As the small-sized firm owner, you are solely accountable for ensuring that all of your financial numbers are legitimate at the end of the day. From employee payroll to spending budget, your firm income must add up. When your business requires documenting its account balance, this refers to reconciliation accounting. With all of the dynamic elements contributing to your success, business accounting can be quite a cumbersome task. By all means, Reconciliation of account is imperative from the financial standpoint of an organization.

Why Reconciliation of Account is Important for a Business?

Reconciliation of account is an accounting process that actual money earned or spent matches the money entering or leaving an account at the end of the financial period. Reconciliation of the accounts is an essential activity for a firm and individual because it gives a chance to identify fraudulent activity and mitigate potential errors in the financial statement.

Firms typically conduct reconciliation processes at a set period, such as monthly or quarterly, as a part of standard accounting protocol. Properly conducted payment reconciliation ensures a seamless transition between dispute resolution and payment processing. Any delays in this regard can result in a severe risk of security and compliance, fraud, and asset loss.

General ledger records & Bank statements are the souls of business operations. They keep constant tracking of receipts, collections, and outstanding receivables. Operating expenses and payroll have to be checked, posted, and validated at regular intervals. Timely reconciliation of account makes sure that the back-end process and functions are performed effectively.

In the absence of this, businesses can find it hard to identify and correct issues before they become severe. Reconciliation & Dispute resolution initiates as soon as the merchant has commenced the settlement process and meet the customer order.

Read our article:10 Simplistic Ways to Manage Accounts Receivable Process Effectively

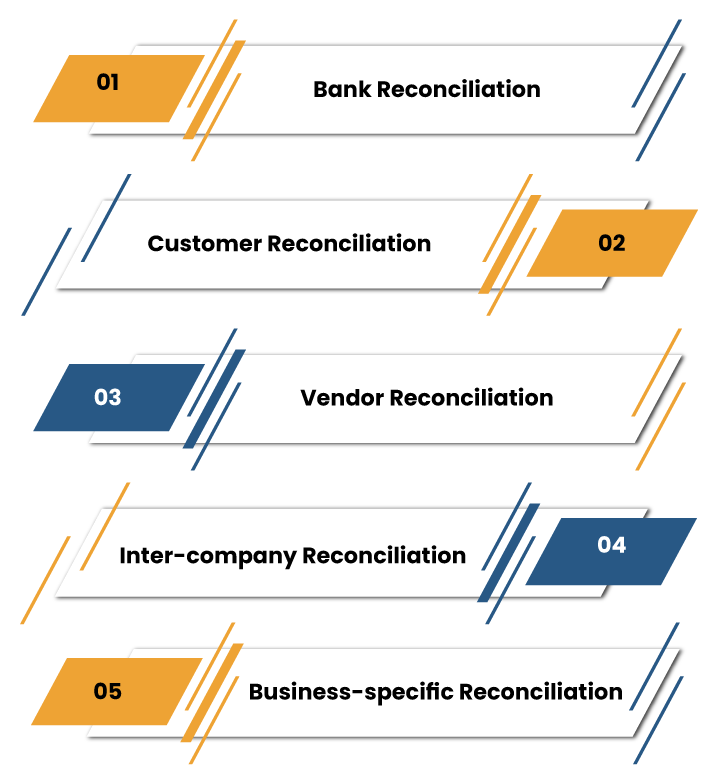

What Are the Types of Reconciliation?

Five major types of reconciliation accounting are utilized in daily business operation.

Sources of Reconciliation of Account Receivable

The Reconciliation of account receivable is the process of matching the amounts of unpaid billing to the Account receivable (AR) total stated in the general ledger. This process is crucial because it proves that the receivables figure in the general ledger is justified. The two information sources relating to Reconciliation are as follows:-

General Ledger

There is generally an account present in the general ledger designated for the sole compilation of all receivables of the customers. After all transactions recorded in the ledger for a reporting period & the entire subsidiary ledger balances have been recorded, the account’s resulting balance is the summary total to be validated via Reconciliation.

Receivables Detail

The comprehensive listing of unpaid billing that should match the ledger’s resulting balance is commonly goes to the subsidiary sales ledger. To get this detail for reconciliation purposes, print the previous AR report as of the final day of the reporting period. The aggregate on this report is then contrasted with the receivable total in the general ledger.

Possible Loopholes Prompted After the Completion of the Reconciliation Process

- After completing the Reconciliation process, there may be differences present between the two accounts for the given reasons.

- A journal entry added to the general ledger that skipped the subsidiary sales ledger. It is one of the common mistakes that trigger the difference.

- A billing was mistakenly recorded to an account other than the account of trade receivables. It happens very often since the billing model is set to post total billings to the legit account automatically.

- The old receivables report was run as of a different date as compared to the date used to obtain the balance in the general ledger.

- This reconciliation of account is primarily carried out as a part of the month-end closing activities before the issuance of the financial statements. If the Reconciliation is not carried out and some errors are prompted in the general ledger, this implies a material default in the statements.

Things to Consider while Scrutiny of Relevant Entries

There should be a reconciliation of AR at the end of the financial year. Any error related to receivables will be mitigated from the statement before their audit by the firm’s external auditors.

Any difference that exists between the two balances must be scrutinized. The general reason for errors is journal or adjusting entries reported directly in the ledger and not exhibited in the subsidiary sales ledger or vice versa. It may also happen due to differing cutoff dates of the reports used. Other viable issues are incorrectly offsetting client & supplier’s account & recording to the wrong ledger account.

When you have pinpointed all the errors, make the relevant entries required for the accounts to reconcile with the legit balances. Add a precise detail of the reason for each transaction for the purpose of auditing. Where possible, reverse the invalid entry & repost it accurately, instead of posting the difference only, to make the transaction simpler to track. When all entries have been recorded, make sure to reconcile the balances as a final check.

What is the Purpose and Correct Frequency for Reconciliation of Bank Account?

Bank reconciliation is essential for business as it serves the following purposes:-

- Identification of errors such as calculation mistakes and missed payments.

- Keeping track of bank fees & penalties in the books.

- Identifying theft & misleading transactions.

- Keeping track of account payable (AP) and account receivable (AR).

Accounts ought to be reconciled whenever you get a bank statement[1]. The majority of the firms opt to do this task daily, weekly, and monthly. The best option for your firm is essentially based on how many transactions you do. Knowing the reconciliation process can be helpful and productive both in terms of money and time.

Conclusion

Reconciliation of account identifies how much money your firm has in general checking. To do this effectively, your firm needs to keep records of each & every transaction that comes into existence to compile a reconciliation report. Documents like contracts and invoices come in handy during the reconciliation process. Financial Reconciliation is essential for the growth of your business.

Read our article:Accounts Receivable: Definition and Tips to Manage