Importer Exporter Code (IEC) is obtained by an individual or a company who intends to jump into the business of global trading. The issuance right of the IEC code is under the Director-General of Foreign Trade (DGFT). IEC code is the doorway to international trade. If you are the owner of the small business entity and willing to sell your offering at a global platform then an IEC license is something you can’t overlook.

IEC code is a ten-digit code that provides legal status to your business to carry the business of international trading. In this blog, we will unfold a legitimate way to obtain an IEC code. But before diving into the core topic, let’s look into some fruitful insights regarding IEC code.

Why you Need an IEC Code for your Business?

Unlike the domestic market, the global market is not easy to access due to unprecedented legal constraints. Someone who is looking to sell a product abroad has to encounter a series of legal obligations from customs and other related authorities. This is where the IEC code comes into the picture. This code legalizes the process of export and import and enables the traders to overcome unnecessary obstacles to clear the shipment from the port. The IEC code holder is deemed as a registered trader across the worldwide market.

Moreover, IEC can also help in obtaining payment from the overseas client. All in all IEC code is basic registration for every trader who wants to sell their internationally. The same thing applies to the importer as well. IEC Code Benefits in the following attributes, which are as follows:-

- Clearing the shipment from the customs and other authorities.

- Remitting money via authorized banks

- Receiving inward remittance from overseas buyers.

- Accessing subsidies from the customs and the other authorities.

Who Can Obtain an IEC Code?

Any individual or company with valid identification and resident proof can obtain an IEC code. The IEC code is available in the DGFT’s portal[1] where applicants need to fill applications for the same by filing the required application.

Procedural Steps Required to Obtain an IEC Code

The procedure below would let you avail of Import Export Code through an online mode.

Step 1: Reach out to DGFT Portal

Those who are seeking an IEC code needs to visit the official portal of the Directorate General of Foreign Trade website.

Step 2: Get Access to Online IEC Application

On the home page, head over to the “Services” section followed by IEC to get access to the Online IEC Application.

Step 3: Provide the PAN Card Number

After selecting the “Online IEC Application” the portal will give you access to the page where you need to enter the PAN number to proceed further.

Step 4: Complete the Verification Requirement

To complete the verification process, enter the registered Email id and phone number.

Step 5: Fill the e-IEC form

After being verified successfully, the portal will open the web-based form to obtain an IEC code. All you need to enter the requested detail in blank fields and upload the soft copy of mandatory documents. The fees are also required to go along with the application. Once submitting the document, the portal will generate the IEC code.

