As the terms indicate, One Person Company refers to a private entity that can be set up only by a natural human being that belongs to the Indian Territory. The owner of such a company will serve as Director and shareholder. The notion of the OPC is widely praised in the business fraternity owing to the benefits it adheres to. OPC is more stable when contrasted with other business models like sole proprietorship or partnership from a legal standpoint. This article will give you a detailed briefing on One person company compliance requirements.

Potential Pros of Setting up OPC in India

Before we briefs out One Person Company Compliance requirements, here are some possible pros of setting up One Person Company in India.

Lesser compliances and improved legal stability

One Person Company is ideally suited to those entrepreneurs who wish to commence their business journey with limited administrative personals. Apart from ensuring minimal compliance, the OPC business form offers negligible hassle on liability and legal stability.

Inclusion of the Nominee

Even though OPC revolves around the concept of a single owner, it offers the liberty of including a nominee via a legal contract.

Fewer Compliances

When contrasted with a business[1] model like a Private Company, OPC encounters fewer compliances, be it a matter of conducting board meetings or holding an AGM.

Read our article:Government Relaxes Provisions for OPC in Budget 2021

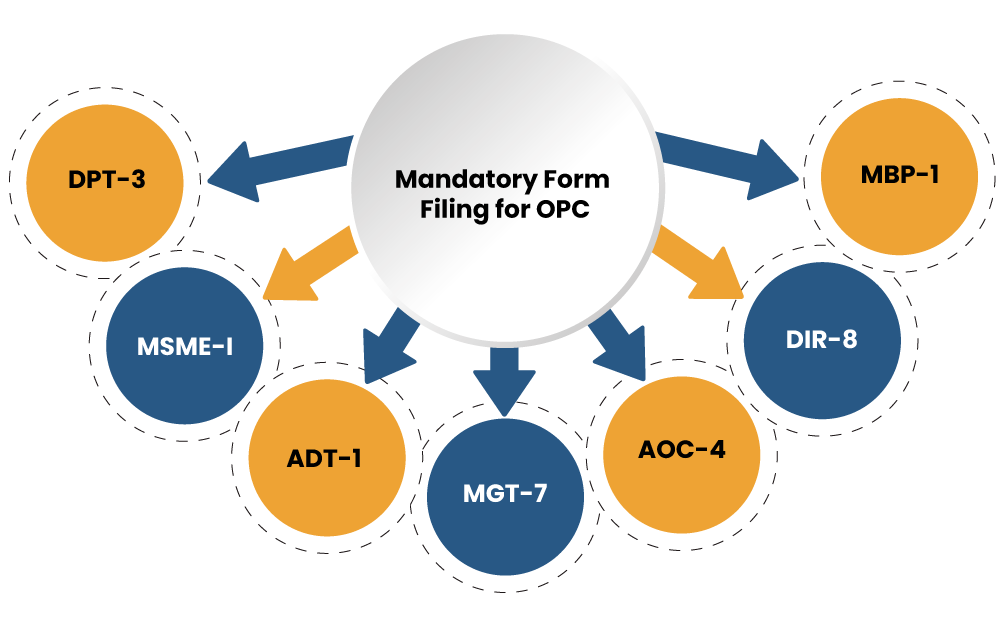

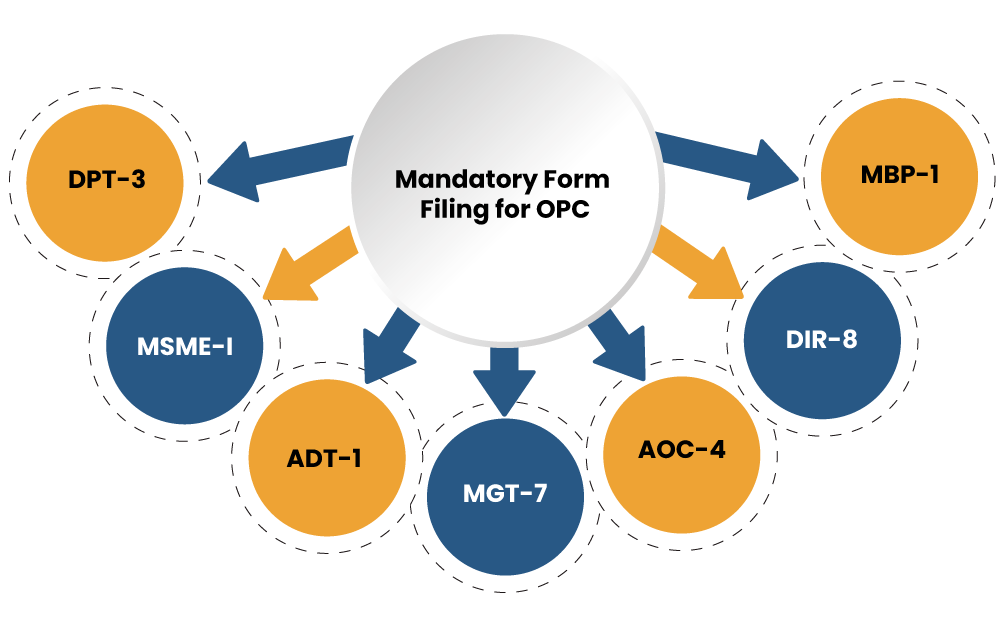

Table for One Person Company Compliance Checklists

| Sl. No. | Particulars | Status |

| 1. | Form INC-20A* | Form regarding starting of Business within 180 days of incorporation |

| 2. | Stamp duty on Share Certificates | Payment pertaining to stamp duty is to be submitted within 30 days from the issuance of share certificates |

| 3. | Board Meeting | OPC must hold two board meetings in each half of calendar year. The gap between such meetings should be not be less than 90 days. |

| 4. | Annual General Meeting | The provision regarding the AGM has been waived off for the OPC |

| 5. | MBP-1* | Disclosure of Interest is needed to be provided in the first board meeting or where ever there is any alteration by every Company’s Director. |

| 6. | DIR-8* | Declaration in form DIR-8 prompting authority that director is not disqualified |

| 7. | Statutory Registers, Minutes Books and Records | A legal compulsion for ensuring proper Maintenance of statutory registers, secretarial records, and minutes Book |

| 8. | Form AOC-4* (Financial Statements) | 180 days from completion of financial year i.e. 31st March |

| 9. | Form MGT-7 * (Annual Return) | 180 days from completion of financial year i.e. 31st March |

