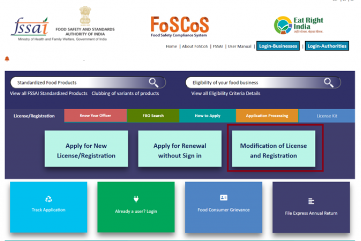

FSSAI stands for the Food Safety and Standard Authority of India (FSSAI). In an latest official notification issued by the authorities of Food Safety and Standard Authority of India (FSSAI), in last year of May for the modification of licenses due to the shift of their website system from Food License and Registration System (FLRS) to the Food Safety and Compliance System (FoSCoS)[1]. Thus, in this case, the existing Food Business operator (FBO) who is having a bona fide license, needs to apply for modification of the existing license by shifting to the new system of FoSCoS for which the department has extended the time period as well. This article will delve into the detailed modification of FSSAI license and their impact on ensuring food safety standards.

What is FSSAI and its categories?

The Food Safety and Standards Authority of India (FSSAI) is the regulatory body responsible for ensuring food safety and quality standards in India. FSSAI licenses are mandatory for all food businesses operating in the country. In recent years, FSSAI has undergone various modifications to enhance its licensing process, making it more streamlined and effective.

1. Centralized Licensing System:

One significant modification of FSSAI License introduced by FSSAI is the implementation of a centralized licensing system. Earlier, food businesses had to obtain separate licenses from different state authorities, leading to inconsistencies and complexities. The centralized system streamlines the licensing process by providing a single platform for license applications, renewals, and modifications. It ensures uniformity and simplifies compliance for food businesses operating in multiple states.

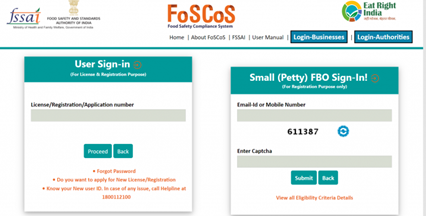

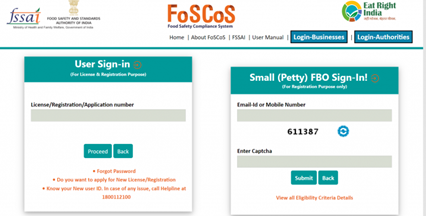

2. Online Application and Registration:

To enhance accessibility and convenience, FSSAI has introduced an online application and registration system for obtaining licenses. Food businesses can now apply for licenses, submit necessary documents, and track the progress of their applications through the FSSAI online portal. The modification of FSSAI License has significantly reduced paperwork, eliminated manual processes, and expedited the license issuance process.

3. Categorization of Food Businesses:

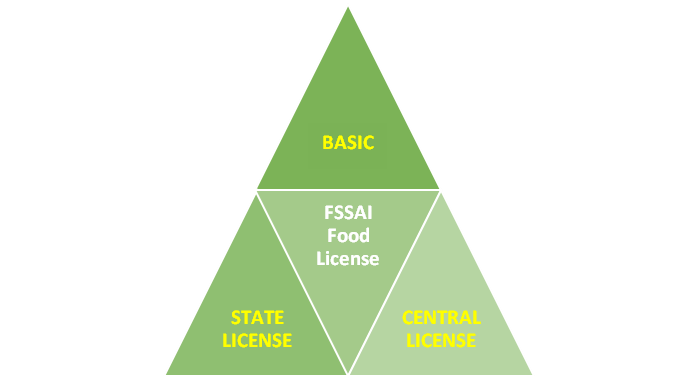

FSSAI has categorized food businesses into three types based on their size and turnover:

a) Basic Registration: This category includes small-scale food businesses with an annual turnover below a specified threshold. They require a basic registration with FSSAI, which is a simplified process aimed at promoting ease of doing business.

b) State License: Medium-sized food businesses fall under this category. They are required to obtain a state-level license from the respective state authorities.

c) Central License: Large-scale food businesses, importers, and manufacturers requiring an all-India presence come under this category. They must obtain a central license from FSSAI.