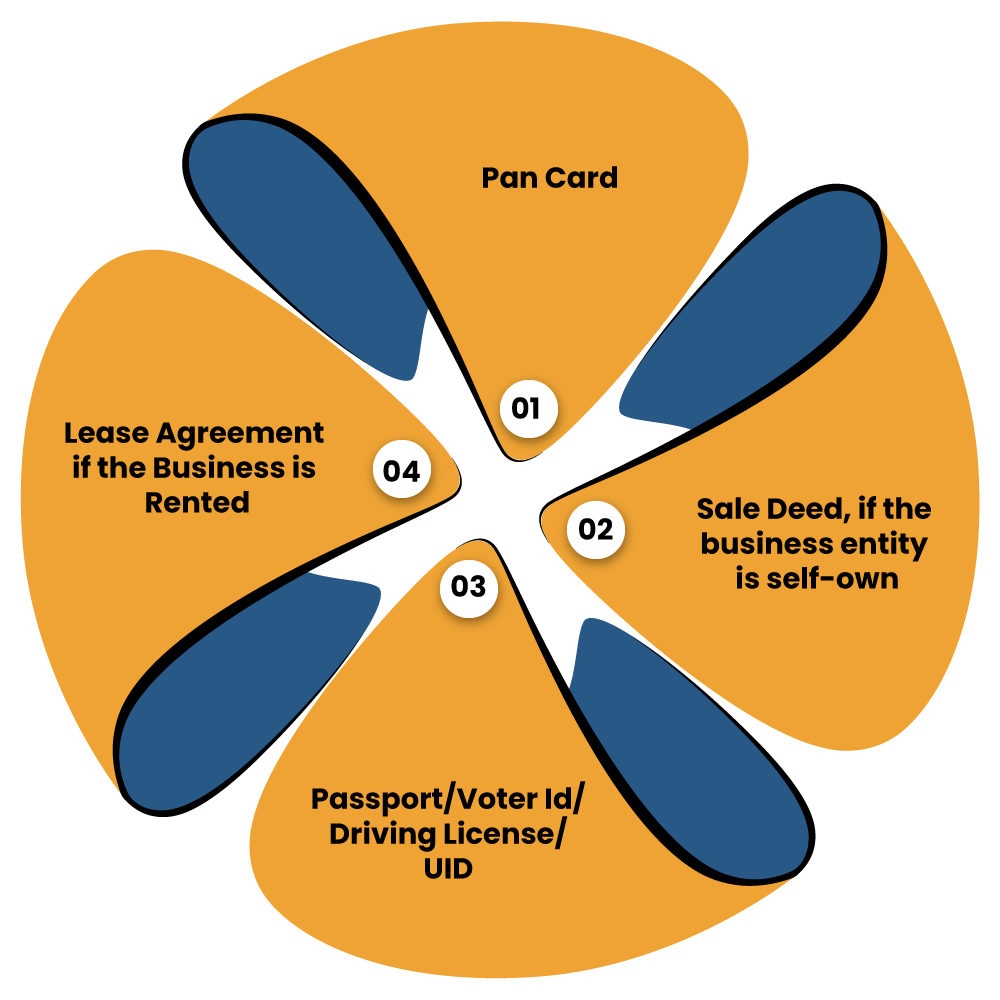

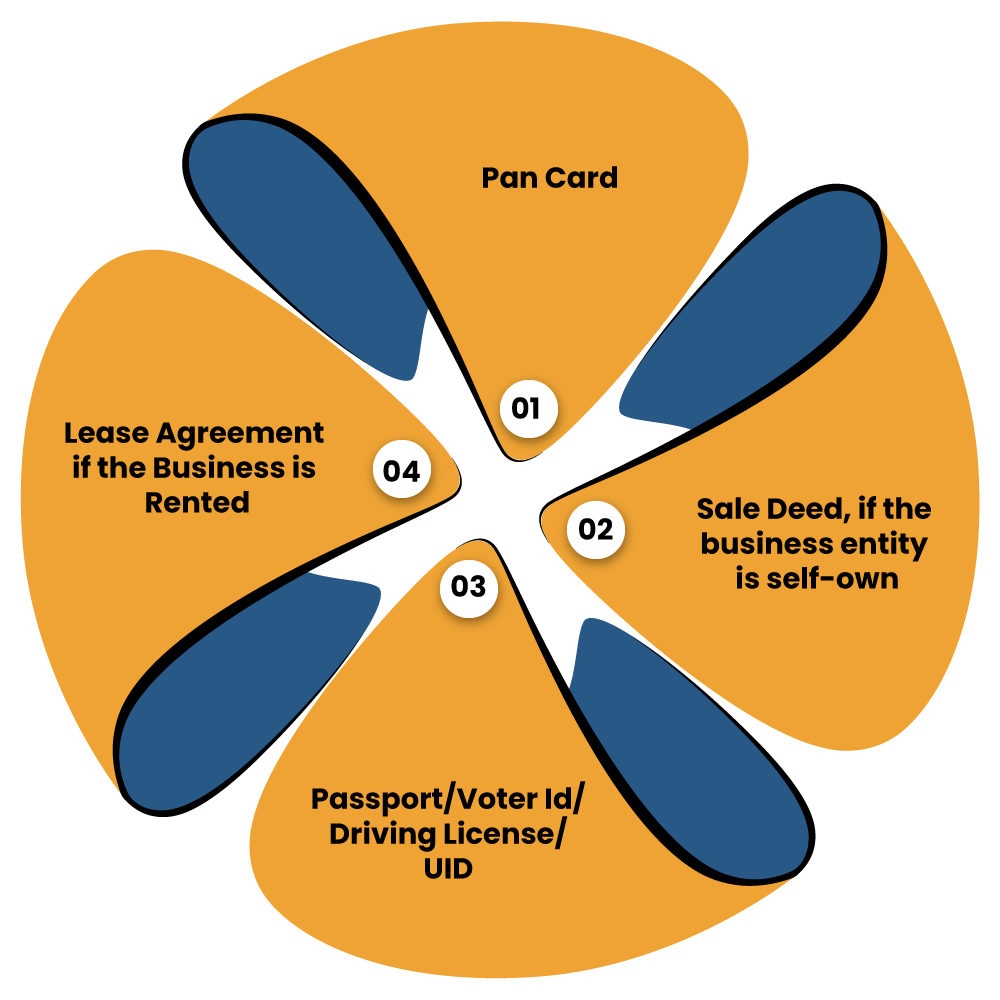

Requisite Documents for Small business to Obtain an IEC Code

Documents for Businesses under the Partnership Category

- Copy of Partnership deed/

- Passport/Voter Id/UID/Driving License/PAN of the managing partner

- Passport/Voter Id/Driving License/UID

- Sale Deed, if the business is self-own

- Bank certificate/canceled cheque

That means small businesses also have the privilege to obtain an IEC Code just like bigger companies. Now let’s dive into Do’s and Don’ts of IEC registration.

What are the Do’s and Don’ts for an IEC Registration?

- Keep the customer reference numbers and ECOM handy.

- The application can fill up the IEC application in an offline mode.

- The PAN number, contact number, and email id is non-alterable after completing the IEC registration at the IEC portal.

- Since not all businesses require IEC code, do not forget to determine the exemption for the same.

- Do not apply for more than one IEC against one PAN number.

- Do make a mistake of obtaining a dual IEC code against one PAN number as it is not permitted under the law.

- In case of application rejection, one can get started with the registration process again.

- Applicants are free to alter or reload the files of supporting documents before completing the application process.

- Providing wrong information in an e-IEC form is a punishable offense.

- The modification of the IEC profile could be done at the DGFT portal on the payment of Rs 200/-.

- Make sure to ascertain the adaptability quality of your product in the given market before you obtain an IEC code.

- Get details info about the target market in which you wish to export the product.

- Ascertain regulations, provisions, and limitations about cross-border trading from the legal perspective to avoid future conflict.

Conclusion

So it is obvious that IEC code is one of the most prerequisites that one has to obtain for commencing cross-border trading of goods. Once obtained, the IEC would serve your business lifetime, which indicates that you don’t have to renew it again and again as long as your business is active. Free feel to drop any query related to IEC code in the comment section. We will strive to put in our best effort to respond to them promptly.

Read our article: A Detail Guide to Complete IEC Modification Online