Corporate governance aims to ease effective, entrepreneurial and prudent management that can deliver the long-term success of the company.

Introduction

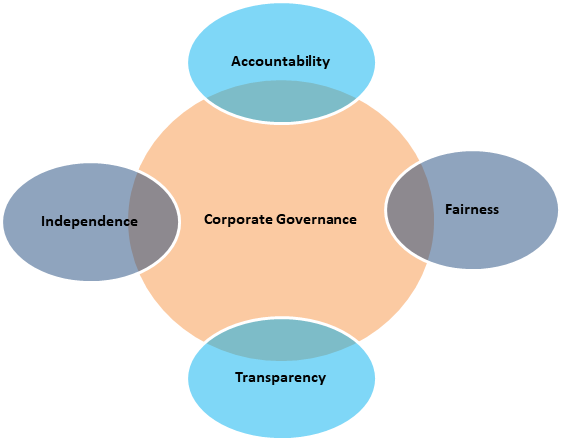

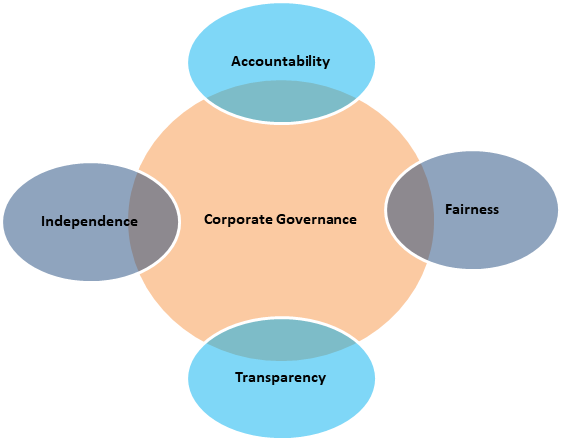

In the year 1990, Industry Association on Confederation on Indian Institute introduced the term Corporate Governance. It was the voluntary measure to be adopted by the Indian Companies after availing Company Registration, which touches the essential affair of the company, transparency, accountability, fairness, and responsibility. It is the way through which the companies are directed and controlled.

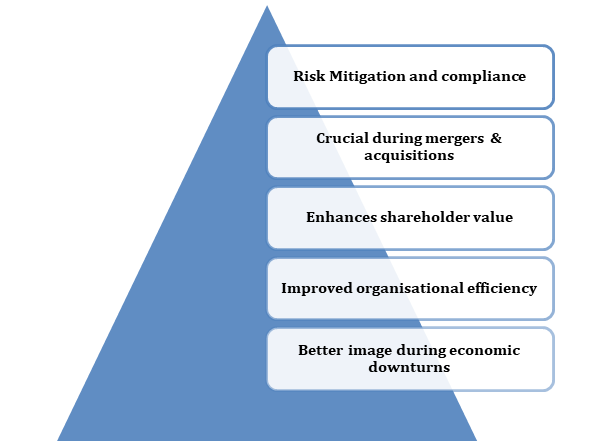

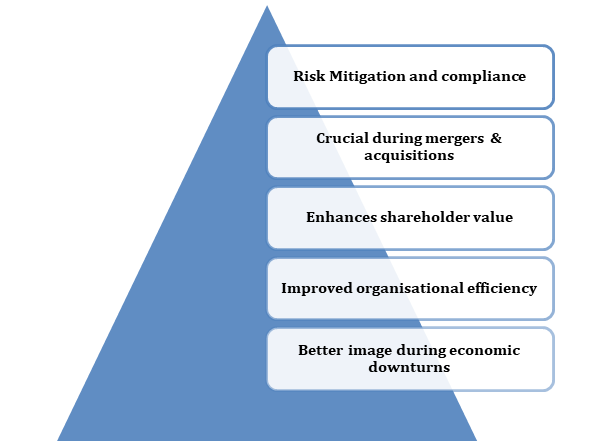

Importance of Corporate Governance is discussed below;

What is Corporate Governance?

In India, Corporate governance is set on policy, internal controls and procedures which form the plan of dealing stakeholders and company operations such as management, employees, customers, industry bodies and government. The structure of such policies should be such as to uphold the principles of transparency, accountability, fairness, and responsibility.

The main intention of its to have sound management to take out economic efficiency in an organization. Sound corporate governance in an organization can achieve the goal of profit maximization and shareholder welfare.

Definitions;

As stated by the Institute of Company Secretaries of India;

Four Pillar of Corporate Governance

What is the Legal Framework on Corporate Governance?

The Companies Act, 2013;

The Act deals with the provisions of the constitution of the board, board processes, independent directors, board meetings, audit committees party transactions, audit committee, disclosure requirements in the financial statements, etc.

SEBI Guidelines;

Stock Exchange Board of India[1] is a governing authority having power and jurisdiction over the listed companies. SEBI issues regulations, rules, and guidelines to companies to protect the investors.

Standard Listing Agreement of Stock Exchanges;

For the companies who have listed their companies share with the stock exchange, the Standard listing agreement is mandatory.

