The common stock shareholders have definite rights pertinent to their ‘equity investment’ in a company. The right to vote on definite corporate matters is an important right of shareholders.

The Right to vote in elections for the board of directors is a noteworthy right of Shareholders which is provided customarily. Those are predicted on corporate changes namely, elemental mechanical changes or change of corporate endeavor and objectives.

This blog will give an impression on the provisions in Companies Act, 2013 for registered companies connecting to restriction on Voting rights and distinct cases associated to voting rights on stocks.

What are the avenues Associated with Restriction on Voting Right under Companies Act, 2013

Taking place on the Restriction on Voting Right of a shareholder, the articles of association of a company can place certain restrictions/limitations. For example, there will be a Restriction on Voting Right of shares in the articles of association of furthermost companies, on which a call or one-time sums at the instant has not been paid which is fundamentally accountable to be compensated.

Avenues of Clause 106

This particular clause 106 is applicable in cases of all companies not including One Person Company and Private Companies with conditional subjects to Provisions in Articles of Association the Company concerning Restriction on Voting Right. The transcripts on clauses for Restriction on Voting Right speak as follows: –

Parliamentary Involvement

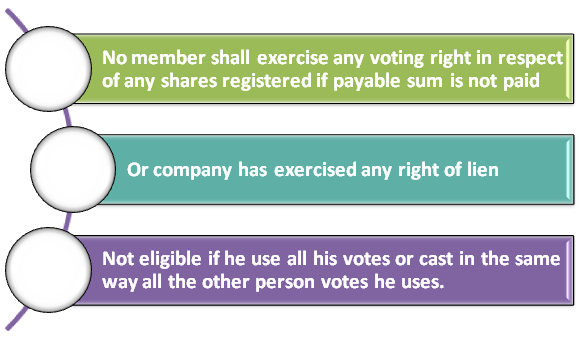

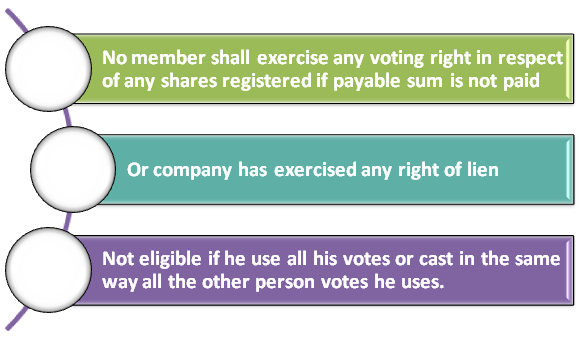

This clause 106 seeks to provide the expediency for Restriction on Voting Right; that no member shall exercise any voting right in respect of any shares listed in his name and agrees to sections 181, 182, and 183 of the (Before Amendment) Companies Act, 1956[1].

These are on which company has exercised/worked any right or lien or on which any calls or other sums currently payable by him have not been paid/compensated. No member can be prohibited on any extra ground from working out his voting right.”

Certain Cases in Restriction on Voting Right

Wherever calls are in arrears or, other sums are presently payable or, the company has exercised its ‘right of lien’, in that case, Sub-section (1) of section 106 authorizes the company to levy Restriction on Voting Right to exercise in terms of shares registered in his name on members through its Articles of Association.

Concerning the Restriction on Voting Right, the non-obstante clausestretches an overriding effect to the provisions of this sub-section over other provisions of the Act with the sub-section (1). The term “voting right” is well-defined in clause (93) of section 2 of the Act above stated.

In the regulation 9 to 12 of Table F contained in schedule I, the provisions of lien are controlled which give the right to a company to sell the shares of a member for any sum owing to the company within time. In regulation 55 and 56 of Table F, the provision for calls and other money due is getstested for restriction on Voting Right.

A call is in amount in overdue only when the call is duly completed. It performances specifying the timeframe within which ‘call money’ is compulsory to be paid, and the member has not paid such ‘call money’ runs by notice of call is given to memberships of the corporation.

Furthering down with under sub-section, the right of the company conferred also covers to other moneys owed on such shares of the members of company. Likewise, all duties payable under the memorandum or articles from any members drops under this grouping of “other sums payable”, as provided section 10 of the Act in sub-section (2). Moreover, such sum may take account of subscription money also.

The points at which the rights are sought to be exercised are known to be deciding point for these restrictions. Therefore, calling of extraordinary general meeting of the company will not be available based on different holding of certain voting powers. Further, such shares will not be considered for all provisions of the Act where certain voting powers are set as criteria for exercise of the right.

Read our article:Voting by Electronic Means: 2020 COVID-19 Regimes

Grounds: Prevention for a member from exercising their voting

The company cannot prevent any member from exercising his voting rights as per sub-section (2) of section 106, on any ground other than those stated in the sub-section (1).

Legitimacy of Agreements

Legitimacy for exercising of voting rights in a certain manner has a crucial essence in contradiction to the sub-sectionas said above. The contracts entered between desist from exercise of voting rights or shareholders to exercise the voting rights in a definite manner are inter agreements between contracting revelries. As they are not the restrictions imposed by the company, such agreements are not prevented by this sub-section.

The discrepancy of casting votes

Any member need not use all his votes in a uniform method while voting on a poll provides under section 106ofsub-section (3). It permits a member to exercise his voting right partly against or in any other manner or partly in favor of the motion, as he wishes to apply accordingly.

The member of the company need not use all his votes, moreover whether the member is casting vote himself or through proxy or through any other person, this right is obtainable in case of poll irrespectively.

This right is not obtainable or the restriction on Voting Right and will get applicable in case of voting by show of hands as a member acquires only one vote regardless of percentage of shares held.

Private Companies Applicability

According to the notification, No G.S.R. 464 (E) dated 05.06.2015, the exemption is given to this section which applies to a private company, if not its articles provide anything else. Henceforth, the articles of the private company make its own regulations, as it regards the exercise of voting rights of members and may eliminate the applicability of this provision concerning restriction on Voting Right.

Outlooks on Secretarial points

- Secretary must check whether there is a specific provision for restriction on Voting Rightin the articles of association of the company.

- Secretary must check whether the proper notice of call has been served after being duly sanctioned under section 179 in a board meeting.

- Secretary must check whether calls in arrears or on date of general meeting such other money on equity shares are payable.

- Secretary must check whether the members are appearing the general meetings either proxy or personally. If yes, such members shall not be permitted to exercise their voting rights in the meeting.

Multifaceted Punishment

This section does not suggest any penal provision for infringement of the section, therefore in those cases; section 450 of the Act will be valid. For that reason, the company and every officer of the company who is in default shall be punishable with a fine uptoRs. 10,000 as the punishment for contravention. In this regard, where the contravention is a continuing one then the fine shall be Rs. 1,000 for every day of contravention/infringement. The offenses committed by company are compoundable under section 441 of the Act and officer, being punishable only with a fine.

Conclusion

The companies shall guarantee that all additional compliances connected with the provisions concerning general meetings or the making of disclosures, or authorizations for voting by bodies corporate, the examination of related documents/registers by members, etc. as delivered in the Act. Relating to the restriction on Voting Right, along with the articles of association of the company should be verified completely through electronic mode.

If you would like advance information or detailed assistance in formulating for your Annual General Meeting and Restriction on Voting Right, please connect with our CorpBiz experts. Our CorpBiz group will be at your disposal if you want expert advice on any aspect of Entity Compliances and registration. We will help you to ensure complete compliances as per your desired activities, ensuring the fruitful and well-timed completion of your enquiry.

Read our article:Shareholders Right – Know Its Variations and Procedures of Modification