The Goods and Service Tax Act was enacted by the Indian Parliament on March 29, 2017, and it became operative on July 1 of that same year. GST is a tax that is applied to goods and services from the point of manufacturing to the customer. This taxing scheme has been implemented in over 160 nations. Whether separate GST registrations are required for each state is a crucial question that companies operating across many states must answer in the ever-changing environment of India’s Goods and Services Tax (GST). All providers of taxable goods and services are required under the CGST Act to register with the GST in the State or Union territory where the taxable supply of goods or services occurs.

Additionally, the GST Registration Rules provide provisions for acquiringGST registration for branches. Businesses are now required to file under GST compliance since the government adopted the Goods and Services Tax regime, particularly if your company operates out of many locations. This is because the GST tax approach is a destination-based tax approach.

We shall explore the subject of GST registration for multi-stage operations in this blog. So let’s begin by getting a broad understanding ofIndia’s Goods and Services Tax as well as GST registration in Multiple States.

What is Goods and Service Tax?

The financial relationships between the Indian Central Government and State Governments have undergone a significant change as a result of the introduction of the Goods and Services Tax (GST). Many indirect taxes imposed by the central and state governments have been replaced with the single Goods and Services Tax (GST). The ability to impose and collect taxes on goods and services is shared by the federal and state governments under the GST. The integration of the economy has been facilitated by the increased consistency and harmonization of tax structures among States as a result of this. Any business that qualifies for GST has to register on the GST site that the Indian government has set up. A special registration number known as the GSTIN will be assigned to the registered companies.

Registration is required for all service providers, purchasers, and vendors. Businesses that earn Rs. 20 lakhs or more in revenue over the course of a fiscal year are mandated to register for GST. The Goods and Services Tax (GST) is a destination-based tax that is applied just once, at the moment when a customer consumes goods or services. It is an integrated tax in which the majority of the former indirect taxes, including service tax, VAT, cess, and other taxes (17 Taxes), have been merged into one tax structure. The GST will create a single, shared national market and operate under the theory of “One Nation, One Tax.”

What is GST Registration?

Companies that have revenue over the threshold of Rs. 40 lakh, Rs. 20 lakh, or Rs. 10 lakh, depending on the circumstances, are required under the Goods and Services Tax (GST) to register as regular taxable persons. We refer to it as GST registration. Certain companies are required to register under the GST. Obtaining a distinct, 15-digit Goods and Service Tax Identification Number (GSTIN) from the GST authorities is a prerequisite for registering a company with the tax authorities. This number allows for the collection and correlation of all business-related data and processes. In order to manage your business efficiently, you must first register for GST. This allows the business to function lawfully and helps build your brand as trustworthy and genuine.

Why is GST Registration Vital?

Uniform Tax Regulations

Tax rates and structures will be uniform nationwide with the introduction of the Goods and Services Tax (GST), which will boost predictability and make conducting business easier.

Elimination of Cascading

There would be less tax cascading if there was a system of seamless tax credits across state lines and the whole value chain. This would lower operating expenses that are not readily apparent.

Management of Taxes is Easy

The GST is replacing a number of other indirect taxes at the central and state levels. GST is more straightforward and easier to administer than all previous indirect taxes imposed by the Centre and States combined with a strong end-to-end IT infrastructure.

Improved controls over Leak

A robust IT infrastructure brought up by GST would lead to improved tax compliance. The smooth transition of input tax credit from one value-adding stage to the next means that the GST design has a mechanism to encourage merchants to comply with tax laws.

Increase in Revenue Efficiency

GST is anticipated to lower the cost of the government’s tax revenue collection, which will increase revenue efficiency.

Growing Efficacy in Logistics

The Goods and Services Tax (GST) has facilitated the movement of goods and services across states, decreased business costs, and enhanced overall logistics and operations.

Enhance Transparency

With its transparent tax structure and full picture of taxes paid and collected, the Goods and Services Tax (GST) system helps to lessen corruption in associated agencies and the tax administration itself.

Simple in Accessibility

Higher compliance is encouraged by the ability to file GST returns at any time and from any location using a web-enabled device, such as a PC, tablet, or smartphone.

Small Enterprises have Easy Access.

