In continuation of extending e-invoicing across the nation, the Government of India has decided to make it mandatory for MSMEs whose annual turnover is more than 100 cr. Taxpayers would get around 50 days to incorporate a new IT system for the implementation of e-invoicing. Previously, the firm earning more than Rs 500 crore comes under the ambit of this requirement.

Impact of Announcement Implementing IT Infrastructure in 50 days

Previously, small businesses were not liable to abide by such a provision. But after this announcement, the government mandates to implement e-invoicing for everyone. Now, this would drive the MSMEs to set up or upgrade their existing IT system that thoroughly supports e-invoicing.

Some experts have predicted that in most of the cases the businesses might find it daunting to abide by such a requirement. The reason being is that the cost of setting up an IT system is considerably higher, and not all entities can bear such expenditure. Also, the time offered by the government to complete this requirement could act as a constraint for these entities.

The medium scale industries are now required to act accordingly for system up-gradation to ensure conformity with the existing invoicing regulations. Moreover, the tax experts have claimed that the Government’s action regarding the deployment of e-invoicing across industries is a part of a systematic blueprint drafted by the GST implementation committee. On a whole, the phase-wise implementation sounds to be an authentic approach, where MSMEs would get enough time to make changes to their existing IT system.

What is E-invoicing?

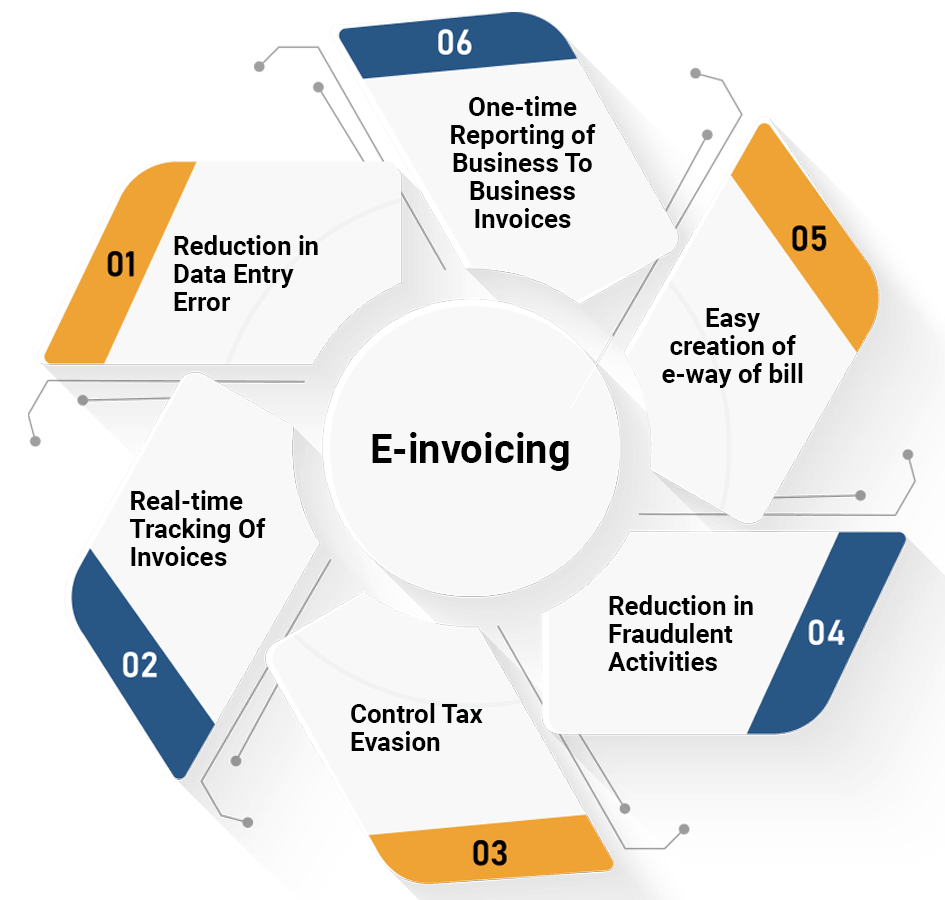

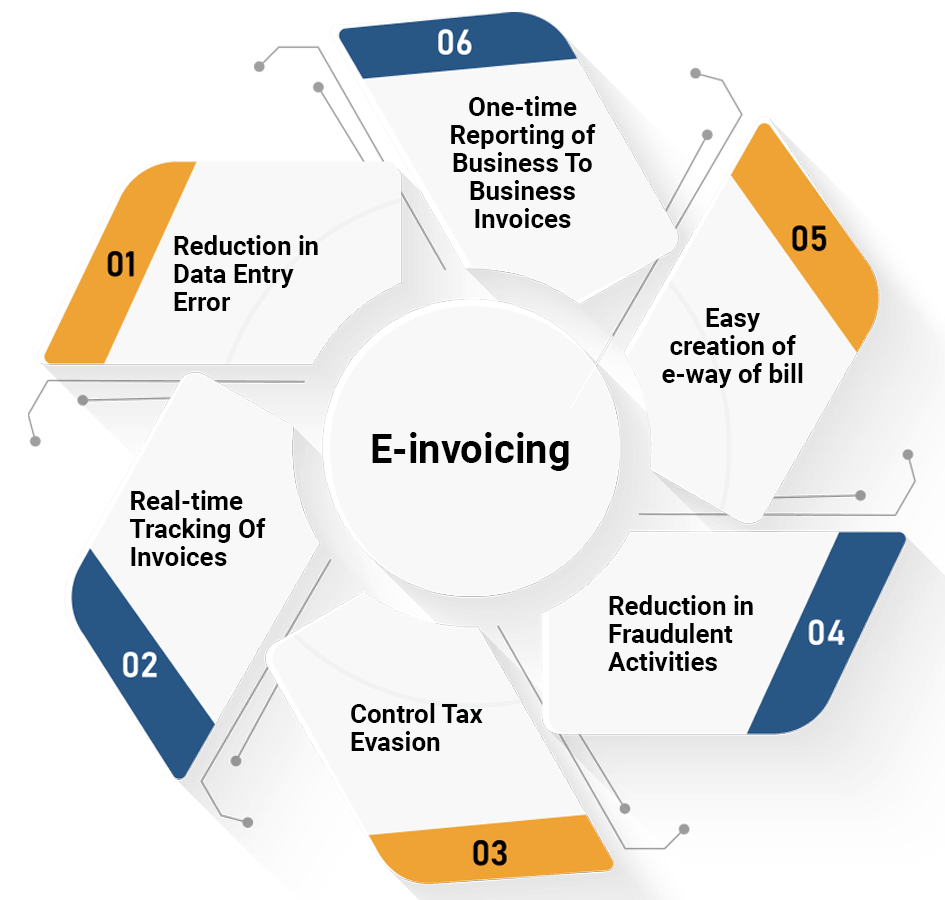

E-invoicing is generally referred to as electronic billing. As per the GST, framework invoices are considered an imperative part of the system. E-invoicing offers plenty of benefits to the taxpayers such as:

How E-invoicing would Benefits Tax Authority?

The electronic regulations also indicate that the tax authorities will be able to track down the fake invoices and criminal and duplicitous credits availed by business entities sternly. In the view of false invoices, the government has already started blocking ITC (input tax credit) of any entities. Input tax credits (ITC) are part of the tax paid by an entity that could be utilized to set out the tax obligations for the future. As per many tax experts, many business entities are negatively utilizing the GST system for the sake of the fiscal benefits.

Tips for Easy Implementation of the E-Voicing within the Organization

Here are some productive suggestions to successfully implement e-voicing in the business entity, those are as follows:-

Ask Yourself- Why Your Company Need E-Invoicing?

E-invoicing is in the nascent stage and most of the companies are not familiar with it. Therefore, you need to work from the ground up to check its viability. First, try to outline a checklist for determining if your company is ready to adapt to the changes or not. Your checklist might enclose the following questions:

- To what extend e-invoicing would benefit my company?

- Does my company fit the criteria of e-invoicing?

- Can my existing IT system seek some change in regards to the implementation of the e-invoice schema?

- Does my existing program or software offer the feature of e-invoicing integration?

- Do my employees need some training to get accustomed to e-invoicing?

- How various stakeholders would react to such changes?

Get Accustomed to the E-Invoice Schema

