GST payment is a recurring obligation for businesses, crucial for maintaining compliance. According to guidelines, registered regular taxpayers must remit their GST amounts by the 20th of each month, coinciding with the submission of the GSTR-3B return. Within the GST framework, the payable tax is categorized into three segments:

- IGST (Integrated Goods and Services Tax): Applicable for interstate supplies, remitted to the central government.

- CGST (Central Goods and Services Tax): Levied on supplies within the state, remitted to the central government.

- SGST (State Goods and Services Tax): Applicable for intrastate supplies, remitted to the respective state government.

In addition to these payments, businesses must adhere to specific requirements:

- Tax Deducted at Source (TDS):

In cases where a government agency contracts a builder for services, TDS is deducted from the contract value at a rate of 1% before payment.

For instance, if a government agency awards a road laying contract worth Rs 10 lakh to a builder, TDS of Rs 10,000 (1% of the contract value) is deducted, and the remaining amount is paid.

- Tax Collected at Source (TCS):

Primarily applicable to e-commerce aggregators, TCS involves deducting 2% before making payments to dealers selling through e-commerce platforms.

Note: The application of TCS is currently relaxed and is not applicable unless notified by the government.

- Reverse Charge: This mechanism shifts the responsibility of tax payment from the supplier to the recipient of goods and services.

These varied components ensure a comprehensive understanding of the diverse tax obligations that businesses may encounter within the GST framework.

What are the specific GST payment processes for different types of taxpayers?

GST payment processes exhibit a general consistency across different taxpayer categories under GST. When a sufficient cash balance is available in the electronic cash ledger, no additional payment is required. However, if the balance is insufficient, taxpayers must use a challan to deposit funds into the cash ledger through prescribed payment modes. Here’s an overview of the payment procedures for various types of taxpayers:

- Regular Taxpayer:

Regular taxpayers utilize the PMT-06 challan when making GST payments for the electronic cash ledger, typically aligned with the filing of GSTR-3B. The transaction details are reflected in the GSTR-3B. Challan creation and payment can occur either before or after login or during the filing of GSTR-3B returns.

- Quarterly Taxpayer (Under QRMP Scheme):

Taxpayers operating under the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme deposit taxes directly in the first two months of a quarter using the PMT-6 form. Payment for the last month (3rd month) of the quarter is made while filing GSTR-3B. Payments are due by the 25th of the next month for the first and second months of the quarter. When making payments with PMT-06, taxpayers must select the ‘Monthly payment for quarterly return’ reason and opt for either the Fixed Sum or Self-Assessment method.

Note: The QRMP scheme, introduced from the January-March 2021 quarter onwards, allows taxpayers to file GSTR-1 and GSTR-3B after the quarter concludes.

- Taxpayers Filing Nil GST Returns:

Taxpayers with no sales, purchases, or tax payable for the relevant period (monthly or quarterly) are not required to use a challan or make any payment.

- Composition Taxable Persons:

Composition taxable persons summarize their sales/turnover details for the quarter in the CMP-08 challan and proceed to make the tax payment.

How do you choose the right GST payment mode?

Businesses have the flexibility to choose a suitable mode for GST payment when generating the GST challan (PMT-06), considering factors such as time availability, convenience, and banking preferences. Here’s an overview of the available modes for GST payment on the GST portal:

Online Payments:

- Net Banking: Payments made through internet banking.

- Debit Card/Credit Card (Not Activated): Card payments can be utilized if activated.

- Immediate Payment Services (IMPS) and Unified Payment Interface (UPI): Introduced through CGST Notification number 14/2022 dated 5th July 2022.

Notes on Online GST Payment:

- Online payments can be made with or without logging into the GST portal.

- There is a specific list of banks authorized for online payments on the GST portal.

- The electronic cash ledger is automatically updated after online GST payments. Immediate payment is crucial if generating the challan without logging in.

Offline Payments:

- Over the Counter (OTC): Includes Cheque, Demand Draft, or Cash.

- National Electronic Fund Transfer/Real-Time Gross Settlement (NEFT/RTGS): Electronic fund transfer options.

Notes on Offline GST Payment:

- Offline options are available for voluntary selection or when a taxpayer’s bank is not listed for online payments.

- For OTC, the taxpayer needs to print the challan, fill in the details, sign it, and submit it to the bank. The update to the electronic cash ledger takes a day or two.

- The maximum OTC payment limit is Rs 10,000; for amounts exceeding this limit, alternative modes must be chosen.

- For RTGS/NEFT, after generating the challan, the taxpayer prints it, fills and signs the mandate, submits it to the bank, and receives a Unique Transaction Reference (UTR) number. The UTR is then linked to the particular challan through the GST portal.

Selecting the appropriate payment mode ensures a seamless GST payment process, aligning with the unique needs and preferences of each business.

How can businesses ensure compliance with GST payment rules?

