National Small Industries Corporation (NSIC) is the ISO certified Indian Government Enterprise under Micro, Small, and Medium Enterprises. NSIC is working to aid, foster, and promote the growth of MSMEs (micro, small and medium enterprises) all across the country.

NSIC schemes operate all across the nation through a network of Technical Centres and offices. In order to manage its functions and operations in African countries, NSIC operates and performs its administration from South Africa. Apart from this, National Small Industries Corporation (NSIC) has set up Training and Incubation Centres managed by highly trained professional human resources.

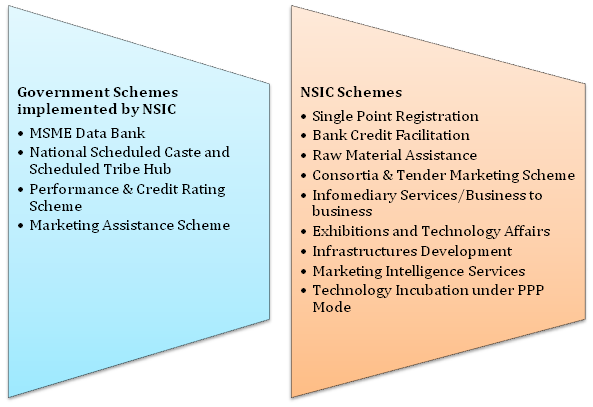

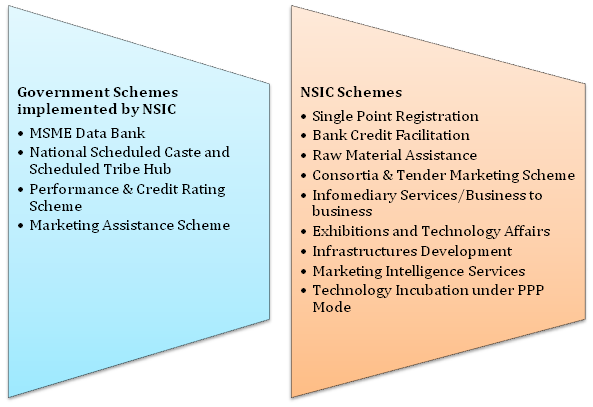

NSIC Schemes

Banks/ NBFC’s Interest rates under NSIC Schemes 2020

NSIC offers the interest rate to MSMEs from 10.50% to 12.00% p.a. for meeting the credit needs of MSME units. The NSIC has signed a (Memorandum of Understanding) with leading nationalized, non-banking financial institutions and private sector banks. Under this pivotal deal with a bank, NSIC also enables MSME units to avail of the credit support from the banks to operate and manage their business venture successfully.

The interest rates levied on the MSME loan varies from bank to bank. The banks typically charge floating interest rates from 10.50 to 12.00% per annum. Specific significant sectors play a crucial role in deciding the interest rates, including the credibility of the venture and present and future viability and stability.

Read our article:What is NSIC Registration? Know Its Step by Step Procedure

Marketing Support

Marketing support is considered as one of the essential tools for the development of any business. This is crucial for the survival and growth of the Micro, Small, and Medium Enterprises in today’s intensely competitive market.NSIC Registration devised numerous schemes to support enterprises (both domestic and foreign markets) in their marketing efforts. The NSIC schemes are described as under:

Consortia and Tender Marketing

Micro & Small Enterprises in their individual capacity encounter several issues in order to procure and deliver large orders, which negate them the level playing field large enterprises. NSIC forms consortia of MSEs manufacturing the same or similar products or products, thereby combining the capacity.

The National Small Industries Corporation applies the tenders on behalf of Single Micro & Small Enterprise and Consortia of Micro & Small Enterprise for securing orders for them. Finally, the orders are dispersed amongst Micro and Small Enterprises in tune with their production capacity.

Marketing Intelligence

Disseminate and collect both international and domestic marketing intelligence for the benefit of Micro and Small Enterprises. This Marketing Intelligence cell, apart from spreading awareness about several schemes for MSMEs, will maintain the database in detail and distribute information.

Exhibitions and Technology Fairs

To showcase the core competencies of Micro & Small Enterprises in India and to capitalize on market opportunities, National Small Industries Corporation participates in National & International Trade Fairs and Exhibitions every year. NSIC facilitates the participation of the MSEs by offering concessions in rental etc. The participation in these national and international events exposes Micro & Small Enterprises units to international practices and improves their business competencies and prowess.

Financing for the Raw Material Procurement

The NSIC schemes framed for Raw Material’s assistance help MSEs by financing the procurement of Raw Material (both indigenous & imported). The salient features are as follows:-

- Bulk purchase of necessary raw materials at competitive rates

- Financial Assistance for the Raw Materials procurement up to 90 days

- NSIC facilitates import of scares raw materials

- NSIC takes overall care of all the documentation, procedures, and issuance of a letter of credit in case of imports.

Finance through Syndication with Banks

To ensure the smooth flow of credit to MSEs, NSIC enters into strategic alliances with several commercial banks to facilitate working capital and long-term financing of the MSEs across the country. The engagement foresees the forwarding of the loan applications of an interested MSEs by NSIC to the banks and sharing the processing fee.

Credit Rating Scheme and the Performance for Small Industries

There is a need for a Credit Rating Mechanism and Performance appraisal for MSMEs. The NSIC schemes for registered MSMEs have been drafted in consultation with Rating Agencies and IBA (Indian Banks’ Association). NSIC has appointed a nodal agency for the implementation of this scheme through empanelled agencies.

Benefits of the Performance and Credit Rating

- Availability of credit at attractive interest rates

- A trusted and independent third party opinion on credit-worthiness and capabilities of Micro & Small Enterprises

- Prompt sanctions of the credit from Banks and Financial Institutions

- Recognition in global trade

- Facilitate buyers and vendors in capacity and capability assessment of MSMEs

- The subsidized rating fee structure for Micro & Small Enterprises

- Enable to ascertain the strengths and weaknesses of their existing operations and take corrective measures.

Technology Support

NSIC offers the small enterprises the following support services through its Technical Services Centres

- Material testing facilities through accredited laboratories

- Advise on an application of new techniques

- Common facility support in the machining, EDM, CNC, etc

- Product design including the CAD

- Energy and environment services at selected centers

- Classroom and practical training for skill upgrading

Conclusion

National Small Industries Corporation assists in financing marketing[1] activities such as Exports, Internal Marketing, and Bill Discounting. NSIC schemes also enable MSME units to avail of the credit support from the banks to operate and manage their business venture successfully.

Read our article:What is The Difference Between MSME and NSIC Registration?