The Section 128 of the Companies Act, 2013 talks about the maintenance of books of accounts for the registered entity in India. According to this section, every registered entity has to mandatorily ensure the well-being of the financial record by maintaining them properly.

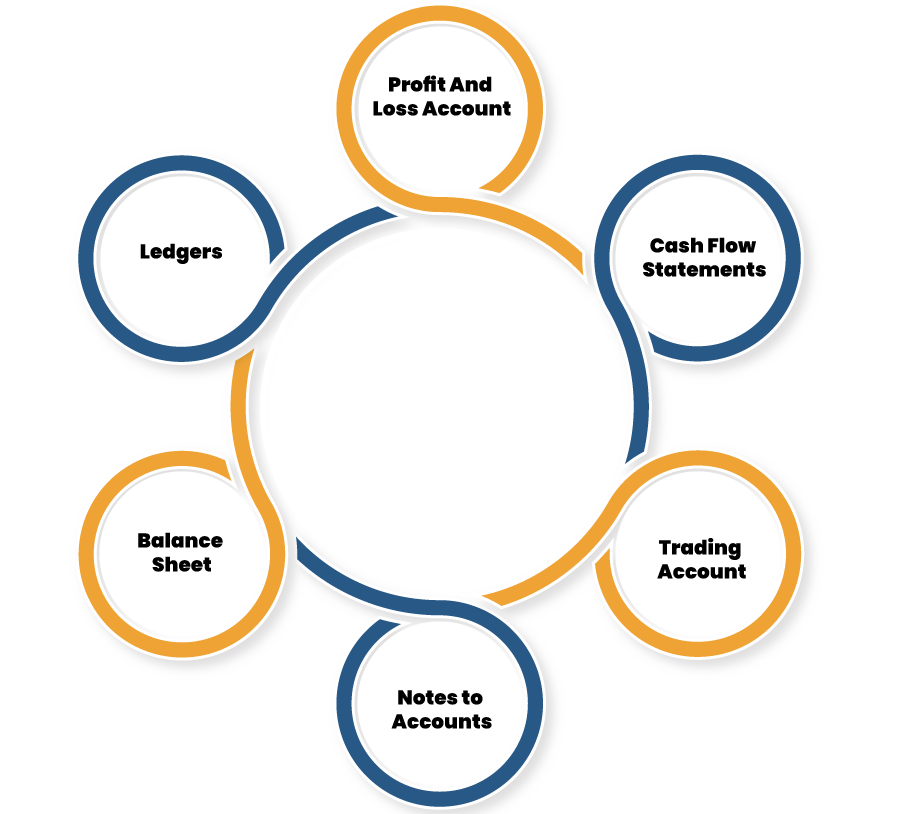

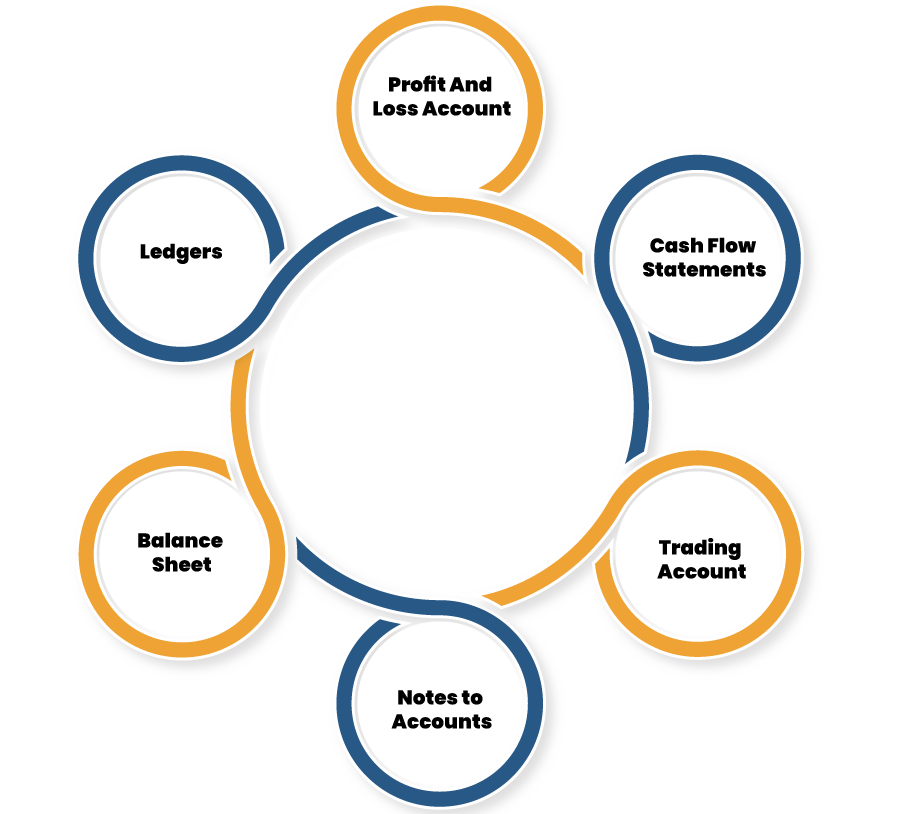

Books of Accounts define as the documentation that reflects the financial status of a business. All financial transactions find their way into the books of accounts. In general, the person-in-charge or the owner of a company is liable to maintain the books of accounts and other financial records for a given timeline. It mainly includes-

In India, a registered organization has to maintain Books of Account under:-

- Goods And Service Tax Act, 2017

- Income Tax Act, 1961

- The Companies Act, 2013

Who is Liable to Maintain Books of Accounts?

