NGOs in India have always been exempted from certain kinds of tax norms. Such exemptions are provided under Section 12A and 80G of Income Tax Act. Section 12A provides that NGOs with 12A registration can be fully exempted from the Income Tax Department. And, NGOs with 80G registration provide benefits to the donor of any NGO. The donor gets financial benefits in his taxable amount of their income. If NGOs don’t get such registrations, then in that care they are subjected to regular tax rates. Also, attracting donors for donations becomes difficult. In this blog, we are going to shed some light on the important updates on 80G and 12A Applications.

Changes in Norms for 80G and 12A Applications

Recently, in the Budget of 2020 presented on February 1, 2020, some changes were introduced in the current norms for the exemptions under Section 80G and 12A Applications. It was said that all these amendments were to be made effective from June 1, 2020 but due to the current crisis prevailing in the country, the new date of compliances shall begin from October 1, 2020 and shall continue till December 1, 2020.

Read our article:Tax Exemption for NGOs: Section 12A & 80G

Following are the changes in the norms which were made in the Budget 2020 for 80G and 12A Applications:-

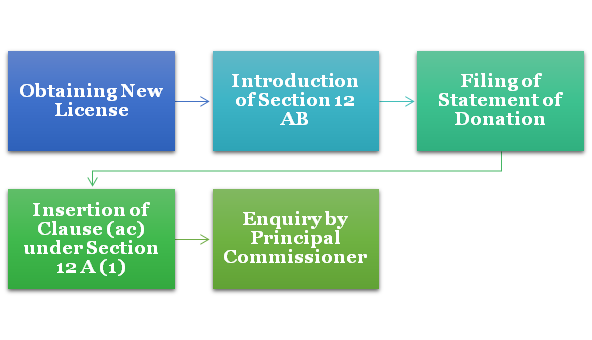

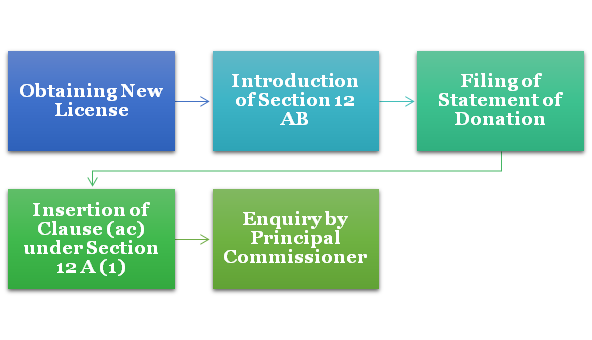

Obtaining New License

All the existing NGOs which are already registered or approved under Sections 12A, 12AA, 10(23C), and 80G of Income Tax, 1961[1] are compulsorily required to obtain fresh registration from Income Tax Authorities under Section 12AB.

Re-application for registration

All the NGOs which are already registered under Sections 12A, 12AA and 80G of Income Tax Act, 1961 will now be required to apply again for registration by December 1, 2020.

Introduction of Section 12 AB

The new Section 12AB proposes to change the registration process by prescribing time frame for processing the application and all the existing NGOs already registered under Sections 12A, 12AA and 80G would move to new rules and regulations prescribed under Section 12AB by January 1, 2021.

Filing of Statement of Donation

All the NGOs will now have to file statements of donation received and issue of donation certificate to donors. On failure to file such statements by these institutions, heavy fines and penalty will be imposed by the concerned authority.

Insertion of Clause (ac) under Section 12 A (1)

Further, a new clause (ac) has been inserted in Section 12 A (1) which provide that all the NGOs registered under Section 12A or under Section 12AA shall be required to makes an application in the relevant form to the Principal Commissioner or Commissioner for registration of trust. It should be within three months from the date of such amendment and such an NGO shall obtain registration under Section 12AB.

When any application is made under Section 12A(1)(ac)(i) by the NGO already registered under Section 12A or Section 12AA registration shall be granted by the Principal Commissioner by passing an order within three months from the end of the month in which application was received and such registration shall be valid for the period of five years.

Enquiry by Principal Commissioner

At the time of renewal, the Principal Commissioner or Commissioner shall call for such documents or information to make an enquiry about the objects and genuineness of the activities of NGOs and the compliance of the requirement of any other law and it is only after achieving these objectives by the NGOs, the Commissioner shall pass an order for granting of re-registration under Section 12AB.

Validity of registration

The registration will be valid for a period of five years only and all the NGOs again have to apply for such registration on the expiry of said period, failing their name will be struck down from the list. The application for renewal shall be made before six months prior to the expiry of five years validity period.

Filing Online Application

The process of application will be online and there will be a period of three months provided to such NGOs within which they have to submit their application.

Other various changes

- All those NGOs which are newly established applying to Income Tax Department for registration for the first time are given provisional registration for three years.

- Prior to six months from the expiry of three years provisional registration, an application for renewal of provisional registration or rather registration has to be made.

- Tax deductions under Section 80G will not be available to donors who opt for reduced rate of tax.

Advantages of New Amendment for 80G and 12A applications

The advantages of New Amendment are as follows-

- The process of revalidation of all the NGOs will enable the Government to remove all the inactive and no longer functioning NGOs.

- The renewal of registration after every five years will provide an opportunity to withdraw the exemptions without going through the complicated cancellation provisions.

- This process of registration will curb the process of malpractices which these institutions undergo for private profiteering rather than any genuine social work.

- Since the process is completely online, it will simplify the compliance for the new and existing NGOs.

Disadvantages of New Amendment for 80G and 12A applications

The disadvantages of new amendments are as follows-

- The new process of registration will impose higher administrative burden on tax authorities.

- This new process of registration will become more cumbersome and costlier to the NGOs.

- Additional burden on NGOs in case of delayed filing of returns.

- NGOs dependent on overseas funds are exposed to higher risks.

- Greater control and leverage on Government authorities to monitor and control the activities of NGOs.

Conclusion

The Indian Government is trying hard each and every day to prevent the use of any malpractices in institutions be it private, non-private or for charitable purposes. In the past, many registered NGOs under Section 80G and 12A application were found to be engaged in these activities and using it for personal gains rather than social work and so to curb these activities, the Government has come up with this new amendment. With new era, all the process will be completely online and it will prevent all the complex procedure of physical registration. Though there will be a burden (administratively and economically) on NGOs as well as the concerned authority but undoubtedly, it will prove to be beneficial for everyone.

Read our article:Charitable Institutions Related Changes u/s 12A/12AA and 80G-Budget 2020