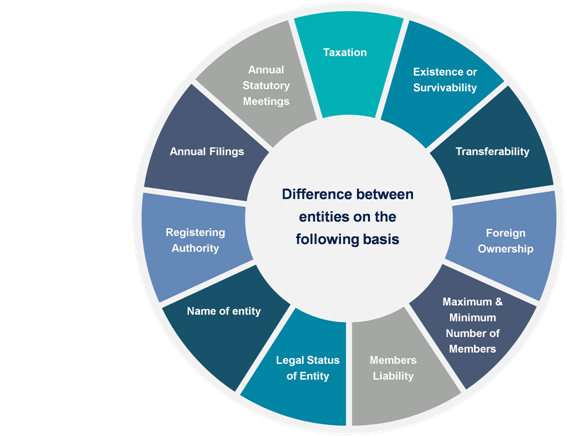

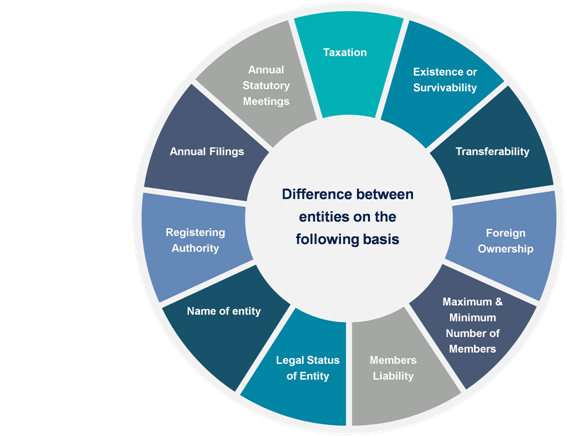

To select an entity before starting a new business is very important from the terms of legal conditions and benefits of the entity. The Companies Act 2013, Limited Liability Partnership Act have created more option for an entrepreneur to start a new business such as Pvt Ltd Company vs OPC. Hence, it is important for an Entrepreneur or Promoter to understand both pros & cons of each of the business entity and then chooses the right one. Among the choice of for profit entities available, Let’s compare between all the entities in detail that are Pvt Ltd Company vs OPC or LLP vs Partnership or OPC vs Sole Proprietorship.

Difference between the Entities on the Following Basis

Registering Authority

- Private Limited Company– Private Limited Company Registration has to be done with a Ministry of Corporate Affairs under the Companies Act 2013.

- One Person Company– One Person Company Registration has to be done with a Ministry of Corporate Affairs under the Companies Act, 2013.

- Limited Liability Partnership– Limited Liability Partnership Registration has to be done with the Ministry of Corporate Affairs (MCA) under the Limited Liability Partnership Act, 2008.

- Partnership Firm- Partnership can be registered or it can be unregistered. Partnership Firm Registration is optional. In case of registration, the Partnership will get registered under the Partnership Act, 1932.

- Sole Proprietorship– There is no formal registration for Sole Proprietorship.

Name of entity

- Private Limited Company– The choice of name provided by a Promoter has to be approved by the Registrar of the Company. Only names that are not identical or similar to an existing company or Limited Liability Partnership name. Also the name must not be offensive or illegal. The name of the entity will end with the words “Pvt Ltd” or “Private Limited Company”.

- One Person Company– The choice of name provided by a Promoter has to be approved by the Registrar of the Company. Only names that are not identical or similar to an existing company or Limited Liability Partnership name and names that are not offensive or illegal would be allowed. The name of the entity will end with the words “OPC” or “One Person Company”.

- Limited Liability Partnership– The choice of name provided by a Promoter must be approved by the Registrar of Company. Only names that are not identical or similar to an existing company or Limited Liability Partnership name. Also the name must not be offensive or illegal. The name of the entity will end with the words “LLP” or “Limited Liability Partnership”.

- Partnership Firm– Promoters have to choose the name that can be used for the Partnership. The approval is not necessary for using name. However, it is good to avoid names that have already been trademarked.

- Sole Proprietorship– Promoters have to choose the name that can be used for the Sole Proprietorship. The approval is not necessary for using name. However, it is good to avoid names that have already been trademarked.

Read our article:What is the Documents Required For Private Company Registration?

Legal Status of Entity

- Private Limited Company– Private Limited Company has the separate legal entity registered under the Companies Act, 2013. The Directors and the Shareholders of the Private Limited Company are not personally liable for the liabilities of a Company.

- One Person Company– One Person Company has the separate legal entity which is registered under the Companies Act, 2013[1]. The Director of a One Person Company is not personally liable for the liabilities of a Company.

- Limited Liability Partnership– Limited Liability Partnership has the separate legal entity registered under the LLP Act, 2008. The partners of LLP are not personally liable for the liabilities of the Limited Liability Partnership.

- Partnership Firm– Partnership is not recognised as a separate legal entity and therefore the promoters becomes personally liable for the liabilities of a partnership.

- Sole Proprietorship– Proprietorship is not recognised as a separate legal entity and therefore the promoter becomes personally liable for the liabilities of a Sole Proprietorship.

Members Liability

- Private Limited Company– The shareholders have limited liability and are liable only to an extent of their share capital.

- One Person Company– The Director and Nominee Director have limited liability and is liable only to the extent of his/her share capital.

