On the 26th June 2020, MSMEs received the most-anticipated change from the government on account of classification criteria. The change was made to widen the scope of classification so that more and more firms can join the MSME’s ecosystem.

The previous structure of the MSME classification keeps the majority of the companies beyond its reach. The new amendment is expected to attract a considerable number of entities in the upcoming years. The changes were made by expanding their existing bandwidth of parameters like Turnover and Investment. Let’s see how the new structure of MSME classification looks like.

What are Amendments made to the Existing Structure?

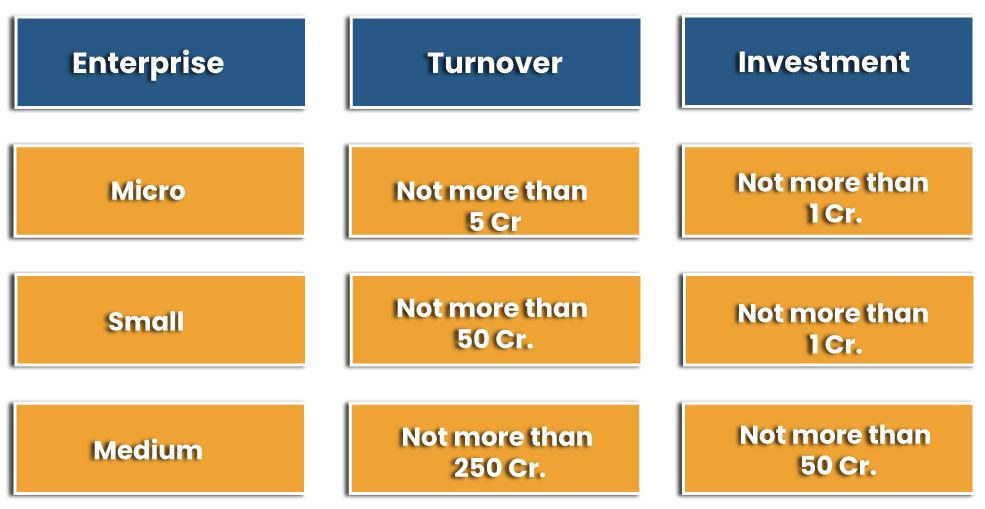

The new structure of MSME classification offer more flexibility in terms of coverage. Compared to the past version, the new structure allows the new entities (medium enterprise, in particular) to join the MSME ecosystem. The section below represents the new classification structure for MSMEs.

New Structure of MSME Classification

- Any enterprise having investment up to Rs 1 crore & annual revenue under Rs 5 crore will be regarded as “Micro“.

- Any enterprise having investment up to Rs 10 crore & annual revenue up to Rs 50 crore will be regarded as “Small“

- Any enterprise having investment up to Rs 20 crore & annual revenue under Rs 100 crore will be regarded as “Medium“.

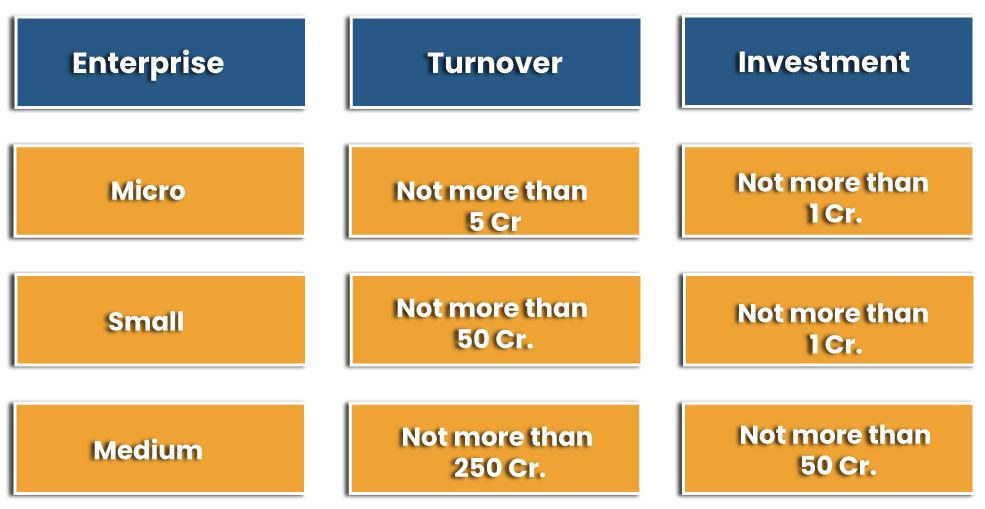

Previous Structure of MSMEs Classification

Manufacturing units: Based on investment in machinery and plant

- Micro enterprises – investment limit capped at 25 lakhs

- Small enterprises – Investment more than 25 lakhs rupees but not surpassing 5 crore rupees.

- Medium enterprises- Investment more than 5 crore rupees but not surpassing 10 crore rupees.

Service sector: (Based on investment in equipment)

- Micro enterprises – Investment limit capped at ten lakh rupees

- Small enterprises – Investment more than Rs 10 Lakh but not surpassing Rs 2 crore.

