Indian Banking Association (IBA) has submitted a list of recommendations to the government and the Reserve Bank of India to ease the financial burden faced by various sectors due to the outbreak of the COVID-19 pandemic. Some of the key suggestions included a blanket credit guarantee for MSME loans, one-time loan restructuring for sectors hit hard by COVID-19. RBI announced a moratorium scheme for relief to the loan repayment under the raw material assistance scheme against BG (bank guarantee) in the wake of COVID-19.

Loan Repayment under Raw Material Assistance Scheme against Bank Guarantee

Any manufacturing industry under MSME having “Udyog Aadhaar Memorandum” (UAM) can apply for the raw material assistance scheme. However, the RBI has announced certain regulatory measures to mitigate the burden of debt servicing and risk of disruptions in its servicing on account of the Coronavirus pandemic and to ensure the continuity of businesses.

These measures can bring relief to those businesses and individuals where there may be a temporary disruption in cash flows and loss of income. With the directions of RBI, the moratorium scheme has been released by the Corporation.

Terms of Notification

- RBI has permitted all public and private-sector lenders, All-India Financial Institutions, Non-Banking Finance Companies (including Housing Finance Companies) (lending institutions) to grant a moratorium of 3 months on payment of all installments falling due on 01 March 2020, to 31 May 2020.

- Further, it has stated that interest must continue to accrue on the outstanding portion of the term loans during the moratorium period. The moratorium is for all installments (including payments for principal and interest components, bullet repayments, Equated Monthly installments, credit card dues), which fall between 01 March 2020 to 31 May 2020.

- As per the notification, the rescheduling of payments, including interest, will not qualify as a default for the purposes of supervisory reporting and reporting to (CICs) Credit Information Companies by the lending institutions.

- The scheme provides an option for the moratorium on loan repayment to its customers, availing the facilities under the Raw material assistance scheme against Bank Guarantees.

- MSMEs that are facing problems in repayment of their outstanding dues under the scheme due to disruption in their cash flows or loss of income will be provided an opportunity to avail of this moratorium option.

Read our article:What is NSIC Registration? Know Its Step by Step Procedure

Details of the Raw Material Assistance Scheme against Bank Guarantee

- All MSMEs who have availed the facilities under the scheme of Raw Material Assistance against Bank Guarantee (working capital credit facility) prior to 01 March 2020 are eligible for the moratorium.

- MSME, which opts to avail moratorium of 3 months in respect of outstanding falling due for payment from 01 March 2020 till 31 May 2020, shall confirm this on email to the respective Branch, from where it had availed the assistance.

- MSME avail the option under the scheme that has to ensure in all cases, that Bank Guarantees are valid and kept valid by renewing them wherever required. The MSME registered unit (borrower) has to furnish the proof of renewal of the Bank Guarantee for record by email or any other form.

- Interest on the loans must continue to accrue on the outstanding dues for the moratorium period at the already agreed rate & terms & conditions.

- MSME must be required to pay the total outstanding dues, including interest after 31 May 2020, in view of the prevailing situation.

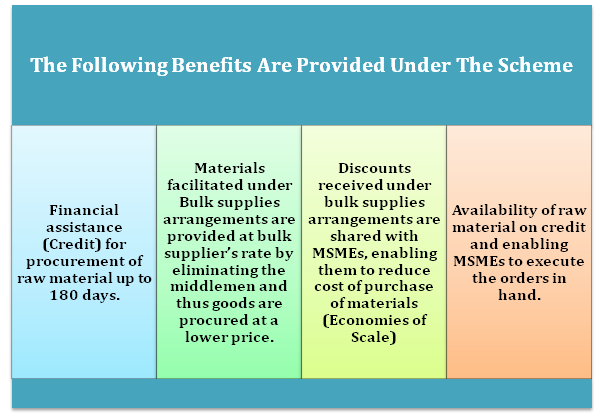

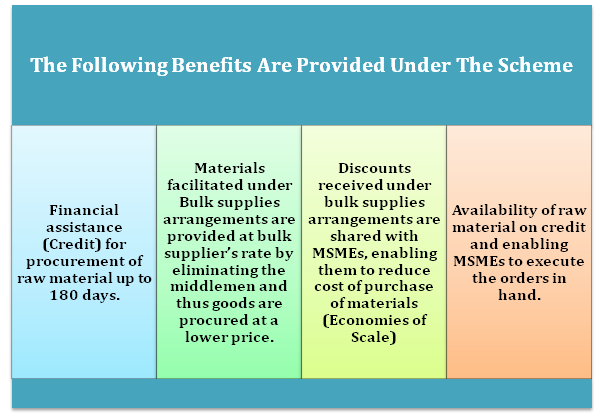

Benefits of Scheme

How to apply for Raw Material Assistance Scheme?

The MSME needs raw material through NSIC may apply to any of the NSIC field offices for the Raw Material Assistance Scheme in the prescribed application forms, which can be downloaded from NSIC’s website (nsic.co.in) or may be obtained free of cost from any of the field offices. The application forms are also available free of cost in the Branch offices. The process is as follows:

- Duly filled in an application form that is submitted along with the Documents.

- The registered NSIC carries out preliminary appraisal & Unit inspection.

- Sanction of Limit to the Unit

- The signing of an agreement between NSIC and Unit

- Disbursement of assistance to the unit

Documents Enclosed with Application Form

- A passport size photograph of the Proprietor/ Directors/ Partners/ Society

- Self-attested photocopy of Udyog Aadhaar Memorandum (UAM)

- GST Registration Certificate

- PAN Card of the Firm/Proprietor

- Copy of latest Income tax return of the Firm/ Company/ Proprietor/ Directors/ Partners

- Self-attested statement of assets and liabilities along with the residential address of Proprietor/ Directors/Partners/Society.

- Copy of MOA and AOA along with a list of Directors in case of Company

- Copy of Partnership Deed duly notarized in Partnership.

- A copy of Bye-Laws & charter of society with the list of governing body or executive members in case of society.

- A copy of a Board Resolution in case of Private or Public Company

- A Power of Attorney in case of partnership firm

- The Governing Body Resolution in case of society authorizing a signatory to sign and to deal with an NSIC in respect of financial assistance required, for and on behalf of the applicant unit.

- The Specimen signatures of authorized signatory attested by the bank.

- A Copy of the sanction letter for credit limit sanctioned by the FIs/ banks.

- Audited and Provisional financial statements of the unit:

- Last year’s Audited financial statements.

- Provisional current year all financial statements.

- For a startup, the MSME unit- Current year estimates financial statements duly certified by its Auditors or CAs.

- Bank statement of the unit for the last 6 months

- Copy of latest Electricity Bill.

- Conduct Report of the Account of the unit with Banks and Financial Institutions[1]

- Certificate or Undertaking from the borrower that their name, name of the company/its owners/its associates/its members in any way fall in the list of CIBIL and RBI Defaulters list or any sort of case is there against them.

- A Copy of orders in case of enhancement of limit beyond 5 crores.

Conclusion

Raw Material Assistance Scheme aims to help MSMEs by way of financing the purchase of Raw Material (both indigenous & imported). This allows MSMEs to focus better on manufacturing quality products. According to the RBI’s norms, restructuring of loans is prohibited, and resolution of default cases is dealt with as per the Insolvency and Bankruptcy Code (IBC).

Read our article:What are the Schemes for obtaining NSIC Registration?