Have you ever come across the term Full Fledged Money Changer? Are you aware of the regulations that control the functioning of FFMC in India? Are you willing to know how foreign exchange works in India, or if you wish to set up a business that deals with money changing activities, then you are at the right place? This blogs will brief everything about the FFMC License and Regulatory Framework.

FFMC License overview

Before diving into the notion of the Regulatory Framework for FFMC License, let go through some necessary details regarding the FFMC license.

FFMC is abbreviated as Full Fledged Money Changer, and it is regulated by Section 10(1) of the Foreign Exchange Management Act and RBI. If any person or a firm interested in conducting forex exchange activities in India, an RBI permission is an absolute necessity in that regard. Without it, no business or person can be engaged with such business as it would be deemed an offense. The entities approved by RBI to conduct forex exchange are referred to as FFMC.

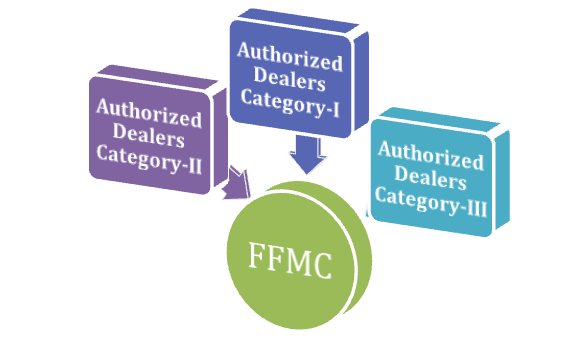

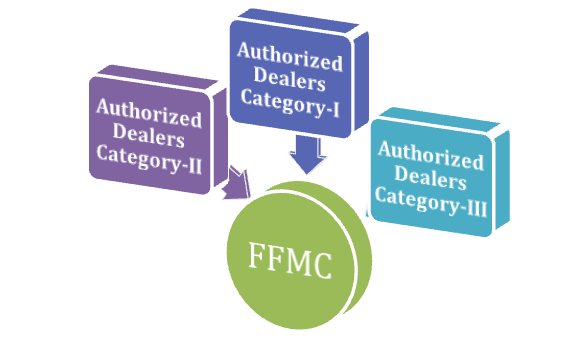

RBI has classified the Authorized Dealers in three categories:

Authorized Dealers Category-I

The banks capable of carrying out current and capital account transactions are treated as Authorized Dealers Category-I. The following entities work under this section:

- Commercial Banks

- State Co-op Banks

- Urban Co-op Banks

Authorized Dealers Category-II

The FFMC, who are authorized to conduct non-trade related current account transactions, is generally treated as Authorized Dealers Category-II. Entities that come under this category are as follow:

- Upgraded FFMCs

- Coop Banks

- Regional Rural Banks (RRBs)

Authorized Dealers Category-III

Authorized Dealers Category-III covers a wide array of firms under its ambit. Starting from companies approved by the Companies Registration Act 2013 to several financial, and other institutions. These entities are authorized to works as Full Fledged Changer, and they are under the obligation to provide services w.r.t specific foreign exchange transactions.

- Franchisees working under these categories are authorized to process cheques related to traveling or coins in Indian currency

- Conduct a forex exchange service.

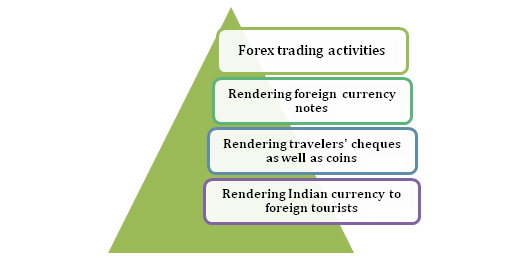

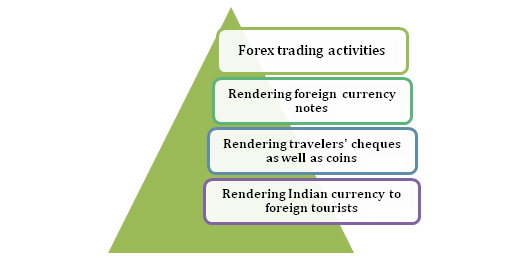

Functionality traits of FFMC

FFMC based entities’ primary job is to provide hassle-free money changing services to the needy ones, and they are bound to follow the stringent Registration procedure. The list below will shed some light on the work that they usually performed. FFMC involve in the following activities:-

