NBFC is one of the key contributors to the Indian Economy. Over the past few years, this sector has witnessed tremendous growth owing to its customer-oriented business functions. Their working protocol bears a weird resemblance to traditional banks.

Their primary area of function is to lend money via short or long-term loans with flexible interest rate. In the past, RBI has mandated the requirement for maintaining the Liquidity Coverage ratio for these institutes. In the article, we will try to unfold various facets regarding the same.

What Is The Liquidity Coverage Ratio?

Liquidity Coverage Ratio denotesthe proportion of the High-Quality Liquidity Assets that an NBFC has to manage to meet the net cash outflows over the time span of 30 days, in the state of the market’s fiscal crisis. The mathematical expression for Liquid Coverage Ratio is as follows:-

Numerically, It Is Given By

Stock of High Quality Liquid Asset

Total Net Cashflows over the Next 30 Days

Important Financial Institutions are needed to maintain the 100% of Liquid Coverage Ratio. As per the aforesaid definition, we can assume that the Liquidity Coverage Ratio is comprised of two imperative components given below:-

- High-Quality Liquid Assets

- Total Net Cash Outflows

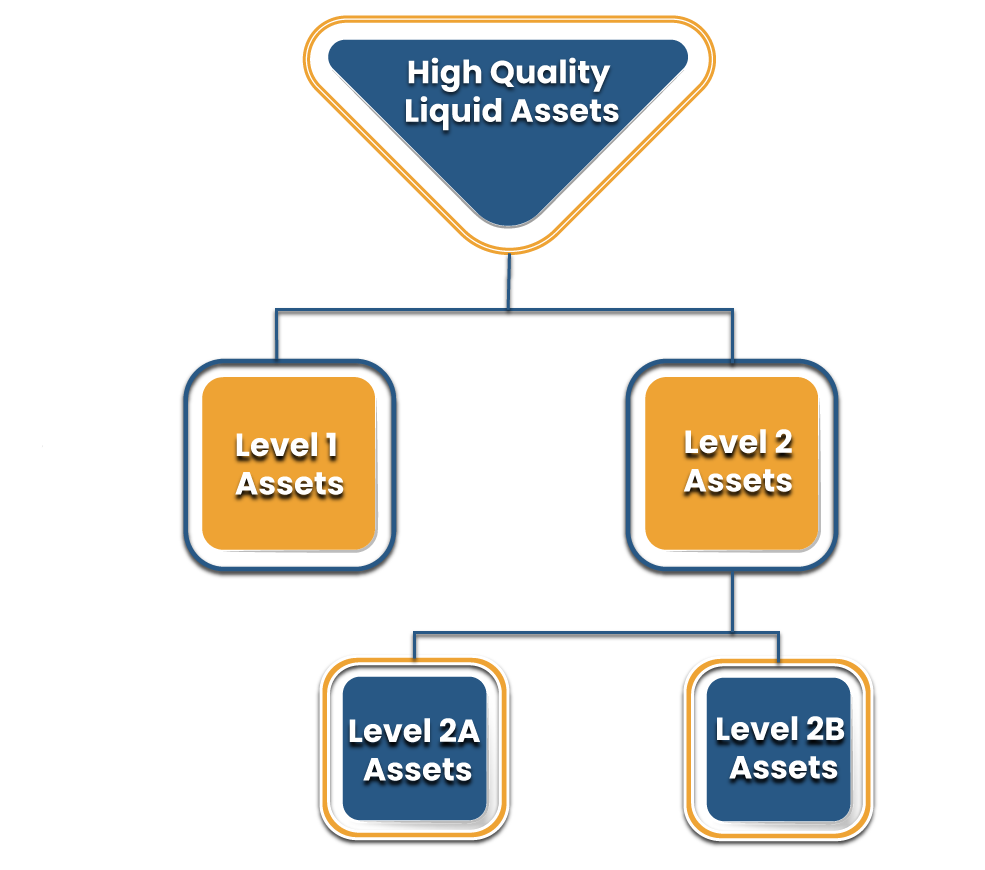

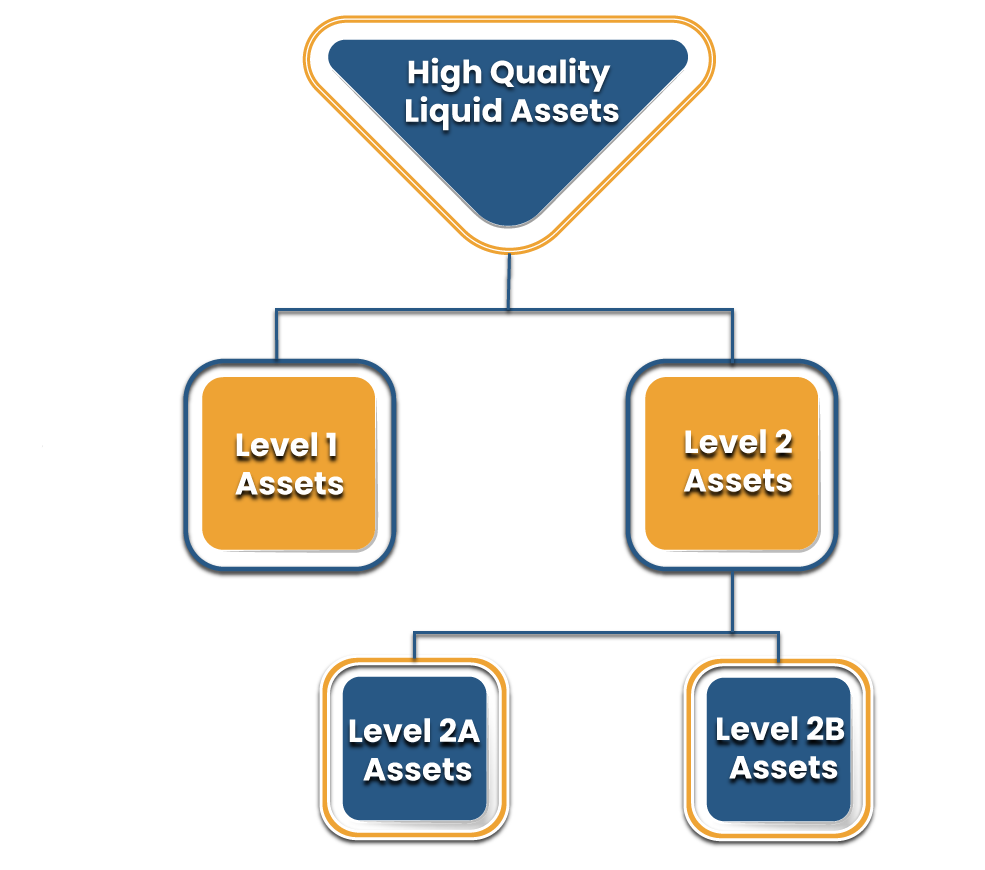

An Overview on the High-Quality Liquid Assets

As per the Basel III Framework related to Liquidity Standard, High quality liquid assets are classified in the following way:

Level 1 asset might be in a variable proposition in the total stock of High-Quality Liquid Assets. But, Level 2 is to be confined to 40% of the overall stock requisites after taking applicable haircuts into account.

Level 1 Asset

Given Liquidity requisites, these assets might be taken at their market value without considering the haircuts. (the term “Haircut, in view of legal affair, is regarded as the reduction applied to the asset’s value to calculate margin, capital requirements, or collateral level).

- Cash and cash reserves in surplus of necessitated Cash Reserve Ratio