Micro, small, and medium companies (MSMEs) no longer have to worry about the hassle of complying with numerous regulations, and the tax system has become more straightforward thanks to the Goods and Services Tax (GST).

Digitization

The Goods and Services Tax (GST) has prompted firms to digitize, leading to increased operational efficiency and more transparency in reporting.

Boost in Economy

The whole economy has profited from increased tax revenue and more effective interstate supply networks, particularly the less developed states that can now share in the greater GST amount that may be dispersed around the nation.

What Does GST Registration in Multi-Stage Business Mean?

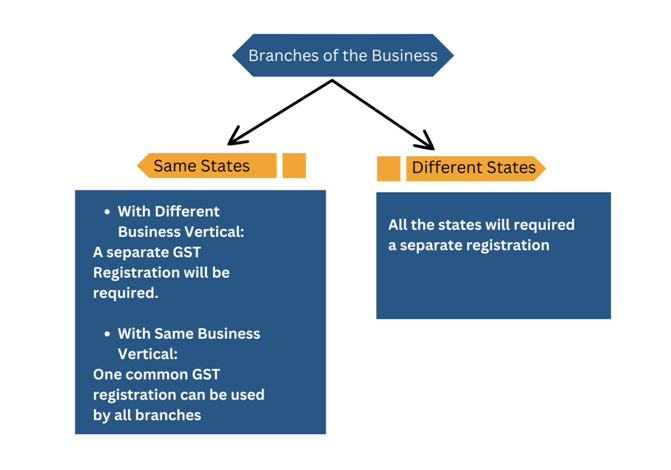

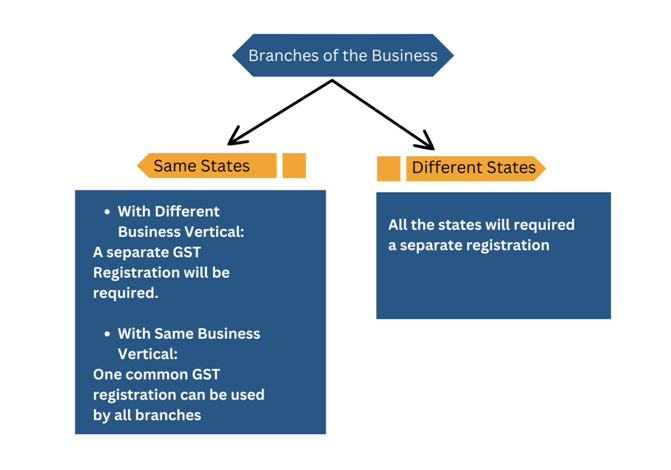

In terms of GST, a multi-stage business is one that operates in many Indian states. A jewellery shop that operates throughout Gujarat, Rajasthan, and Maharashtra, for instance, is a multi-state business that operates in many Indian states. In this case, the company will also need to register for GST in Maharashtra, Rajasthan, and Gujarat. Therefore, you must register in each state from which you want to make outward supply. Furthermore, rather than being set at the shop or state level, the GST registration turnover criteria are set at the PAN India level.Obtaining numerous GST registrations is not required if you operate various branches inside the same state. Only if you have branches in other states is it required.

The goal of maintaining several GST registrations across several states and union territories is to adhere to India’s indirect tax regulations. A business that has a taxable presence in more than one state must obtain separate GST registrations under the Goods and Services Tax (GST) system. This requirement is meant to protect the company from penalties for non-compliance and to guarantee that it can accurately collect and submit GST on the supplies that it generates in each state.

Hence, if you operate more than one branch in the same state, you are not required to seek multiple GST registrations. Only if you have branches in other states is it required. The state of registration is indicated by the first two digits of a GST registration number. Therefore, the first two digits of the GSTIN would change if the company operated in two distinct states, but the entity’s PAN would stay the same. Additionally, the entity code would alter if a state had several GST registrations.

What Are the Advantages of GST Registration in Multi States?

Enhanced tax preparation

By maintaining distinct records for various company divisions, multiple GST registration enables firms to manage their taxes more efficiently and perhaps reduce their tax burden. It accurately ascertains if it is taxable in each state and union territory and guarantees that the GST regulations are followed.

