Small Scale Industries (SSIs) are the entities that are concerned with the production, manufacturing and products services on the small and micro scale. The maximum investment by Small Scale Industries cannot exceed Rs. 1 crore in plants & industries and machinery. MSME and SSI are enterprises working under the guiding principle of Government of India.

What are MSME and SSI?

Small Scale Industries are the one of the main reason behind the growth of the nation so it is also considered as the backbone of Indian economy. SSI facilitates in the improvement of employment and generates more job opportunities as because maximum of the SSIs involve labours.

MSME stands for Micro, Small and Medium Enterprises. The Government of India with Micro, Small and Medium Enterprises Development (MSMED) Act of 2006 has initiated with MSME or Micro, Small, and Medium Enterprises. These enterprises are mainly involved in the manufacturing, producing, in preserving or processing the goods and commodities.

What is the Similarity between MSME and SSI?

There is no such difference between the MSME and SSI and earlier MSME was termed as SSI. Basically, SSI or Small Scale Industries was started to expand the Small scale industries with the emergence of MSMED (Micro Small and Medium Enterprise Development Act, 2006.

Small Scale Industries (SSI) are industries where the production of goods and its manufacturing process and the services provided are everything done on a micro scale or a small scale. But in the Micro, Small and Medium Enterprises (MSMEs), the Government gives loans to the people willing to start or invest in their businesses and are in the service and manufacturing sector.

Therefore, both MSME and SSI are involved in the service and manufacturing sector, but the only small difference lies that the manufacturing of goods or providing services by the SSIs are done with the help of comparatively smaller number of machines and workers.

Read our article:MSME Registration: Essentials and Upcoming Benefits for Business

The Investment Limit of MSME

The MSMEs by the Micro, Small and Medium Enterprises Development (Amendment) Bill, 2018, has classified the manufacturing or service-providing enterprises which are based on their annual turnover. Then on 13th May, 2020 Government of India announced some major relief to the MSMEs by revising the definition of the MSME as whole.

The MSME and SSI industries make a one-time investment in machinery, plants, and industries which does not exceed Rs 1 Crore.

Earlier the MSME and SSI investment limit was divided into two:-

- Manufacturing enterprise: Investment in Plant & Machinery (Excluding lands & buildings)

| Micro Enterprise | Investment of up to Rs.25 lakhs |

| Small Enterprise | Investment of up to Rs.5 crores |

| Medium Enterprise | Investment of up to Rs.10 crores |

- Service enterprise: Investment in Plant & Machinery (Excluding lands & buildings)

| Micro Enterprise | Investment of less than Rs 10 lakhs in equipment |

| Small Enterprise | Investment of less than Rs.2 crores in equipment |

| Medium Enterprise | Investment of less than Rs.5 crores in equipment |

Revised MSME and SSI for Aatma Nirbhar Bharat on 13th May, 2020

|

Classifications |

Manufacturing & Service Sector |

|

|

|

Investment |

Turnover |

|

Micro-Enterprise |

1 Crore |

5 Crore |

|

Small Enterprise |

Over 1 Crore but less than 10 crore |

Over 5 Crore but less than 50 crore |

|

Medium Enterprise |

Over 10 Crore but less than 50 crore |

Over 50 Crore but less than 250 crore |

What are the Benefits of Registering MSME and SSI?

Both MSME and SSI are under Government of India[1] and it provides various benefits. Any enterprise whether it is the Small scale industries or Micro, Small and Medium Enterprises (MSME) can register under the MSMED Act to avail the benefits of the schemes and subsidies offered by the Government.

The various advantages comprises of capital investment subsidies, priority sector lending, and subsidies on power tariff, excise and direct tax exemptions.

- Easily get government tenders.

- Easily get various licenses and permits for business.

- Import subsidy of 15 % on fully automatic machinery in case of a bank loan.

- Avail ISO Certification compensation.

- There is no need for filing returns.

- There are subsidies on electricity bills.

- These are the priority sector lending.

- Subsidies will be provided under excise laws and direct tax laws.

- Beneficial interest rates.

- 50% Subsidy on Patent Registration.

