Nidhi Company and Chit Fund Company are two different entities that excel on the same concept, i.e. facilitating financial cushion to its members. This article aims at considering key points that draw a line of distinction between Nidhi Company and Chit Fund Company.

But before we delve into the core topic, i.e. what is the difference between Nidhi Company and Chit Fund Company, let’s explore these entities individually.

What is the Nidhi Company?

A Nidhi company refers to a non-banking financial institution that operates u/s 406 of the Companies Act, 2013. The main business is lending & borrowing money between their members. They are also regarded as the Benefit Funds, Permanent Fund, Mutual Benefit Company, & Mutual Benefit Funds. Ministry of Corporate Affairs[1] keeps a tab on their activities. Further, this apex institution also directs them to follow the guidelines relating to deposit acceptance activities.

The term Nidhi refers to an institution that aims at fostering the habit of thrift & allocates funds amongst its members & also receiving deposits & disbursing to its members only for their mutual benefit. Nidhi companies came into existence even before the enactment of the Company Act 2013. Further, these companies excel on the concept of “Principle of Mutuality” These companies has garnered immense popularity in South India. Presently, more than 80% of the Nidhi companies are located in Tamil Nadu.

Nidhi companies operate in line with the provisions drafted under Nidhi Rules, 2014. They are legalized in the nature Public Ltd Company. Therefore, they are liable to comply with two sets of conditions, one of Public Ltd. company as per Companies Act, 2013 & another is for Nidhi rules, 2014. No Reserve Bank’s consent is required to legalize such a company. Every Nidhi Company is mandated to procure a minimum threshold of members, i.e. 200, within a year from the commencement date.