This categorization helps determine the level of scrutiny, documentation, and compliance requirements based on the scale of operations, ensuring appropriate regulation and supervision.

4. FSSAI Licence Renewal and Validity Periods:

FSSAI Licence Renewal and Validity Periods to ensure timely compliance and monitoring of food businesses. The validity of a license now ranges from one to five years, depending on the category. Food businesses must renew their licenses at least 30 days before the expiry date to avoid any disruptions in their operations. This modification ensures regular assessments of food safety practices and encourages businesses to maintain high standards continuously.

5. Regulatory Compliance and Audit:

FSSAI has strengthened its regulatory compliance measures by conducting regular audits and inspections of licensed food businesses. The authority has increased its focus on food safety training and capacity building to improve compliance levels across the industry. The modifications emphasize the need for food businesses to adhere to hygiene and safety standards, maintain proper record-keeping, and implement robust quality control measures.

6. Penalty and Enforcement:

FSSAI has enhanced penalty provisions and enforcement mechanisms to deter non-compliance and ensure strict adherence to food safety standards. Non-compliant businesses can face penalties, suspension, or cancellation of licenses, depending on the severity of the violation. These modifications serve as a strong deterrent and foster a culture of compliance among food businesses.

Process for the Modification of FSSAI License

To modify your FSSAI (Food Safety and Standards Authority of India) license, you need to follow a step-by-step process. Here’s a general outline of the process for the modification of FSSAI License:

1. Determine the type of modification of FSSAI License required: Identify the specific changes you need to make to your FSSAI license. It could be related to changes in the business name, address, contact details, category of the license, scope of operations, or any other relevant information.

2. Review FSSAI guidelines: Visit the FSSAI website or contact their regional office to review the guidelines and regulations for modifying your license. Familiarize yourself with the necessary documents and procedures to ensure compliance.

3. Gather required documents: Collect all the documents needed to support your modification request. The specific documents may vary depending on the nature of the modification, but common documents include:

- FSSAI license application form (Form-B)

- ID proof and address proof of the proprietor/partners/directors

- Proof of change (e.g., new address proof, name change certificate)

- Affidavit stating the reason for modification of FSSAI License

- Supporting documents relevant to the modification (e.g., updated floor plan, partnership deed, memorandum of association)

4. Prepare the application: Fill out the application form (Form-B) accurately and completely. Ensure that all the required information is provided, and double-check for any errors or missing details. Attach the supporting documents along with the application form.

5. Submit the application: Visit the nearest FSSAI regional office or the designated online portal, depending on the mode of submission specified by FSSAI. Submit your application along with the required documents. If applying online, follow the instructions for uploading the scanned copies of the documents.

6. Pay the modification fees: Pay the applicable modification fees as specified by FSSAI. The fee may vary depending on the type and extent of modification. Ensure that you have the necessary payment details and make the payment through the prescribed mode (online or offline) as per FSSAI guidelines.

7. Track the application: Keep track of your application’s progress by using any tracking mechanism provided by FSSAI. This may include an application number or reference ID that allows you to monitor the status of your modification request.

8. Verification and inspection: Depending on the nature of the modification, FSSAI may conduct an inspection or verification process to ensure compliance with food safety regulations. Cooperate with the officials and provide any additional information or documentation they require.

9. Approval and issuance of modified license: Once your modification of FSSAI License request is processed and approved, you will receive the modified FSSAI license. It will reflect the updated information or changes as requested.

It’s important to note that the specific steps and requirements may vary depending on your location and the nature of the modification. It is advisable to consult the official FSSAI website or contact their regional office directly for the most accurate and up-to-date information.

Conclusion

The modification of FSSAI license have brought significant improvements to the food safety landscape in India. The introduction of a centralized licensing system, the online application process, the categorization of food businesses, revised validity periods, strengthened compliance measures, and strict enforcement mechanisms have collectively enhanced the effectiveness of FSSAI’s regulatory framework. These modifications not only streamline the licensing process but also encourage food businesses to prioritize food safety and maintain high standards throughout their operations. Ultimately, these efforts contribute to safeguarding.

