Bonus Shares are given to shareholders as some additional shares, based upon the number of shares the shareholders hold in the Company. The accumulated earnings of a company sometimes are not distributed as Dividend but are issued as Bonus Shares. These shares are issued to the current shareholders without receipt of any consideration from them. Bonus Shares increases the marketability of the Company. The main intention behind Bonus Issue is to bring the nominal capital of the Company in line with the assets. In this article, we discuss the procedure followed for the Issue of Bonus Shares.

What are Bonus Shares?

Sometimes Companies are not able to pay Dividend in cash, due to shortage of funds, despite profit in the Companies. In such a situation, the Companies Issue Bonus Share to existing shareholders instead of paying the Dividend in cash to the shareholders. Bonus Shares are issued without paying any cost in the proportion of the shares.

Earlier under the 1956 Companies Act, no specific provisions were regulating the Bonus Shares. The Controller of the Capital Issues issued certain norms, but after the emergence of SEBI as a regulator, it was also removed. Now in the new Companies Act, 2013, Section 63, when reading with Rule 14 (Companies Share Capital and Debenture) Rules, 2014 states for the Issue of Bonus Shares to the shareholders.

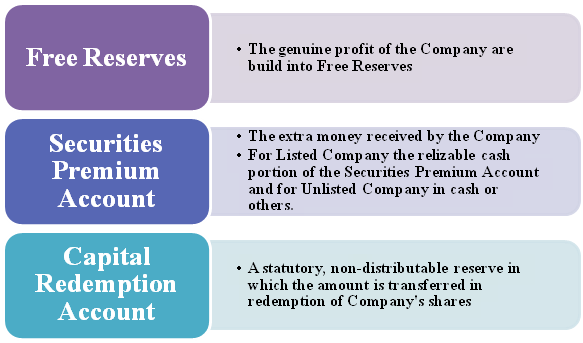

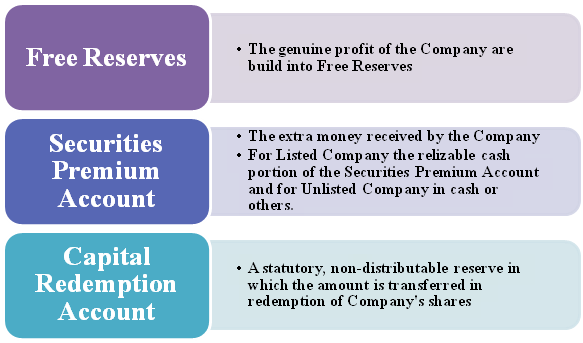

Under Section 63 of Companies Act, 2013, the Issue of Bonus Shares can be done of fully paid-up equity shares:

- Through Company’s Free Reserves

- Through The Securities Premium Account

- The Capital Redemption Reserve Account

Furthermore, the Company cannot Issue Bonus Shares in the following situations:

- When through revaluation of assets, Capitalizing Reserve is created in the Company.

- The Issue of Shares cannot be done in lieu of Dividend.

What are the SEBI guidelines on Issue of Bonus Shares?

The main guidelines of the Securities and Exchange Board of India (SEBI) for Issue of Bonus Shares are as follows:

- No Dilution of other issues by the Bonus Shares.

- The Bonus Shares shall only be issued out of the Free Reserves.

- The Reserve formed by the revaluation of an asset cannot be capitalized for Bonus Shares.

- In lieu of Dividend, the Bonus Shares cannot be issued.

- The availing Company registration, the entity should implement the proposal of Bonus Shares within 6 months of the date of approval of the proposal in the Board Meeting.

- The Bonus Shares proposal cannot be withdrawn by the Company if once made.

- There should not be default in payment of interests of the Company issuing Bonus Shares.

- The Issue of Bonus should not be done within 12 months of the Public Issue.

- There should be a suitable provision for the Capitalization of Reserves in the Articles of Association (AoA)[1]. If no provision is there, then alter the AoA accordingly.

- If necessary, the Company can increase its authorized capital to permit the Bonus Share proposal.

Read our article: Conversion of Dormant Company into Active Company

What are the Conditions and Checks for Issue of Bonus Shares?

Conditions for Issue of Bonus Shares

- The Articles must contain the provisions for the Issue of Bonus Share according to Section 63 of the Companies Act, 2013.