- Government securities in surplus of the minimum Statutory Liquidity Ratio requisite.

- Within the compulsory SLR requisite, Government securities permitted by the Reserve Bank of India under Marginal Standing Facility (MSF)

- Marketable securities by overseas sovereigns fulfilling the given conditions:

- Allocated a 0% risk weight under the Basel II standardized regime for credit risk;

- Not granted by a bank/NBFC/financial institution/ or any of its connected entities.

- Traded in large & active repo or cash markets; and has been recognized to be a dependable source of liquidity in markets even during bad market conditions.

Level 2A Assets

A minimum haircut of 15% should be applied to these assets.

- Marketable securities indicating claims guaranteed by

- Sovereigns

- Multilateral development banks

- Public Sector Entity

Those are given a 20% risk encumbrance under the Basel II Standardized regime for credit risk & provided that they are not issued by a bank/NBFC/financial institution or any of its connected entities.

- The Corporate bonds are not issued by a bank/ NBFC/ financial institution or any of its connected entities, with a rating of AA4/above by an (ECRA) Eligible Credit Rating Agency.

- Commercial Papers not issued by a PD/bank/financial institution/affiliated entities, which secured short-term rating equivalent to the rating of AA4 or above by certified agency.

Level 2B Assets

A minimum haircut of fifty percent in the market value ought to be applied to these assets. Level 2B assets ought to be a maximum of 15% of the aggregate stock of High-Quality liquid assets.

- Marketable securities embodying claims on or claims promised by sovereigns having credit rating not lower than BBB.

- Common Equity Shares that meet the given conditions:

- Not issued by a financial institution/bank/NBFC or any of its affiliated entities;

- Included in S&P BSE Sensex index and or NSE CNX Nifty index

What is the Concept behind the Working of NBFCs, and what Triggers the Liquidity Crisis?

