Employees State Insurance Act, 1948 regulates Employees’ State Insurance (ESI) in our country. ESI is a self-financed social security scheme that aims to safeguard employees under the regime of the ESI act. Employees of a registered firm are covered against the fiscal crunch that occurs due to health and other issues. ESI for employees aims to stabilize the life of workers with a string of monetary and health-related benefits. In this write-up, we will discuss about this scheme.

Who Comes Under the Regime of ESI Scheme?

As per the ESI Act, 1948, the scheme encompasses the establishments where the worker’s strength is ten or more. The organized and unorganized sector has to opt for the ESI for employees without exception.

The same norms are applicable to the non-seasonal factory where the worker strength is ten or more. Moreover, the scheme’s applicability has been extended to hotels, cinemas[1], shops, educational institutions, and private medical institutions since 2001.

However, the worker strength needed for ESI registration for factories is ten nationwide. For establishments, this limit has been capped under 10-20 based on the state.

Who all are Eligible to get Registered?

Employees who are earning less than or equal to Rs 21,000 are eligible under the ESI act. Previously, this limit relating to ESI for employees was capped at Rs 15,000, which the government extended in 2016.

Read our article:Employees State Insurance (ESI) Scheme in India

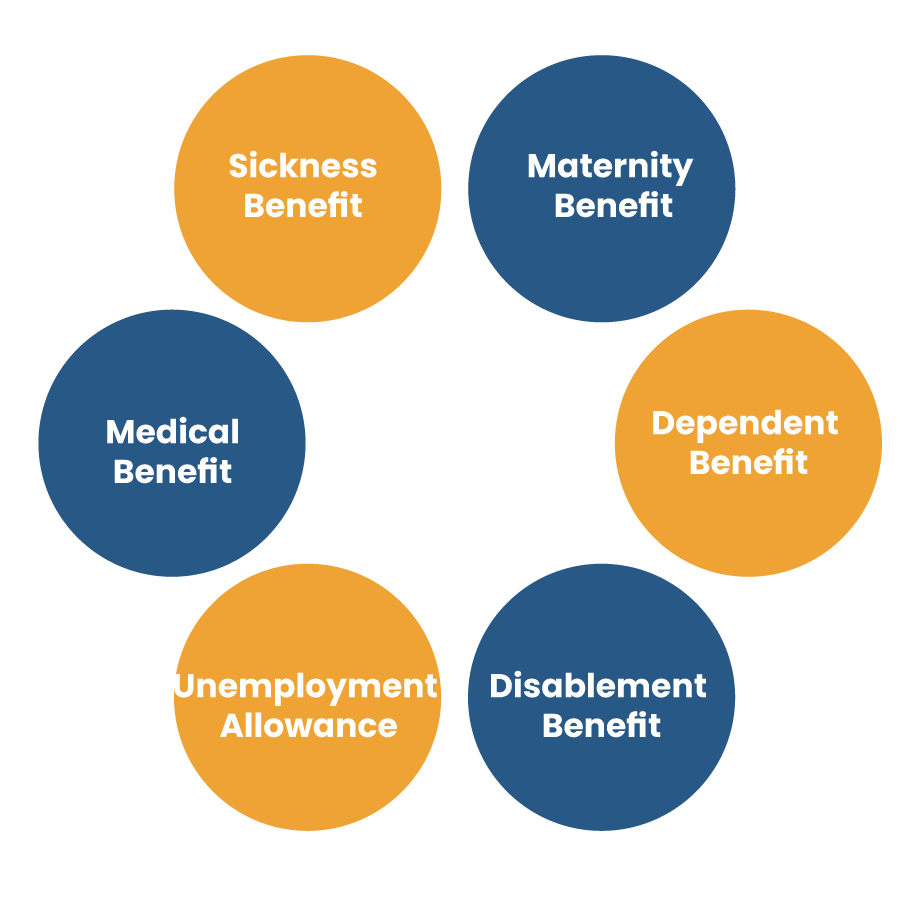

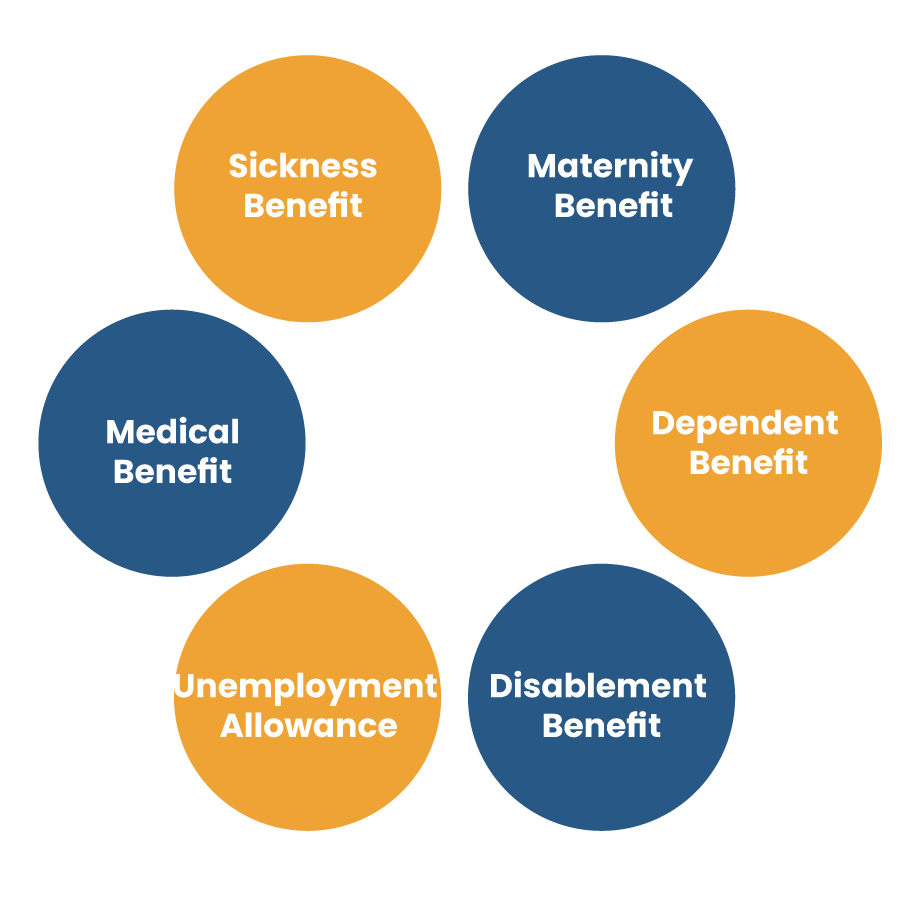

What are Viable Benefits Related to ESI for Employees?

The scheme renders monetary and health-related benefits to the insured employees. The contributions made by employees & employers funds these benefits to be in existence.

Registered workers are eligible for full medical care when they are incapable of performing their duties due to health-related issues. The scheme relating to ESI for employees renders fiscal help to compensate for the loss of wages due to absenteeism from work due to sickness or hospitalization in any ESI hospital.

The income limit for accessing medical-related benefits under the ESI scheme by the dependent parents of a registered individual has been raised to Rs 9,000/month from Rs 5,000 in Feb 2019.

What is the Process of Registration Relating to ESI for Employees?

Any employer that fits to norms under ESI Act can get its factory registered under ESI via ESIC web-based portal. Previously, ESI registration was not an online process, and a lot of documents were required to address the registration formalities.

After the advent of the digital platform the registration process has been simplified. The following steps would help you complete the registration process:-

- Reach out for the EPFO portal.

- Select the option “Establishment Registration” located on the home page.

- A new window will be prompted on the screen, which lets you download the manual related to employers’ EPF registration.

- Before furnishing the form, it is compulsory to avail of the DSC. Make sure to follow the instruction in the manual to get the DSC from the respective certifying authority.

- On the subsequent page, tap on the option “Sign-in. If you are already serving as a registered user, login with the help of UAN and password.

- On the sign-in page, provide your name along with email and other information accordingly.

