In the past few years, the legal paradigm of one-person companies has helped several startups and persons looking for quick incorporation. But, bigger enterprises and starts up restrain by the restrictive definition of OPC. With the introduction of Budget 2021, the Indian Government has made an effort to incentivize these entities to thrive and retain their status. This article will examine what type of relaxations is given to the OPC in Budget 2021.

Overview of One Person Company in India

The OPC paradigm comes into existence in 2005 when the JJ Irani Committee proposed a setup for individual business owners. According to Section 2(62) of the Companies Act, 2013, one-person company is an establishment that has only one person as member.

The introduction of OPC would promote micro-businesses corporatization with a simplified legal framework so that the small business owners can save their precious time and energy by averting complex legal compliances.

This will enable individual capabilities to make a significant contribution to economic growth and create job opportunities. One Person Company has been provided with relaxed requirements under the Companies Act, 2013[1].

Outlook on Restrictions Existed in Previous Regime

The Companies (Incorporation) Rules, 2014 define paid-up capital and specific turnover limits for each type of entity. Rule 6 under this talk about the mandatory conversion of One Person Company into a Public Company or Privately-held entity, in the case where such entities exceed fifty lakh rupees.

Or its average yearly revenue during the given timeline surpasses two crore rupees—this restrained companies from reaching the threshold for the apprehension of triggering automatic conversion.

What Relaxations are given to OPC in Budget 2021?

While disclosing detail about OPC in Budget 2021, the Honorable Finance Minister states that the Indian Government is taking a step forward by incentivizing the incorporation of OPCs. The new rules will allow these entities to get rid of various complex requirements such as;-

- Restrictions on paid-up capital and turnover

- Conversion into other company forms

- Residency limit for an Indian citizen

- Non-availability of rights for foreign nationals to incorporate OPCs in India

Change in the Criteria for Setting up a One Person Company

Companies (Incorporation) Rules, 2014 states that only a natural individual who is an Indian national & resident in India-

(a) will hold the right to incorporate a one-person company;

(b) shall be a nominee for the OPC’s sole member

The criteria of 180 days have been reduced to 120 days to allow NRIs to operate One Person Company in India.

The table below will give a clear understanding of relaxations conferred to OPC in Budget 2021.

| S.No | Areas Subjected to Changes | Current Provisions | Proposed Provisions |

| 1. | Who are eligible to form an OPC in India? | An Indian national is eligible to incorporate OPC in India. | Non- Resident Indian (NRI) can also incorporate OPC in India. |

| 2. | Residency limit for an Indian citizen | 182 days | 120 days |

| 3. | Conversion of OPCs into other company forms | Conversion is possible only if OPC has completed two years of service life from the date of incorporation or has paid-up share capital more than INR 50 lakhs, or average annual turnover during any FY exceeds INR 2 crores. | No such criteria will be imposed on OPCs seeking conversion to other company forms. |

Apart from these amendments, Union Budget 2021 also proposed some tax relaxations for Innovators & startups, like claiming tax holidays till March 31, 2022, etc. These changes will boost such Government’s initiative.

Probable Impact of Union Budget 2021 on OPCs in India

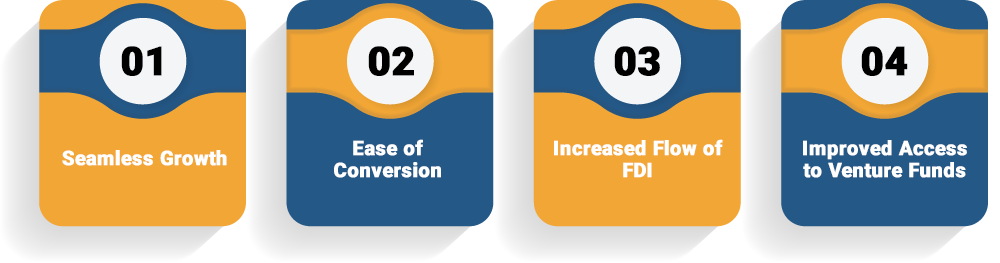

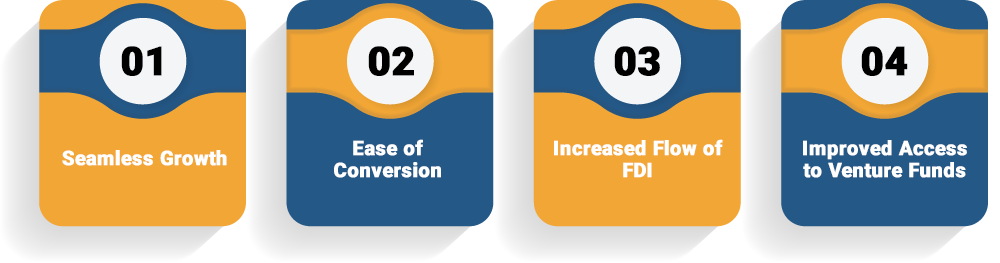

For years, OPC’s business model has been plagued with tight compliance and redundant requirements that act as potential growth barriers for them. But after the inculcation of the above measures proposed in Union Budget 2021, it seems that these business entities will thrive like never before. In view of the aforesaid measures, OPCs in India may witness the following benefits in the future.

Seamless Growth

Through Union Budget 2021, the Indian Government has removed restrictions on annual turnover and paid-up capital, thereby ensuring seamless growth of such companies.

Ease of Conversion

Previously, OPCs were obligated to complete at least two years of service life to transform into privately-held companies. This was one of the major growth barriers for One-Person companies in India. Nevertheless, the Union-Budget 2021 has proposed eliminating this requirement, thereby making conversion easy for OPCs in India.

Increased Flow of FDI

The previous law framework doesn’t allow foreign individuals to set up OPC in India. The concept doesn’t seem to fit with the context of foreign direct investment, a key performance indicator of any developing economy.

Fortunately, the finance ministry has got rid of this potential growth barrier by allowing foreign nationals to incorporate OPC in India. This incentivization will definitely increase the inflow of overseas funds in India.

Improved Access to Venture Funds

Most venture capitalist firm was reluctant to make any significant investment in OPC owing the lack of scalability. But after the omission of restrictions on annual turnover and paid-up capital, things might change for these entities. After inculcation of aforesaid changes, OPCs across this nation can expect seamless access to venture funds.

Conclusion

These amendments w.r.t to One Person Company will give these entities relaxation as the threshold limit for turnover and paid-up share capital being removed. The move to incentivize One Person Companies and a relaxed residency limit is anticipated to impart wider investment opportunities for venture funds. The startups and small businesses will praise the removal of restrictions on the paid-up limit. Through amendments above, the Government is striving to create a better business environment for OPCs operating across this nation.

Read our article:Benefits of OPC (One Person Company)