- On the recommendation of the Board, the members should authorize the Issue of Bonus Shares.

- No default of payment should be by the Company regarding the fixed deposits or debt securities.

Checks for Issue of Bonus Shares

- Check the authorized capital is sufficient for the issuance of Bonus Shares. If the capital is adequate, then the Company can move ahead with the Issue of shares. If the capital is not sufficient, then the capital clause should be altered in the Memorandum of Association (MoA).

- Check the Articles of Association (AoA) whether they authorize for the Issue of Bonus Shares or not. If AoA authorizes then, the Company can go ahead with the Issue but on the other hand, if AoA does not allow, then alteration of AoA should be done.

- Resource Availability will be checked.

- Quantum of Bonus shares will be checked.

What is the procedure followed for Issue of Bonus Shares in a Company?

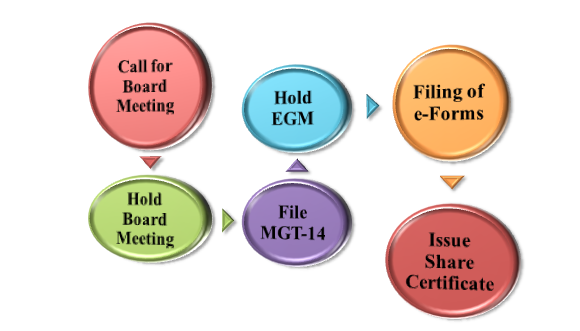

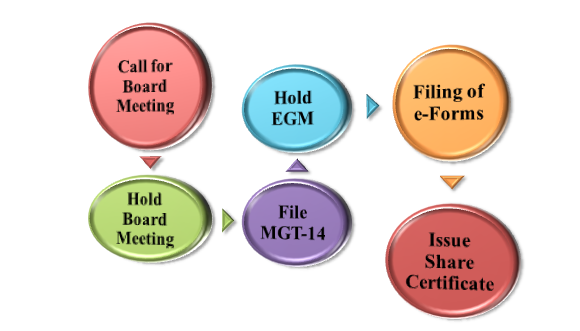

The procedure followed for the Issue of Bonus Shares is as follows:

Call for Board Meeting

Issue a notice of not less than 7 days for having a Board Meeting of members.

Hold Board Meeting

The Board Meeting should consider the following points:

- Section 174(1) states that Quorum of the Board Meeting should be 1/3rd of the total strength of the Board.

- The ratio of the Bonus Shares to be issued should be decided.

- Pass the Resolution of the Board Meeting.

- Decide the time, place and date for the Extraordinary General Meeting (EGM).

- Issue notice for the EGM. The notice of EGM will include complete details of the EGM as well as Director authorize for the Issue of right Issue.

- The Issue of notice of EGM should be passed at least 21 days before the date on which the EGM will be held according to Section 101 of Companies Act, 2013.

File Form MGT-14

After passing of the Board Resolution for the Issue of Bonus Shares, e-form MGT-14 should be filed within 30 days. The Resolution passed for the Issue of shares should be attached with the MGT-14 Form.

Hold EGM

The EGM should check for the following:

- Check for Quorum of the Meeting.

- Check whether the Auditor is present or not. If not present, then check for Leave of Absence is granted or not as prescribed in Section 146 of Companies Act, 2013.

- Pass Resolution for Bonus Shares Issue.

- Pass Resolution for Allotment of Bonus Shares.

Filing e-Forms

After EGM, passed the Resolution for Bonus Shares Issues, file Form PAS-3. The Form PAS-3 should be attached with the following requisites:

- Resolution for Allotment of Bonus Shares

- Resolution for Issue of Bonus Shares

- List of the Allottees with the name, address, occupation, and the number of securities allotted to each.

Issue Share Certificate

After the share allotment is done, the Company is mandated to allot share certificate to all shareholders within 2 months.

Conclusion

The Companies Act, 2013, prescribes for the Issue of Bonus Shares to the shareholders. For the Issue, the AoA should authorize for the same. The Issue of Bonus Shares once recommended, the Company cannot withdraw it. The Issue process of Bonus Shares is time-consuming and long-lasting. We at Corpbiz have experienced and qualified experts to assist you with the process. Our experts will assure the successful completion of your work in the prescribed time limit.

Read our article: Process for Shares Issue through Employee Stock Option Plan