- Limited Liability Partnership– The Partners have limited liability and are liable only to the extent of their contribution to the LLP.

- Partnership Firm– The Partners have unlimited liability and they can be held responsible for all the liabilities of the Partnership Firm.

- Sole Proprietorship– Proprietor has unlimited liability and is responsible for all the liabilities of the Sole Proprietorship.

Minimum Number of Members

- Private Limited Company– A minimum of 2 members are required to start the Private Limited Company.

- One Person Company– A minimum of 1 member is required to start the One Person Company.

- Limited Liability Partnership– A minimum of 2 members are required to start the Limited Liability Partnership.

- Partnership Firm– A minimum of 2 members are required to start the Partnership Firm.

- Sole Proprietorship– A single person as sole proprietor can start a Sole Proprietorship business.

Maximum Number of Members

- Private Limited Company– A Private Limited Company can have a maximum of 200 shareholders or members.

- One Person Company– A One Person Company can have 2 people, viz. Director and Nominee Director.

- Limited Liability Partnership– A Limited Liability Partnership can have unlimited number of Partners.

- Partnership Firm– In the Partnership Firm the maximum number of partners can only be 20.

- Sole Proprietorship– In the sole proprietorship only one person runs the business as a proprietor.

Foreign Ownership

- Private Limited Company– Foreigners must be allowed to invest in a Private Limited Company under a Automatic Approval route in most sectors.

- One Person Company– Director and Nominee Director cannot be Foreigners.

- Limited Liability Partnership– Foreigners are allowed to invest in a Limited Liability Partnership only with a prior approval of (RBI) Reserve Bank of India and (FIPB) Foreign Investment Promotion Board approval.

- Partnership Firm– Foreigners are not allowed to start a Partnership Firm.

- Sole Proprietorship– Foreigners are not allowed to start a Sole Proprietorship business.

Transferability

- Private Limited Company– In the Private Limited Company the ownership can be transferred by way of share transfer.

- One Person Company– In the One Person Company the ownership can be transferred.

- Limited Liability Partnership– In the Limited Liability Partnership the ownership can be transferred.

- Partnership Firm– In the Partnership Firm the ownership can be transferred by making changes in the partnership deed.

- Sole Proprietorship– In the Sole Proprietorship the ownership can be transferred by way of inheritance.

Existence or Survivability

- Private Limited Company– The existence of Private Limited Company must not be dependent on the Directors or Shareholders. It can be dissolved only voluntarily or by Regulatory Authorities.

- One Person Company– Existence of a One Person Company is not dependent on the Director or Nominee Director. It can be dissolved only voluntarily or by Regulatory Authorities.

- Limited Liability Partnership– Existence of a LLP is not dependent on the Partners. It could be dissolved only voluntarily or by an Order of the Company Law Board.

- Partnership Firm– Existence of a Partnership business is dependent on the Partners. It could be up for dissolution or death of a Partner.

- Sole Proprietorship– Existence of a Proprietorship business is dependent on the Proprietor of the business.

Taxation

- Private Limited Company– Private Limited Company profits are taxed at 30% plus surcharge and cess as applicable.

- One Person Company– One Person Company profits are taxed at 30% plus surcharge and cess as applicable.

- Limited Liability Partnership– Limited Liability Partnership profits are taxed at 30% plus surcharge and cess as applicable.

- Partnership Firm– Partnership profits are taxed at 30% plus surcharge and cess as applicable.

- Sole Proprietorship– Taxed as individual, based on the total income of the Proprietor.

Annual Statutory Meetings

- Private Limited Company– The board and General Meetings must be conducted periodically.

- One Person Company– There is a requirement to conduct annual statutory meetings

- Limited Liability Partnership– There is no requirement to conduct annual statutory meetings.

- Partnership Firm– There is no requirement to conduct annual statutory meetings

- Sole Proprietorship– There is no requirement to conduct annual statutory meetings.

Annual Filings

- Private Limited Company– Private Limited Company has to file Annual Accounts and Annual Return with the (ROC) Registrar of Companies each year. Income Tax Return can also be filed for Private Limited Company.

- One Person Company– One Person Company has to file Annual Accounts and Annual Return with the Registrar of Companies each year. The (ITR) Income Tax Return can also be filed for One Person Company.

- Limited Liability Partnership– LLP has to file Annual Statement of Accounts & Solvency and Annual Return with the Registrar each year. Income Tax Return can also be filed for LLP.

- Partnership Firm– No requirements to file annual report with (ROC) Registrar of Companies, Income Tax Return can be filed for the Partnership.

- Sole Proprietorship– No requirements to file annual report with (ROC) Registrar of Companies, Income Tax Return can be filed based on the income of the Proprietorship.

Conclusion

A Pvt Ltd Company vs OPC requires more compliance while an limited liability partnership has fewer rules to adhere to. One Person Company is suitable for one business owner but does have a hefty tax rate. A partnership firm and sole proprietorship both are easy to start but come with unlimited liability. We at Corpbiz provide assistance to a new entrepreneur to choose the best for him/her such as between Pvt Ltd Company vs OPC and also help our clients in the compliances before and after been registered.

Read our article:Step By Step Process of One Person Company Registration