Coronavirus has left businesses disrupted concerning the shutdown of its physical operations, scarcity of employees and resources, compromised cash flow, and more. Businesses are confronting issues in managing their internal processes, including accounting since it seeks the utmost accuracy. At present, Businesses are at a gap and seeking an expert level of assistance to handle their cash flows. While most of the staff is stuck at home, these businesses are left helpless and are gradually losing their grip over their finances. The majority of business owners have chosen to outsource their accounting services to third-party companies to overcome the accounting challenge. But is it really helpful? Let’s find out.

How Outsourcing Accounting Services can be helpful for Struggling Firms?

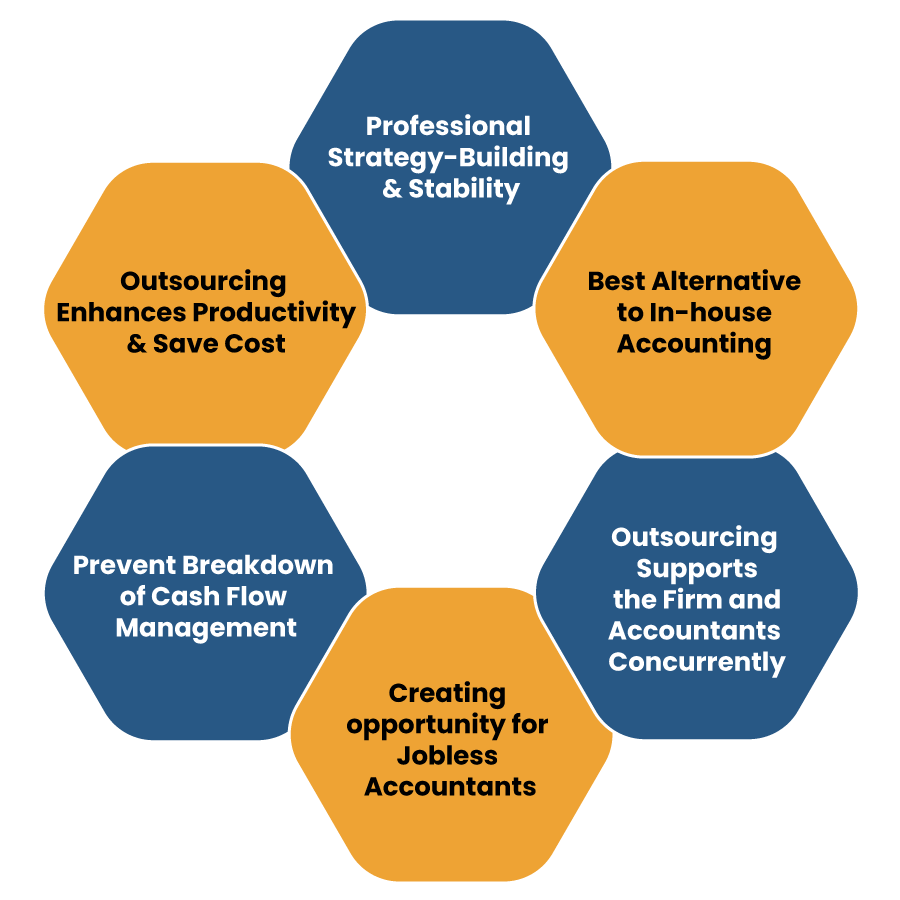

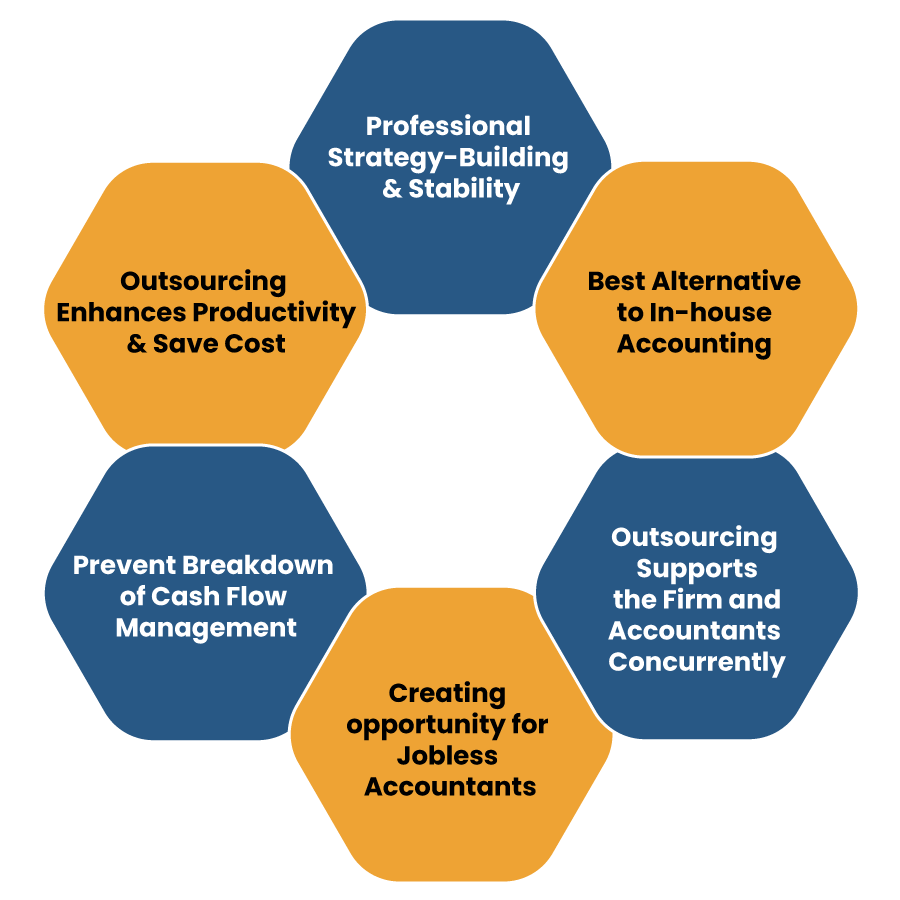

Given the existing situation, outsourcing has become an inherent need for many struggling businesses unable to impart transparency within their accounting framework. Below are some potential advantages of hiring an outsourcing firm to manage the company’s finances amidst the ongoing pandemic.

Outsourcing Enhances Productivity & Save Cost

Outsourced accounting services are indispensable for the bigger organization. Many non-essential businesses still require executing their backend operation away from the office, and outsourced services are the best way to do that.

- First, it enables businesses to ensure continuity if employees are in unpaid leave of absence.

- Outsourcing is cost-effective than paying workers to set up home offices.

- Additionally, the provider handles the outsourced services, allowing businesses to stop worrying about the WFH employee productivity.

Read our article:An overview – Outsourcing of Accounts Payable Services

Professional Strategy-Building & Stability

Many small firms are combating the unprecedented challenges owing to the COVID-19 outbreak. Their funding sources are compromised, and they are finding it hard to keep their team employed.

While stuck at home, the team members must make critical decisions for boosting the business. It’s better to have good tracking of accounting numbers that help make informed decisions under such a situation. Business[1] owners should know:-

- How much cash reserve do I have at present?

- How much revenue do I require to break even?

- What expenses are irrelevant or can be delayed?

- What list of expenses is accruing that I need to be pay later?

It’s hard to answer these questions under such circumstances. Outsource accountants can ensure stability as they work in tandem with businesses to answer all these questions.

An autonomous advisor can take some of the workloads over but also provides that realistic data-driven perspective. Outsourced advisors usually work with multiple clients and can render thoughtful insight and encouragement from what they discover through the business they serve.

Best Alternative to In-house Accounting

Accounting services are indispensable for running a successful business, but they tend to consume more time than any other department-especially now. Having a third-party at your disposal that effectively looks into your accounting matter is more important than ever.

