A cheque is a negotiable instrument and used in various transactions likewise the repayment of loans, payment for salary, bills and fees, etc. It is an instrument/exchange bill drawn on a specific Bank which is payable only on demand.

A crossed or AC payee/account payee cheque is not negotiable by anyone other than the payee himself/herself. The cheque has to be deposited in the payee’s Bank account. When a cheque is returned by the bank unpaid, it will be considered as a matter of cheque bounce cases and It will be covered u/s 138 of N.I Act 1881.

What is Cheque Bounce?

When a cheque is returned by the Bank unpaid, it is called rejected or bounced. Cheque bounce can occur due to many reasons like insufficient funds, etc. When the cheque bounces for the first time, the Bank issues a ‘Cheque Return Memo’ along with the reasons for non-payment.

Cheque Return Memo

Cheque Return Memo is a slip provided by the Bank when a cheque is returned by the Bank unpaid. Cheque Return Memo includes date & on the ground, the cheque has been dishonored by the Bank.

Grounds on which Your Cheque Can Be Bounced or Dishonored by the Bank

There can be many grounds which lead to the bouncing of a cheque or it being dishonoured when submitted for payment to a Bank, some of which are mentioned below;

- Submission of a cheque for payment after its validity expires, i.e. presented after the expiration of 3 months.

- Irregularity in the account number mentioned on the cheque.

- Irregularity among the words or figures written on the cheque

- The Signature done on the cheque does not match with the signatures attached on the official documents such as the passbook etc.

- In case finds any evident overwriting on the presented cheque.

- Cessation of account.

- In case, the drawer becomes insane.

- In case, the drawer declares insolvent.

- Issued cheque found against the rules & regulations of trust.

- In case, the amount mentioned on the cheque crossed the limit of cheque overdraft, i,e. The maximum withdrawal limit allowed by the Bank results in cheque bounce or dishonour.

- Presented cheque by the drawee in the wrong branch of the Bank.

- Cheque deems to be bounced /dishonoured in case the drawer stops such payment.

- If any alterations made in the cheque.

- In case the Bank finds any reasonable doubts related to the authenticity of the cheque.

- In case the bank finds an insufficiency opening balance in the drawer account.

- When the funds available in the drawer account are not sufficient.

- Cheque issued from a joint account and one of the account holders’ signatures is missing.

Legal Rights Available for Payee under Cheque Bounce Cases

The following are the legal rights available under the Negotiable Instrument Act, 1881 for the cheque bounce case.