Previously, there was no standard format or regulation for the generation of e-invoices. But with the introduction of e-invoicing, things will be changed entirely. The e-invoicing would adhere to a standard format for all organizations. Since e-invoicing adheres to various industry standards; there would be a common format available to all businesses for preparing an invoice for their vendors. The format will be comprehensive and comprises of three parts- master, e-invoice schema, and e-invoice template. It would be prudent for the employees to get accustomed to various data fields under the new format.

Along with the e-voicing, the businesses can also generate e-ways bills at the time of generating the Invoice Reference Number (IRN). Understanding the process of generating e-invoices, issue of e-way bills & return filing would help maximize the company’s efficacy.

Track Eligible Vendor to Sync Your ERP Systems

Updating your ERP system with the new e-invoicing standards could be a challenging undertaking. Since it cannot be sync without expertise, you might be required to track a suitable vendor who can effectively align your ERP system with new e-invoicing standards. Don’t forget to consider the experience and other important detail of the vendors before getting them on board.

The software solution must facilitate the dynamic updates and the vendor should be able to render seamless support through the e-invoicing journey. Entities outfitted with the old ERP system need not replace them entirely. All they need to find the vendor who can reconfigure the existing system with the new scheme.

Integrate the Existing System with the E-Invoice Standards

With the government providing a strict timeline for the adoption of e-invoicing every organization seeking prompt integration of e-invoicing standards into their ERP systems[1]. There are several methods available to the organization to integrate the software system. Currently, the organization can opt for SFTP-based, API-based, and utilities such as Excel to serve this purpose.

The API-based solution is time-consuming and thus required a deliberate approach as compared to an external utility such as Excel. But API-based solution seeks no manual intervention and facilitates the generation of e-invoices in real-time. So it would be better to opt for an in-built solution that can maximize efficacy in the long run. However, such a decision must be taken on account of the volume of invoices and budget constraints

Draft the Action Plan to Launch E-Invoicing

The installation of a new system is a cumbersome undertaking in every aspect. Collective effort is something that a company would require for the successful implementation of any system. If possible, arrange a definitive program to train your employees about e-invoicing. Also, outline the clear objectives regarding the same. From the introductory stage to final implementation, everything must be shared with the stakeholders to maintain transparency. During the testing phase, try to pinpoint possible errors while generating the invoices. Make sure that the e-invoice contains all the necessary information that needs to comply with the new system

Conclusion

The businesses with MSME registration that have successfully complied with the existing prerequisites would now have to concentrate on their procurement procedures. Companies must ensure that their existing IT system should have a robust mechanism in place to rectify any complications regarding the e-invoices. Of course, all this would incurred considerable expenditure.

Read our article: A Coast-to-Coast Coverage of E-Invoicing in GST