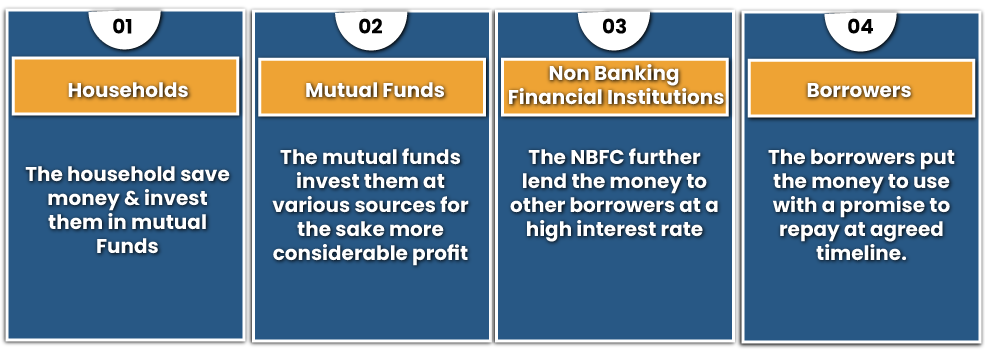

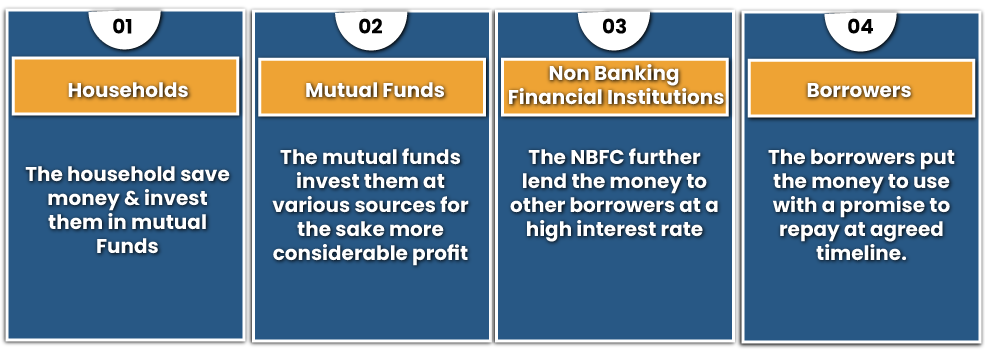

The NBFCs usually operate by procuring credit from traditional lenders like banks and Mutual funds and providing credit to borrowers in the market.

This NBFC model works seamlessly in the healthy economy. However, the problem might incur in the stare of economic crisis. During such a phase, the borrower’s ability to repay the loans may also compromised, which in turn creates the scarcity of funds and Liquidity Coverage Ratio for the NBFCs.

This may be explained as-

- NBFCs are encountering liquidity crisis; which ultimately hampering their lending ability.

- This slows down the credit flow as NBFC lending ability is undermined.

- Disrupt the economic conditions of the companies by mitigating the viable sources of funding

- Owing to reduce profitability, companies are finding it hard to repay the loans.