D-I-Y accounting comes with severe consequences that could be translated into huge losses in the future for your company. Hiring a third-party firm can let you overcome loose ends with your cash flow management and take other strategic decisions.

Outsourcing Supports the Firm and Accountants Concurrently

Accounting services are an imperative thing to have, particularly in the ongoing scenario. With many businesses confronting moderations to still operate under these conditions, you are bound to get support for getting all financial accounts in order.

Outsourcing is equally beneficial for the company and the accountants. They need clients, and you need their service. It is the perfect time to outsource accounting services and nudge down the financial adversities through effective management. Besides, it can help you ensure long-term growth for your company.

Creating opportunity for Jobless Accountants

Most major firms are their workforces stuck at home owing to the Coronavirus Outbreak. High-level accountants serving these firms for years are now are left jobless. Either their company is crumbled under relentless economic pressure, or they have no jobs left for their employees.

Nobody has expected to encounter such times. Outsourcing these accountants will be an excellent opportunity for these firms to get back on track and start earning cash during the lockdown.

Working remotely might not be easy for these accountants who may possess the skill but lack remote work experience. The firm can negotiate a lower rate with these accountants until they are settled to earn more. If most of these accountants are left jobless amidst the lockdown, outsourcing them can create a new career opportunity. They can reshape their career once the pandemic is over.

Prevent Breakdown of Cash Flow Management

Having an outsourcing firm at backend allows firms to focus on areas that lack attention and have immense growth potential. This is something we required at present as we cannot interact with the client in person. It is also a conducive medium to obtain expert-level feedback on expenses, revenues, taxes, and identifying areas to save during such a tight situation.

Typically, accounting companies render various other services like HR, payroll, and others that seemingly add value you receive. Since bookkeeping & accounting aren’t the strongest points for everyone, it also a medium to reduce potential adversities.

Conclusion

This concludes the fact that outsourcing accounting services is rather the best option when it comes to controlling the accounting processes. It not only helps you cope with the financial adversities but also ensures sustainable growth for your company.

Therefore, it is a feasible alternative for struggling business owners, particularly when they find it challenging to invest in technology for work for home or keep an eye on their productivity. Confidentiality, quality, and productivity are the few areas that one has to consider while shifting the control towards the outsiders. Once you worked out these attributes well, you can quickly get out of the trouble of handing over your department to another firm.

Read our article:Prerequisite of Outsourcing Accounting Services for Business