Anybody who owns a shop for commercial purposes needs to avail shop and establishment license in their respective states. The period of 30 days is allowed by the authority to complete the registration process from the commencement of business. The applicant who seeks such a license must furnish the application for the same along with mandatory documents to Chief Inspector in a prescribed time frame. A shop or establishment license is granted by the authority based on the number of employees.

What does Shop and Establishment Act Signifies?

It is important to note that this particular Act uphold the rights, role, responsibilities and regulations of employee in terms of working hours, work protocols, overtime, and leave policy within the organised establishment for several aspects of work. This Shop and Establishment Act is applies to commercial establishment, educational as well as charitable institutions, and many other establishment which makes profit through their daily operations.

Read our article:A Complete Overview of Shop and Establishment Act And How to Obtain its License?

Application for Shop and Establishment License

- The applicant must furnish the following particulars in the application.

- Employer or the owner name of the business entity.

- Complete address detail of the establishment

- Establishment’s name.

- Other mandatory details mentioned in the application.

Documentation required to avail Shop and Establishment License

- Constitutional documents such as AOA, MOA, Partnership agreement

- Particulars of the owner managing the establishment.

- NOC from the owner in case of the rented property.

- List of core members governing the operation of the establishment.

- Bank account number.

- PAN card

- Rubber stamp of the firm

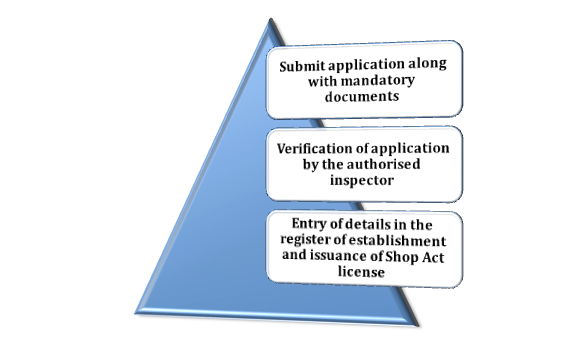

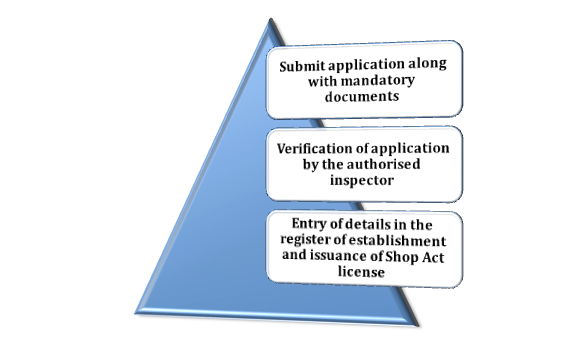

The Procedure of availing Shop and Establishment License

Procedure for availing Shop and Establishment License are as follows:-

Step 1: Submit an application

The shop owner who intends to avail Shop and Establishment License needs to submit an application to the Chief Inspector along with standard fees. The application for Shop and Establishment License consolidates several particulars such as employer’s name, address detail, and name of the shop that needs to be filled by the applicant.

Step 2: Verification of the application

Upon receiving the application for Shop and Establishment License, the inspector will conduct an investigation of the same until he gets satisfied with the given information and credentials. Remember,, any invalid detail in the application lure the chances of cancellation. The inspector is authorized to cancel the application in case of any loopholes.

Step 3: Issuance of the certificate

Once the application is approved, the inspector would incorporate the details in the Register of Establishments and award the registration certificate to the applicant. The validity of the certification would stay active for five years. After this period, the applicant must cater to the renewal requirement.

Exhibiting the registration certificate in the establishment’s premises is another mandatory requirement of this act. Failure to meet such provisions would be treated as an offense and might lure some penalty.

Advantages of Shop Act License

- Shop Act renders the legal status to the establishments.

- Shop act ensures the safety and wellbeing of the employees within the establishment.

- It prevents child labor or any unethical practices in the shop or establishment.

- It act regulates the wages and working policy for the benefits of the employees.

- It helps the entities to open a separate business account in the bank.

- Allow the establishments to overcome the hassle of frequent inspection made by state authority.

- Let the establishments to avail of benefit from the government scheme.

Aspects of Shop Act Regulations

The Shop and Establishment Act has been established to control the various key points that lay the foundation of any establishment on the unorganized sector.

Some of the aspects are as follow:

- Uneven time-period of work

- Policy regarding rest and suppers

- Child labor

- Work timing of the establishment

- Provision of weekly off

- Wages for urgencies

- Time for disbursing wages

- Details of wages

- Holiday strategy

- Policy regarding Expulsion

- Sanitation within the premises of establishment.

- Arrangement of ventilation, lighting, & emergency exist.

Noteworthy Points regarding Shop and Establishment License

- The unorganized sector in India doesn’t work with transparent policy, and that’s where Shop & Establishment act comes into the play. It generally controls the activities of all the establishments and let them work within the prescribed framework.

- The Shop and Establishment License benefits the entire establishment in several ways.

- The documents that go along with Application for Shop and Establishment License may vary from state to state.

- Shop owners need to furnish the detail like GSTIN, PAN card, name of the shop in the application before submitting to the concerned officer of the specific area.

Conclusion

Every shop and establishment is bound to work under the provision of the Shops and Establishments Act. The Act usually regulates the right and obligations of the employees at the workplace in the unorganized sector. Also, the act is applicable to pan India, and nearly every establishment specifically from the unorganized sector cannot work outside the provision of this very act[1].

Therefore, the shop and establishment license is a mandatory requirement for all the active and upcoming entities whose intent is to reap profit through their business activities. The CorpBiz is a one-stop destination for business owners and professionals who want to ensure 100% conformity with compliances without tedious paperwork or complicated process. Our experts have years of experience in handling complex task related taxation and financial services.

Read our article:Wondering why Shop and Establishment License is Required for Business?