As per Sec 128 (6) of the Companies Act, 2013, the given entities are accountable for maintaining the books of accounts of the company:

- Managing Director of the company;

- CFO (aka Chief Financial Officer) of the company;

- The Whole-time Director in charge of finance; or

- Any other person in-charge of finance appointed by the BODs with the obligation to comply with the provisions of Section 128.

What do Books of Accounts Include?

Books of Account, other financial papers for a financial year ought to be maintained by companies, including their subsidiaries (If any).

Books of Accounts includes-

- Cash flow statement (sums of money collected & expended by an organization and matter in relation to which expenditure and receipts occur).

- Records related to sales & purchases of goods or services,

- Records related to assets & liabilities of Company

- Items of cost

- Deeds, vouchers, documents, register, and minutes whether in physical or digital format.

Read our article:What are the Basic Financial Statements?

What is the Required Timeline for Maintaining the Company’s Books of Accounts?

The Sec 128 of Companies Act, 2013 has underpinned a specific timeline for maintaining the Company’s Books of Account. These are as follows:

- Every Company must keep the books of account in relevant order relating to a timeline which should not be less than 8 years promptly preceding a Financial Year; or

- If the Company is relatively new, it is supposed to maintain the books of accounts in good order in respect of all the past years together.

- If there’s an order regarding the investigation as per Chapter XIV of Company Act, 2013, the Company will have to maintain the books of accounts as per the direction of the Central Government.

Penalty Provisions Related to the Non-maintenance of Books of Accounts

If the Company fails to maintain the books of account as per the bylaws, the person-in-charge will be charged with penalties mentioned below for such misconduct:-

- A penalty of Rs 50,000 will be imposed on the person-in-charge. This sum of the penalty may extend to Rs 5 lakhs.

- Imprisonment for a pre-determined period which may extend to one year.

- The defaulter may confront both of the above punishments depending on the level of non-compliance.

Places for Maintaining Books of Accounts

- As per Section 128(1), every company must prepare and maintain the Books of Accounts and other essential books at its registered office.

- However, the company’s BODs have the right to shift all the essential financial records to a place other than the existing one in India.

- In case the location changes, the company needs to share such information with the ROC within seven days. For this, the company must issue a writ notification enclosing the full address of the decided place.

What are the Required Forms for Maintaining the Books of Accounts?

Given the second proviso of Section 128(1), all the entities may opt to store their books of account and other essential papers in a digital format or as prescribed.

Such Books of Accounts must be accessible in India so that it can be used whenever the need arises (the Companies (Accounts) Rules, 2014 from now on mentioned in this Chapter as Rule) (Rule 3(1)).

Therefore, the books of account as well as other essential papers stored digitally:-

- Shall remain accessible in India;

- Be in principle format & complete;

- Must be in the format that supports readability;

- Information/details obtained from the branch office shall not be modified;

- One must store the books of account in servers located in India.

Moreover, the Company must intimate the ROC annually during the filing of financial statement:

- Name & IP address regarding the service provider;

- Location regarding the service provider (wherever applies);

- Where the Books of Accounts are store digitally, mainly on the cloud, such address as furnished by the service provider. (Rule 3(6)).

Applicability of Section 128 of Companies Act, 2013 on the Overseas Companies

Section 128 of the Companies Act, 2013 applies to those overseas companies only that have a principal location of the business in India.

According to Section 384 (3) of the Companies Act, 2013, the provisions cite under Sec 128 shall apply to an overseas firm in the given scenarios:

- The Principal location of business situated in the Indian Territory[1].

- Books of Accounts as defined u/s 128 of the Companies Act, 2013 with respect to: –

- Money spent & received;

- Sales & purchase made;

- Assets & Liabilities.

Conclusion

It’s evident from the information above that the maintenance of books of accounts is not optional for a company. Every registered entity has to make sure that Books of Accounts should be kept on an accrual basis.

Moreover, the account should reflect the valid view of the Company’s financial transaction. It must be examined for flaws only by the Company’s director and should be kept in digital format.

If a company fails to comply with such a requirement, it will have to confront severe penalties. So, maintaining Books of Accounts is hugely vital from a legal standpoint.

Read our article:How to Select the Best Accounting Firm for your Business?