DGFT is the sole institution in India that looks after the foreign trade activities in India. In association with apex government institutions, DGFT, from time to time, may restrict the cross-border trading for certain products to protect the nation’s interest. To curb the transportation of hazardous and restricted substances, the DGFT has underpinned some guidelines for the same as per the country’s EXIM Policy. The authority also plays a significant role in easing out the registration process and other restrictions in view of India’s initiative “ease of doing business.” In this article, we will see the legality associated with the importation of restricted items such as gold, silver, and animal in India.

Role of Directorate General of Foreign Trade in the Cross-Border Movement of Restricted Items

The DGFT is also liable for formulating & deploying the foreign trade policy to promote India’s exports. The DGFT facilitates the authorization to the exporters and probes their corresponding obligations via a network of 38 regional offices.

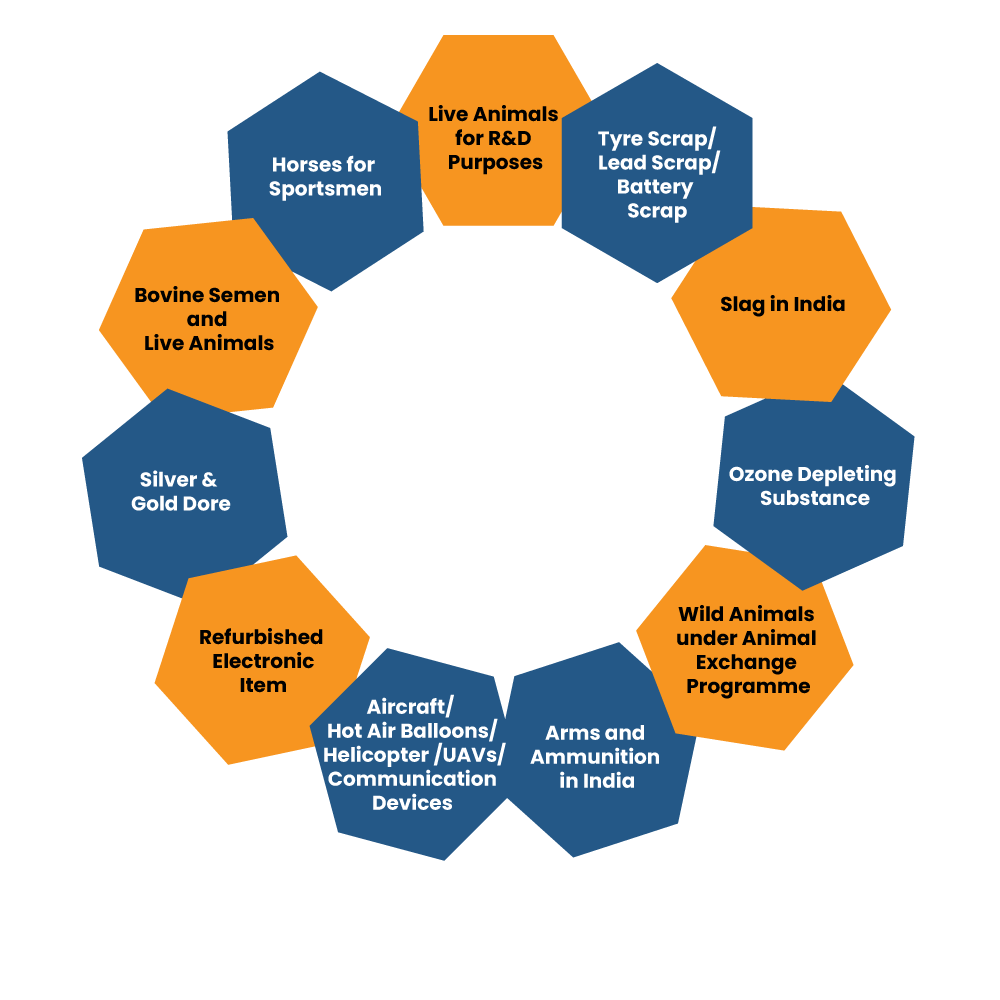

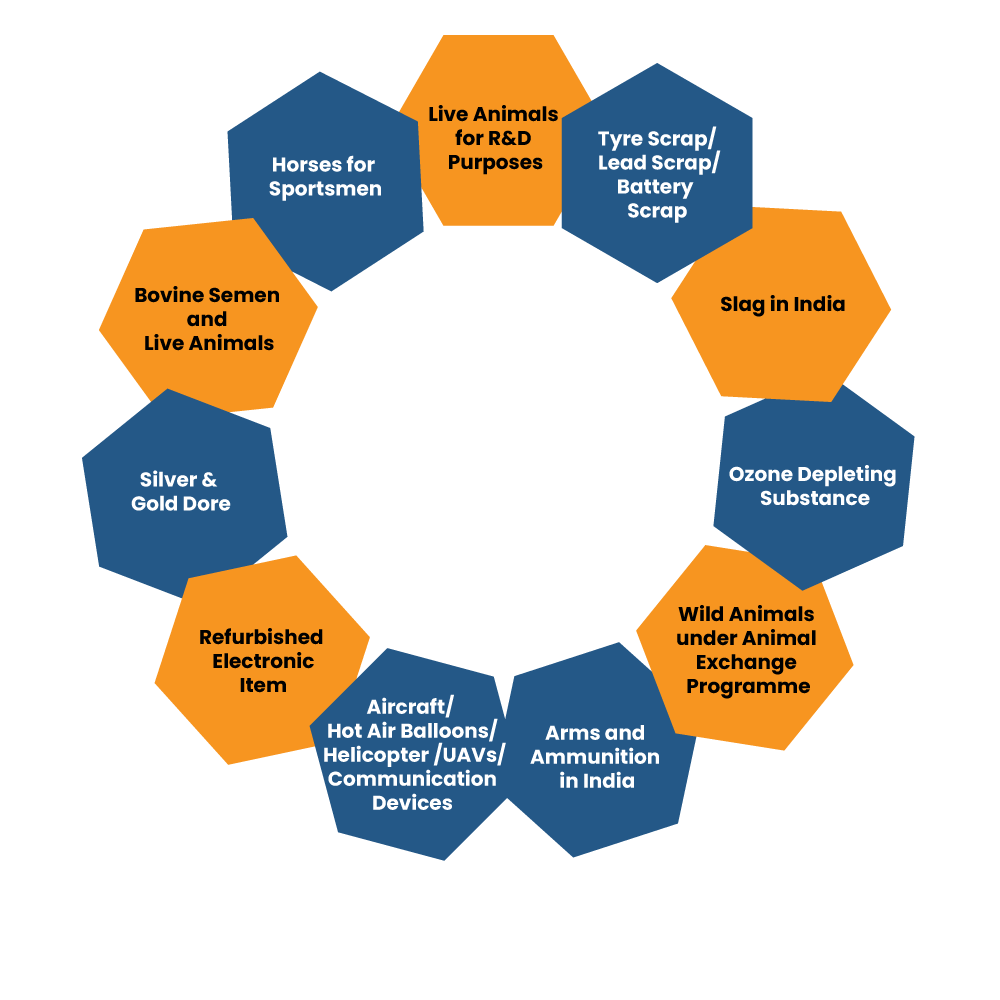

What are the Restricted Items as per the EXIM policy?

A restricted item refers to those items that seek special approval from the concerned department or local authorities. Restricted items will only stand eligible for import in the presence of valid authorization from the concerned departments.

List of Restricted Items

- Live animals & bovine semen

- Pets

- Horses for sportsmen

- Live animals for R&D purposes

- Slag

- Ozone-depleting substance

- Tyre scrap/ Lead scrap/battery scrap

- Wild Animals under Animal Exchange Programme

- Arms & ammunition

- Import of gold –Dore

- Transmitter or Communication device

- Refurbished electronic products

- Aircraft/ Hot Air Balloons/ Helicopter/UAVs

- Import of Silver – Dore

Read our article:What is the Complete Procedure to Check the IEC Application Status?

