Import-export License empowers the business owner to conduct the activities of international trading. In the absence of IEC license, the business owners cannot avail of the benefits of export schemes and nor they can obtain payment from the overseas location.

Moreover, without IEC the cross-border transaction of goods is prohibited as customs and other authorities need to clear the shipment from the port. The IEC (Import-Export License) is issued as a 10 digit code. In this write-up, you will come across Prohibited and Exempted items under IEC. It is of utmost importance to understand this topic before getting into the business of global trading. Before you laid eyes on the core topic, have a look on the latest update:

“On 1st September 2020, the government of India capped export incentives as per the MEIS scheme at two crores per exporter on outbound shipments executed during the period from Sep 1 to Dec 31, 2020. Moreover, the government also added that any exporter with an IEC code who doesn’t send any shipment for the period of 1 year preceding Sep 1, 2020, or any IECs availed on or after the release of this notification shall not be able to reap benefits under this scheme.”

Now let’s move ahead to our core topic i.e. Prohibited and Exempted items under IEC.

Issuance Authority of IEC Code: Director General Foreign Trade

IEC Import-Export License is granted by the DGFT i.e. of Director General Foreign Trade, Ministry of Commerce & Industries, GoI. As far as the validity is concerned, IEC is non-renewal in nature and serves lifetime services to the businesses. Henceforth, it is valid for all functional entities. The applicant cannot avail multiple IEC number against one PAN card.