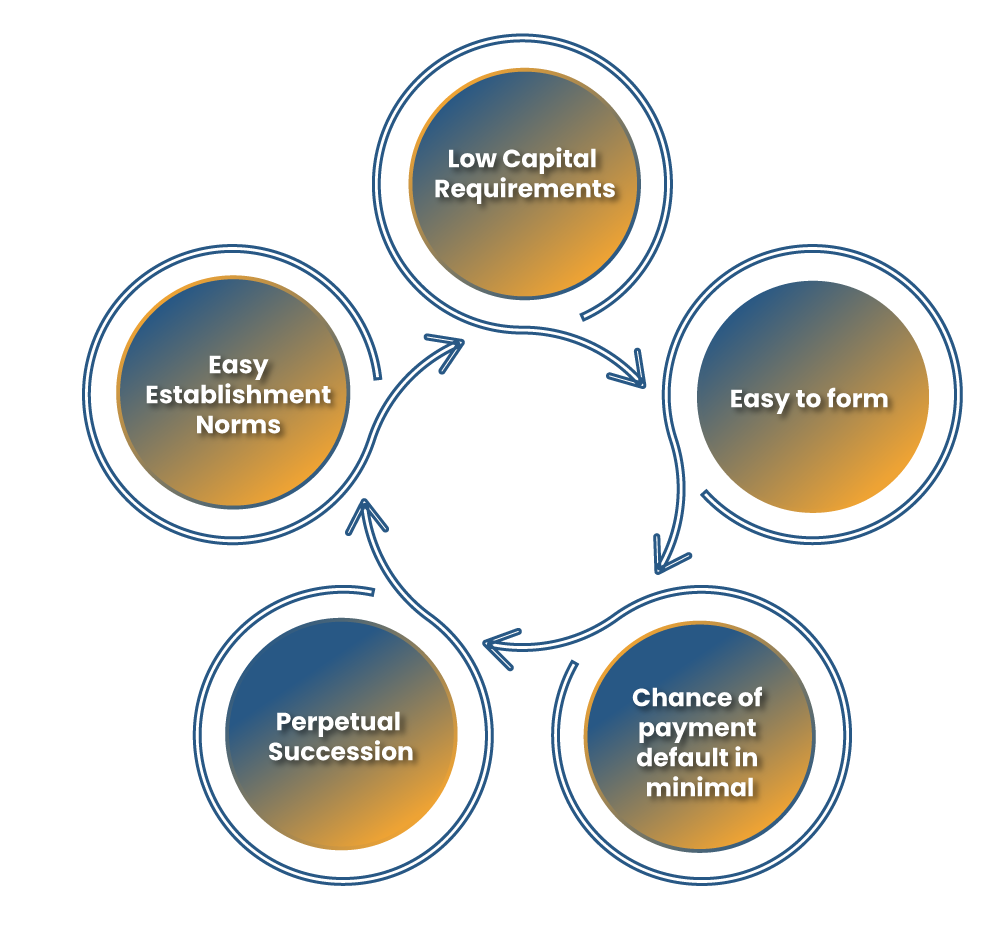

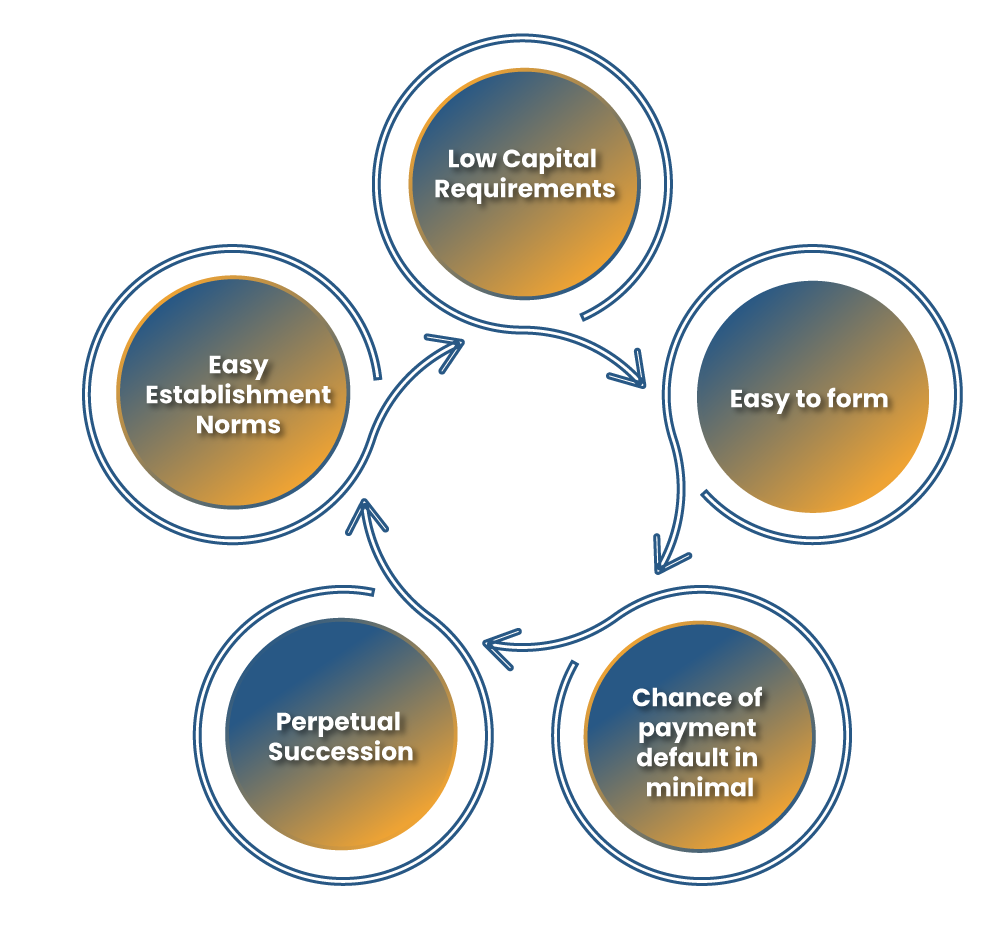

Pros of Setting up Nidhi Company

What is the Chit fund Company?

A Chit Funds is probably the oldest form of saving scheme in India, and it rules the unorganized money market industry. Chit funds facilitate access to borrowing & saving to the unbanked populace of the country. Chit Fund Companies run the chit fund scheme.

A Chit fund involves groups of members, broadly known as subscribers. An organizer, an entity or a reliable relative or neighbour forms a group together & manages the group activities. For their contributions and efforts, the group’s organizer is either remunerated each month or at withdrawal time. (the fee might be obliterated in the informal events.)

The fund commences at a predetermined date & continues for the no. of months equivalent to the number of subscribers. Each month, the subscribers invest a set amount of funds into a common pot every month. Then, an organizer conducts an open auction to determine the lowest amount a subscriber intends to take that particular month.

Read our article:Know the Checklist of Documents Required for Nidhi Company Registration

Understanding the concept of Chit Fund Schemes via real-world example

For instance, if the monthly instalment is INR 500 & there are 50 subscribers, the pot in the first month will contain INR 25,000. Once the winner is determined via auctioning who intends to accept INR 20000 for that month, the remaining Rs 5000 is aptly dispensed among the rest of the members, excluding the organizer’s fees.

