The Delhi bench of (ITAT) Income Tax Appellate Tribunal has ruled that long term capital gains tax will be not imposed on an indirect transfer of Indian assets. This matter came up with the sale of Singapore-based Accelyst startup Augustus Capital PTE Ltd to Jasper Infotech Pvt Ltd (JIPL) in a Financial Year 2016. The decision comes as a relief to the foreign funds and institutions for the tax demands for earlier years.

The root of a problem was an imposed amount of ₹36.3 crores in the form of long-term capital gains (LTCG) by an Assessing Officer (AO), against the claim of zero or nil income by Augustus Capital, stating that a transaction was not taxable in India.

What are the Facts of the case?

- An appellant company, Augustus Capital PTE Ltd. is in a business of incubation of companies that provides new businesses, with a necessary financial support and also technical services. During the course of its business, an appellant made investments in the Accelyst Pte Ltd, a company which was incorporated in and resident of Singapore.

- The Assessing Officer asked an assessee to explain as to why long term capital gains tax arising from a sale of shares from the Accelyst to Jasper Infotech Private Limited must not be brought to tax in India under section 9(1)(i) of Act.

- An Assessing Officer further disregarded all submissions of an assessee as the Assessing Officer was of a firm belief that an operation of Explanation 7 to section 9(1)(i) of Act is prospective. It was inserted in 2015 in the Finance Act and made effective from 1st April 2016 and, therefore, not applicable in that year under consideration.

Read our article:Abolishing of tax on Long Term Capital Gains

What is held by the ITAT?