Greater Transparency

By clearly separating the transactions and tax obligations of several company divisions, multiple GST registration enhances transparency and can be beneficial for tax planning and decision-making.

Simpler Adherence to Tax Law

Since firms can keep various records and accounts for each business unit, it is easier to comply with tax laws when there are separate GST registrations for each unit.

What is the procedure for GST Registration in Multi States?

The procedure for GST registration in multi-state is similar to a standard GST registration procedure. Following are the steps of GST registration in India:

- The first step is to get a PAN number for the business. A PAN number is issued by the Department of Income Tax in India.

- You can register the business for GST by using the GST portal made available by the government of India.

- Fill in all the necessary details regarding the business and its goods or services.

- Attach the necessary documents, which are mentioned in the state-wise requirement for the GST registration in multiple states.

At Corpbiz, our GST experts are well-equipped with GST registration for multi-state branches and can provide expert assistance and guidance for the same.

What are the Crucial Documents Required for GST Registration in Multi States?

There are many essential documents that are required to be submitted at the time of GST Registration in multiple states. GST registration can differ in different states. There can be some requirements that are state-specific in GST registration for multi-state branches. This is also seen in the case of documents for GST registration in multiple states. Some of the general documents required for GST registration in India are mentioned below:

- PAN Card of the company

- Certificate of Incorporation of the company, which is provided by the MCA.

- Articles of Association of the company

- Memorandum of association of the company

- Identity proofs

- Address proof of the company

- Photograph

- All company director’s address proof

- The Aadhaar card of the signatory

- Other additional documents as per the requirements of the specific state.

What Is the Impact of GST Registration for Multiple State Branches?

The GST registration for the multi-state branches, like a coin, has both negative and positive impacts.

One of the best positive impacts of GST registration for multiple state branches is having a clear picture of all the state branch’s tax compliance and performance. All the branches can claim ITC respectively according to the regulations mentioned. With GST registration in multiple states, each having a separate GSTIN will help separate the transactions and guide decision-making and planning. It can also aid in financial and tax management.

As we are aware, when a business has more than one branch, and the other branches are in different states, a GST registration for that particular state is also required. When a company has 2-3 branches, it can be challenging for the business to handle all the diverse regulations of the different states. It can lead to a complex compliance of procedural regulations for the business. Managing all the administration work for all the branches can sometimes be burdensome for the business.

Corpbiz’s GST experts can help your business overcome all the challenges and ensure thorough compliance with all the GST regulations.

Conclusion

In conclusion, transparency is facilitated by multi-state GST registration, which helps with tax compliance, planning, and decision-making. Although it simplifies operations, various state rules lead to complications. Despite its challenges, multi-state GST registration helps businesses develop in India’s complicated tax environment by providing them with more clarity in tax compliance and informed decision-making across branches. The goal of maintaining multiple GST registrations across several states and union territories is to adhere to India’s indirect tax regulations. A firm that has a taxable presence in more than one state must obtain separate GST registrations under the Goods and Services Tax (GST) system.

Frequently Asked Questions

Yes, provided they are in the same state and have separate trade names, you may register two distinct companies under a single GSTIN. Under GST, this is referred to as a vertical business.

Businesses in India must register for GST if their annual revenue exceeds Rs. 40 lakhs (or Rs. 20 lakhs for enterprises in certain special category states).

A taxpayer should get a separate GST registration for each state in which a business is operating.

It is feasible for an individual to have numerous GST registrations at the exact location as long as they meet the requirements of having unique and different business sectors.

New branch offices in such states must have several GSTINs, one for each state as relevant. You must apply for a new GST registration for the new branch if you are launching another one in the fourth state.

Applying for a GST registration in more than one state follows a similar procedure to that of registering in only one state. Companies that have a taxable presence in any state or union territory must apply for registration, submit the necessary paperwork, and pay the associated costs.

No, As per Section 22(1) of the CGST/TSGST Act, any individual who is eligible for registration must register individually for each State in which they operate a business and are required to pay GST.

GST is a multi-stage, destination-based comprehensive tax that is imposed at every value-addition stage.

Read Our Article: How To Change GST Registration Details?