- Medium enterprises -Investment more than Rs 2 crore but not surpassing Rs 5 crore.

Inclination towards Atmanirbhar Bharat Abhiyan

With anticipation to aggressively counter the loss that occurred by the pandemic, the government has rolled a dozen schemes under Atmanirbhar Bharat Abhiyan. The aforesaid announcement came as a relief to distressed MSMEs who are expecting the government to take relevant actions in the wake of the COVID 19 Pandemic.

Key Announcements that were made under “Atmanirbhar Bharat Abhiyan”

- Rs 3 lakh crores stimulus package deployed to render collateral-free automated loans for the distressed MSMEs.

- A borrower having outstanding liabilities up to 25 crores and INR 100 Crore of turnover has access to this scheme.

- The loan tenor has been capped at 4 years along with a 12 months moratorium on principal repayment.

- The bandwidth of the interest rate has been kept under the range from 9.25% p.a to 9.75% p.a

- Meanwhile, private lenders like NBFCs would charge a 14% rate of interest.

- The credit guarantee scheme aims to render easy credit to distressed MSMEs to curb Non-Performing Assets.

Accordingly, looking way ahead in this context of the MSME has increased to many folds. The amendment is expected to bring more and more enterprises under the canopy of the MSME ecosystem; thus ensuring collective development of the sector. Earlier the entities under MSME registration were classified into two categories namely manufacturing & service entities. With the arrival of the latest amendment, the said categories shall be viewed under the common matrix. Additionally, they are classified as investment in plants and machinery or equipment and turnover.

What Are The Existing Schemes That Are Accessible To Entities under MSME Registration?

Following are the schemes accessible to the entities under MSME registration.

- Micro & Small Enterprises Cluster Development Programme.

- MSME Technology Centres (TCs)

- Credit Guarantee Scheme for Micro & Small Enterprises.

- Credit Linked Capital Subsidy Component (CLCS & TU Scheme)

- Interest Subvention Scheme for MSMEs-2018

- Promotion of MSMEs in NER and Sikkim- a sub component of Central Sector Scheme “ Technology and Enterprise, Resource Center” .

- Procurement and Marketing Support (PMS) scheme

- ZED Certification Scheme

- Lean Manufacturing Competitiveness for MSMEs

- Design Clinic for Design Expertise to MSMEs

- Digital MSME

- Entrepreneurial & Managerial Development of SMEs via Incubators

- Awareness on Intellectual Property Rights (IPR)

- ESDP Scheme

- Assistance to Training Institutions (ATI) Scheme

- International Cooperation (IC) Scheme

- Science & Technology

- Coir Industry Technology Upgradation Scheme

- Skill Upgradation and Mahila Coir Yojana

- Export Market Promotion

- Domestic Market Promotion

- Trade & Industry Related Functional Support Services

- Welfare Measures

- Prime Minister’s Employment Generation Programme (PMEGP)

- 2nd Loan for up-gradation of the existing PMEGP / MUDRA units

- MMDA

- ISEC

- Work-Shed Scheme for Khadi Artisans

- Strength-ening of Infrastructure of Existing Weak Khadi Institutions and Assistance for Marketing Infrastructure

- Rojgar Yukt Gaon

- Honey Mission Programme / Beekeeping

- Mission Solar Charkha

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

- A Scheme for Promotion of Innovation, Rural Industries and Entrepre-neurship (ASPIRE)

- Mahatma Gandhi Institute for Rural Industri-alization (MGIRI)

- National SC-ST Hub

Problem Faced By MSMEs in Wake of COVID 19 Pandemic

- Absence of timely & adequate banking finance

- Limited capital & knowledge

- Non-availability of latest generation technology

- Low production capacity

- Ineffective marketing strategy

- Limitation ofmodernizationand expansions

- Absence of skilled labour at affordable cost

- Follow up with government authorities to solve issuesowing to lack of man power & knowledge etc.

Make sure to remember points in mind while considering the criteria for MSME classification and composite investment as well as turnover. If the enterprises cross the ceiling limit in their respective category as contrasted with two criteria then it will automatically place into the next category. The enterprise position will not be compromised in the event if it manages to satisfy the ceiling limit.

All the entities with GSTIN listed against the one PAN number will be treated as one entity and the investment and turnover figures will be seen together for classification.

Calculative Means for Investment in Plant & equipment

It should be linked with the IT return of past years filed under IT Act, 1961 for Existing enterprises. For New Enterprises where no income tax return available be considered based on Self declaration of Promoter & the same shall end post 31st March of the first financial year with compulsory GSTIN & PAN in possession.

Conclusion

MSME is the major contributor to the Indian economy as it is accounted for 29% of the country’s GDP. The majority of the employment is generated from this sector itself. It’s not only helping in strengthening the country’s GDP but also curbing the prevalent issues like unemployment.

The announcement pertaining to new structure of MSME classification has paved down a roadmap of growth for the entities that are waiting to get some exposure to the government-related scheme. Talk to our expert at Corpbiz helpdesk in case if you need some services pertaining to MSME registration or other government related license.

Read our article: An Overview on Policy Measures That Can Uplift the MSMEs Sector in India