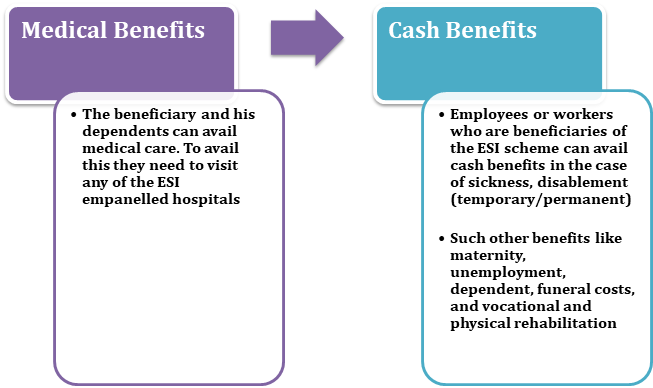

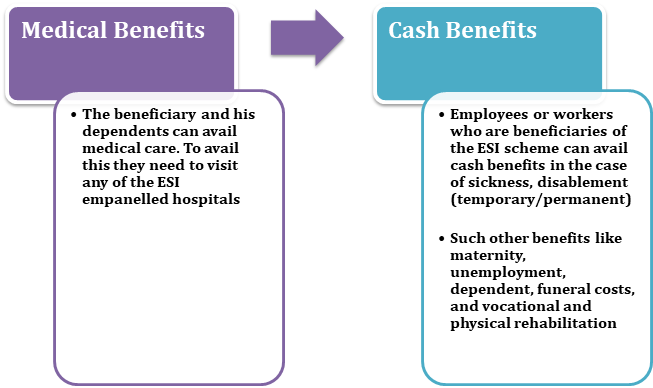

ESI eligibility provides full medical care to an employee and his dependents that are admissible from day one of insurable employment.

The insured persons must also be entitled to a variety of cash benefits in times of physical distress due to any sickness, temporary or permanent disablement, etc. resulting in loss of earning capacity. The confinement with respect to insured women, dependents of an insured person who dies in industrial accidents or because of employment injury or occupational hazard, is entitled to a monthly pension called the dependant’s benefit.

What is ESI eligibility?

Employees State Insurance Scheme of India is a social security system tailored to provide the socio & financial protection to worker population and their dependents covered by the ESI eligibility scheme.

- If a company/organization/business establishment employs 10 or more employees or workers, and Maharashtra and Chandigarh are more than 20 employees, they require ESI registration. The company must register itself with an ESIC for availing ESI eligibility schemes.

- As for workers or employees, they must be covered or entitled under ESI when their earning is less than Rs.21,000 monthly and Rs.25,000 in the case of a person with any disability. The worker contributes 1.75% of the salary while the employer contributes 4.75% towards the ESI scheme. Please note it these rates get revised from time to time.

- Workers whose daily average wage is up to Rs.137 are exempted from contributing to the ESI fund. However, employers will continue to contribute to these workers.

What are the Advantages of ESI Registration?

Some of the significant advantages of registering under the ESI eligibility scheme are as follows:-

Sickness benefits

Sickness benefits at a rate of 70% (in the form of salary), if any certified illness is certified and lasts for a maximum of 91 days in any year.

Medical Benefits & Old age care medical expenses

Medical Benefits to any employee and his family members

Maternity Benefit

Maternity Benefits is provided to women who are pregnant (paid leaves)

Death of an employee and Funeral expenses

In case the death of an employee happens while on work – 90% of a salary is given to his dependents every month in case of death of the employee.

Disability of an employee

Same as above in the case of disability of an employee

Read our article:Employees State Insurance (ESI) Scheme in India

How to Claim ESI Benefits?

As a beneficiary of the ESI scheme, one can claim two types of benefits, which are as follows:-

ESI Enrolment Procedure

The procedure for the ESI registration by employers is entirely online and does not require the submission of physical application regarding the registration. The steps to register THE establishment or company with the ESIC are below:

Step 1: Visit the ESIC Portal and click on ‘Login.’

Step 2: On a new page, click on ‘Sign Up.’

Step 3: Enter the company name, employer name, state, region, email ID (that will be your username), and your phone number.

Step 4: Click on to checkbox for confirming your establishment or factory is under an exclusive labor contract, manpower suppliers, security agencies, or contractors supplying labor categories.

Step 5: Click on ‘Submit.’ An email shall be sent along with the login credentials or details.

Step 6: Now that after signing up, one needs to visit the ESIC Portal to log in.

Step 7: Enter a username and password received by email and click on ‘Login.’

Step 8: Click on ‘New Employer Registration.’

Step 9: Select a type of unit and click on submit.

Step 10: On a new page, enter the unit’s name, complete postal address of the factory or an establishment, and the police station under whose jurisdiction the unit is.

Step 11: Enter if a building or a premise of the factory or an establishment is owned or hired. Click on ‘Next’ to proceed.

Step 12: Enter the nature of a business and category, PAN details, etc. Click on ‘Next.’

Step 13: On the next page, enter the date of commencement of a factory or an establishment and license details (if any).

Step 14: Now, select a constitution of ownership and details of owners and click on ‘Save’ after entering all owners’ designation and then click on ‘Next.’

Step 15: Enter the number of employees working in the establishment or factory and the number of employees earning below the Rs.21,000 and click on ‘Save.’

Step 16: In a new page, enter the date when the first 10/20 employees were employed and click on the ‘Employee Declaration Form.’

Step 17: Select ‘Yes’ if an insured person is already registered and enter the IP number and date of joining. Select ‘No’ if IP is not registered & click on ‘Continue.’

Step 18: Enter the name of the IP and father’s name, address, date of birth, marital status, gender, family details, and date of joining.

Step 19: Now, click the checkbox and click on ‘Submit.’

Step 20: Once all the details are duly filled, click on ‘Close’ on the new page.

Step 21: On a new page, select the respective ESI branch office and the inspection division.

Step 22: Now, click on a checkbox to declare that information provided is correct and then click on ‘Submit.’ You’ll be redirected to a new page.

Step 23: On a new page, you will have to click on ‘Pay Initial Contribution’ and click on ‘Submit.’ It will be provided with a Challan Number for a future reference.

Step 24: Click on the ‘Continue’ to pay through a required payment gateway.

Once the payment is completed, one will receive the system generated ESI Registration certificate known to your registered email ID.

Conclusion

A new employer must be informed of the ESI Registration Number after the insured switches from one company to another. ESI eligibility will make him/her eligible for utilizing the same benefits, if and when needed. At Corpbiz, we will help our clients in obtaining licenses without any problem and needless effort.

Read our article: How to obtain ESI Registration in India?