Input tax credit is the tax paid on purchase of goods and services by the buyer at the time of paying taxes on output, the buyer can reduce the tax as he has already paid the tax in inputs. In simple words, Input Tax Credit Mechanism means to reduce the tax paid on inputs from taxes to be paid on output.

When any services or goods are supplied to a taxable person, the GST charged is known as Input Tax. So, Input Tax Credit means to claim credit on the paid GST on purchase of Goods and Services which are utilised for furthering the business. Being the backbone of GST the Input Tax Credit mechanism is one of the major reasons for the introduction of GST.

The Goods and Services Tax is the sole tax levied in whole of the India starting from the production and manufacture of the goods and services until it reaches the end customer. This chain does not get broken and everybody is able to take benefit of the same and hence there is smooth credit flow.

ITC in GST and the Persons Eligible to Claim under Input Tax Credit Mechanism

The Input tax Credit Mechanism is available to categories of person who are covered under the GST Act. Therefore, this includes a manufacturer of the goods, the supplier, the middleman or the agent, e-commerce manager, aggregator, etc who are registered under GST.

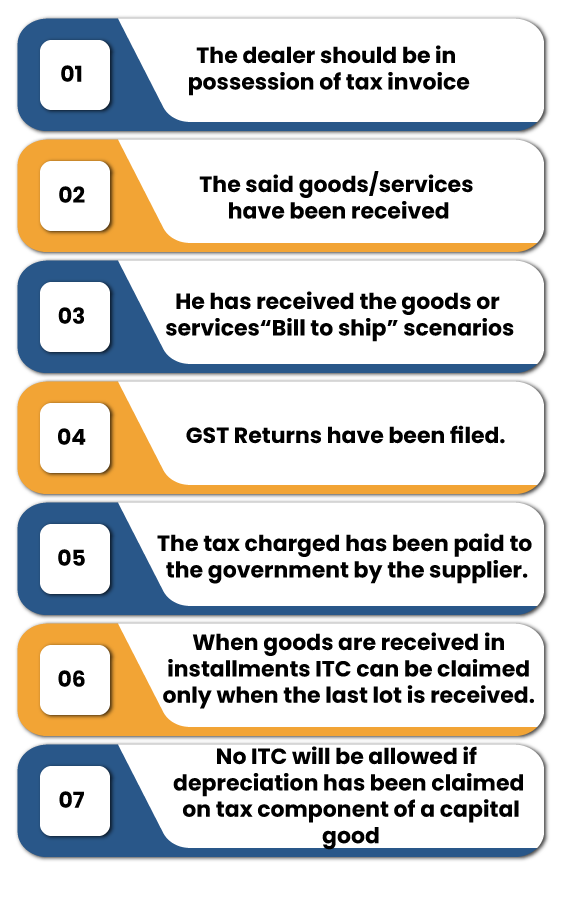

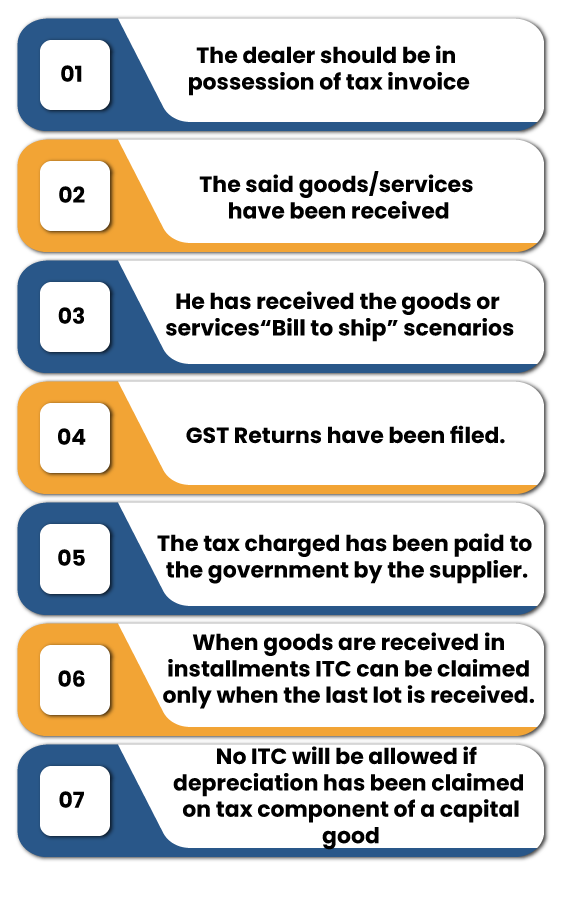

They are qualified to claim the input credit for the tax paid by them on purchases. The persons registered under GST can claim Input Tax Credit only if he fulfils the conditions as given below:

