An Indian subsidiary is also known as a subsidiary or a sister company of the parent company. The company that controls the Subsidiary Company is called parent company or sometimes a holding company. A subsidiary is always partially or wholly owned by the parent company (holding company). An Indian subsidiary is called a holding or a subsidiary of the parent company.

Meaning of Subsidiary Company

The parent company must own at least 50% or more subsidiaries. When the parent company is owned 100%, the parent company is known as a wholly-owned subsidiary.

But the main point is that the foreign parent company’s subsidiary is a separate legal entity from the parent company, and the subsidiary is obliged to act under the rules and compliance of the country where it is located or registered.

Advantages of Opening Indian Subsidiary Company

Listed below are various advantages in business compliance, to open an Indian Subsidiary.

Independent Legal Structure

The Indian subsidiary is an independent or separate legal structure from its parent company and is regulated under Indian commercial law.

Transfer of Share

After signing the share transfer certificate, shares purchased by one shareholder can be simply transferred or exchanged to another party or person.

Obtain Property in India

Since the subsidiary is an independent structure, it is permitted to acquire assets in India.

Registration with Foreign Direct Investment

Foreign direct investment is widely permitted for Indian subsidiaries and is applicable to most economic activities available in that country.

Read our article:An Outlook on Different Types of Company Registration in India

Types of Subsidiary Companies in India

- As detailed in the amended Companies Act 2013, an Indian subsidiary is defined as a company in which a foreign legal entity holds at least 50% of the total share capital.

- This definition shall state that a foreign company having legal authority over the composition of the board of directors of a subsidiary company.

Procedure to Incorporation an Indian Subsidiary Company

SPICe+ shall be a unified web form. SPICe+ shall have two parts. Part A is for name reservation for new companies and part B is providing services at the time of incorporation of companies. Discussed below are the criteria for registering an Indian subsidiary company .

SPICe+ Form

- The applicant must first login to the website of the Ministry of Corporate Affairs[1].

- After that he has to click on Ministry of Corporate Affairs services “SPICe+ web form”

- After that he requires to click on ‘new application” if he is going to incorporate a ‘New company’

- Clicking on an existing application, the applicant can check the application number with the proposed name.

Part A

SPICe+ Part A will be enabled by clicking on the new application in MCA portal, which includes fields related to the name reservation of proposed name.

- Applicant requires filling the details of class, type of business, category, sub-category and proposed name of the company.

- In next step the applicant has to choose auto check button (auto check do the automatic scrutiny of first level of the proposed name against the name rules).

- When Part-A has been completed, Applicant can click on the submit for name reservation or, he can proceed for registration or, cancel.

- In case the applicant opted for proceed for registration, Part-B of the web form will be enabled which will have different process to follow.

Part B

- Applicant has required filling the basic details regarding the company to be incorporated.

- In next step he has to submit the details of subscribers and directors & the details regarding capital investment.

- After that applicant requires filling the basic details for the issuance of PAN card & TAN card (Tax Deduction Account)

- The applicant needs to upload necessary attachments in the SPICe+ form.

- Once he completes the aforementioned steps; after that the applicant has to confirm the declarations and click on the attached documents for pre-scrutiny.

- Once pre-scrutiny of the attached document is successfully done, after that he has to click on the ‘submit’ button.

- When the SPICe+ form is submitted successfully, Applicant will receive a confirmation message.

- After that he can download the Spice+ Part-B pdf file from the dashboard to affix the DSCS.

- After successful completion of Part-B, all relevant linked forms based on the applicant’s fields will be available for the applicant to fill and submit.

AGILE-PRO Form

- AGILE-PRO stands for Application for Goods and Services Identification Numbers, Employee State Insurance Corporation Registration plus Employee Provident Fund Organization Registration.

- The old AGILE form (INC-35) has been replaced with the AGILE –PRO form.

Electronic Memorandum of Association & Electronic Article of Association Web Form

eMoA is the constitution of the company that needs to be filed with the Spice+ form. eAoA contains all rules and regulations regarding the company’s internal affairs, which can be filed as a form linked with the SPICe + form.

URC-1 INC-9 PDF Generation

In Part A, it is mandatory to file URC-1 form with all the details of existing company based on the details of subscribers and directors filled in Part B, INC-9 declaration web form will be available in dashboard for the applicant to download and affix DSCs.

To Upload Spice+ Form

Once the DSC is affixed with SPICe+, Part B PDF and all other linked forms, the applicant requires clicking on the option to upload web form. Once all the forms will be uploaded successfully, a Unique Service Request Number (SRN) will be generated and displayed to the applicant.