- Invalid Return for Unpaid Tax: Furnishing a GST Monthly Return without paying the corresponding tax deems the return as invalid.

- Sequential Return Filing Requirement: Without filing the return and clearing the tax dues for a particular month, the subsequent month’s return cannot be submitted.

- Interest on Unpaid Tax: If the tax due is not paid, interest accrues from the GST payment due date on which the tax was supposed to be remitted.

- Importance of GST Payment: To avoid penalties associated with non-payment of taxes, it is crucial to comprehend and follow the GST payment methods.

What are crucial Forms for GST payments in India?

To facilitate the smooth processing of GST payments online in India, various forms are integral for dealers meeting their GST obligations:

- Form GST PMT-01:

Maintains the electronic tax liability register, providing a record of tax obligations.

- Form GST PMT-02:

Manages the electronic credit ledger, ensuring accurate tracking of available credits.

- Form GST PMT-03:

Issued by an authorized officer, communicates the rejection of a claim for a refund of the balance in the electronic credit ledger or electronic cash ledger.

- Form GST PMT-04:

Allows individuals to report discrepancies noticed in their electronic credit ledger, ensuring accuracy in ledger information.

- Form GST PMT-05:

Maintains the electronic cash ledger, recording cash transactions for tax payments, interest, penalties, fees, or other obligations.

- Form GST PMT-06:

A crucial form for generating challans, facilitating the payment of taxes, interest, penalties, fees, or any other specified amount.

- Form GST PMT-07:

Enables individuals to inform authorities if their bank account has been debited, but the Challan Identification Number (CIN) has not been generated or communicated to the GST portal.

These forms collectively streamline the GST payment process, ensuring transparency, accuracy, and effective communication between taxpayers and the GST portal. By using these forms, individuals and businesses can fulfil their GST obligations seamlessly and maintain accurate records of their financial transactions.

How do ledgers and set-offs Play a Role in the GST Payment Process?

In the GST payment process, registered dealers must adhere to maintaining three crucial ledgers in the GST payment portal. These ledgers serve as the foundation for the GST payment process:

- Electronic Tax Liability Register:

This ledger records all liabilities a person incurs, including tax, interest, penalty, late fees, or any other specified amount. Entries in this ledger represent debits.

- Electronic Cash Ledger:

Every deposit made by a person towards tax, interest, penalty, late fees, or other specified amounts is credited to this ledger. It reflects the available cash balance.

- Electronic Credit Ledger:

Credits in this ledger arise from self-assessed input tax credits, as claimed in Form GSTR-2. It can only be utilized for tax payments and cannot be applied to settle other liabilities such as interest or late fees.

GST Payment Ledgers Set-off:

To settle the liabilities indicated in the Electronic Tax Liability Register, a person can leverage the balances in both the Electronic Cash Ledger and the Electronic Credit Ledger.

When a liability is paid:

- The Electronic Tax Liability Register is credited by the amount paid.

- The Electronic Credit Ledger is debited by the credit utilized for the payment.

- The Electronic Cash Ledger is debited by the amount of the deposit used for the payment.

This set-off mechanism ensures a systematic and transparent approach to managing and settling GST liabilities. By utilizing the available balances across these ledgers, businesses can fulfil their tax obligations efficiently and maintain accurate records of their financial transactions.

How to Pay GST Online?

Making your GST payment online is a straightforward process. Here’s a step-by-step guide:

- Set-off Tax Liability:

Begin by using the credit available in the Electronic Credit Ledger to set off your tax liability.

- Deposit in Electronic Cash Ledger:

If there is a balance tax liability after set-off, deposit the required amount in the Electronic Cash Ledger.

- Generate Challan (Form GST PMT-06):

- Access the GST payment portal to generate a challan using Form GST PMT-06.

- Enter details of the amount to be deposited for tax, interest, penalty, fees, or any other specified amount.

- The generated challan is valid for 15 days.

- Make GST Payment:

Utilize one of the following modes for making the GST payment:

- Internet banking through authorized banks.

- Credit card or debit card through authorized banks.

- National Electronic Fund Transfer (NEFT) or Real-Time Gross Settlement (RTGS) from any bank.

- Over-the-counter (OTC) payment through authorized banks for deposits up to Rs.10,000 per challan per tax period, by cash, cheque, or Demand Draft (DD).

Note: If using NEFT or RTGS, a mandate form will be generated with the challan. Submit the mandate form to the bank making the payment; it is valid for 15 days.

- Generation of Challan Identification Number (CIN):

- Once the payment is credited to the government account, a Challan Identification Number (CIN) is generated and mentioned in the challan on the GST portal.

- The CIN confirms the successful payment and credits the amount to your Electronic Cash Ledger.

By following these steps, businesses can efficiently complete their GST payments online, ensuring compliance with tax obligations and maintaining accurate financial records.

How to Calculate GST Payments?