Kinds of Supply that can Avail under the Input Tax Credit

| SL.No. | Nature of Supply | Availability of ITC |

| 1 | Taxable Supply | Yes |

| 2 | Zero Rated Supply (Export+SEZ) | Yes |

| 3 | Exempt Supply | No |

| 4 | Non- Taxable Supply | No |

Documents Required for Claiming ITC

The following documents are essential for claiming benefit under Input Tax Credit Mechanism:-

- The tax Invoice given by supplier of the goods and services

- The document showing the debit note of the recipient as has been given by the supplier (if applicable)

- The Bill of entry or related document as prescribed under the Customs Act.

- The Bill of supply, which is known as the document-can be a substitute for tax invoice in certain cases

- The Credit note or the invoice given by the Input Service Distributor (ISD) as the GST invoicing rules

- A bill of supply particularly issued by supplier of goods/services

- Bill of entry

Read our article:Input Tax Credit for Restaurants

ITC is allowed only for Goods and/or Services used for Business

The benefit of Input Tax Credit can be availed on only business purposes under the Input Tax Credit mechanism:

- ITC can be claimed only for business purposes. Goods and Services used for Personal use will not come under Input Tax Credit.

- Where the Goods and/or Services are received partially for Business[1] and partially for personal use then the person can gain the benefit of ITC only to the extent of the portion which is used for Business.

- Where the goods and/or services are utilised in taxable supplies partially and partially on exempt supplies then the benefit of ITC can be claimed only on the part used for making zero rated supplies and taxable supplies.

- ITC is not approved on the part being used for making exempt supplies.

How to Claim Input Tax Credit (ITC)?

To be entitled to claim benefit of Input Tax Credit Mechanism under the GST scheme, the following conditions have to be satisfied:

- The person must be a registered taxable person.

- The person can claim Input Tax Credit only if the goods and services received is used for business purposes.

- Input Tax Credit can be claimed by a person on exports and zero-rated supplies and are taxable.

- In case of a registered taxable person, the Input Tax Credit which is unused shall be forwarded to the merged, sold or transferred business if the constitution changes due to merger, transfer of business or sale.

- As laid down under the model GST law, the person in a provisional manner can credit the Input Tax Credit in his Electronic Credit Ledger on the common portal supporting documents – debit note, supplementary invoice, tax invoice are needed to claim the Input Tax Credit.

- The Input Tax Credit can be claimed only if the person is having the real receipt of goods and services.

- The Input Tax should be paid through Electronic Credit or Cash ledger.

- All GST returns like GST-1, 2,3, 6, and 7 needs to be filed.

Significant Change under Input Tax Credit Mechanism under the Budget 2021

Under the Budget 2021, the Section 16 has been amended to permit the taxpayers to claim the input tax credit based on GSTR-2A and GSTR-2B. Hence, from now on only when the details of such invoice or debit note have been furnished by the supplier in the outward supplies statement then only the input tax credit on debit note or invoice may be availed and such details have been communicated to the recipient of such invoice or debit note.

- These are the changes in Rule 36(4) applicable from 1st January 2021

- The ITC shall be offered according to the invoices as given by respective suppliers either by using the Invoice Furnishing Facility (IFF) or in their GSTR-1.

- The recipient can now claim provisional input tax credit in GSTR-3B to the extent of 5% as a replacement for the earlier 10% of the total ITC available in GSTR-2B for the month.

- Certain taxpayers cannot make payment in excess of 99% of the total tax liability from their electronic credit ledger for the tax period as per a new rule 86B.

- If the conditions laid down under Section 16 of the CGST Act are not followed then the GST Registration can be cancelled.

Conclusion

Consequently, for availing the benefit of Input Tax Credit mechanism registration under GST is a necessary condition. The ITC can be claimed as refund if the tax paid on inputs is more than the tax paid on output. A person who applies within 30 days for GST Registration is entitled to claim ITC in respect of goods held in stock on the day previous to the date from which he becomes liable to pay tax.

Thus, by fulfilling the requirement of the documents and the eligibility conditions the person can avail the benefit of Input Tax Credit mechanism.

Read our article:What is Input Tax Credit under GST?