The role of Company Liquidator in winding up of Company is to ensure a fair distribution of assets of the Company to creditors for their benefit. In a Voluntary Winding Up of Company members or creditors can wound up without the intervention of the Tribunal. So to avoid any misunderstanding between the members and the creditors a Company Liquidator is appointed. The Company Liquidator will work according to the rules prescribed under Section 314 of the Companies Act, 2013, and complete the Voluntary Winding Up of the Company. In this article, we will discuss Powers and Duties of Liquidator in the process of Voluntary Winding Up of the Company.

Who is a Company liquidator?

In a Company, Liquidator is appointed by a court, shareholders, and creditors to sell off the assets of a Company going for winding up. A person should be qualified to be a liquidator of the Company. The Liquidator will take control of the business and will distribute the assets of the Company. The appointment of Liquidator will only be effective if the majority of the creditors approve for the same. If the creditors do not allow for the appointment of Liquidator, then creditors should appoint another Liquidator. The main aim to appoint a Liquidator is that fair distribution of assets is done to the shareholders.

The Company in General Meeting where a resolution for Winding Up is passed should appoint a Company Liquidator. The fees paid to the Company Liquidator should also be decided in the same General Meeting. After the appointment of an individual as Company Liquidator, he/she should call a Meeting immediately of the Liquidation Committee. The meeting of the Liquidation Committee should be called within 6 weeks of its establishment.

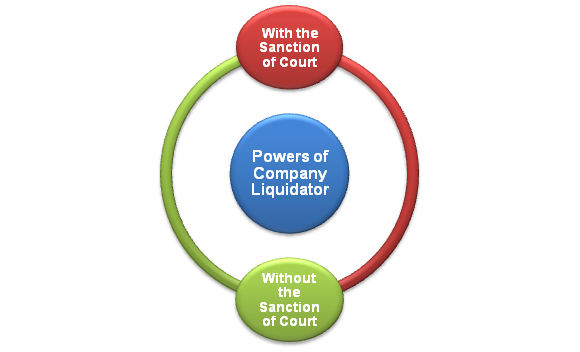

What is the Powers of Liquidator in Voluntary Winding Up of the Company?

Subject to adherence to specific legal provisions and legal procedures, the Powers of Liquidator are broadly summarized in two heads which are as follows:

With the Sanction of Court

The Company Liquidator with Court Sanction can exercise the following powers:

- To institute or defend any, trial or other lawful proceedings, criminal or civil in the name of Company.

- To carry on operations of the Company.

- To sale off the immovable property and actionable claims of Company by auction in public or through a contract privately. The power of transfer is with the Liquidator regarding these sales.

- To raise the money required as security of assets for the Company.

- To assist him with his duties, the Company Liquidator can appoint a Pleader, an Attorney or an Advocate.

- To take securities from debtors in the discharge of any claim.

- To make an arrangement for compromise of debts and other financial liabilities with the contributories.

Without the Sanction of Court

The Company Liquidator without the sanction of court can exercise the following powers:

- To inspect the files of the Registrar to check the records and returns of the Company. It is not entitled to pay any dues of the Company while inspecting files.

- To do all acts, when necessary, on behalf of Company, and execute all deeds and documents for the purpose of use.

- To accept, draw, make and endorse any bill of exchange on behalf of the Company.

- To appoint a person as an Agent to do a business, which the Liquidator himself is not able to do.

- To receive Dividends in insolvency and prove rank and claim of any contributory for any balance against its assets.

- To do any act which is necessary to be done as to obtain payment from a contributory. The above act can be done in the Company Liquidator official name if it is not fit to use the Company’s name.

- To take out letters of administration in Company Liquidator official name.

Read our article:New Winding Up Companies Rules (2020) under Companies Act 2013

What is the Duties of Company Liquidator in Voluntary Winding Up of the Company?