The winner was able to access Rs 25000 in the first month, and the rest benefited in their share of the INR 5,000 surplus. The process reoccurs, dispensing the auction sum to one member each month. The rest of the subscribers, including the ones who have already taken their share in the preceding month, continue paying the instalments on a monthly basis.

The system manifests per se as a borrowing scheme because members have to access the sizeable amount of money before they have paid in full amount. Moreover, it also acts as a saving scheme, because member contributes every month & may recover a large amount in the future while obtaining their share of the surpluses.

Variations of the system obliterate the auction part instead of determining a winner by conventional procedure, i.e., chit drawing technique.

Key Differences between Nidhi Company and Chit fund Company

The key difference between Nidhi Company and Chit fund Company is that the latter one is an NBFC that can only accept or lend deposits, while the former refers to a committee that accepts instalments over a fixed timeline that are paid by its subscribers, & the neither accept nor lend the amount as a whole.

| Nidhi Company | Chit Fund Company |

| No Reserve Bank’s consent is imperative to legalize Nidhi Company as RBI has exempted such type of NBFC from complying with its main norms such registration with RBI etc. Nidhi companies are bound to comply with Nidhi Their undertakings related to soliciting deposits are regulated by Non-Banking Financial Companies & Miscellaneous Non-Banking Companies (Advertisement) Rules (1977) underpinned by Indian government u/s 58A of the Companies Act 1956 Rules, 2014. | Chit funds are governed as MNBCs i.e. Miscellaneous Non-Banking Companies |

| Nidhi company are incorporated in the nature of Public Ltd co. & therefore, they are liable to follow two sets of norms one is for Nidhi rules, 2014 and another is Public limited company as per Companies Act, 2013 | Organized chit fund entity is mandated to legalize under Registrar of Firms (ROFs), Societies and Chits. |

| A Nidhi company refers to a type of entity in the non-banking finance regime, recognized u/s 406 of the Companies Act, 2013. | A chit fund company refers to an entity that administers conduct as defined in Chit Funds Act, 1982. |

| A Nidhi company functions like a NBFCs where the member are allowed to make a deposit (maybe in a recurring fashion) and lend money. | A Chit Fund is also regarded as a committee that allows its members to make a predetermined monthly instalment for a set period. |

| Nidhi Company is operated by its members only. | Chit Funds are administered by an outsider appointed on the mutually agreed decision of the members. |

| Nidhi Company shareholders can lend money in the form of a loan to its members with some interest. | The Chit Fund members can withdraw a certain amount of funds via auctions or a lucky draw, etc. |

Common FAQs regarding Nidhi Company and Chit Fund Company

Here are some general queries asked by end-users on the CorpBiz’s forum.

What does Nidhi Company do?

Nidhi Company refers to an NBFC entity that aims at borrowing and lending money to its members. It fosters the habit of saving among its subscribers/members and functions on the concept of mutual benefit.

Is Nidhi company safe?

Indeed, the deposit with Nidhi companies is secure and safe because the MCA and RBI have underpinned norms to ensure the security of the deposits.

What is a chit fund company?

A Chit fund is a widely acknowledged saving scheme in India, and it is often deemed as a prevalent player in the unorganized market industry. Chit funds facilitate access to borrowing & savings for people who do not have access to conventional credit facilities.

How do chit fund companies work?

The chit fund scheme acts like a committee where a group of individuals contributes to the chit value for a timeframe equivalent to the number of investors. The amount accumulated is given to the organizer or in charge, which is either selected via an auction or a lucky draw.

Are chit funds legal in India?

Chit funds are legal in most of the Indian states and UTs. Chit fund entities function under the ambit of the Chit fund Act, 1982. Since chit funds lack the status of financial entities, they are not governed by the RBI’s norms.

How does Nidhi Company make money?

The primary objective of such companies is to instil and foster the habit of frugality and savings among its subscribers/members. These institutions undertake the business of borrowing from subscribers & lending to members only.

Conclusion

Nidhi Company and Chit Fund Company allow its members to rejoice the sense of financial freedom at minimal risk. Further, these avenues permit the unbanked section to cater to their financial needs with minimal hassle. However, Nidhi companies are somewhat more trustable owing to their legalized business structures and strict norm. Chit Fund Companies, on a whole, have a poor track record of rendering reliable services to the end-users.

Read our article:Guide on Benefits of Nidhi Company Registration in India