Ministry of Corporate Affairs (MCA) under sub-section (1) of 205C of the Companies Act, 1956 has established a fund called as the Investor Education and Protection Fund (IEPF) through the Companies (Amendment) Act, 1999. The prime objective behind this was to educate, aware and secure the interests of investors in securities and further encourage governing the securities market and things connected. IEPF is supervised under Securities and Exchange Board of India (Investor’s Protection and Education Fund) Regulation, 2009

What is the Reasoning behind IEPF?

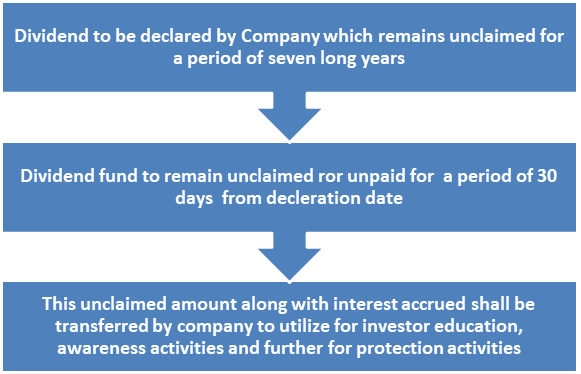

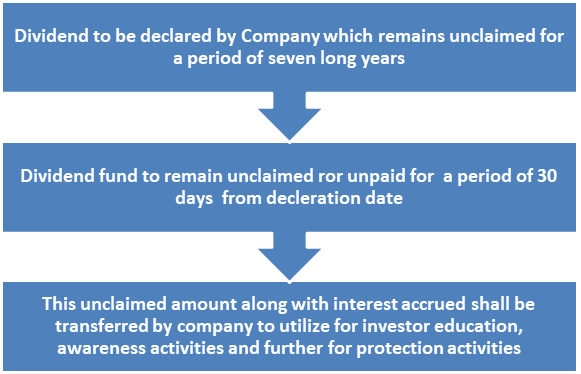

The main apprehension behind IEPF is to account for unclaimed dividends account of a company, share application amount or matured debentures which remains unclaimed for a period of seven long years from the date of declaration of dividend. This unclaimed amount, along with interest accrued, shall be transferred by company to utilize for investor education, awareness activities and further for protection activities. In order to transfer the same, a company need to share certain details with authority. A statement containing the details of the transfer shall be shared by company to authority in a prescribed form. Further after due scrutiny of said funds concerned authority which administer the said fund shall furnish a receipt to the company indicating such transfer.

How do authority so utilization of funds?

Below mentioned shall be part and parcel of IEPF fund if remain unpaid for a time period of 7 years:

- Unclaimed funds in dividend account of the company

- Funds due and unclaimed for refund received for issuance of security

- Deposits which have been matured and unclaimed

- Debentures which have been matured and remain unclaimed

- Any interest accrued and unclaimed on funds as mentioned above

- Any sponsorship or donation was given by Government, central or state, any company or institution for the purpose of this fund

How IEPF is being Managed?

In order to manage IEPF, Government has constituted a Committee consisting various members such as secretary, various members from Company/Corporate Affairs, senior members from Reserve Bank of India (RBI) , Security and Exchange Board of India (SEBI) and various others experts in this domain. The reasoning behind forming a committee is to aspire fund utilization for activities like investor education and protection. Further, it is also the liability of the board to ensure proper maintenance of all accounts and other relevant details related to the fund.

The objective of IEPF and the said committee is to build a lawful and fair stock market to secure the interest of investors. Further, to empower investors by educating them in order to enable systematic and effective competitive market, ensuring guaranteed and safe investment avenues.

Read our article:Essentials to Create a Compelling Investor Pitch Deck

How IEPF create awareness?

From the time of its commemoration, IEPF has conducted numerous awareness programs in order to promote protection and investor education. Authority has conducted these programs through institutions engaged with it such as Partner Institutions, Ministry of Mass and communication, IT department of Indian Government, CSC etc. Further authority has conducted various awareness programs focusing on educating people about the significance of investment, providing information about mutual funds, debentures, pension funds, equity, investment policies etc. with the help of various associations like ICSI, ICAI, Institute of Corporate Affairs, National foundation and many others.

Investor Awareness campaign or program:

The IEPF, in order to create awareness among people, conduct various awareness programs by engaging partners throughout the country, basically in rural and semi-rural areas.

Various awareness campaigns are conducted taking in alliance with various Educational institutions, Professional academies and institutions, various local chambers and associations. Yearly many such kinds of campaigns or programs are being conducted by association with help of hundreds of associations or participants. Authority also sends the invitation to local government authorities for their participation to enlighten people about it. Volunteers do a detailed writeup of the campaign and upload complete details of the program over the official website of IEPF to create awareness among people.

More than 36,000 Investor Awareness Programmes have been organized by authority throughout the country in various rural and urban areas. This was done in order to create awareness among people with the help of various Professional Institutes organized under the Ministry of Corporate Affairs (MCA) and Common Service Centers (CSCs) and others.

The main responsibility of the authority:

As per the provisioning of the amendment act, the authority has been given the responsibility to administer and regulate the funds assigned for Investor Education and its Protection.

- Chairperson is the supreme authority of the organization, who supervise and administer all powers vested in the authority;

- Chief Executive Officer (CEO) works under supervision and directions of Chairperson and has been allocated with powers to administer affairs of the general management of the authority;

- As per the legal provisions Permanent Committee(s) can be formed to oversee the affairs of authority;

- Every committee shall contain two (2) members, which shall be headed by an ex-officio member. One member to be Chief Executive Officer (CEO) and other be Functional head, who shall also be the secretary of the concerned committee;

- In order to address any specific issue committee may appoint experts with special knowledge and expertise in the same domain;

Various forms to submit with authority:

- IEPF Form 1- Fund statement that is credited to authority

- IEPF Form 2- Fund Statement of unclaimed and unpaid amounts paid to authority

- IEPF Form 3- Fund Statement of shares & unclaimed/unpaid dividend that is not transferred to authority

- IEPF Form 4- Shares statement that is transferred to authority

- IEPF Form 5- Application in order to claim unpaid amounts & shares out of authority

- IEPF Form 6- Fund statement of the unclaimed amount transferred to the authority

The mentioned forms can be downloaded from the official website of the authority.

Recently the authority has simplified the provisions of the act dated 14.08.2019 by amending the Investor Education & Protection Fund (Accounting, Audit, Transfer and Refund) Rules 2016 vide GSR No.571 (E). By this authority has simplified the procedure for claiming refund with the authority, i.e. the Investor Education & Protection Fund Authority. Via amendment certain provisions have been changed to simplify the refund procedure inter-alia providing transparent and faceless digitalization procedure of claims by the authority. The further amendment has also simplified and systemize the procedure and has made it system-driven and time-bound with procedural enforcement.

Read our article:Filing of Financial Statement with Registrar