RBI-Based Liquidity Coverage Requirement Applicable to NBFCs

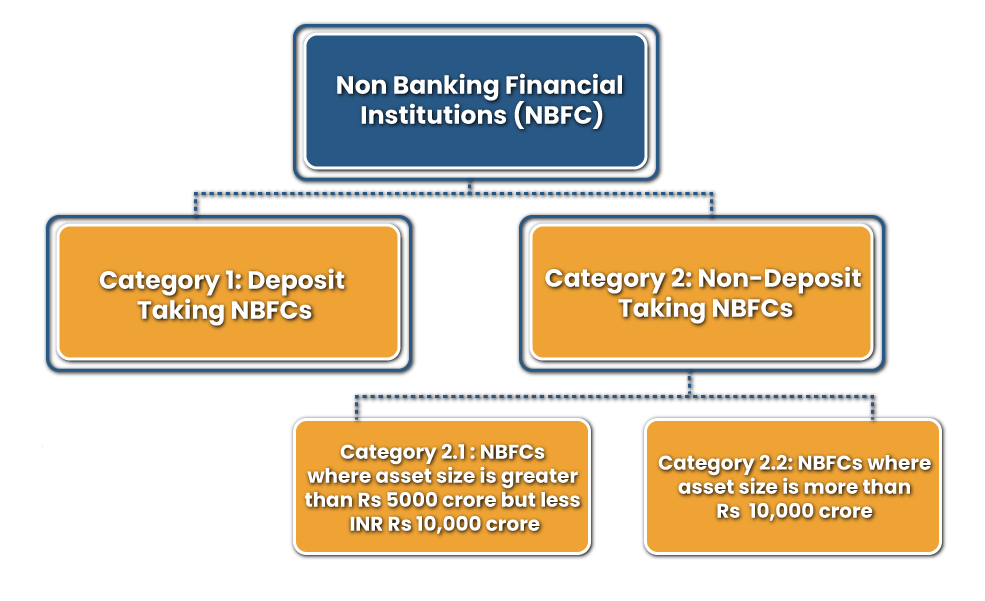

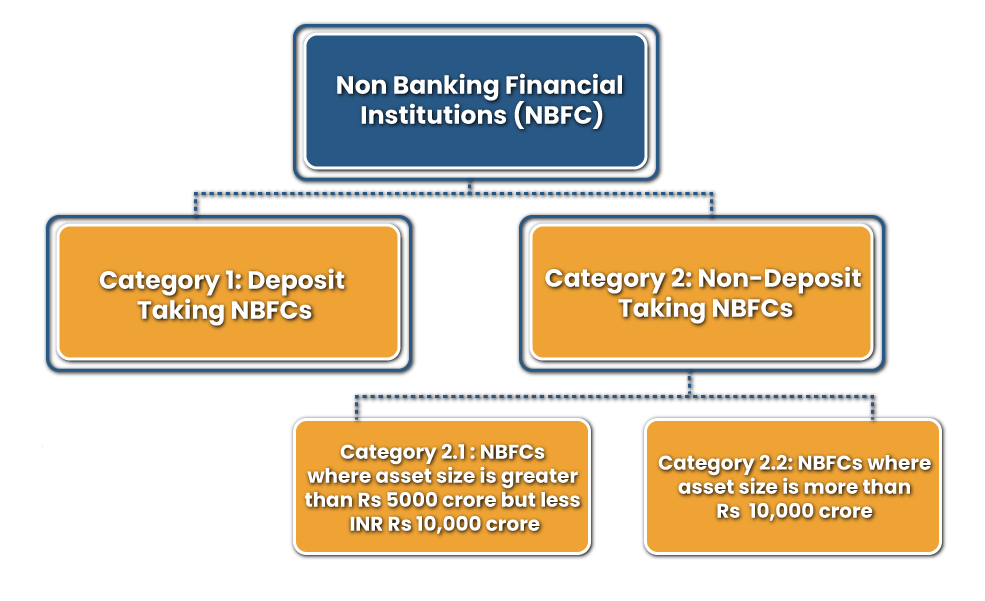

In order to comprehend the scope of applicability of Liquidity Coverage Ratio, we have to categorize the NBFCs into 2 sections mentioned below:

It is included in the given table:

| DATES | CATEGORY 1 AND CATEGORY 2.2 | CATEGORY 2.1 |

| Dec 1, 2020 | 50% | 30% |

| Dec 1, 2021 | 60% | 50% |

| Dec 1, 2022 | 70% | 60% |

| Dec 1, 2023 | 85% | 85% |

| Dec 1, 2024 | 100% | 100% |

The following list comprises of NBFCs not including the requirement of maintaining the High-Quality Liquid Asset, which are given below:-

- Core Investment Companies

- Type 1 NBFC-NDs

- Non-Operating Financial Holding Companies

- Standalone Primary Dealers

A Brief Note on Section 45 IB of the RBI Act, 1934

The Section 45 IB of RBI ACT, 1934[1] encloses the provisions for the maintenance of liquid assets NBFCs. It has been in existence before the arrival of the Liquidity Coverage Ratio by the Reserve Bank of India.

According to the said Act, the deposit-taking NBFC has to maintain a minimum level of an asset in the liquid form up to 15% of public deposit outstanding as on the final working day of the second previous quarter.

NBFCs are required to Invest the Threshold of 15% in the following way:-

- Minimum 10% in approved securities

- The 5% can be in other forms of deposit, particularly tagged as unencumbered with any scheduled commercial bank.

Conclusion

There is no denying that RBI has tightened the existing norms for liquidity to counter the potential liquidity stress to stay in line with the ever-evolving economic situation & its outcomes.

It’s a well-known fact that the Reserve Bank of India mandates liquidity requirements for deposit-taking NBFCS through the incorporation of Section 45 IB in the RBI Act. By incorporating Liquidity Coverage Ratio, the Reserve Bank wishes to inculcate the broad category of NBFCs to manage a stock of liquid assets.

Furthermore, in the new Liquidity Coverage Requirements, the Reserve Bank of India has prescribed high-quality liquid Assets as per the Section 45 IB of the Act. The former renders more liquidity as compared to the latter one. Taking the above patterns into account, the Reserve Bank of India may tighten the existing norms in upcoming times. Strict compliance by the private lenders of the Liquidity Coverage Ratio is vital to ensure protection against possible economic degradation.

Read our article: Government Issues Directions for Interest Waiver on Loan to Borrowers