent to the amount of such receipt. But, no penalty will be levied if such an individual proves that there were viable grounds for contravention.

Read our article:Income Tax return e-filing: Things you must know

Important Points That Worth Your Attention

Circular No. 27/2017, dated 3-11-2017:-Applicability of income-tax provisions u/s 269ST to cash sale of agriculture-based produce by agriculturists/ cultivators to traders

- Section 269ST of Income Tax Act 1961 revolve around certain exceptions, forbids the receipt of Rs, 2, 00,000 or more, otherwise than by an account payee draft/ cheque or by way of digital clearing system via a bank account from an individual in a day with reference to a single transaction or in respect of transactions relating to an event from an individual. Thus, any cash sale of a sum of Rs. 2, 00,000 or more by an agriculturist of agricultural produce is forbidden under section 269ST.

- CBDT has already clarified that the cash sale of the agriculture-based produce by its cultivator to the trader for a sum less than Rs. 2 00,000 will not lure prohibition u/s 269ST in the case of the cultivator.

Understanding concept of section 269T via Examples

The section below encloses some practical examples that will boost your understanding regarding the Section 269T of the IT Act.

Example No.1

Mr Rakesh buys a sports bike worth Rs 2 00,000 & pays a sum by cash to Mr Rahul on a single day in 4 instalments of Rs 50,000. As Mr Rahul accepted cash of sum Rs 2 00,000 from a single person in a day, section 269ST come into effect in such scenario, and Mr Rahul must pay the penalty equivalent to the transaction amount, i.e. Rs 2, 00,000.

Example No.2

Mr Kamlesh goes through medical treatment, and the hospital charges a bill of Rs. 4,00,000. Mr Kamlesh makes the full repayment in 4 equal instalments on different dates. Here the hospital is liable to address the penalty because the splitting of payment over different dates is prohibited under Section 269ST.

Example No. 3

Mr Pankaj receives a loan worth Rs 18000 on 01/Oct/2020 & by account payee cheque on 20/Nov/2020 of Rs 22000. Mr Pankaj makes the full repayment on 20/Nov/2020 by Rs 15000 in cash & Rs 25000 via account payee cheque.

In this scenario, the total sum of the loan has surpassed the limit of Rs 20,000. Mr Pankaj received the 2nd loan via account payee cheque. Therefore, there is no contravention of section-269SS. The total amount outstanding of Rs 40,000 as of 04/Oct/2020. Mr Pankaj has repaid the above amount in cash amounting to Rs 15000 on 20/Nov/2020 & has breached the provisions of section 269T as the total amount due was more than Rs 20000.

Conclusion

Section 269ST is all about curbing the movement of illegal funds, widely known as black money. Such funds are the biggest disruption to the economy and national security. The combination of power &money gives birth to black money.

The origination of such money disrupts the balance of commerce, trade, & industry of the nation. The influence of black money can trigger the unfair accumulation of essential commodities and endangers healthy competition.

Read our article:Potential Consequences of Not Filing The Income Tax Return