Registering an NGO in India is beneficial for many reasons. The basic reason is the rebate received in Income Tax under Section 12A and 80G. NGOs with 12A Registration can claim a full exemption from the Income Tax department. NGOs with 80G Certification attract more donors for donating funds to the organization. If NGOs don’t get such registrations, they are subjected to regular Tax Rates. Furthermore, attracting donors for donations becomes difficult. Earlier the registration under 12A was one time registration and if once the registration is approved then it will be valid till its cancellation. But with effect from 1st April 2021, the registration shall be given for a time period of 5 years only and the organisation will have to apply for the renewal after every 5 years. Under the new tax regime all the sections 10(23C), 11, 12AA, Section 12A & 80G of the Income Tax Act, 1961 shall be registered under a new Section 12AB.

Why should NGO apply for 12A and 80G Registration? – Benefits

Section 12A and 80G have their own implication and offer many benefits to NGOs with such registrations. Some advantages are listed below:

- NGOs can get tax exemption simply by getting itself registered and fulfilling all the required formalities. But the donors are not benefitted with this registration process.

- The person/ entity making donations can avail this benefit only if the NGO receives a certificate under 12A and 80G.

- The person or organization will get a deduction of 50% of donation amount from the Taxable Income.

- An NGO will receive Government Funding, only if registered under section 12A & 80G.

- An NGO doesn’t have to pay tax just by getting 12A and 80G certificate.

What are the eligibility criteria of NGOs to get 12A and 80G certificate?

The basic eligibility criteria to get 12A and 80G Certificate are as follows:

- The assets and income of the NGO should be for charitable purpose only.

- The Books of Accounts should be properly maintained, including all receipts and expenditures.

- NGO should not be formed with the help of any particular religion, caste or community.

- The core objective of the NGO should be charity, and whole income should be from donations.

- In case an NGO has a business income then the trustee of the NGO should maintain separate books of accounts to assure that the donations are not diverted.

Can an NGO be disqualified from exemptions received from 12A and 80G registration?

Yes, an NGO can get disqualified from exemptions.

Here are a few situations which may disentitle a donor from claiming Tax Deductions:

- If a charitable organization or trust registered as an NGO engages in promoting interests of any particular religion, caste or community.

- If the NGOs has any ‘non exempted income’ that is if they have any commercial purpose to give rise to incomes.

- If the donor pays in cash, the Government from the budget 2018-2019 onwards has reduced the admissible deduction from 10,000 rupees to only 2,000 rupees. However, no such limit is made for cheque or other electronic modes of transfer.

- If the routine account of expenditures and receipts is not maintained by the NGO.

- If the NGO is not registered under the Societies Registration Act, 1860 or under section 8 of the Company Registration Act, 2013.

Read our article:NGO Registration – Step by Step Procedure

What is the process of Registration under Section 12A and 80G of the Act?

The Finance Minister presented the Union Budget 2020[1] where it was planned to make significant amendments for giving exemptions to the Charitable, Institutions or Religious Trusts, etc. It is proposed under the new tax regime to amend Sections 10(23C), 11, 12A, 12AA and Section 80G of the Income Tax Act, 1961 and at the same time to introduce a new Section 12AB in its place.

These amendments came into effect from June 01, 2020. Ultimately, the amendments were brought by the Taxation (Relaxation and Amendment of Certain Provisions) Act, 2020 which has in addition extended the new registration under Section 12AB of Income Tax Act to April 1, 2021.

- The amendment in the budget also includes digitizing the registration process for Charitable Trusts.

- This amendment also applies to the charitable institutions that already exist to apply for their fresh registration under the new provisions of Section 12AB of IT Act.

- All the existing Charitable Trust and Institutions or the ones that are registered under the sections 10(23C), Section 12A, Section 12AA and Section 80G all of them shall have to register itself under the new amended Section 12AB to claim exemption u/s 10 or 11.

- For fresh registration, the application under section 12A shall be given to the Principal Commissioner or the Commissioner in accordance with the provision of section 12AB.

- After the online forms are prepared there shall be a time period of three months within which application must be submitted. Trusts and institutions may do this on their own or through their auditors or practicing chartered accountants.

- After dealing out with the application, the trust or institution’s registered under Section 12AA and 80G can be re-validated by income tax authority for a period of 5 years.

- A provisional registration shall be given for 3 years to the organizations. In case the renewal of the application is done, then the new registration shall have to be submitted within 6 months from the initiation of activities or within six months before the expiry of validity period whichever one is earlier.

- The registration validity period shall be for 5 years and it is required to be renewed in every 5 years of the time period.

- The application will be submitted before one month from the commencement of the previous year – in the cases of new registration, which is also relevant to the assessment year of registration. Therefore, the new NGO will not be allowed the benefit of registration under section 12AB in its function of first year.

- It is mandatory for every institution and charitable trust that is registered u/s 80G to submit a statement of donations that it has received in such manner as prescribed & the advantage of 80G shall be offered to the donors on the grounds of information concerning the donation as given by the related institution or the charitable trust.

- Under Section 80G the tax deductions shall not be available to donors like companies or individuals who choose for reduced rate of tax.

Documents Required for Both Registration under Section 12A and 80G

List of documents required for registration is provided below:

| 1. | Registration Certificate Memorandum of Association (MOA) or Trust Deed –two copies which are to be self-attested by the head of NGO. |

| 2. | NOC or No Objection Certificate received from landlord where the registered office is situated. |

| 3. | Copy of registration with Registrar of Companies or Registrar of Firms and Societies OR Registrar of Public Trusts- Self Attested Copy. |

| 4. | The Self Certified Copy of documents evidencing adoption and modification of the objects. |

| 5. | A copy of PAN Card of NGO or Trust or an Institution. |

| 6. | Photo Copy of the Electricity Bill or House Tax Receipt Bill or Water Bill. |

| 7. | A proof of the welfare activities pursued. |

| 8. | The list of the contributors and the donors along with their address and PAN. |

| 9. | A self-certified copy of registration granted or registration denied under section 12A if any. |

| 10. | The description of the overall business carrying out by the institution or trust. |

| 11. | A progress Report of previous three years since the formation of the NGO. |

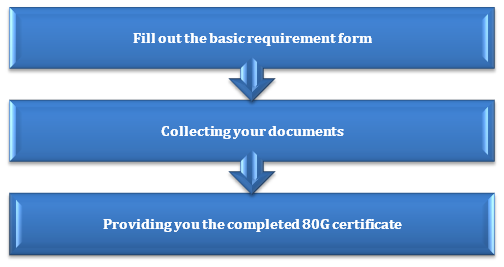

Contact Corpbiz for easy steps to apply for 12A and 80G certificate!

Corpbiz Professionals will help you in:

Conclusion

To summarize, registration under section 12A provides tax exemption to NGOs and section 80G works for the benefit of individuals and organizations willing to save tax. By following the procedure allotted by the NGOs, they can quickly get registered. It is better to make donations by way of cheque or online banking transfer. The application for 12A and 80G registration can be filed together or separately under section 12 AB. It is up to the commissioner to accept or reject the proposals of NGOs or trust. The document should be adequately submitted to avoid any chances of rejection.

Read our article:A Detailed Guide For Obtaining 80G Registration