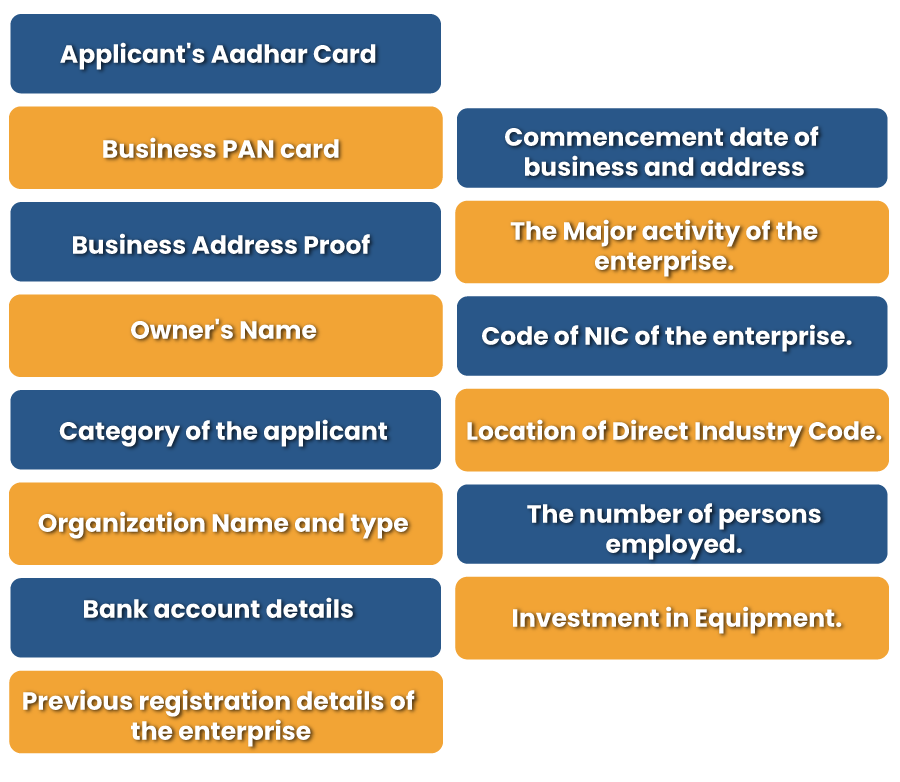

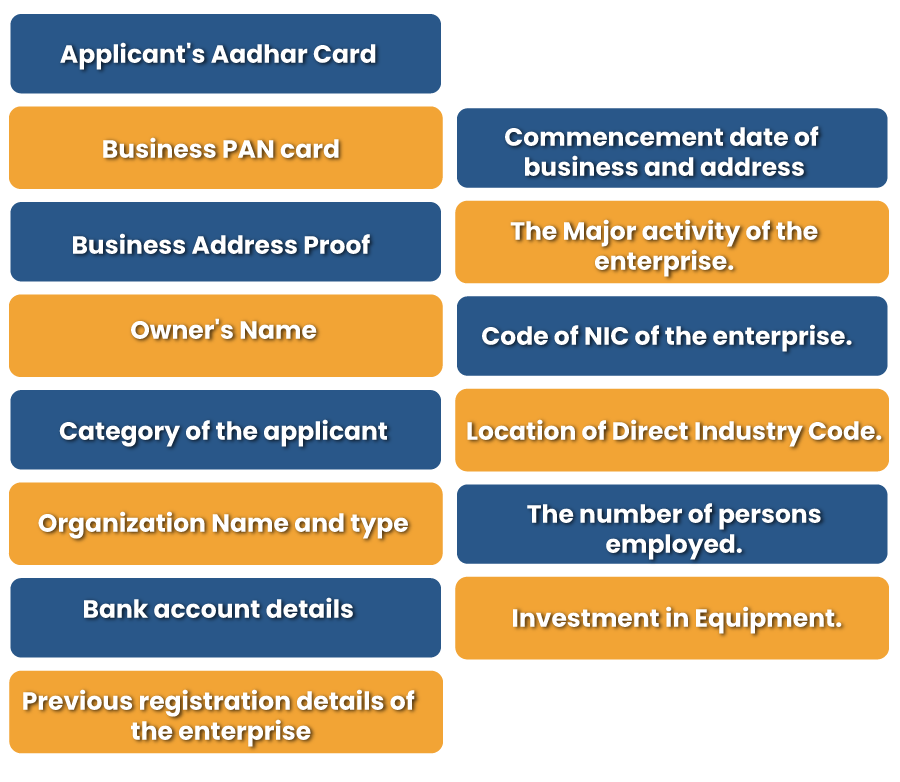

Documents Required for Filing MSME and SSI Registration?

The few important documents required for the MSME and SSI registration are given below:

What are the Objectives of MSME and SSI?

- MSME and SSI assists with counting and keeps a list of the small businesses.

- Provide a certificate declaring that the registration under MSME and SSI will empower the enterprises to gain profit of the legal advantages essentially they will have the long term protection.

- Fulfils the purpose of the statistics collection.

- MSME and SSI registration can be used as identification for businesses to open a bank account and also for registration of GST.

- MSME and SSI facilitate the growth and development of socio-economic status of our country.

Role of MSME and SSI in Indian economy

There are specific roles that MSME and SSI plays in the Indian Economy, which are as follows:-

Employment

They are the major source of generating employment for developing countries like India. Because of the availability of labour and manpower it has helped in development of the production even after having an inadequate availability of technology and resource.

Total Production

These enterprises are the backbone of India. They give 40% of the total production of goods and services in India. These enterprises are one of the main reasons for the expansion and growth of the Indian economy.

Make in India

MSME and SSI have always aimed in supporting the Make in India initiative. Their major focus is to accomplish the mission for manufacturing products in India and selling them worldwide. This helps in maximum export and also keeps on creating more demands from over the world all around.

Export Contribution

MSME and SSI products are in demand because of which the India’s export industry is dependent on this micro, small and medium enterprises. Almost half of the goods produced or manufactured in India are exported to various different countries which is the reason for the development and growth of Indian economy.

Public Welfare

These enterprises give an opportunity to the nation to earn capital and generate employment. MSME and SSI is also significant for the soci0-economic growth and development of our nation.

Conclusion

The MSME and SSI are both under Government of India. Earlier it was only SSI but then Government decided to include micro and medium enterprises into it and therefore the name is MSME now. The Indian MSME and SSI enterprises sector provides quiet a support to the national economy and by protecting it acts as a defense in case of recession, global economic shock and any other unprecedented adversities. Hence, it can be said that India through a silent revolution is growing forward towards a strong and powerful global economy powered by MSMEs.

Therefore, both MSME and SSI aim for the socio-economic development and growth of the Indian economy and works for the same cause.

Read our article:An Outlook on the New Structure of MSME Classification