- After completing the sign-in formalities, tap on the option “Registration for EPFO-ESIC.”

- On the subsequent page, tap on the option “Apply for New Registration.”

- Now you will be provided with the following options. All you need to opt for the right one that fit your need.

- “Employees’ State Insurance Act”

- “Employees Provident Fund and Miscellaneous Provision Act, 1956.”

- On the next page, you were required to complete the following details related to the employer’s online EPF registration.

- Details of establishment

- Employer & employee details

- Identity proofs

- Details related to work and others

- Once done, tap on the Submit button to wrap up the proceeding.

- After this, the DSC would be submitted against the new application.

- As soon as you are done with the above requirement, a confirmation mail will be sent to your registered email address.

An Outlook on ESI Contribution Rates

The ESI contribution is comprised of employer’s & employee’s contribution at pre-determined rates. These rates are alterable and are subject to periodic modification.

As of now, the employer’s contribution has been set to 3.25% of the wages, and that of employees is 0.75% of the wages paid in every wage period. Generally, the wage timeline is a month. Employees whose daily average income is around Rs 176 are exempted from payment of their contribution. But, the employer is liable to contribute their share for such employees.

Due Dates Related to ESI Payment & Return Filing

An employer ought to pay their contribution & the employees’ contribution monthly to the ESIC. The due date for paying such contribution is the 15th of the following month.

Moreover, employers require filing ESI return every six months. Here are the deadlines for filing half-yearly ESI returns:

| Period of return | Due date of filing returns |

| April to September | 11th November |

| October to March | 11th May |

However, these deadlines can be extended or modified via an official notice by the concerned authority. For example, deadlines of ESI contributions for Feb and March 2020 were extended by the authority to May 15, 2020. The deadline for filing ESI return for October 2019 to March 20 was extended to June 11, 2020, from May 11, 2020.

What is the Penalty for Late Payment or Non-Payment of the Contributions?

Simple interest @ 12%/annum for each day of payment delay will be applicable to every employer who fails to make the timely payment related to the ESI contributions.

Additionally, delayed payment, false payment, or non-payment under the ESI Act may lure imprisonment up to 2 years & fine up to Rs 5,000.

Moreover, the IT act disallows ESI contributions deposited after the prescribed deadline. The employers shall not reap deduction benefit of said contributions & will end-up paying income on it.

Conclusion

If you wish to spend your precious time managing core business operations & not wondering about the said due, then you must get in touch with CorpBiz’s legal associate. ESI for employees aims to ensure the well-being of the workers via monetary and health-related schemes.

A registered firm’s employer has to closely monitor the implications regarding ESI contribution or else they might end up paying severe penalties. Feel free to share your views related to this by commenting in the message box. We will try to respond to your concern swiftly.

Read our article:ESI Eligibility, Advantages and Enrolment Procedure