Legal services rendered by an individual attorney, a law company, or senior attorneys are subject to an 18 per cent tax under the Central Goods and Services Tax Act. Legal services refer to products and services offered by Advocates and Lawyers in regard to consultation, advice, or help in any area of law, as well as representative services in front of any court. Under the GST, legal services are given particular consideration.

- Legal services are defined under the notification number’s entry 2 (zm). 12/2017 – Central tax (rate), dated June 28, 2017, which is reproduced below:

- Legal services include representational services before any court, tribunal, or authority and encompass any service related to guidance, consultancy, or help in any area of law in any way.

Many of us have taken some legal aid but have you ever thought about the GST levied on it? Through this article, the author will elaborate on the procedure of GST on legal services that have been amended in the Indian indirect taxation system. Read on to learn more about the applicability, exemption, and GST rate on legal services offered by an advocate(s) or law firm(s) in India.

Applicability of GST on legal services

Any legal services provided by a lawyer or law firm to a company with annual aggregate revenue of at least 20 lakhs of Indian rupees are subject to a GST charge. GST on legal services provided by a senior advocate to another advocate or firm of advocates must also be paid.

- Since the passage of the GST law, the taxation of legal services has remained constant. Attorneys and law firms are exempt from the reverse charges.

- All indirect taxes have been consolidated into a single levy under the Central Goods and Service Tax Act of 2017 (CGST Act) and other GST laws.

- Section 7 of the CGST Act deals with charges when the term “supply” is considered to include all forms of supplying goods or services in exchange for money or both in order to further a business.

- Article 279A of the Indian Constitution states that the GST Council determines the tax rate for legal fees for legal services. Exclusions from the prior system were carried over.

Businesses operating in general category states, such as the Northeast that generate up to INR 20 lakh or INR 10 lakh in revenue are exempt from paying taxes.

Numerous changes have taken place since the government introduced the GST in July 2017. For legal services subject to GST on legal services, senior advocates are listed in a separate category on the reverse charge list. They fall under the category of services for reverse charges.

Under the Reverse Charge provision (RCM) of the GST laws, all legal services, whether offered by a law firm or an individual, are liable for payment. Since all of them would be exempted from GST application for legal services, no other output produced by law firms or attorneys who offer legal services is subject to GST liability.

Meaning of Advocate, Senior Advocate and business entity

Understanding what the terms “advocate,” “senior advocate,” and “business entity” imply in the context as mentioned earlier is crucial:

- Advocate

The definition of Advocate states:

The term has been defined under Section 2(1)(a); the provision says that ‘An advocate is someone who has entered in any roll under the provisions of this Act.’

- Senior Advocate

The definition of Senior Advocate states:

There are two kinds of advocates: senior and other advocates. If the Supreme Court or a High Court determines that an advocate merits such distinction due to his ability to stand at the Bar or unique knowledge or expertise in law, the designation of senior Advocate may be made with the Advocate’s assent. Senior solicitors must abide by any limitations on their practice that the Bar Council of India may impose in the best interests of the legal community. For this section, a Supreme Court attorney who was a senior attorney before the designated day is considered a senior attorney.

- Business Entity

The notification states that a business entity means any person carrying out business.

Legal fees and services under the subject to GST

As of June 28, 2017, the following legal services are defined under entry 2 (zm) of notification no. 12/2017 – Central tax (rate): Legal services include representational services before any court, tribunal, or authority and include any services linked to advising, consulting, or help in any area of law, in any way.”

Furthermore, it is stated that notification No. 13/2017-Central Tax (Rate), dated June 28, 2017 (Serial No. 2), is applicable. For example, it states that the following services fall under the purview of the reverse charge mechanism:

“Services supplied by an individual advocate(s), or a senior advocate(s), by way of representational services before any Court of Law, Tribunal, or Authority in India, directly or indirectly, to any business entity located in the taxable territory of India.