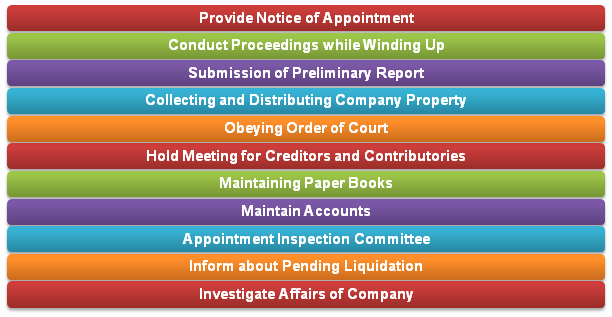

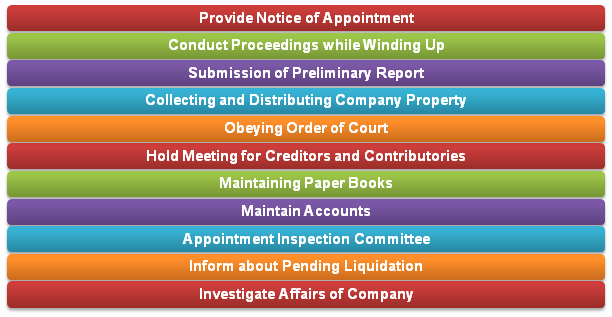

Subject to specific legal provisions the Duties of Liquidator in Voluntary Winding Up of Company are as follows:

Provide Notice of Appointment

Section 275(6) and 310 (4) of the Companies Act, 2013, mandates the Company Liquidator appointed should within 7 days of appointment notify the Tribunal about the appointment. A declaration should also be made in which the conflict of interest or lack of independence will be disclosed by the Liquidator.

Conduct Proceedings while Winding Up

According to the provisions of Section 457 of Companies Act, 2103,[1] the Liquidator should conduct proceeding while winding up of the Company. The Liquidator should perform all the duties as referred by the court. The act should be valid as per law.

Submission of Preliminary Report

According to provisions of Section 455 of Companies Act, 2013, the Liquidator is entitled to submit a preliminary report in the court. The Preliminary report should include the following:

- Statement of Affairs from Directors

- Capital issued of the Company

- Subscribed and paid Capital

- The estimated amount of Assets

- Cause of failure

- His opinion regarding fraud and punishable offence committed by Directors of Company

Collecting and Distributing Company Property

After winding up order is made by the court, immediately the Liquidator should manage all the assets of the Company. The right to enjoy those accumulated assets should vest with the Liquidator. The Liquidator, after preparing the schedules of all creditors, distributes the assets proportionately to all the creditors.

Obeying Order of Court

While performing duties, the Liquidator should abide by the orders of the court. The Liquidator should also be careful regarding his/her actions that whether they are in line with the law or not. The duties should be carried out faithfully and honestly by the Liquidator.

Hold Meeting for Creditors and Contributories

The Liquidator can call meetings of Creditors and Contributors whenever he/she deems fit. The creditors, when direct the Liquidator to summon the meeting, he shall follow the directions of the Creditors and Contributories.

Maintaining Paper Books

The Liquidator is authorized to maintain proper books. The books should include each entry and minutes of the proceeding at meetings.

Maintain Accounts

The Liquidator is authorized to pat al the cash with him with the Reserve Bank of India (RBI). The receipts and payments to Liquidator should be presented in the court twice a year.

Appointment of Inspection Committee

The Liquidator is entitled to appoint an inspection committee under him if the court directs him. The committee should be formed within 2 months from the direction of the court. The committee should be formed with the consent of the majority of creditors. If the creditors form no committee, then the court will accordingly form 1 Committee for the Company.

Inform about Pending Liquidation

If the Winding Up of the Company is not completed in a year, then the Liquidator should file a statement in prescribed format about the proceedings of Winding up of the Company.

Investigate Affairs of Company

The Liquidator can examine the conduct of the Company’s present and past officers and can see whether they were guilty of any misconduct in the Company or not.

Conclusion

The Company Liquidator is authorized to perform all the Powers and Duties as prescribed under the Companies Act, 2013. The Liquidator is accountable to shareholders and the creditors of the Company. There is a fiduciary relationship between the Liquidator and the Company and its creditors. The primary purpose of appointing Liquidator is to wing up a failed business and act with professional efficiency.

Read our article:Commencement of Winding Up of a Company by Tribunal under Companies Act 2013