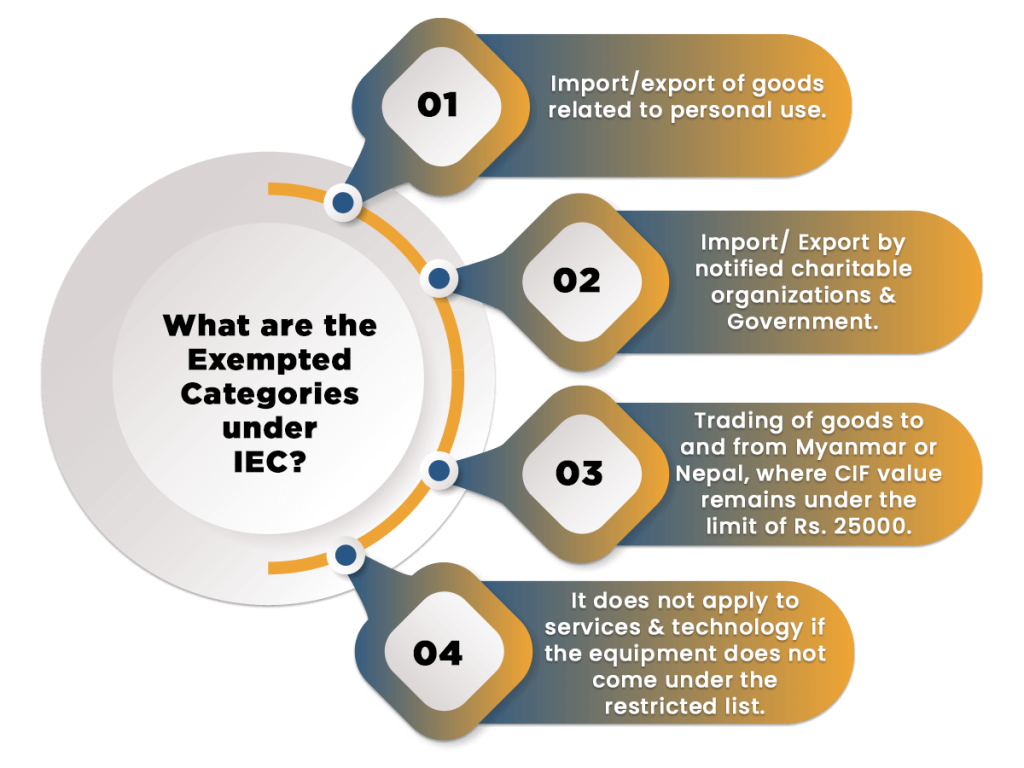

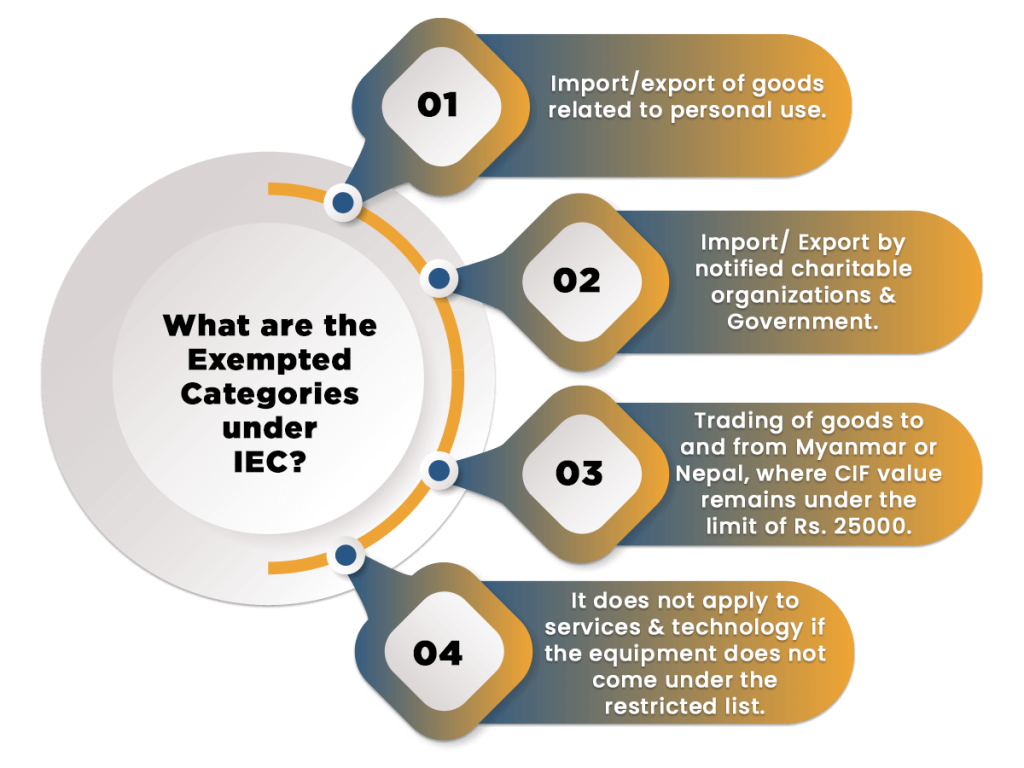

What are the Exempted Categories under IEC?

Prohibited items under IEC

The Restricted items mentioned under ITC (HS) Indian Trade Clarification based on Harmonized System of Coding which can be imported only in the presence of an import license. Such a license can be obtained from the relevant regional licensing authority.

Form no. ANF2M is used for the import of restricted items and it is available at the DGFT. Moreover, the importer has to approach Canalizing Agencies for importing canalized items like petroleum products from overseas locations. The items that come under ITC (HS) are strictly prohibited for import within the country.

Export of Restricted/Prohibited/State Trading Enterprise

To export goods with prohibition, explicit permission would be need by the license holders. The exporter must take care of compliances to ensure the seamless movement of the goods. Please note that the export of wild animals or animal articles is completely forbidden subjected to the norms laid down by the DGFT.

Moreover, certain items can be allowed for overseas delivery via state trading enterprises subjected to the provisions mentioned under the Export Import (EXIM) policy. Grant of license for the export of goods in the said categories is done by the DGFT which may consult the representatives of Technical Authorities and Departments/ Ministries concern.

What is the List of Import and Export Requirement?

Obtaining IEC is the first and the foremost step that one has to be availed of before commencing activities of import and export.