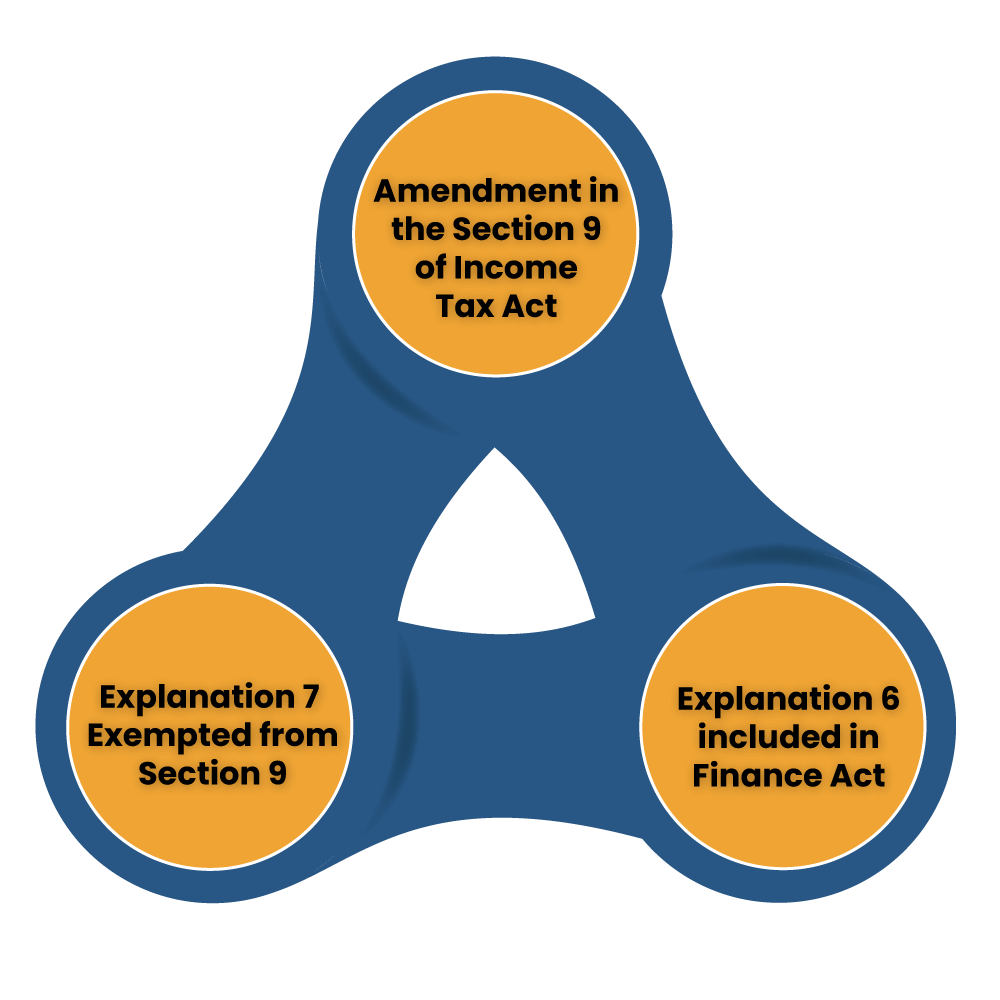

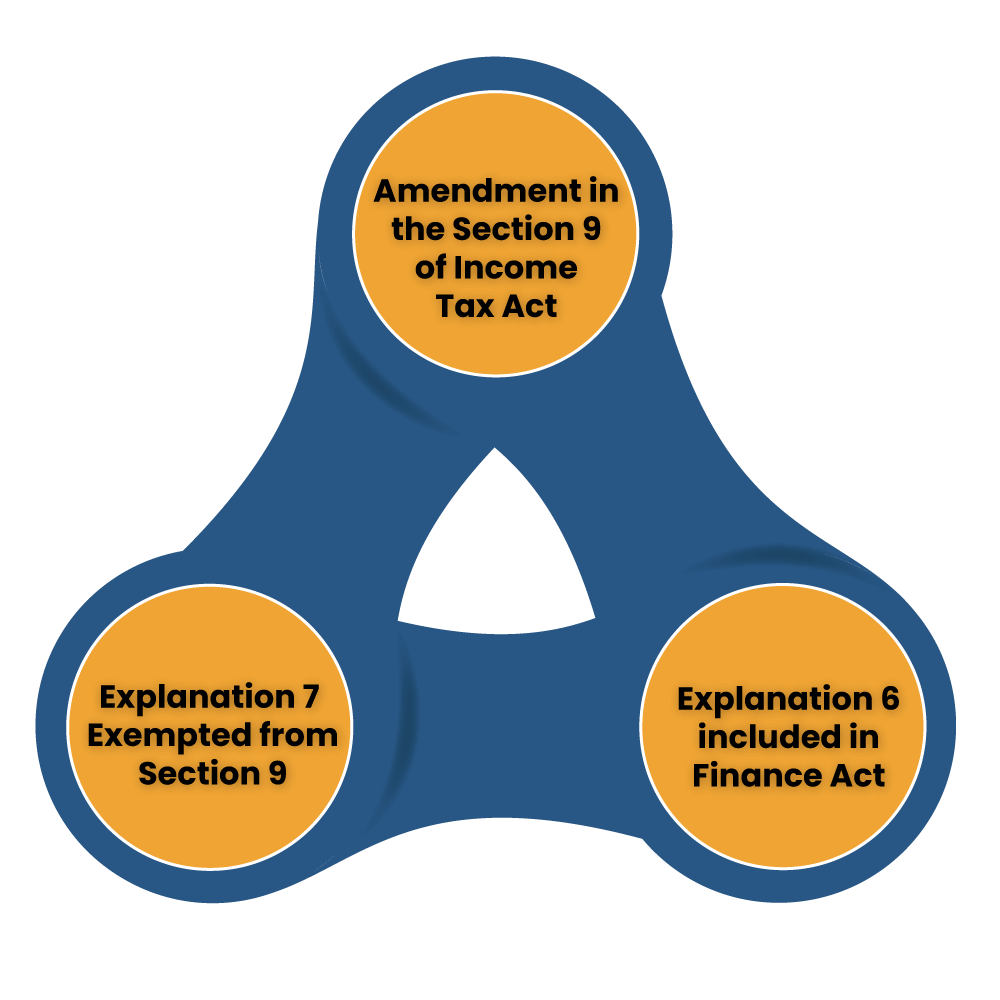

The Section 9(1)(i) of a Act was amended and Finance Act[1] inserted explanation 5, 2012 giving retrospective effect from 1st April 1962. The Shome Committee was constituted because of apprehensions and ambiguities in the said Explanation and on the recommendations of the Shome Committee, Explanations 6 & 7 were inserted by Finance Act, 2015.

- Amendment in the Section 9 of Income Tax Act in 2012 clarifies that if the share or interest in a foreign entity is substantially derived from assets located in India, such share or interest is deemed to be located in India. Also, any Income arises from a transfer of such shares or interest deemed to have arisen in India.

- Explanation 6 later included in Finance Act, and it clarifies that the term ‘substantial’ means the fair market value (FMV) of assets located in India exceeds ₹10 crores and that the FMV of assets or property located in India is represented at least 50% of the FMV total assets of the foreign entity.

- Explanation 7 exempted from Section 9:- Small investors who do not own the management right or control of such an entity and hold less than 5% of the total voting power.

The order stated that the Assessing Officer (AO) rejected the assessee’s claims stating that Explanations 6 & 7 were effective from Financial Year in 2017 while a transaction was conducted in Financial Year 2016. With the new ruling, the tribunal directed the income tax department to remove the addition of LTCG (long term capital gains tax). It was articulated that this would provide a breather to foreign funds and entities which are being subjected to tax demands for earlier years where substantial investments otherwise may not have been made by them.

Conclusion

The two-member bench of Amit Shukla & N.K. Billaiya while providing relief to the foreign funds and entities being subjected to tax demands for earlier years directed an Assessing Officer to read Explanation 7 as applicable for a year under consideration and delete the impugned addition. According to new ruling, the tribunal directed the income tax department to remove the addition of long term capital gains tax, as it does not apply to indirect transfer of Indian Assets.

Read our article:What is Capital Gain Tax and Difference between LTCG & STCG