The majority of the companies are still in the midst of the crisis due to the Covid 19 pandemic. They are putting their best efforts to contain the losses by employing various strategies, including outsourcing the delicate functions. But outsourcing is not a cup of tea for everyone, particularly for those who have ample staff to manage the core departments.

Outsourcing is generally required when certain business elements go beyond the scope of managerial abilities of the company. Indeed, outsourcing comes with a certain cost, but it’s up to you to figure out whether it’s justifiable to outsource a specific department to an outsider from the growth standpoint. However, if you are in the midst of the confusion of whether to opt for outsourcing or not, keep reading this blog till the end.

What Makes Outsourcing Account Receivables Necessary for the Company?

Managing accounts without discrepancies remains one of the daunting undertakings for organizations operating at a larger scale. Since AR is more prone to human error, it forces the management to invest more time and energy to streamline the function.

Outsourcing Account receivables ensures that the management no longer requires stressing on such a delicate area. With such facilities at disposal, they can channelize their whole attention to areas

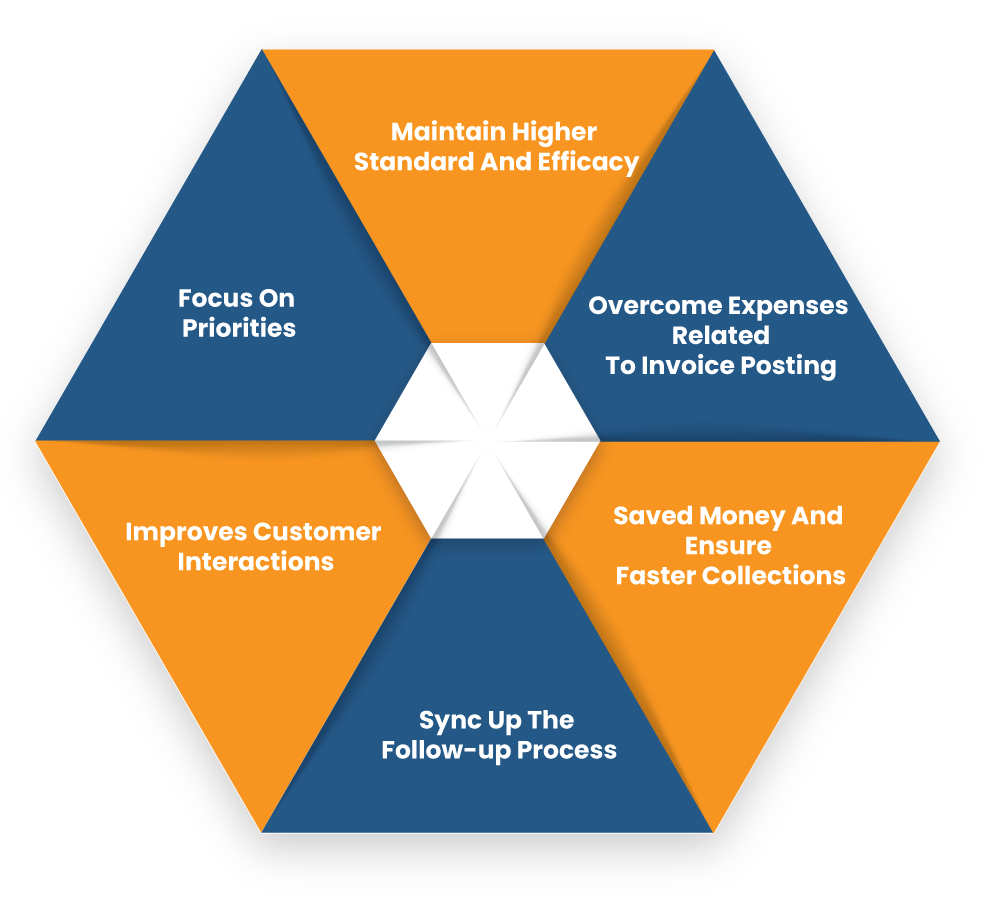

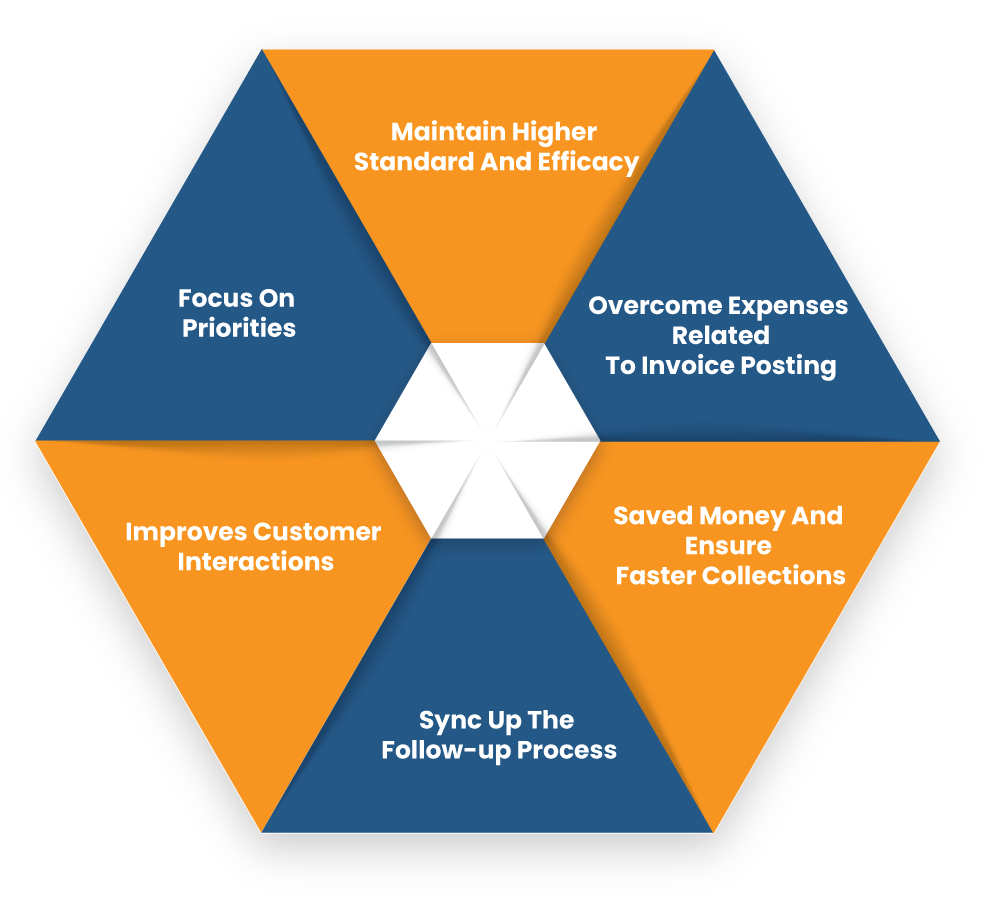

Benefits of Outsourcing Account Receivable

Outlining a plan to hand over the AR to a third-party is a smart move saving both money & time for business, but particularly for new ventures and small firms. Here are five primary advantages you can reap by outsourcing accounts receivable services:-

Let’s focus on priorities

Businesses need to thrive to stay afloat in the competition, and growth seeks a focus on customer service, R&D, and marketing. Managing Account receivable is a time-consuming task and pushes main staff away from these critical growth activities.

Considering the tedious nature of the debt collection, managing it in-house tends to mitigate staff’s confidence. Outsourcing account receivable permits employees to pay attention to the priorities for stable and seamless growth.

Maintain higher standard and efficacy

The companies you hand over your AR process have a degree of finance & accounting expertise that in-house employees radically lack. As such, they can accomplish improved efficacy and perform your account receivable task with more preciseness.

Cut down the Labor-Related Expenses For Sending Invoices

Companies are less likely to take labor costs into account while factoring the expense of paper & postage for invoicing. According to a previous study, laboring in such case costs significantly to the company in the longer run. Outsourcing can help you cut down those expenses and speed up the collection process.

Saved Money And Ensure Faster Collections

Any delay in the collection process will eventually hamper the cash flow management of the company. Overdue payment can shift to the non-payment zone if you ignore the defaulters for long. Studies have shown that the longer it takes to gather on delinquent accounts, the less money your company will be able to recover.