- Foreign exchange is handled by FFMC to address activities like a private visit, Forex Prepaid cards, and business visits.

- FFMC is a legal platform to purchase foreign currency notes.

- FFMC is a one-stop provider of travelers’ cheques as well as coins to residents and non-resident personals.

- FFMC also involves in providing Indian currency to foreign tourists against the International credit & debit cards.

- As a franchisee, if you wish to perform forex exchange activities, then Franchisee Agreement is an option for you. The agreement will enable you to perform various activities such as forex exchange, rendering notes, coins, and travelers’ cheques.

- Authorized Money Changers are the RBI approved entities under Section 10 of the Foreign Exchange Management Act 1999.

Registration procedure

The registration process of FFMC is a reasonably straightforward task. Firms who project themselves as authorized money exchangers in the country need to get registered in the following manner. Keep in mind that the FFMC license is not attainable via an online process.

The first thing that the applicant needs to do is to fill up the application form. After completing this requirement, the applicant must submit the form to the respective Regional Office of the Foreign Exchange Department along with necessary documents such as:

- Certificate of Incorporation

- MOA which briefs the company’s provision toward this business.

- A bank assessment report in a sealed envelope.

- Certificate from Statutory Auditors.

- Copy of latest audited Accounts which must contain audited copies of Balance Sheet,

- The newest copy of Profit and Loss Account (if applicable)

- Board Resolution copy approved by core members stating money changing business.

- The relevant documents that describe the company.

- Investigation report of DOE/DOI.

- Detail of other branches that are dealing with financial services.

- Disclosure w.r.t FFMC/RMC License held previously.

Read our article:Guide: Compliances for a Full Fledged Money Changer in India

Regulatory Framework for FFMC License

The business owner needs to look into the Regulatory Framework’s attributes for the FFMC License. The concerned entities need to jot down important points that might affect their interest w.r.t this business. The following section will cover this very aspect and let you understand the notion related to the Regulatory Framework for FFMC License.

The procedure for attaining a new FFMC license is a vital aspect included in the Regulatory Framework for FFMC License as it helps in securing an FFMC license. Moreover, it provides details regarding FFMC license renewal, the appointment of agents/Franchisees, Know Your Customer (KYC) / Anti Money Laundering (AML), and Branch Licensing, etc.

Regulatory Framework for FFMC License discourages the terrorist funding and consider it as an offense. A detailed guideline has been laid down by RBI in this context, which applies to all FFMC based entities.

Eligibility criteria to avail FFMC license

If you are projecting yourselves as an approved FFMC entity, specific eligibility criteria need to be met. The following section has covered this aspect in details, have a look on that.

- The company must be working as a ROC registered entity that follows the provision of Companies Act, 2013[1].

- If the company is working as a single entity with no branches, its net owner funds should not be less than INR 25 lacs. Meanwhile, in the case of multiple branches, the figure raised to INR 50 lacs.

- The company must not have any pending cases related to fraud or any other offense against the department of Revenue Intelligence or Department of Enforcement.

- The object clause of the company must state detail and obligation regarding money changing activity.

Conclusion

FFMC is an effective platform that streamlines the forex exchange activities and renders services to those entities that need the most. It should be kept in mind that these activities cannot be pursued until and unless the firm avails the license from the RBI. The violation of this provision could lead to dire consequences and substantial penalties.

Read our article:How to Apply For FFMC License in India?