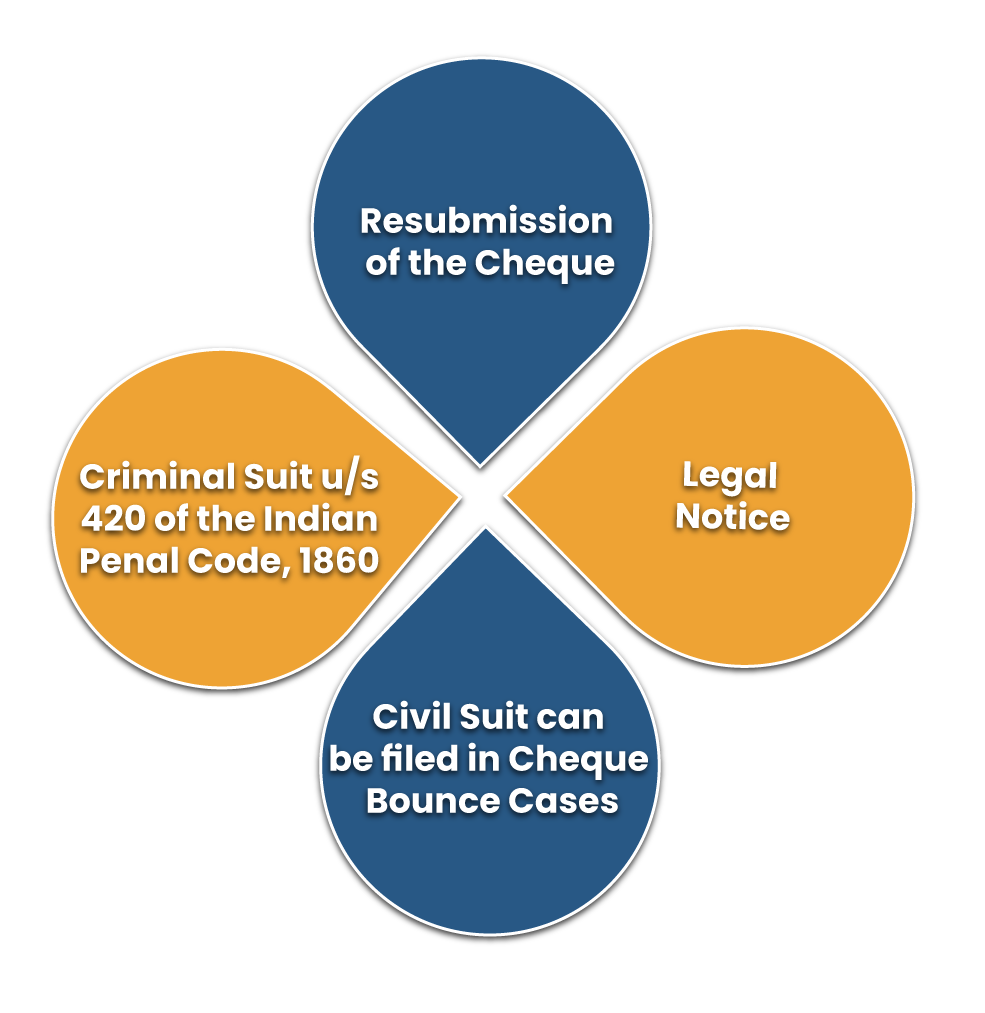

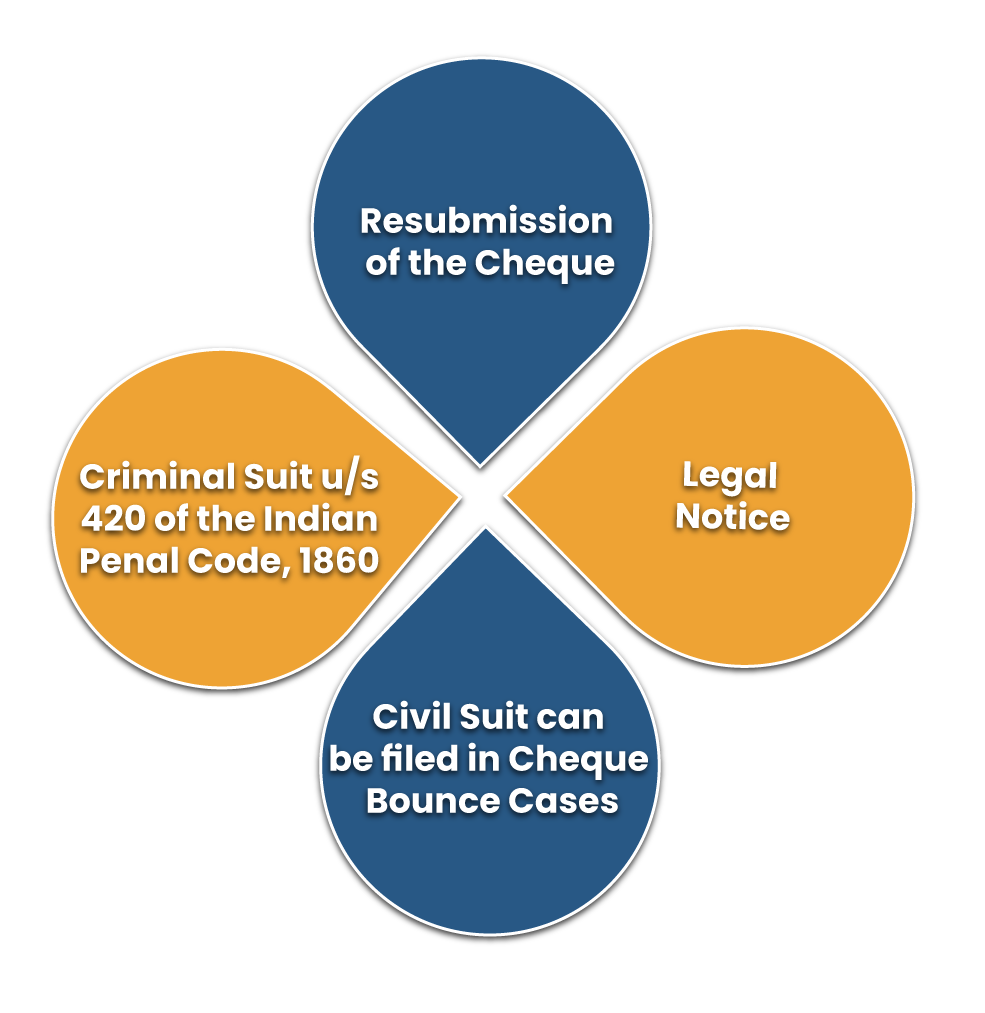

Resubmission of the Cheque

When the cheque bouncing is being intimated to the issuer of the cheque, he/she has an opportunity to rectify the error and can ask the payee to resubmit the cheque for clearance in cheque bounce cases. This can be done within 3 months from the date on which the cheque bounced.

The payee is informed by his Bank about the bouncing of the cheque through the issue of a ‘cheque return memo’. It contains the reasons for non-payment of the money stated in the cheque. For a person to make a valid claim such a person must ensure that they submit the cheque to the Bank within 3 months from its date of issue; otherwise, the cheque would expire.

Legal Notice can be issued in Cheque Bounce Cases

The first step that must be taken by you in case of cheque bounce is the sending legal notice to a drawer demanding your rightful payment, non-fulfillment which will lead you to knock the doors of the Court. A legal notice must be sent as soon as possible and within a period of 15 days from the date of intimation from the Bank that the cheque has been bounced.

Civil Suit can be filed in Cheque Bounce Case

In the stage of cheque bounced or unpaid cheque, the drawee of such cheque has an option to file a civil case against the defaulter of such payments so as to recover such amount from him. A civil suit helps in recovering the unpaid or due amount of the drawee along with his legal expenses for the same suit. In case of a small amount, the civil suit can be filed under Order 37 (of the Civil Procedure Code) to recover the amount in such cases.

