Limited liability partnership is a type of entity having features of a partnership firm and a company. Their partner manages the LLP and it is a separate legal entity from its partners. The incorporation process of LLP is easy and it does not require much annual compliance for LLPs, hence, LLP registration are preferred by Professionals, Micro and Small or closely-held businesses. A concept of Limited Liability Partnership has been brought by way of enforcing the Limited Liability Act, 2008.

What are the Benefits enjoyed by LLPs?

Some of major benefits enjoyed by LLPs are the following-

- LLP has a separate legal entity from its partners.

- It can raise funds from banks, partners and NBFCs.

- The procedure for the Incorporation, conversion and closure of LLP is simple and easy.

- It has assets and liabilities which are separate from that of the promoters.

- LLP can easily Transfer the ownership.

- LLP’s are regulated by Registrar of Companies, MCA. All LLPs are required to endure compliances with Government[1] every year.

- It is compulsory for an LLP to file an Annual return that is not linked to Profits or Turnover.

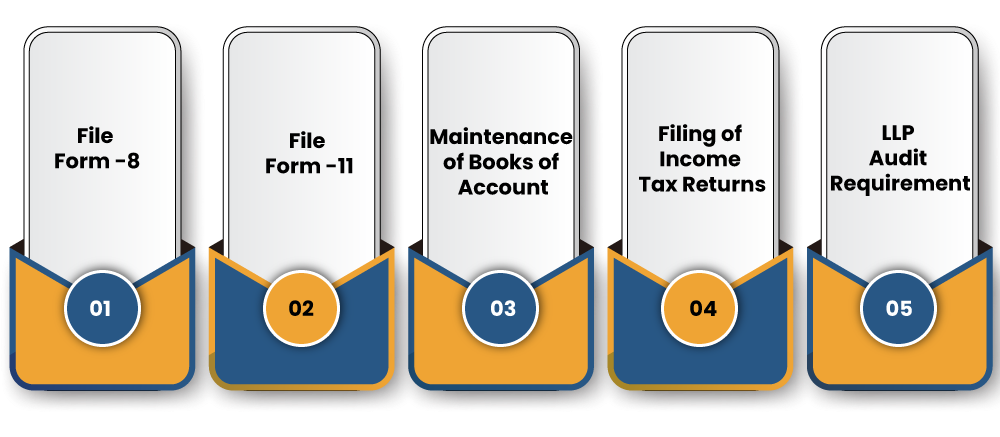

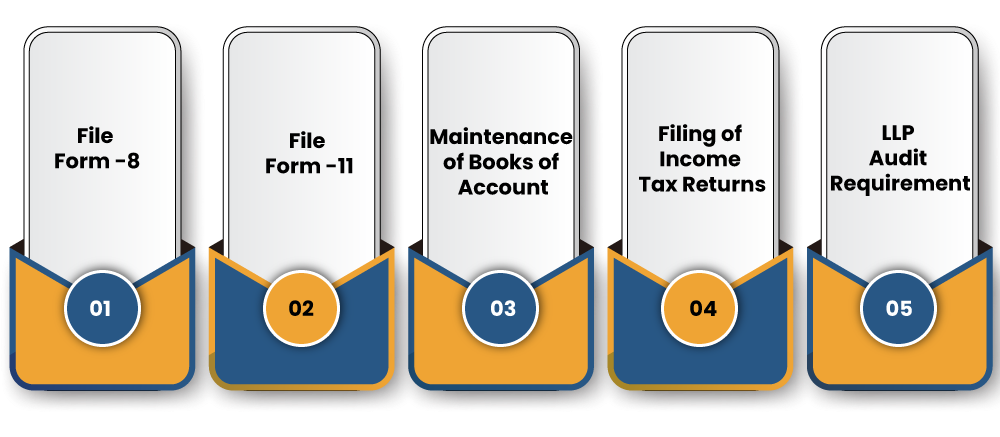

Annual Compliance for LLP

Read our article:A Complete Guide on Annual Filings for Limited Liability Partnership

Filing of Annual Return – FORM-8

Here below is information regarding Form-8, those are as follows:-

What consists in the Form-8?

Form-8 consists of a statement of Account and Solvency. It consists of information related to a statement of assets of LLP and liabilities provide statement of income & expenditure of the LLP.

What is a Due date of filing of the form?

Form 8 has to be filed within 30 days from before end of 6 months of a financial year i.e. by 30th October of each financial year.

Who will sign the form?

Designated partners must sign form digitally. Further, it has to be certified by a chartered accountant, auditor or an accountant of the LLP.

How many parts are there in the form?

There are two parts in Form 8. They are:

- Statement of Solvency

- Statement of Accounts, Statement of Income & Expenditure

Filing of Annual Return – FORM- 11

Here below is information regarding Form-11

What consists of Form 11?

Form -11 consist of an annual return. It contains the details of all the partners and their contributions towards the LLP.

What is a Due date of filing of this Form-11?

Form-11 must be filed within 60 days of the end of financial year i.e. on or before 31st May every year.

Who will sign the form?

It has to be digitally signed by one of a Designated Partner of the LLP. If in case total obligation of contribution of partners of the LLP exceeds from Rs. 50 lakhs or turnover of LLP exceeds from Rs. 5 crores, then LLP Form-11 needs to be certified by Company Secretary in whole time practice.

What is required to File LLP Form 11?

Basic details such as Total obligation of contribution, total contribution received by partners of the LLP, Summary of Designated Partners and Partners Further complete details of LLP and its partner/ designated partner/ partner must also attach with the form.

Maintenance of Books of Accounts and Documents

The LLPs have to maintain books of accounts on cash basis or accrual basis. Other relevant documents such as incorporation document, names of partners & changes made proof of fee payment, the statement of account & solvency and annual return filed by LLP should also be kept at its registered office. The books of accounts must also be preserved in the registered office of the LLP for the specified period.

Filing of Income Tax Returns

Every LLP has to file the income tax return every year. Since LLP has a separate legal entity, so along with partners income tax return then one has to file LLP’s income tax return as well within due date.

LLP Audit Requirement

In any financial year, LLP whose turnover must not exceed to Rs 40 lakh or whose contribution does not exceed Rs 25 Lakh is not required to get its accounts audited. Where partners of LLP do not decide for audit of the accounts of LLP, such LLP must include in the Statement of Account and Solvency.

A statement made by the partners to the effect that the partners acknowledge a responsibility for complying with the requirements of the Act and the Rules with respect to preparation of books of accounts and certificate in the specified in FORM 8. An auditor or auditors of the limited liability partnership shall be appointed for each financial year of the LLP for auditing its accounts.

Why to Maintain Annual Compliance for LLPs?

- Helps firm build higher credibility and trustworthiness

- Enables to request for loans and avail credit from other sources

- Helps other investors check and assess your financial position

- Serves as the credible record of your company’s financial health and worth

- Helps you maintain active status and stay on the right side of the law

- Avoid the fines, penalties, and legal action

- Annual filing ensures straightforward conversion of LLP into other organisational types

Conclusion

The requirement is compulsory to be followed irrespective of any number of transactions or amount of turnover. Since LLP has to comply fewer compliances as compared to company it is always better to file all forms and returns before a due date to escape hefty penalties with timely annual LLP compliance filing. The Corpbiz proven to best company in providing LLP registration, as we have experts who can advise you in best possible way.

Read our article:LLP Compliances – Statutory Compliance Checklist for LLP