Documents required for the Importation of Restricted Items in India

Following documents are required for the registration of Import of Restricted Items.

- IEC Certificate

- Udyog Aadhar

- Board Resolution copy

- Authorized Signatory Aadhar card & pan card

- Authorization from the concerned department

Mandatory Permissions required for the Importation of Restricted Items

Following are items that are tagged under the restricted list of the foreign trade policy. To import such items, one has to avail of the respective authorities’ permissions as mentioned below.

Importation of Bovine Semen and Live Animals

As per DGFT’s policy, the importation of bovine semen and live animals in India is restricted. However, one can import such items after availing permission from the state animal husbandry department. After getting permission from the said department, the applicant can visit DGFT and file an application for the importation of the same.

While filling up the form, the applicant must attach the approval letter and other documents. Upon submission of the application, DGFT will grant the license for the importation of restricted items.

Importation of Horses for Sportsmen

A horse for sportsmen is not an importable item as per the DGFT’s policy. But one can import it after taking the Recommendation from the Equestrian federation. This government-driven institution plays a vital role in authorizing the import of horses for sports person.

After availing permission from the said authority, the applicant must file an application for the importation of restricted items in DGFT. It is worth mentioning that this application will go along with the approval letter’s copy.

Importation of Live Animals for R&D Purposes

The import of live animals for R&D purposes requires adequate certificates for their research & development facility. The R&D facility must have sufficient resources in place to conduct seamless testing and research. After obtaining this certification, the application can be made to the DGFT to import the said items.

Importation of Tyre Scrap/ Lead Scrap/Battery Scrap

Tyre Scrap/ Lead Scrap/ Battery Scrap are potentially Hazardous for human health as per the Hazardous Waste Management rules. The importation of such items is not being possible without the approval of the Ministry of Environment Forest & Climate Change[1]. Inevitably, after getting this approval, the importer must-visit DGFT in order to avail the import permission.

Import of Slag in India

Slag refers to a by-product of molted metal, and it is widely used as a raw material in many processes. Slag is potentially hazardous and comes under the category of restricted items as per the DGFT’s policy. One has to avail the permission from State Pollution Control Board to import slag in India from overseas countries.

Importation of Ozone Depleting Substance

As the name suggests, Ozone-depleting substances are harmful to the ozone layer. DGFT will not approve the request for importing such items until the applicant avails permission from the concerned ministry.

Importation of Wild Animals under Animal Exchange Programme

DGFT’s approval is not sufficient for the importation of wild animals. To serve such a purpose, the applicant must approach the central zoo authority and avail the permission for the same.

Import of Arms and Ammunition in India

Arms dealer license and end-user certificate from the concerned department are the two basic requirements for importing the arms and ammunition.

Import of Aircraft/ Hot Air Balloons/ Helicopter /UAVs/ Communication Devices

The import of aircraft/helicopter etc, seeks approval from the Directorate General of Civil Aviation. Wireless Planning Commission (WPA) department will render import permission for the wireless products such as Transmitter and communication devices etc.

Import of Refurbished Electronic Item

BIS registration certificate or an exemption certificate issued by the Ministry of Electronics & Information Technology is essential for the import of the Refurbished electronic item in India.

Import of Silver & Gold Dore

Gold Dore & Silver Dore refers to semi-pure alloys comprised of 50-70 % of gold & silver, respectively. The import of gold dore seeks NABL, BIS, and pollution certification along with the DGFT’s permission. Meanwhile, to import the silver dore, the applicant has to avail from the state pollution control board in writing.

Fee required for the Importation of the Restricted Items

One per thousand or part thereof subject to a min. of INR 500 and max. of Rs 1 lakh on permission/ CIF value/ license/ duty saved amount of authorization.

Conclusion

In our country, the Export-Import (EXIM) Policy and Foreign Trade (Development and Regulation) Act of 1992 governs the import-export activities. The cross-border movement of the restricted items seeks approval from the local authorities, as mentioned above. If you need some advice on the Importation of Restricted Items, have a conversation with CorpBiz’s experts.

Read our article:The Requirement for Import Concerning IEC with RCMC