Criminal Suit u/s 420 of the Indian Penal Code, 1860 can be filed in Cheque Bounce Case

In serious cases where the mentioned amount on the cheque is huge and where it applies, a criminal complaint about cheating could also be filed under section 420 of the Indian Penal Code[1]. A complaint made under the said Code will be treated as a criminal case and punishment could be conferred likewise the imprisonment or fine or both.

Points to Remember in Cheque Bounce Case

- Under exceptional circumstances, you can delay in filing the complaint with a reasonable cause for the delay i.e. after a lapse of 30 days can be excused by the magistrate.

- A dishonored cheque due to stopped payment shall be covered under Section 138 of the NI Act.

- A cheque must be presented within 3 months from the issuing date. A cheque has no relevancy after the expiration of 3 months and is deemed to be a stale cheque.

Concluding Remark

Cheque bounce is a punishable offense under Negotiable Instruments Act, 1881. Section 138 of the NI Act deals with the punishment of cheque bounce where dishonesty is caused either by insufficiency of the amount or by the amount mentioned in the cheque which exceeds the amount is in account.

Before issung a cheque please ensures that your account should be active & have sufficient funds. Kindly associate with the Corpbiz expert to know more about the legal rights available in cheque bounce cases.

Read our article:How to Send a Legal Notice for Cheque Bounce?