To calculate the GST payment that has to be made, the following methods apply, with variations based on the dealer type:

Common Calculation Steps:

- Determine Outward Tax Liability: Identify the GST payable on outward supplies.

- Reduce Input Tax Credit (ITC): Subtract the Input Tax Credit from the outward tax liability.

- Adjust TDS/TCS: Deduct TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) from the total GST to get the net payable amount.

- Incorporate Interest and Late Fees: Add any applicable interest and late fees to arrive at the final payment amount.

- Cash Payment for Interest and Late Fees: Note that Interest and late fees cannot be claimed as Input Tax Credit and must be paid in cash.

Dealer-Specific Calculations:

- Regular Dealer: Calculate GST payable as the difference between outward tax liability and Input Tax Credit (ITC).

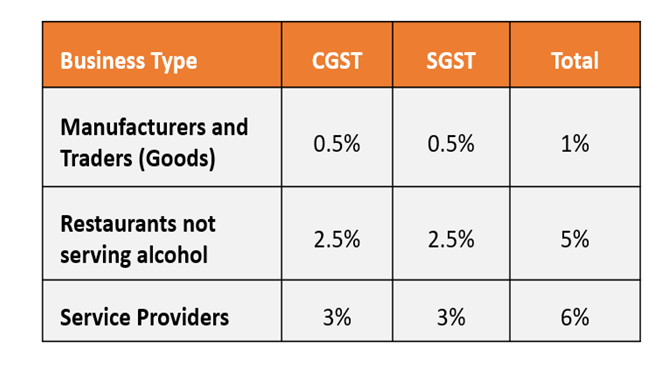

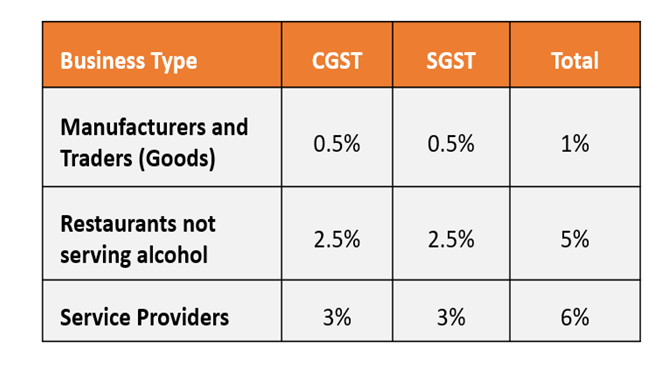

- Composition Dealer: For a composition dealer, payment is straightforward, involving a fixed percentage of GST on total outward supplies based on the business type.

Composition Scheme Rates

What is the Deadline for GST Payment?

GST payment is due when filing GSTR-3, specifically by the 20th of the subsequent month.

What are the Penalties for Non-Payment or Delayed Payment of GST?

In instances of underpaid, unpaid, or delayed GST payments, dealers face both interest charges and penalties. The interest rate is set at 18%, and a penalty is levied, determined as the higher of Rs. 10,000 or 10% of the tax amount that was underpaid or unpaid.

Conclusion

The GST payment process is a critical aspect for businesses to ensure compliance and smooth operations. A fundamental understanding of GST payment formats, accurate calculations considering factors like Input Tax Credit and TDS/TCS, adherence to the GST payment schedule, and meticulous recording of GST payment vouchers are imperative. Businesses must stay vigilant to make timely GST payments online, avoiding penalties and disruptions in their operations. By navigating the complexities of GST payments with diligence, businesses can uphold financial transparency, adhere to regulatory requirements, and contribute to their sustained success.

Frequently Asked Questions (FAQs)

GST payments are typically due on the 20th of the month following the tax period for monthly filers. Quarterly filers have until the last day of the month following the end of the quarter.

Delayed GST payments may attract interest charges at a rate of 18%, and penalties could apply. It is crucial to adhere to the specified payment deadlines to avoid financial repercussions.

No, ITC cannot be claimed on interest and late fees. These must be paid in cash.

GST payments can be made online through modes such as Internet banking, credit/debit cards, NEFT/RTGS, or over-the-counter (OTC) with authorized banks.

To calculate GST payment, subtract the Input Tax Credit (ITC) from the outward tax liability. Adjust TDS/TCS, add any applicable interest and late fees, and then make the cash payment for interest and late fees.

No, a GST Monthly Return cannot be considered valid if the corresponding tax payment has not been made. It is essential to settle tax liabilities before filing returns.

Penalties for non-payment or delayed payment include interest charges at 18% and a penalty, which is the higher of Rs. 10,000 or 10% of the tax underpaid or unpaid.

Regular dealers calculate GST payable as the difference between outward tax liability and Input Tax Credit (ITC). Composition dealers pay a fixed percentage of GST on total outward supplies based on their business type.

Read Our Article: GST Registration For Multi-Stage Operation