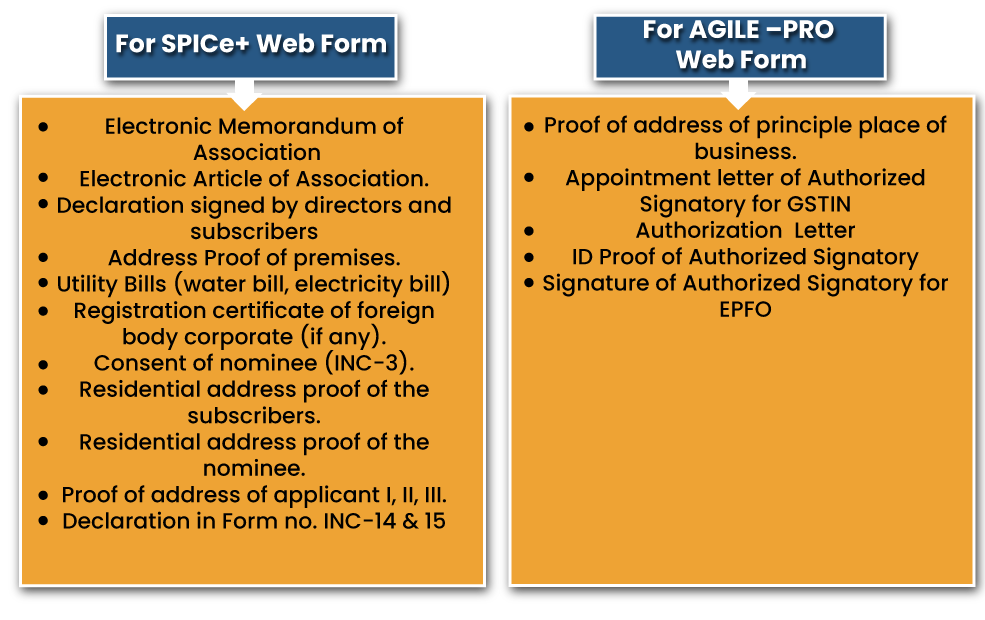

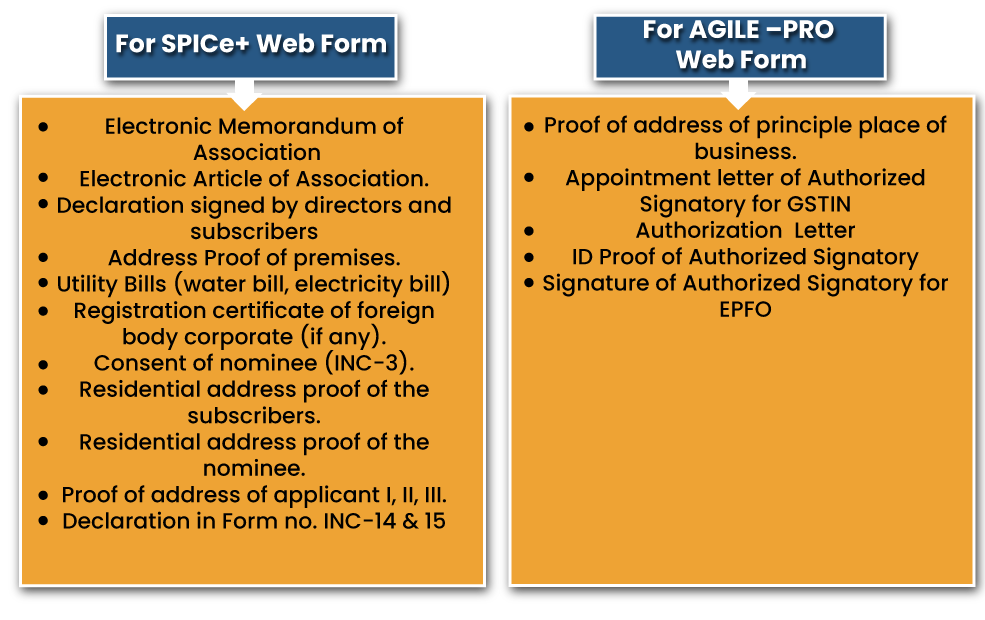

Particulars Required

All below mentioned particulars shall be attached with the web form.

For SPICe+ Web Form

- Electronic Memorandum of Association

- Electronic Article of Association.

- Declaration signed by directors and subscribers

- Address Proof of premises.

- Utility Bills (water bill, electricity bill)

- Registration certificate of foreign body corporate (if any).

- Consent of nominee (INC-3).

- Residential address proof of the subscribers.

- Residential address proof of the nominee.

- Proof of address of applicant I, II, III.

- Declaration in Form no. INC-14 & 15

For AGILE –PRO Web Form

- Proof of address of principle place of business.

- Appointment letter of Authorized Signatory for GSTIN

- Authorization Letter

- ID Proof of Authorized Signatory

- Signature of Authorized Signatory for EPFO.

Key Features of Indian Subsidiary Company

- Indian subsidiary company will be permitted to have its own unique name, therefore, it needs not to bear the parent company’s trading name,

- Indian subsidiary will apply for its own business licenses and will have its own statutory documents,

- From a taxation point of view, it will be imposed the corporate tax on its worldwide profits,

- Indian subsidiary can engage in any type of activity, as long as the requirements imposed for the respective sector are respected.

Concluding Remarks

The Indian subsidiary company is determined as the other type of Indian company, and the rules set for the Indian company are the same as for the Indian subsidiary company.

If the above mentioned particulars are available and the correct procedure is followed, there will be no unnecessary delay and the company can be incorporated as soon as possible. Kindly associate with the Corpbiz expert to know more about the procedure related to register an Indian subsidiary company.

Read our article:Indian Subsidiary Company Registration