The objective was to adapt the indirect tax system to all areas of economic activity. Legal services that were taxable and came into the “legal consultancy services” category were subject to service tax.

The service tax law put into effect the Negative List Regime in 2012. Any legal services rendered by an individual or a law firm are expressly exempt from the GST by the government. However, when the levy is applied on a reverse charge basis, there is no exemption from the requirement to pay service tax. Alternatively put, the customer or service user was in charge.

Thus, no registration was required for lawyers and law offices back then. However, the GST on law firms and on all the legal services must follow the 2017 GST system, which was recently established.

Does that indicate that lawyers who work for businesses rather than legal firms must follow the rules of the reverse charge mechanism? A person must pay GST even if they are not currently practising law.

Previously, neither service providers nor recipients were required to pay taxes. If you hired a non-attorney to perform similar services, it was taxed. However, attorney and law firm fees are subject to GST, even though they are exempt from paying it.

Therefore it is required by a lawyers to first obtain GST registration before beginning a private practice or acting for themselves. Currently, the GST does not necessitate the registration of legal professions. Furthermore, since all taxes combine into one, you are exempt from paying professional taxes.

Meaning of Reverse Charge Mechanism (RCM) under GST law

The Reverse Charge Mechanism (RCM) is a procedure that allows the recipient to pay the GST rather than the supplier. In this instance, the recipient/receiver, instead of the supplier, is responsible for paying the tax.

Latest Update

- 19th December 2022

The Karnataka GST AAR released the decision for M/s Yaadvi Scientific Solutions Private Limited. It was determined that reimbursements for expenses incurred by employees on behalf of the organisation are not taxable under the GST Act 2017 since they fall under Schedule II.

- 09th December 2022

GST AAR: RCM is not applicable to director reimbursements for costs incurred on the company’s behalf.

The statement “Ignore prompt on liability for inward supplies attracting reverse charge in Table-3.1(d).”

In accordance with the GST acts and revisions, the government has finally implemented the reverse charge mechanism as of February 01, 2019. Also, to note that the exemptions up to INR 5000 will be effectively eliminated.

In the following scenarios, the Reverse Charge Mechanism is applicable:

- Imports

- Purchase from an unregistered dealer

- Supply of notified goods and services

This flips the situation around because taxes must be paid by the person receiving the goods and services. A GST must be paid on behalf of the recipient if they are making purchases from unregistered sellers. The supplier needs to give the recipient a payment voucher. As per the Section 2(94) of the CGST Act of 2017, the beneficiary must be registered.

According to Section 2(98) of the CGST Act of 2017, a “Reverse-Charge” is when the recipient of a supply of goods or services or both is responsible for paying tax rather than the supplier of such goods or services or both.

As mentioned under sub-section (3) and sub-section (4) of Section 9 or

under sub-section (3) and subsection (4) of Section 5 of the Integrated Goods and Services Tax Act of 2017.

GST on RCM

When an attorney or law firm enters into a contract for legal services with another attorney or law firm, the RCM on legal services is also in effect.

In accordance with the “Goods and Services Tax and Legal Services” mechanism, the recipient is liable for paying the taxes owed as a result of the reverse charge. The GST on legal services received by the client must be paid and deposited directly to the government, per Section 9(3) of the Central Goods and Services Tax Act, 2017.

Solicitors must first register to provide legal services under the GST system’s reverse charge procedure. Similar to other service providers with an aggregate turnover of more than Rs. 20 lakhs, legal service fees are subject to GST.

Conclusion

It is often believed that law firms and individual Advocates are exempt from the GST on legal services, but legal services rendered by an individual attorney, a law company, or senior attorneys are subject to an 18 per cent tax under the Central Goods and Services Tax Act. Legal services refer to products and services offered by Advocates and Lawyers in regard to consultation, advice, or help in any area of law, as well as representative services in front of any court.

Read our Article:What Is The Rules And Procedure To Surrender A FSSAI License?