A commercial lease agreement is a type of contract that figures out the terms and conditions under a contract on which one party agrees to rent property of the other party. The lease agreement obliges the lessee to make regular payments for a fixed period in exchange for the property of the landowner.

Both the lessor and the lessee suffer the consequences if they fail to comply with the terms of the contract. The commercial lease agreement is an agreement between the landlord and the tenant of rent the property with the intention of operating a business.

On Which Stage Lessee & Lessor Requires Commercial Lease Agreements?

A commercial lease agreement is a type of legal document in between the landlord and tenant. A commercial lease agreement is usually needed when the property is leased for a longer period of time, between 1 to 5 years or even longer. In such cases, a lease agreement plays an important role in maintaining the relationship between the landlord and the tenant and by passes the provisions that legally bind them.

What are the Types of Commercial Lease Agreement?

The below listed are the types of commercial lease agreement, which are as follows:-

Gross Lease Agreement

Gross leases are also popularly known as full-service leases. It is a type of lease where the landlord pays all the expenses of the property out of the rent received from the tenant. The list of such expenses includes taxes, insurance and maintenance.

While the landlord takes all responsibility for the building, the tenant only has to focus on the business. This is one of the important benefits of gross leasing, which is used for multi-tenant buildings.

Net Lease

A net lease is a commercial real estate lease in which, the tenant not only pays for his or her occupied space, but also for a fixed portion of all. These costs are usually associated with the operation or maintenance of the property.

The list of such common costs includes taxes, property insurance, property management fees or payments for utilities. The net lease can further be divided as the following category, which are:-

- Single Net Lease

- Double Net Lease

- Triple Net Lease

Modified Gross Lease

A modified gross lease is similar to a gross lease, except for a few things. Although the tenant is requested to rent in a lump sum, there is scope for agreement between the parties.

Parties to the agreement may negotiate costs that may be included in the base rental rate In addition; expenses such as utility bills and salary of watchman are excluded from the list. A modified gross is more popular among the tenants.

What are the Necessary Clauses under the Commercial Lease Agreement?

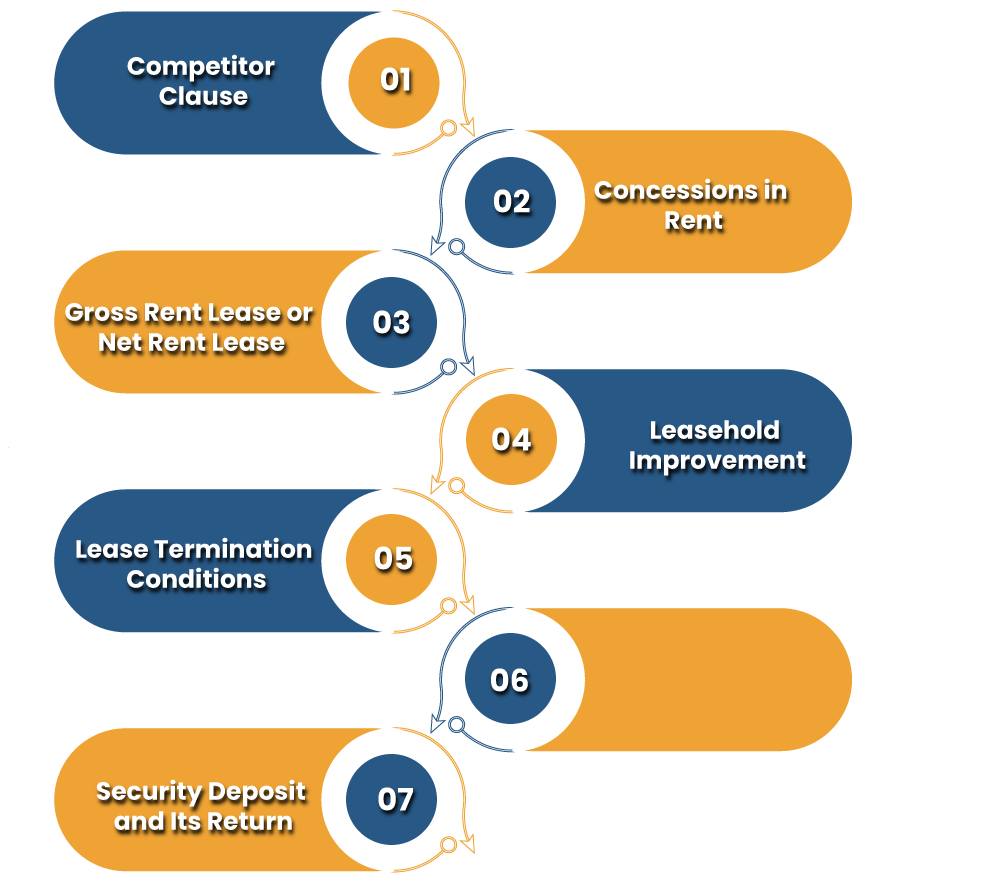

Listed below are the necessary clauses under the commercial lease agreement.

Competitor Clause

A competitor clause debars the landlord from selling or lease out the same space in the building where you are planning to shift.

Concessions in Rent

- Make sure that the landlord is in a decision to allow some exemption for the same premises, similarly, exemption of rent allowed by the landlord for 1-2 months prior beginning the lease period.

- Other rebate or comforts includes the renovation costs from the end of landlord expenses.

Gross Rent Lease or Net Rent Lease

- There shall be transparency about the components rather than the rent, likewise the property tax[1], insurance, maintenance charges and common area expenses etc, between you and your landlord.

- Within the gross rental agreement, you are liable to pay the rent along with the other expenses accordingly.

- In a net lease agreement, you have to pay the basic rent only. The rent to be paid will be lower but make sure to get clear about all the incidental expenses.

- Note the electricity meters and see if you will get a separate bill or combined it with another tenant. And how will each tenant’s charges be ascertained and confirmed?

Read our article:Analysis: Is India ready for Third Party Litigation Funding?