Working with a technologically advanced company that can automate AR & have the expertise to close the books of account sooner will save you a considerable amount of money. Outsourcing account receivables ensures faster and seamless connection.

Improves Customer Interactions

Accounts receivables can become contentious at times when managed in-house. But that is not the case with the third-parties as they ensure you get the best services through the process, whether it’s a question of intimating a client with a gentle reminder or dealing with a client who is ignoring the payment. Your provider will ensure end-to-end support and maintain continual interaction with potential clients.

Sync up the Follow-Up Process

Following up with the clients for payment remains one of the most complex organizational tasks to date. Such functions seek continual attention, time, and resources to stay in action. An organization with other vital priorities at hand may not able to focus on these areas. And that is where outsourcing account receivables can prove to be game-changer for the company.

Outsourcing firms normally take advantage of the latest tools that sort out the clients based on predefined parameters. This makes sure that they follow up with the right client at the right time.

Read our article:Account Receivable & Payable Process in Cash Flow Management

Picking up the Right Partner is Important

Some businesses[1] do not prefer to leverage outsiders’ capabilities to manage one of their departments because they think it will incur more cost and ultimately compromise their secrecy. This is a valid concern because nobody likes to disclose their internal management to outsiders unless something is severely wrong with their processes.

However, the best third-party agencies will delve deeper into your business structure to understand it existing downsides and tweaked it accordingly to ensure improved collection. Before handing over your AR process to outsiders, make sure to do some preliminary investigation to identify the partners who are versatile enough to adapt any business structure in the lesser period.

Such partners can deploy highly efficient strategies to perfectly optimize the cash flow and help save time and money. Companies with third-party support can able to shift their focus on critical priorities.

Conclusion

The account receivable process is a delicate facet of any company that seeks utmost focus from the management. The slightest deviation in terms of handling or management can allow existing errors to grow even further, which eventually can push a firm to a state of crisis. With that being said, outsourcing account receivables helps you mitigate those discrepancies and let you take informed decisions promptly and precisely.

Let us know if you have a second thought on this topic. Feel free to share your concern with us by commenting in the message box.

Read our article:Accounts Receivable: Definition and Tips to Manage