| 10. | IT return of Company | 30th of Sep of each financial year |

| 11. | DIR-KYC (Directors KYC) | 30th of Sep. of subsequent financial year |

| 12. | ADT-1 (Auditor’s Appointment) | Form ADT- 1 to prompt ROC about the appointment of an auditor post completion of the AGM |

| 13. | E-Form MSME-I (Half Yearly Return) | Must be filed by OPC which has outstanding payments dues to MSME for more than 45 days by taking the following timeline into account: For April to Sep. by 31st October For Oct. to March by 30th April |

| 14. | E-Form DPT-3 (Return of Deposits) | DPT 3 refers to a return of deposits that OPCs must submit to reveal detail about deposits &/or outstanding receipt of loan or money other than deposits. |

INC-20A

INC-20A is an imperative of One Person Company Compliance and it is supposed to the filed by the company incorporated on or after 02/Nov/2018 with MCA. It is a mandatory form and commonly regarded as Declaration of Commencement of Business. After securing the certificate of incorporation, the director of the company is mandated to file declaration certificate of commencement of business

MBP- 1

MBP- 1 refers to an attachment to Spice Form (INC 32) which is used in the event of incorporation of a new company. Such forms have to be place in the first board meeting of the financial year.

FORM DIR-8

FORM DIR-8 serves as a intimation form that manifest director’s qualification and disqualification status along with the experience of holding the same position in preceding companies for last 3 years.

AOC 4

Form AOC 4 refers to a legal form that is used to file the company’s financial statements for each financial year with ROC.

In respect of submitting of Annual Return of OPC, there is no such requirement of filing Annual Return within sixty days period of AGM as the norms of AGM doesn’t apply to such companies.

One Person Company (OPC) is mandated to function in accordance with norms cited under the Companies Act and IT Act. Therefore, adhering to an OPC’s compliance also includes filing of IT return and annual return with the MCA. Apart from meeting fundamental compliances, these companies may also be required to adhere to GST norms, TDS regulations, VAT/CST norms, ESI regulations, and Service Tax regulations. The compliance requirement for OPC would differ industry-wise, state of incorporation, sales turnover, & the number of employees.

Conclusion

OPC incorporation is somewhat easier as compared to other company forms, such as a private or public limited company. Also, such companies take a minimal toll when it comes to complying with underlying compliances. Let us know if you have some regarding the One Person Company Compliance checklist.

Read our article:An Outlook on One Person Company (OPC) Formation Procedure in India