For Exporter

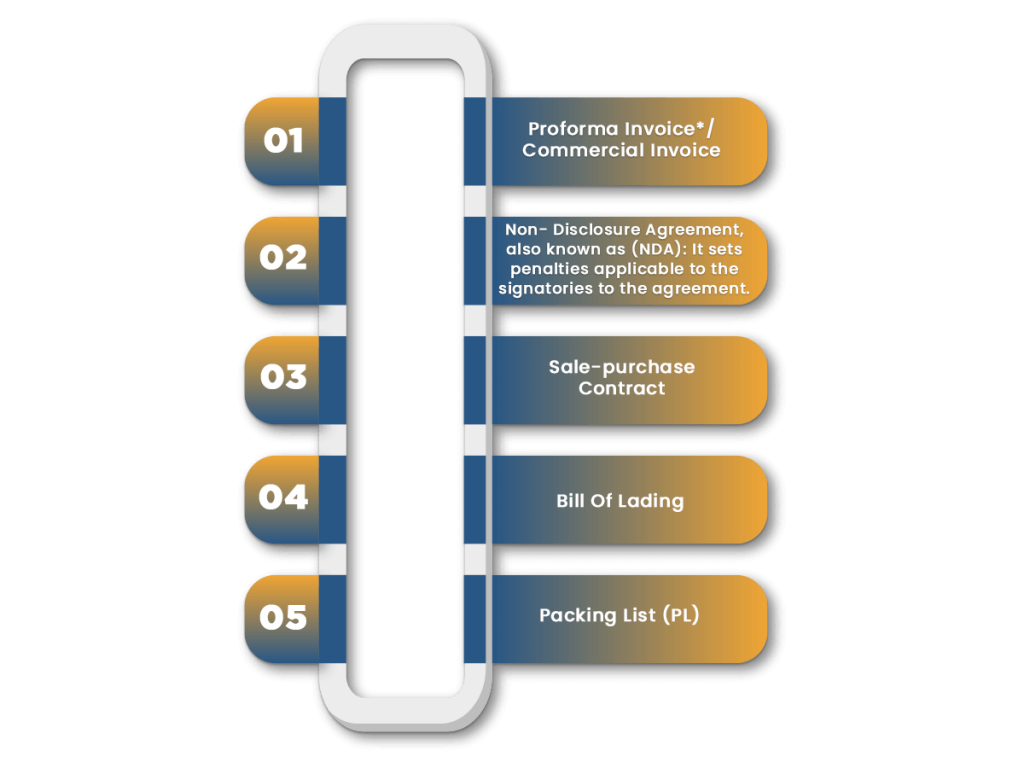

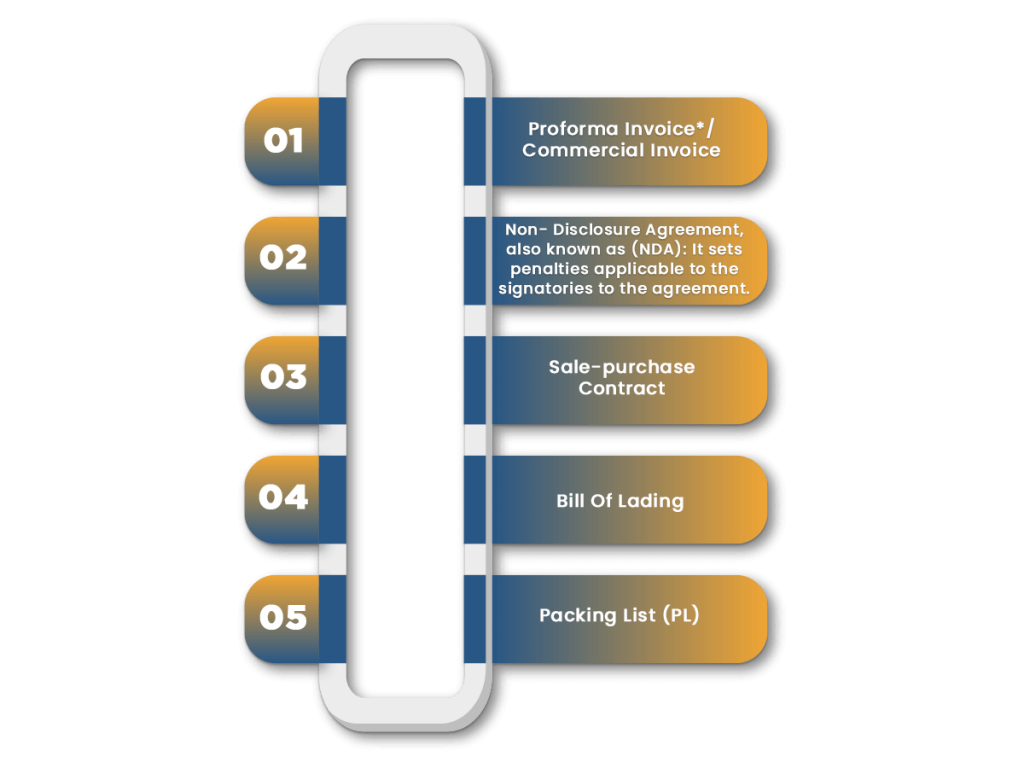

Post shipment, the given documents are required to be furnished as given below:-

Certificate of Origin: The Certificate of origin is required by the customs. The exporters are required to get registered under the Indian Chamber of Commerce (ICC). Other documents include refund form/GST return; Bank realization Certificate, Exchange control Declaration, Registration cum Membership Certificate (RCMC) for reaping export benefits.

Bill of lading: The bill of lading acts as a receipt for the cargo services and is used to move the freight shipment. It encloses all the detail required to process the cargo shipment. The BOL represents the legal contract between the shipper & a freight carrier.

Proforma Invoice: A proforma invoice is recognized as a preliminary bill of sale which is sent to the buyer for the delivery of goods. The invoice exhibits the purchased items and other essential detail like transport charges and shipping weight.

Packing list: An export packing list is a document that encloses detail regarding products and packaging related to each shipment. Shippers are required to generate a clear and detailed packing list for the parties involved in the supply chain. Thus; a packing list is required for all air freight & sea freight shipments.

What are the Regulatory Authority for Global Trading?

Foreign trade (Development and Regulation) Act, 1992 is accountable for regulating the import and export activities within the country. The international trade policy 2015 has underpinned some provision subjected to imports and exports in India.

- The import activities are undertaken as per section 11 of the customs Act, Foreign Trade (Development and Regulation) Act as well as Foreign Trade Policy 2015-20.

- Certain forbidden item seeks special approval and licenses from government & DGFT[1]. Further, identification needs under ITC (HS), aka Indian Trading Classification based on a harmonized system is essential to ascertain the regulations for those goods.

- Applicable duties include safeguarding duty, IGST, social welfare surcharge, anti-dumping, and Customs duty.

Conclusion

One has to ensure the conformity with Import and Export procedure without any deviation for the seamless trading of the goods. In addition to that, elaborate directions have been underpinned by authority related to act and non-compliance to avert complications.

Head over to the CorpBiz expert if you would like to get more information on the Prohibited and Exempted items under IEC. The professional can also help you getting government license and certification with precise technical guidance and hassle-free paperwork.

Read our article:Advantages of Obtaining IEC (Import Export Code) Registration in India