Whether it’s a question of attending an important meeting or completing a vital project, every employee needs to complete all the tasks on a predetermined time to ensure 100% efficacy. Violating such a requirement either kick you out of a job or left you baffled and unsatisfied. Setting up a business is still a dream for many people who are restrained to their jobs. There are thousands of youngsters out there who have already engaged in entrepreneurship. Entrepreneurs are dominating the market.

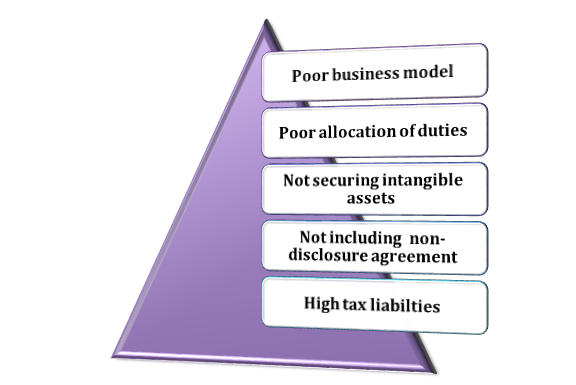

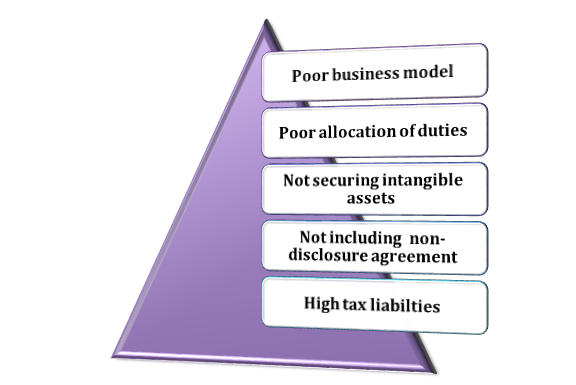

If you are willing to make an entry into a self-driven business or currently in the initial stage, you must be aware of a glaring mistake committed by the business owner in their firm. In this article, we will provide a briefing on the mistake committed by the startup registration in India. This will help you outline your strategy that discourages these mistakes.

Why did Start-up fail?

What are the Registration mistakes by startups and how to fix it?

There are tons of new firms set up every day that aims to grab high profit in the future. However, only a few of them achieve their goal. The majority of the new firms stuck at their initial phase of the lifecycle despite proactive strategies and unparalleled efficacy. The initial phase of the firm’s life cycle is more vulnerable to glaring errors, such as registration mistakes.

How to select right legal structure for your firm?

Unfortunately, most new entrepreneurs are not aware that there are several business formats under which they can register their firm and then commence their operation. In the present time, there are two business formats for registration that are quite popular among the business community.

Private Limited Company or Sole proprietorship firm

To be precise, both the business format is equally capable of delivering unmatched benefits to the new firms, but that doesn’t put the constraints out of the equation. The business owner must look into the pros and cons of both the business format and try to project their impact in the longer run. Try to take every attribute into account and relate it with either of the business formats and determine how it is going to benefit you.

Sole proprietorship firm

It is perhaps the most popular business model in India. Negligible interference of other entities, sole control, and minimum tax liabilities are the few benefits of a Sole proprietorship firm. However, it may seem profitable at first glance, but as the firm grows, the need for additional manpower reach becomes a necessity, thus enticing more expenses.

Complexity is a part of every business model, and it’s up to you how to manage it effectively. Hiring a consultant in this regard can solve a lot of your problems and broaden your concept about managing such a business model.

Not emphasizing employees

The success of the firm also depends on the performance of the workforce. The growing business seeks better employees to sustain competition. Hence, to ensure the company’s stable growth, you need to take good care of your existing workforce. This could be achieved by introducing the employee-oriented programs that support their mental health and boost their working efficacy.

Presently, several companies stress on launching employee welfare programs and exciting training workshops to lift employee morale. What more? The firm is also motivating their employee to take part in ESOPs[1] (Employment Stock Option Plan). The objective behind all these activities is to increase the sense of responsibility in their employee, thus ensuring escalating growth.

Delay w.r.t business launch

Conducting an unregistered business in India is a costly affair, and you should not opt for that strategy at any cost. In case you have a proven approach, then get it registered with the relevant authority before you give it a trial. Also, do not forget to obtain insurance for your business and existing employees.

Do you have your options for investment that will be going to monetize your business? Financial support plays a vital role in running your business. Thus, do not opt for any business structure merely based on a few attributes. Instead, a cautious approach in such circumstances can be your savior. If a business model is not suitable for the product or services or has stringent financial obligations, then you should look for another alternative.

Read our article:One Person Company Vs. Sole Proprietorship: What is the difference between Sole Proprietorship and OPC

Overlooking intellectual property protection

If you are a proactive business operator, you must be aware of intellectual property protection. Stealing business ideas or value-added schematic is quite normal in the business regime. There are instances where firms spend tons of money in a court proceeding to reclaim their intellectual property.

Of course, nobody wants to go that way, and neither do you. To get rid of such business anomalies, you must know how to protect your game-changing ideas. They are two types of business resources- tangible and intangible. The resources like gear, building, and IT products come under the canopy of tangible assets. Meanwhile, the product design, logo, label, and domain name regarded as intangible assets. The intangible resources are the one that comes under the class of intellectual property.

The firms must get in touch with a legal specialist to secure these assets by availing registration w.r.t material assurances such as Copyrights, Patents, & Trademarks.

Registration mistakes w.r.t non-disclosure agreement

As the term suggests, the non-disclosure agreement is a legal settlement between the firm & outside entity to maintain the integrity of the intangible asset. This type of contract is vital for protecting company assets from duplicacy or theft. There will be instances when you need an outsider to serve a certain purpose. In such a case, a non-disclosure agreement will confine the outsider’s involvement with the subtleties of the business by imposing relevant provisions.

Registration mistakes w.r.t tax management

It is worth noting that our education system still lacks support for tax studies, which is essential for those who want to be a part of the business fraternity. Keep in mind that the government has laid down different tax provisions for different business models. Thus, it essential for you to go through tax provisions in detail, and select it, accordingly.

Conclusion

When you start a new business, the allotment of works is something you need to do precisely and correctly. Unfortunately, not all firm is capable of doing that, resulting in inefficacy within the workflow. Such a situation demands an expert that can deal with workforce management with ease and ensure an uninterrupted workflow with excellent efficacy. Before you commence your business, make sure to consult a firm and clarify your doubts regarding asset protection, workforce management, and registration. You might come across a lot of paperwork and registration-based formalities to initiate a brand new business. Avoiding registration mistakes can make a huge difference and let you run the business more smoothly.

Read our article: An Ultimate Guide to Registration of a Sole Proprietorship Firm in India