Accounting Standards Issued by ICAI;

Institute of Chartered Accountant of India is an independent body, which issues accounting guidelines for the disclosure of a company’s financial information.

Secretarial Standards issued by the Institute (ICSI);

Institute of Chartered Accountant of India has secretarial standards according to the provisions of the new Companies Act. ICAI has issued the Secretarial standards on “Meetings of the Board of Directors” and secretarial standards on “General Meetings”.

According to, Section 118(10), of Companies Act, 2013, every company (other than one person company) shall observe secretarial standards specified as such by the ICSI concerning general and Board meetings.

Why Corporate Governance is essential?

Compliance and Risk Mitigation

Governance, risk mitigation, and compliance have a direct relationship with each other. Company is governed on sound principles, that will work accurately to assure that compliance is legally implied over the company. Being stuck with the law and policies, company remain well prepared for any kind of trouble, so the company has risk mitigation. If a company is more disciplined in its operations, company can face any risk arising out of economic, political, or technological events.

Strengthen shareholder value;

However, there is no established relationship between corporate governance and the companies value in market, but corporate governance strengthens the shareholder contentment. It plays an vital part in safeguarding the valuations of a company because the ultimate goal of good governance is to maximize the concerns of the company’s valued shareholders.

Improved organizational efficiency

Corporate governance is an important determinant of industrial competitiveness. Nowadays there are many questions raised on the way a company is governed. Better governance ensures enhanced corporate performance and better economic results. Corporate governance lays the foundation for the behaviour of the company, the utilization of resources, product/service innovation and overall corporate strategies.

Crucial during mergers & acquisitions

Corporate Governance in India plays a critical role during restructuring events such as mergers and acquisitions. Not only does corporate governance of a company helps to differentiate between good deals from bad ones, but M&A activity by a company with good corporate governance is better received by stakeholders in the market. Another aspect of being mentioned is that mergers and acquisitions also have the power to improve the quality of corporate governance of the organization.

Read our article:Importance of Corporate Governance in an Organization

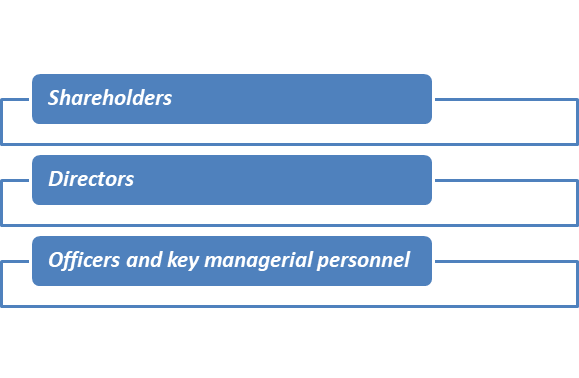

Who are the key participants of Corporate Governance?

Stakeholders

The stakeholders are the principal owners of the company who provide capital to the company instead of return received by them in the form of dividends on the earnings of the company. The individual shareholders take part in corporate governance procedures by exercising their voting rights on the key decisions of the company is

in the interest of all stakeholders. The further institutional shareholders of the company like, insurance companies, NGO, investment banks, etc. who have significant shareholding than other shareholders actively have a big role in observing corporate governance activities of the company as they are attentive in market viability of the company in the form of big market shares.

Directors

The Board of Directors is the main; we can say an important person to bring and implement new corporate governance practices in the company. So that good decisions can be made in favour of the company. Director has the power to set long term strategy and distributing the higher responsibilities to run good governance structure. An effective board leadership can tackle all the company operations and monitor its performance in a fair and transparent way.

Officers and key managerial personnel

These are the top management person which includes CEO, MD, Director, and CS. They can advise the board to achieve the corporate goals by complying good governance practices in an organization.

Why Corporate Governance is Important?

- It lays infrastructure of the accurately disciplined board and a healthy harmony between ownership and management, which makes the management capable of taking independent decision, along with building trust between the company and external shareholders of the organization.

- It enhances the vital reasoning of the management by introducing independent director to the board, to bring the intellectual experience to the company, without any biased approach.

- Its responsibility for the smooth performs of the company.

- It instills fealty among investors as their interest is looked after in a top manner by a company that adopts good management practices.

What is the purview of Corporate Governance?

It imparts proper standards in the organization. It creates space for open communication by incorporating transparency and fair play in key operations of corporate authority. The implications of corporate governance lies in :

- Accountability of Management to shareholders and further stakeholders;

- Transparency in basic operations of the company and integrity in financial reports generated by the company;

- Component Board comprising of Executive and Independent Directors;

- Checks & balances are an integral part of good corporate governance;

- Code of obligations for managing director and employees of the organization.

- Open communication between organization and stakeholders of the company;

- Investor Loyalty is a guarantor of best corporate governance practices.

Conclusion

The company should not only focus on profit, but there are also many factors required for the building company. Most of the companies neglect the part of corporate governance for granted, due to which company can reduce its market value, sale of the majority of the shareholder. However, the regular changes in companies Act[2] are the right direction to run the management smoothly and affair of the company in the interest of stakeholders.

Read our article:Shareholders Meeting is Crucial to Your Business. Learn Why!